The mainstream, dominant view of monetary policy remains as if it were “accommodative” or “stimulus.” Low rates and/or balance sheet expansion are treated as one and the same in terms of economic effects. The mountain of economic evidence since the end of the Great Recession, however, argues that that view is backward; starting with the observation that the Great Recession itself was no recession.

This is a universal problem and not just one for which the Federal Reserve and the United States economy will suffer. As I wrote earlier today with regard to China’s recalcitrant imports and PBOC policy:

Instead, by view of the “dollar”, it becomes clear that China’s central bank policies rather than being “stimulus” were not proactive but merely reactive efforts to counteract the “rising dollar.” Thus, as in the US, Europe, and Japan, monetary policy doesn’t tell us anything about what will happen, it is rendered an indication of what already did.

This is the determined view of bond and funding markets all over the world. Low and even negative rates don’t indicate an economic friendly financial environment, they prove the exact opposite as financial agents are betting directly against it. Therefore, when policymakers tell us, as they constantly do, that interest rates and other monetary policies must remain “accommodative” for an extended period even after nearly ten years already so, what they really mean is that they are merely following the economy down.

There is an increasing risk that the US economy has become trapped in a prolonged period of subdued growth that requires lower official rates than was previously expected, a leading Federal Reserve policymaker has warned.

Jerome Powell, a member of the Federal Reserve Board of Governors, said he was not in a hurry to lift rates, arguing for a “very gradual” path for any rises, while warning that the US outlook was still dogged by global risks.

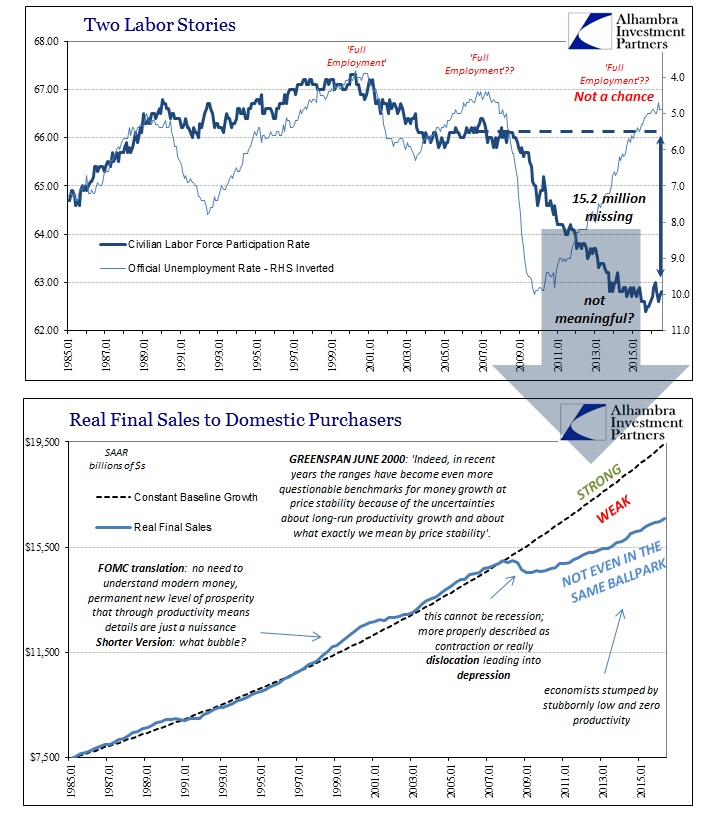

This is easily proven false. Monetary policy followed the real economy lower with additional rounds of QE in the US, Europe, and Japan; now that the economy is down, they have no idea why it won’t get back up. In short, the global economy is not at risk for becoming “trapped in a prolonged period of subdued growth” since it has already been in that condition for years as marked and signaled by central banks thinking always backward. The economy slows, central banks respond but the economy doesn’t. Rinse; repeat. Monetary policy isn’t producing even monetary effects.

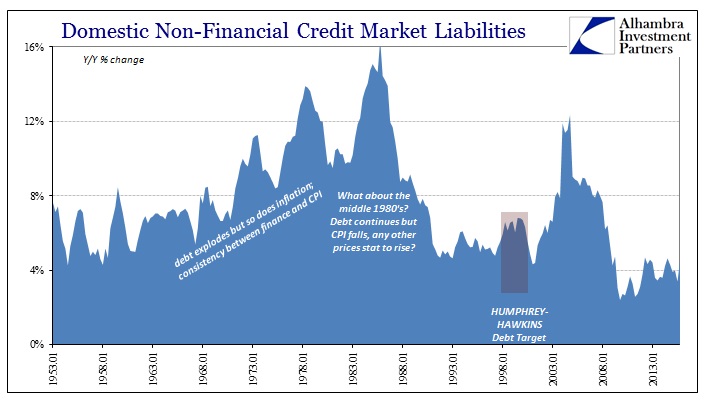

Up until the year 2000, the Federal Reserve was statutorily obligated under Humphrey-Hawkins (the Full Employment and Balanced Growth Act of 1978) to produce and maintain money and debt targets for the US economy. By the late 1990’s, the FOMC had already ceased using these targets in setting monetary policy, so when the legal requirement expired they simply stopped doing them. The last few they produced claimed expansion consistent with 1% to 5% for M2, 2% to 6% for M3, and 3% to 7% for domestic nonfinancial debt.

For most of the 1990’s, nonfinancial debt had been easily within that range. It was only in the later years of the decade that debt growth trended toward the upper end of the policy range. Even then, however, FOMC policymakers felt it was easily absorbed within the economic capacity of that time, particularly as they (mistakenly) judged durable productivity growth to be the long run determinant. In fact, in their last set of targets reported to Congress in the February 2000 Humphrey-Hawkins report, the FOMC noted that since the decade before everything seemed to be especially tolerant.

After an aberrant period in the 1980s during which debt expanded much more rapidly than nominal GDP, the growth of debt has returned to its historical pattern of about matching the growth of nominal GDP over the past decade, and the Committee members expect debt to remain within its range again this year.

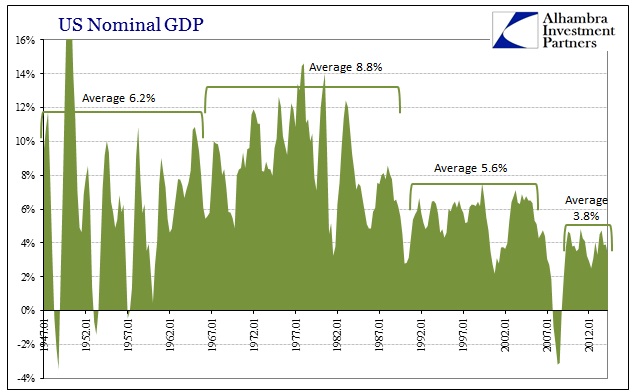

That statement is factually accurate; examining the data does show subdued growth in the 1990’s after an “unusual” and disproportionate burst in the 1980’s (during which inflation fell). Policymakers, rather than investigate further, simply called it the Great “Moderation” and chalked it up to Alan Greenspan’s briefcase.

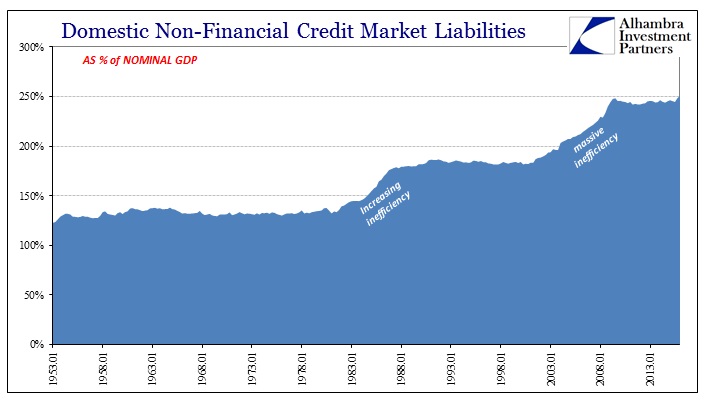

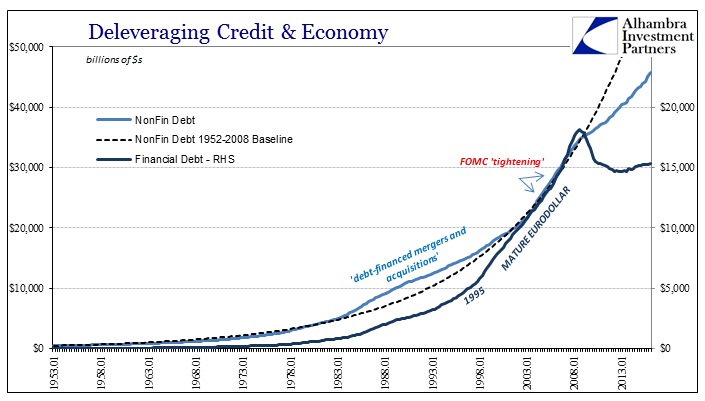

In the chart directly above, you can see why the Fed would have been interested in a debt target; the relationship between non-financial debt and nominal GDP used to be very consistent. From there, it would make sense to figure out the relationship between money and debt. The “aberrant period” of the 1980’s shows up clearly as a disruption in that relationship where debt grew at a sustained pace above nominal GDP. But that led simply to a new level of debt vs. economy that prevailed throughout the 1990’s without an uptick in consumer inflation.

From this narrow view, the concurrent dot-com and housing bubbles make no sense; indeed, nothing of the 21st century does. It’s as if the massive bubbles and debt expansion came from nowhere, yet that can never be the case. We find many clues as to the origin, however, including from none other than Alan Greenspan (as noted on Friday) during the very discussion where the FOMC voted without debate to stop targeting money and debt.

The problem is that we cannot extract from our statistical database what is true money conceptually, either in the transactions mode or the store-of-value mode. One of the reasons, obviously, is that the proliferation of products has been so extraordinary that the true underlying mix of money in our money and near money data is continuously changing. As a consequence, while of necessity it must be the case at the end of the day that inflation has to be a monetary phenomenon, a decision to base policy on measures of money presupposes that we can locate money. And that has become an increasingly dubious proposition.

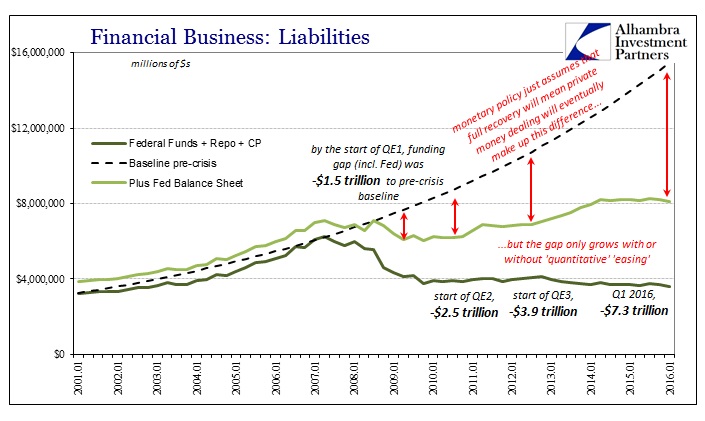

The breakdown, then, is exceedingly simple. If you don’t know money as a central banker then you can’t know debt and thus you will never know economy. If non-financial debt is the leverage that builds up nominal GDP, then financial debt under modern terms of eurodollar money is the leverage that builds up money. From that point forward it became official policy to not bother with money and simply control one money market rate, federal funds, as if that were enough of a master input across all forms of money to maintain these expected close relationships.

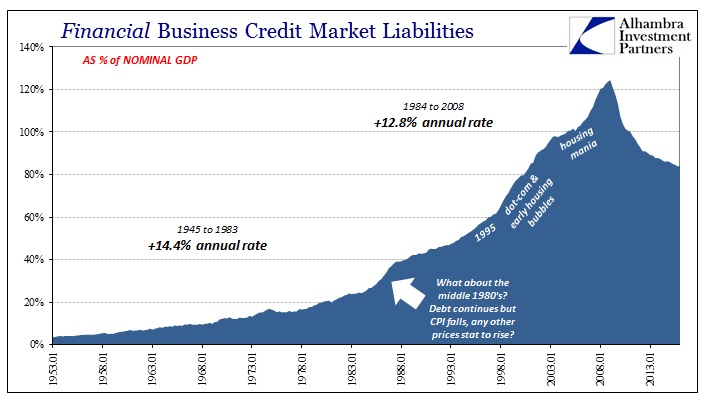

Greenspan in June 2000 instead of being confident that they didn’t need to know the details should have looked at the “increasingly dubious proposition” of money in very cautious terms. Indeed, by the time he uttered those words the leverage of money was already spiraling out of control. The dot-com and early housing bubble was no mystery; it was right there in front of them.

While non-financial debt to nominal GDP was to that point producing a consistent relationship, what it “took” to produce that level of non-financial debt was another matter altogether. This was, unfortunately, a multi-dimensional process that isn’t easily determined by numbers alone. You can plainly see on the chart above the massive, sustained growth in financial debt, but it wasn’t until the 1980’s that such growth began to far outstrip both non-financial debt and nominal GDP.

The overall growth rate was, in fact, lower overall after 1983 than before the year. But, like non-financial debt, there was that burst of growth in the middle 1980’s that didn’t seem to create any consumer price inflation. It wasn’t totally unaccounted for in the official targets, however, as the FOMC’s Humphrey-Hawkins report in February 2000 actually states:

This robust growth reflected large increases in the debt of businesses and households that were due to substantial advances in spending as well as to debt-financed mergers and acquisitions. [emphasis added]

The statement was made in regard to the 1990’s with debt at the upper end of the target range, but it also should have been attached to the descriptions of the “aberrant period in the 1980’s.” In other words, it wasn’t just consumer prices that were being directly affected by money debt growth pushing non-financial debt growth. Since the middle 1980’s, unlike prior periods, this extra element of financialism has been ever-present.

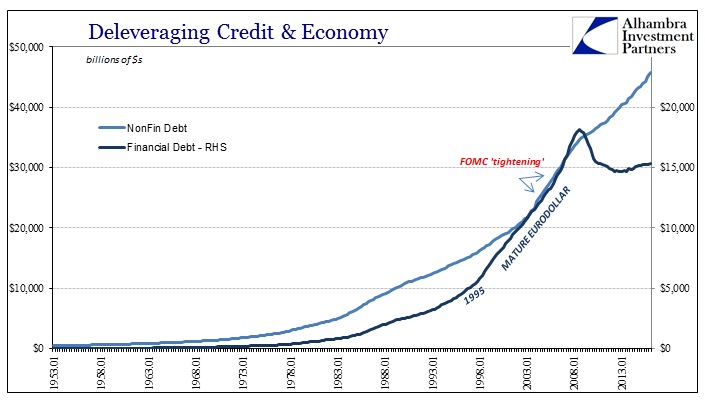

We find, unsurprisingly, that debt growth from then on and really since 1995 far outpaced non-financial debt growth and nominal GDP even though overall the rate of expansion was lower than it had been before 1984. The eurodollar system’s various formats have been proven to exhibit monetary characteristics and behave in money-like fashion, meaning that the explosion in financial debt itself wasn’t really debt in effect but rapid money expansion. This is why Alan Greenspan in June 2000 was having so much trouble “locating” money.

It also further explains why the Fed by the middle-2000’s had rendered itself irrelevant. The intended “tightening” of 2004-06 had no effect whatsoever on this new debt or leverage money, as consumer prices were by then not even the primary outlet of all this money growth and development (nor was the domestic US system the only objective of it).

But that is all just what the numbers present, leaving still to account for the full effect of this financialism. In other words, how is it that despite an overall lower growth rate in financial debt since 1983 that the level of financial debt to GDP surged? By simply math of ratios, if growth in the numerator slows while the ratio itself jumps, then the denominator, nominal GDP, must have really slowed. Sure enough:

That means all this financial expansion has broken its correlation with the real economy; that increasing debt isn’t any longer a direct channel into the real economy and only the real domestic economy as orthodox monetary theory presumes. That works in both directions; as the leverage of money builds up and then falls apart. “Stimulus” can never work where it is easily overwhelmed by money destruction as the leverage of money now shrinks.

Since the 1980’s, the US and global economy became more and more financialized to the point that without leverage in both economy (through non-financial debt) and money itself (the various eurodollar forms of financial debt) it can no longer remain consistent at even weaker levels of nominal expansion. The economic system itself has become monetarily inefficient, with so much siphoning in inflation of especially asset prices. The “deleveraging” shown above primarily of money can also be called eurodollar decay, a trend that appears in so many other formats in similarly consistent fashion.

The results are the “low growth trap” we are already in and have been for nearly a decade (all of the 21st century by count of the labor market), not one that we are just now at risk of finding. Policymakers like the FOMC’s Jerome Powell are suddenly noticing this because QE has failed in every way imaginable. While QE was in effect, the continuing “low growth trap” could be ignored as a temporary or “transitory” impediment that monetary policy “accommodation” would surely and easily overcome if only at some undetermined future date. Four QE’s and the same level of growth anyway, both with and without, have the effect (for the unbiased) of disabusing these notions of “stimulus” even to the point that policymakers have to at least acknowledge it (if not understanding why).

The problem is and remains money; not that we need to rebuild the avenues of financialization again as they were from 1983 until 2008. That would be foolish and repeating the same mistakes as the Greenspan Fed in thinking it was all “moderation.” The answer is monetary stability such that the economy can free itself from past modes of financialization, dependent upon rapid and sustained (and dangerous) money growth rather than productive efficiency.

Enough with the “mergers and acquisitions” economy; put money back in monetary policy. There was never a Great “Moderation”, there was only monetary explosion and massive leverage in other forms that occurred far enough out of sight so that the results of all that expansion, for a time, made it seem almost ideal – so long as you didn’t investigate too deeply into it. Central bankers never did, and still won’t. They will even, apparently, talk about a “low growth trap” without ever mentioning where it came from and why they didn’t see QE failing to overcome it.

Stay In Touch