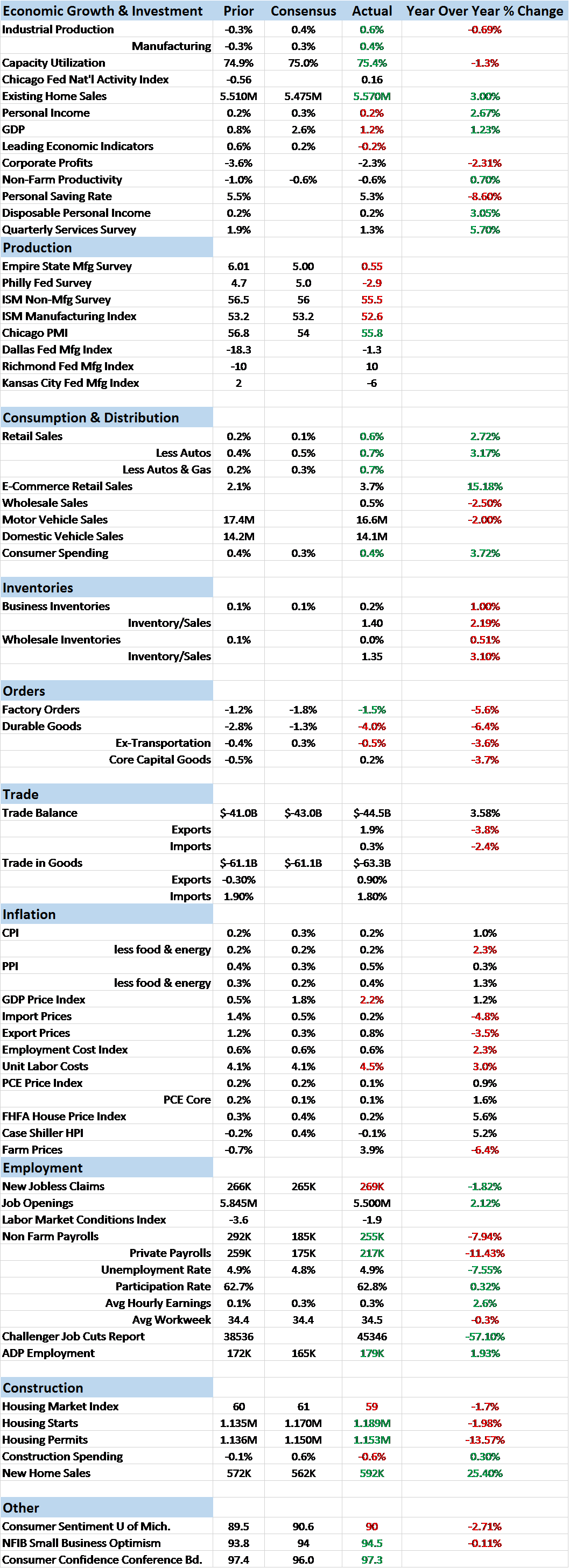

Economic Reports Scorecard

Two reports over the last two weeks epitomize the bifurcated nature of the US economy. The durable goods report last week was just plain awful from top to bottom. Orders down 4% month to month and 6.4% year over year. Ex-transportation -0.5% month to month and -3.6% year over year. Core capital goods orders up slightly month to month, 0.2%, but down 3.7% year over year and now down 17 of the last 18 months. Computers down 9.1%, communications -2.3%, primary metals -1.3%. Unfilled orders down 0.9%. The biggest positive in the report was a slight draw on inventories. Like I said, just plain awful.

By contrast, the employment report released earlier today reflected none of that weakness. Private payrolls were up 217,000, the participation rate ticked up 0.1 to 62.8%, average hourly earnings rose 0.3% and the workweek extended by 0.1 hours to 34.5. The unemployment rate was unchanged at 4.9%. Overall, about as good an employment report as we’ve seen in this recovery. This recovery has been subpar from the beginning but if you believe in secular stagnation – for the record I don’t – and that this is the best we can do, well you’re probably pretty pleased with this report. And apparently the market is, as stocks rose, gold and bonds fell on the report.

We would certainly warn against reading too much into one report though and remind everyone that employment is a lagging indicator. The November 2000 employment report looked pretty good too – +226,000 jobs – and yet we were in recession within just a few months. +240,000 in January 2007 and recession arrived less than a year later. And within this report are some worrisome signs. As in the 2000 and 2007 versions cited, almost all the gains were in the services side of the economy; only 17,000 goods producing jobs were created and 14,000 of those were supposedly in construction on which we also get a negative report recently (down 0.6 on the month and now flat year over year). Retail and transportation and warehousing also added jobs while professional and business services rose the most at 70k. A good portion of that category was in temp services which could be taken as a positive or a negative. Companies do tend to hire temps before hiring permanent workers but they also hire temps when they lack the confidence to hire for the long term.

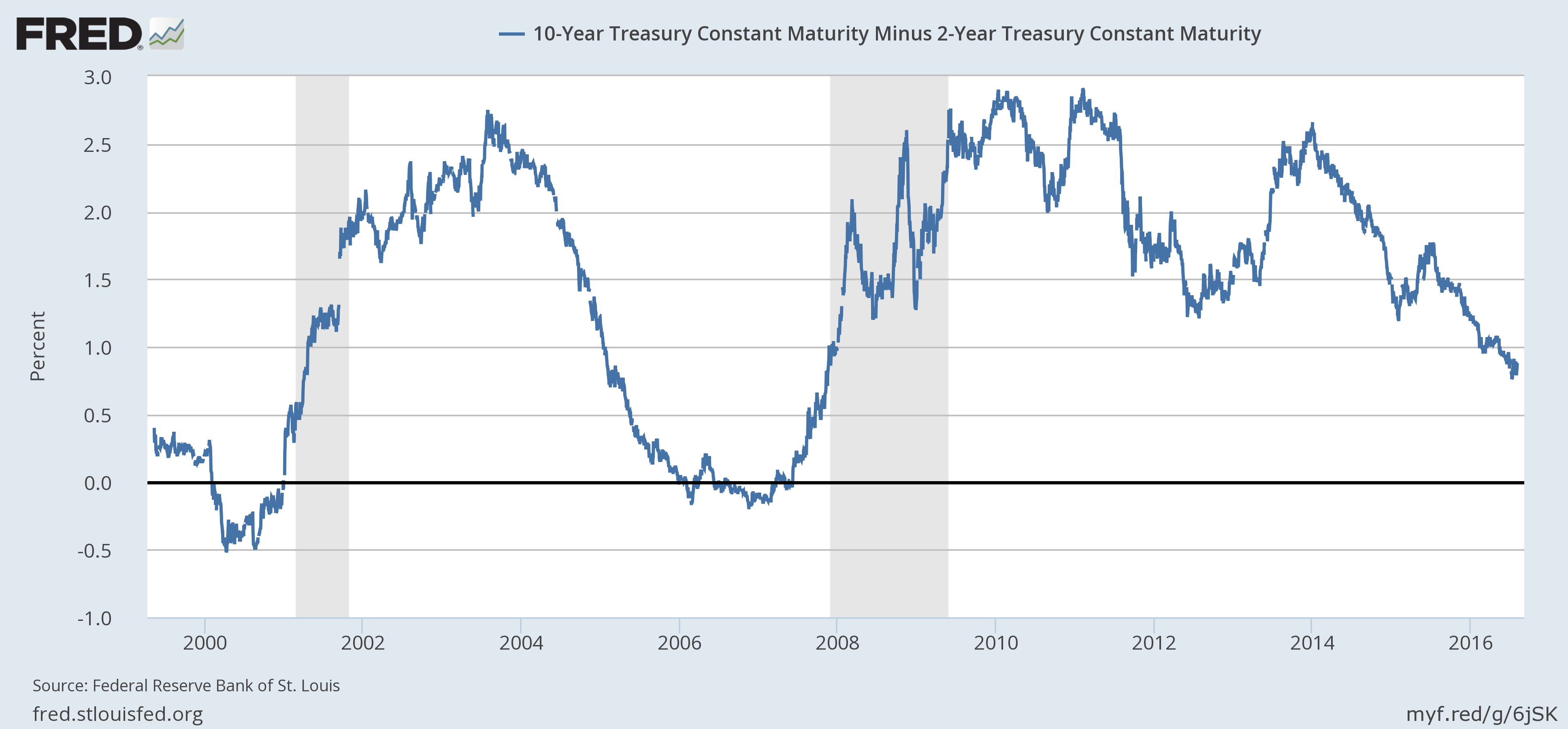

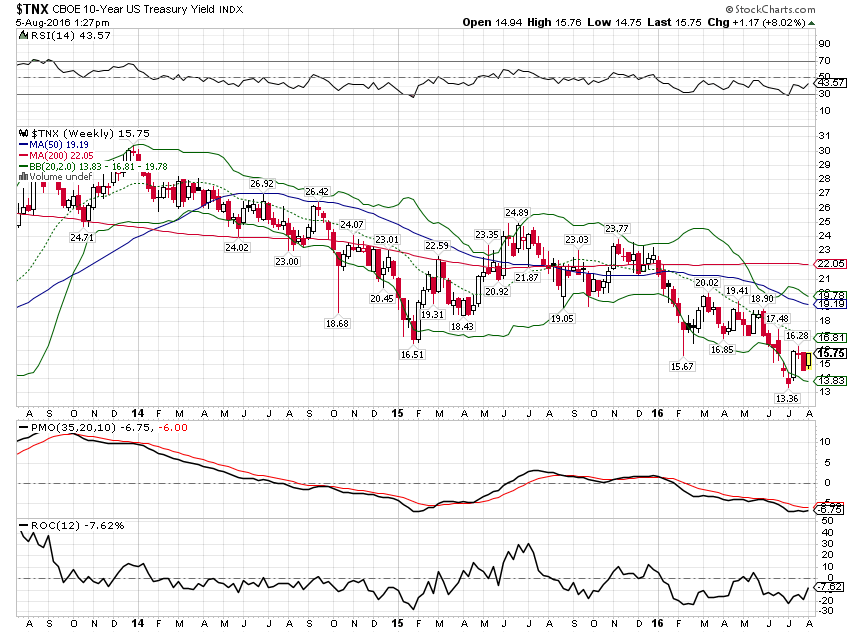

Not much evidence in markets – beyond the nominal new highs in the stock indices – of the positive, employment report view of the economy. The yield curve flattened on the negative durable goods report and then steepened slightly going into the employment report. Not enough to change the trend though which is decidedly in a flattening direction.

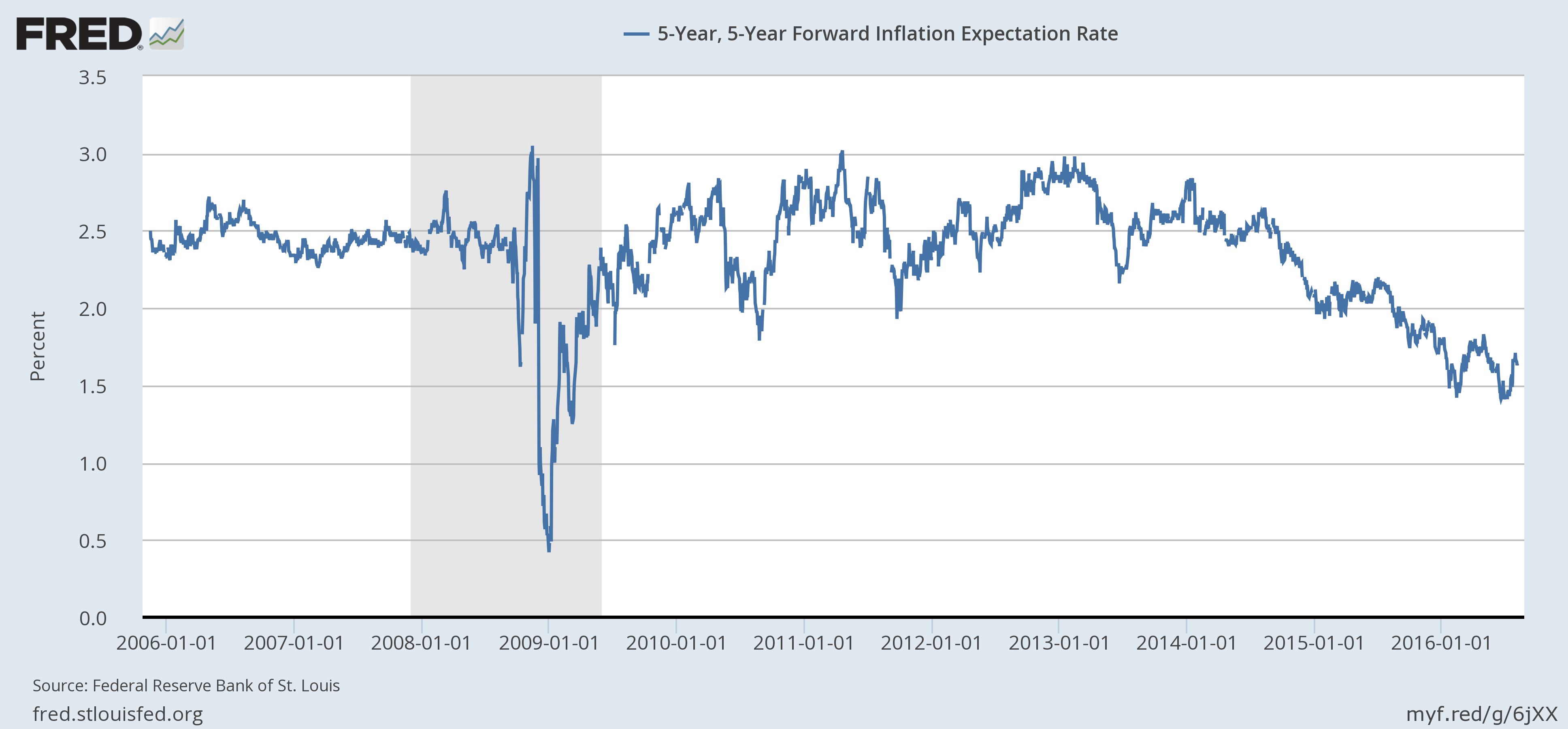

Inflation expectations didn’t rise over the two week period but neither did they fall back to their recent lows. The trend though is pretty obviously down and that hasn’t changed.

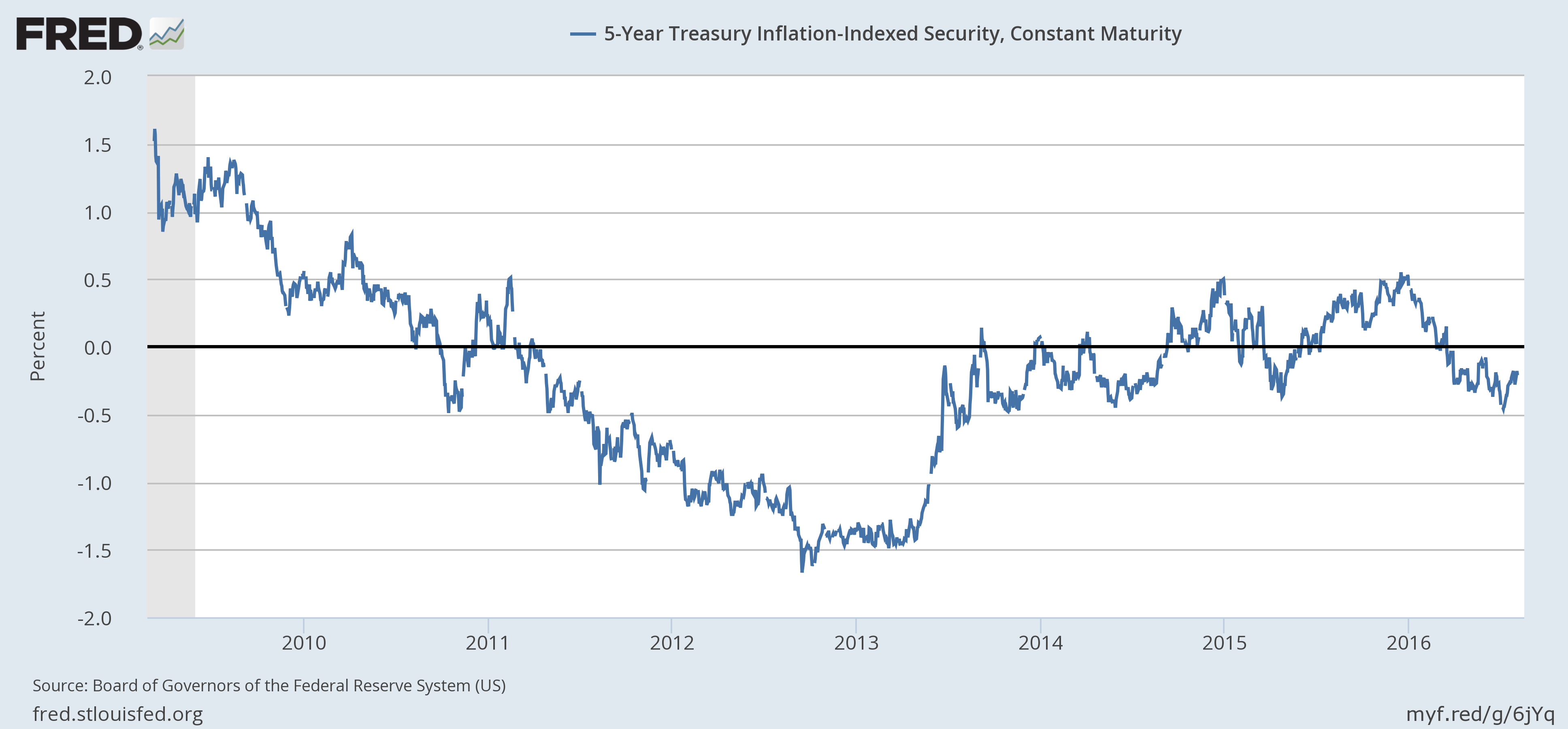

TIPS yields, real yields, are still negative, a sign that real growth expectations are still low and not improving.

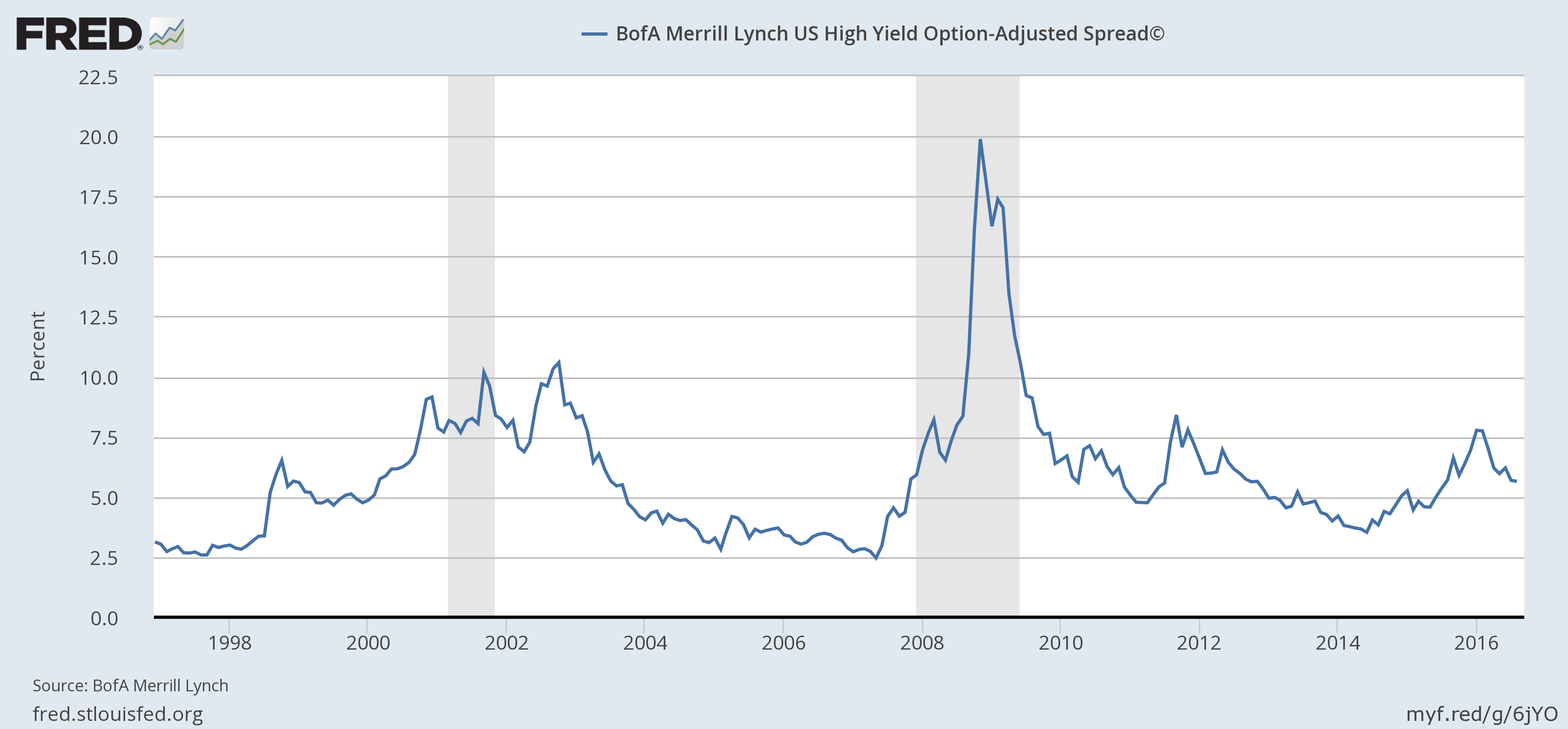

Credit spreads actually widened a bit since the last update, a reflection of falling oil prices. The defaults in energy related junk are probably not done.

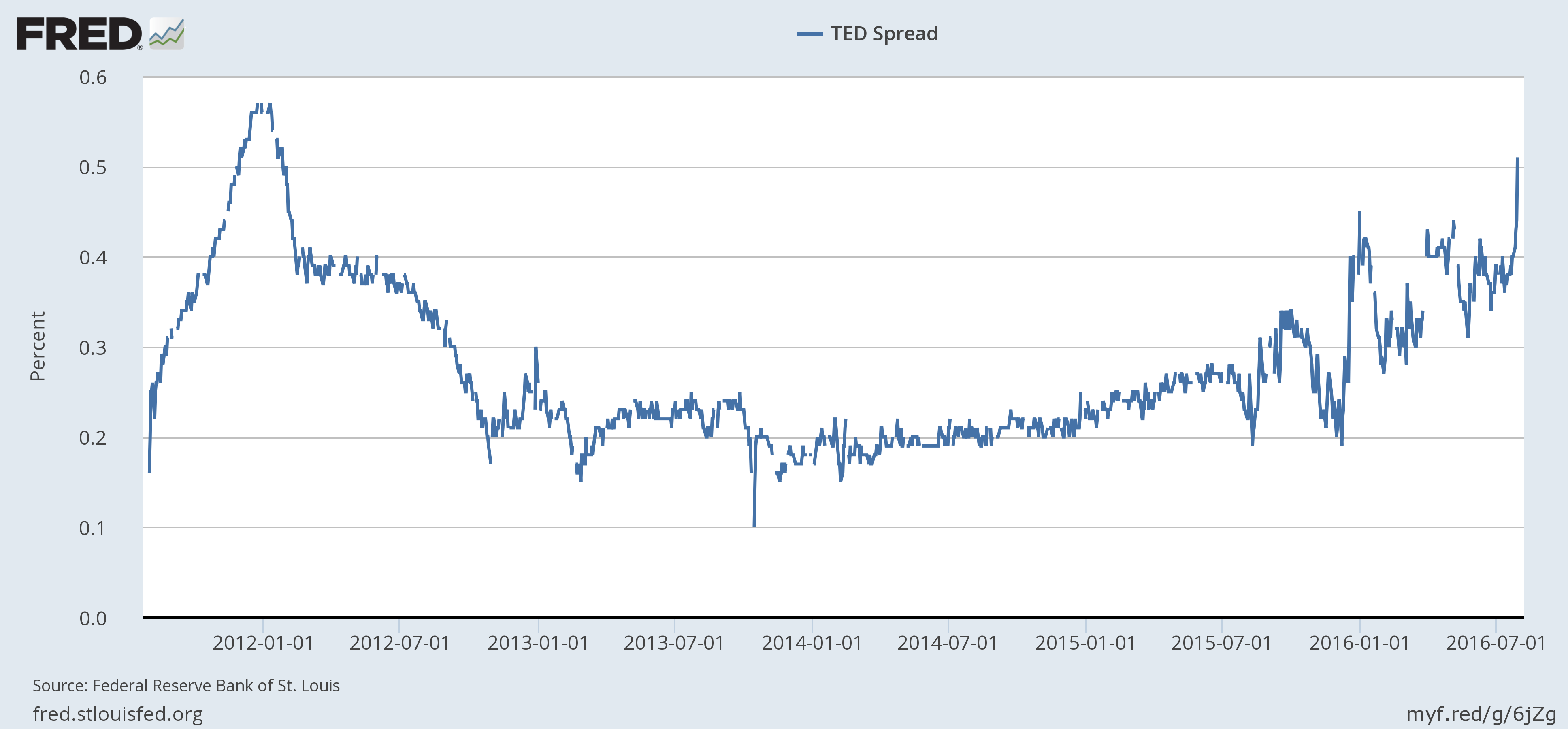

The TED spread has recently caught my attention. I’m not sure this is more or less useful now that it isn’t being manipulated but this indicator of funding market stress – liquidity – has been rising recently. A widening TED spread often precedes market corrections – or worse – but it would probably go wider before any big moves. Current levels are equivalent to March 2007, so some stress but certainly not crisis yet.

The long term downtrend for 10 year Treasury note yields is intact but “oversold” on a technical basis. A move up to around the 2% level would be consistent with the trend and mean little technically. But it sure would be painful for that flood of new capital that’s been flowing into bond funds all year. I’m not saying that is in the cards – the short term chart remains for now bullish – but I would also note that inflation isn’t on anyone’s radar right now. How much of a surprise would a little whiff of inflation be right now?

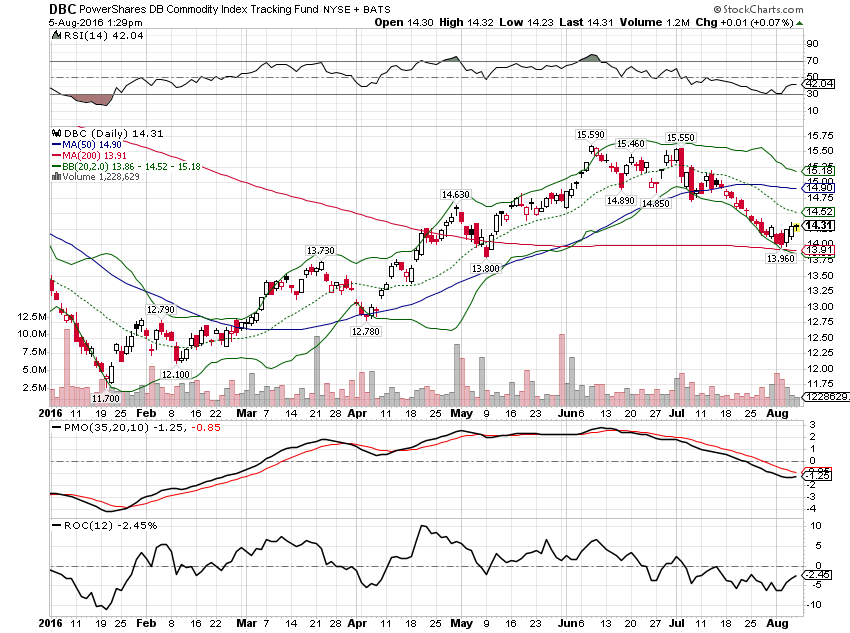

Inflation expectations, as shown above, haven’t moved up yet but other markets support the notion. General commodities have performed well this year, defying all those dollar bulls and commodity bears at the beginning of the year. After a brief correction, the uptrend is trying to reassert itself.

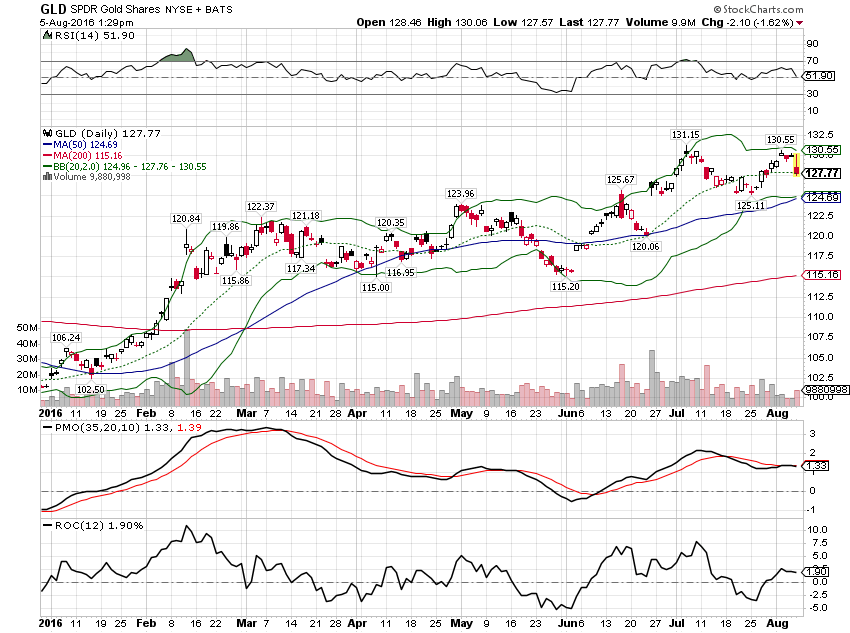

Gold did pull back a little Friday after the employment report but the trend is again obvious and unchanged. Not necessarily an inflation indication – at least not in the way most people think of it – but not good news for real growth either.

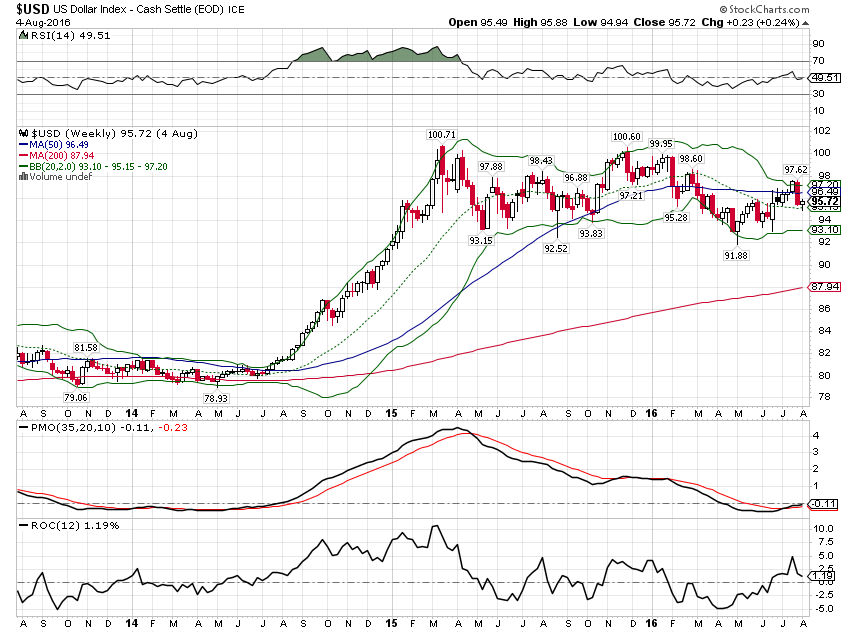

The dollar, meanwhile, hasn’t been able to rally even with the BOJ and ECB standing on the monetary gas pedal and two straight positive employment reports that should have the market on rate hike watch.

The US economy has downshifted over the last three quarters to about a 1% growth pace. If one squints at the recent data through some rose colored glasses, a slight improvement might be discerned. The improvement is confined to the employment data and some consumption measures but completely absent from the goods side of the economy. Corporate investment remains moribund. And evidence of any acceleration is hard to find in any markets other than stocks. A cynic might wonder who exactly the BLS is interviewing to compile these employment reports and why these new employees seem to have no discernible effect on the rest of the economy. Are they like Niles’ wife Maris from the old show Frazier who was said to leave no tracks in the snow? Should we call this the Maris Crane economy?

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch