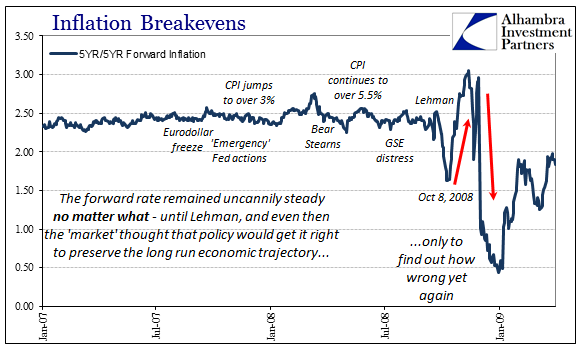

On Wednesday, October 8, 2008, the FOMC voted for an emergency 50 bps cut in the federal funds rate, bringing it down to 1.50%. The day prior, the Fed announced that it would be buying short-term debt from businesses after suggesting the day before that it would fund up to $300 billion for “bad” assets. The Friday before that, Congress had passed TARP. With so much happening, stocks were all over the place; the Dow up nearly 200 points during that Wednesday trading but also down as much as 252. In just one week, DJIA was some 1,600 points lower.

The 5-year/5-year forward inflation rate sunk on October 8 to 163 bps. It had been very steady no matter what until the week after Lehman. Given what the rate purports to measure, this wasn’t necessarily a surprise. Even Bear Stearns’ failure earlier in the spring had failed to make much of a dent, a reflection of market faith in primarily the Fed and secondarily the economy that the Fed supposedly managed.

The forward inflation metric is the proportional difference between inflation breakevens five years out and those 10 years out. Thus, theoretically the number indicates the mythical long run inflation expectations that so worries policymakers. If current conditions, like those in the first half of 2008, suggest even serious weakness, then that would be reflected in TIPS and breakevens up to 5-years in maturity. If TIPS and breakevens from years 6 to 10 remain in relative correlation, then that suggests no matter what is happening in the intermediate term it isn’t believed more than a temporary setback leaving undisturbed the more important, underlying long run potential. So long as the forward rate remains relatively steady, it is at least a possible indication that inflation remains anchored.

Such a sharp decline in late September/early October 2008, then, was the first time the treasury market began to seriously contemplate the Great Recession as more than a recession. Unfortunately, that only makes sense given the events of that time, as global financial panics do tend to leave more than temporary economic damage in their wake. Up until September, even though none of the monetary policy programs the Fed had offered had any positive effect and instead continually disproved policy credibility, the credit market in this long run view still gave it the benefit of the doubt. The actual panic of October 2008, however, severely shook monetary policy faith for the first time since the dot-coms.

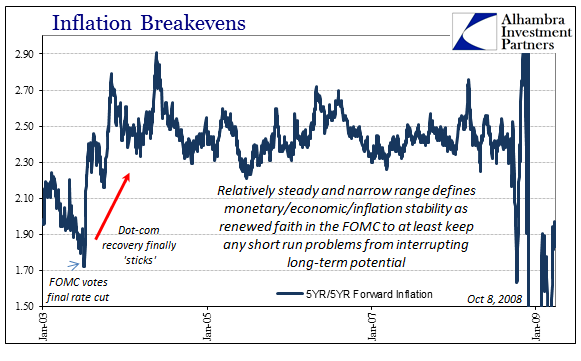

Given what has transpired in the 21st century, it really is a shame that the forward rate finally responded to that last FOMC rate cut in June 2003. Before that point even after the dot-com recession in 2001 was long over, markets were expressing doubt about monetary policy efficacy; so much so, internal misgiving finally crept into the FOMC deliberations themselves. The dot-com bust in stocks had refused to abate, and the recovery after the recession remained nearly as bad as the mild recession itself – all until the last part, the mania, of the housing bubble finally kicked in around the middle of 2003.

Throughout the middle 2000’s, that proved to be the dominant theory. The Fed, it was believed, could limit the fallout even from the crash of a bubble as enormous as the dot-coms. It was this superstition that provided comfort throughout the early stages of the Great Recession, that though it might get rough it still wouldn’t be anything more than recession, severe or not.

The big moves in the early part of October 2008 sent inflation forwards skyrocketing again, a clear reversal from that introduction to long run negativity, also in no small part because the panic appeared to have run its course and provided the surface plausibility that policy escalation might be the trick. Though it was severe, it was thought very possible that by the second week of October the bottom had been reached, leaving the markets in the increasingly active hands of the FOMC as well as only dealing with economic uncertainty to that point. As bad as it was, the real economic crash was still to come.

It was that last piece that brought the 5-year/5-year forward rate back to earth again in December 2008 and January 2009. In announcing ZIRP on December 16, the Fed specifically stated that it was intended to aid in only the recovery as policy was shifting from prevention to damage control. The forward rate would actually drop below 50 bps, wondering just what that might mean.

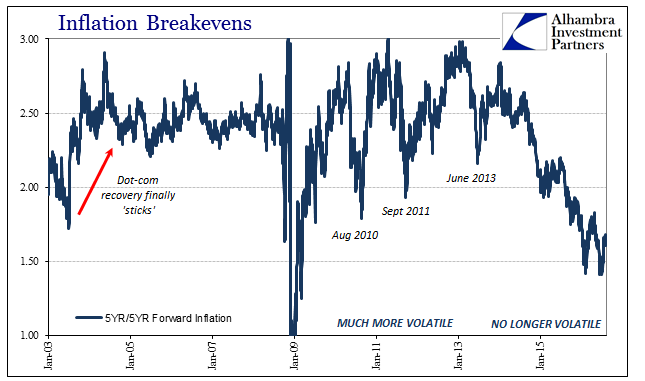

The years that immediately followed were nothing like those of the late housing bubble during the middle 2000’s. The 5-year/5-year rate was nowhere near so stable and anchored. It shifted around violently with each new appearance of crisis and disorder; in 2010 with the flash crash and the world suddenly caring about Greek finances; in 2011 with what really confirmed all the eurodollar suspicions about 2008; and again in 2013 as the final two QE’s were greeted with at best shaky optimism.

In fundamental terms, the credit market was almost bipolar, shifting violently between worrying that the Great Recession did indeed leave a more-than-temporary hole in the US and global economy, and great enthusiasm that whatever next QE or LTRO might prevent that scenario and belatedly fill in the economic gap. I haven’t marked it on the chart above, but the highest the 5-year forward rate got was just shy of 300 bps; once in April 2011 toward the end of QE2, and again in February 2013 not long after QE4 started.

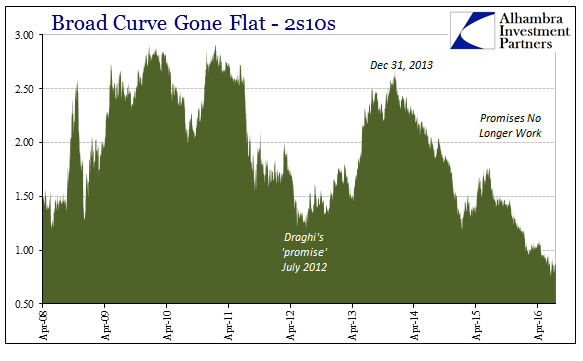

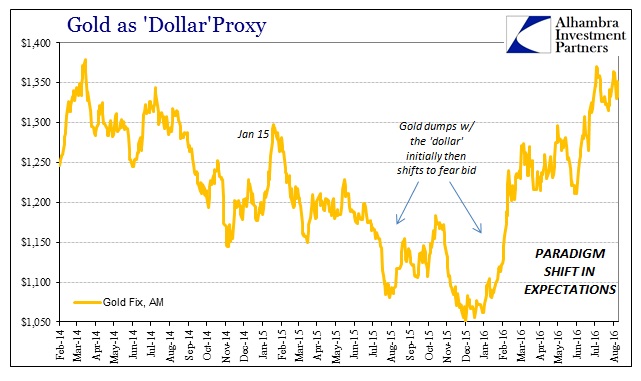

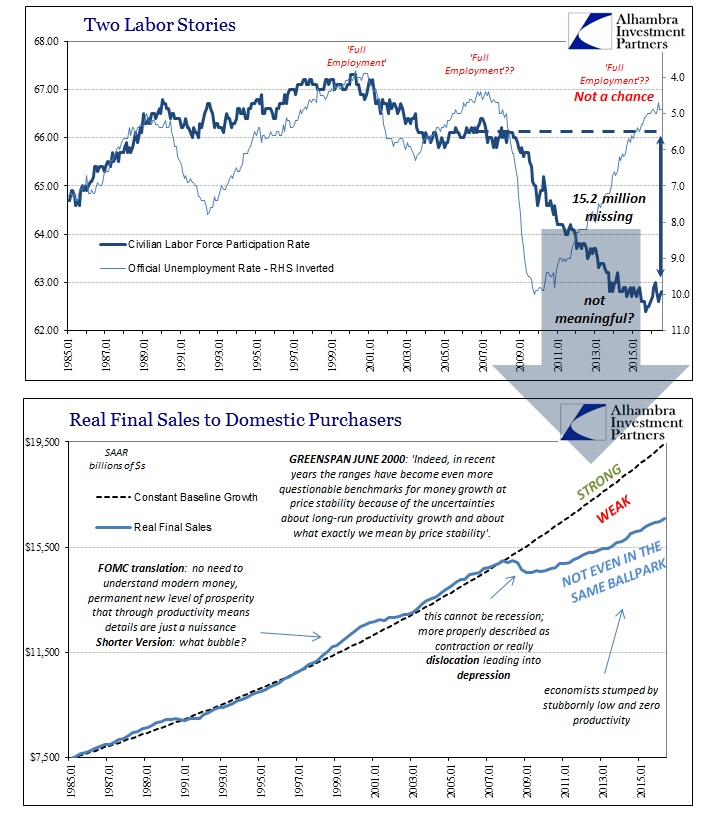

Long run inflation expectations haven’t been quite so volatile since the start of 2014, however. Their direction seems much more determined, sinking deliberately toward the startling conclusions (to economists, anyway) that, yes, the Great Recession wasn’t ever a recession and that monetary policy won’t fix this one. You can make the further argument, as I would, that the treasury market is repudiating “stimulus” altogether for as long as monetary policy remains within this arrangement, but it is at least a collective agreement that in this specific paradigm there is no more magic; certainly not like 2003.

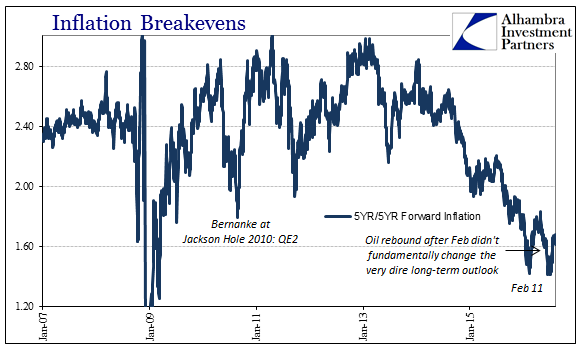

This latest decline is in every way worse than 2008. It is not some financial crime of passion, a recoiling burst from the immense and acutely focused panic of immediate circumstances; it is instead a slow and deliberate conclusion born of a string of “unexpected” events spread across several years that includes clear deceleration from the economy here and globally that had already lost pace long before ever reaching even close to recovery velocity. And this negative outlook on the long run is increasingly entrenched; even after the drastic turnaround in sentiment elsewhere after February 11, particularly stocks and recent record highs, the forward inflation estimate remains hugely subdued, wholly unimpressed with the suggestion that anything substantial might have changed over these past six months.

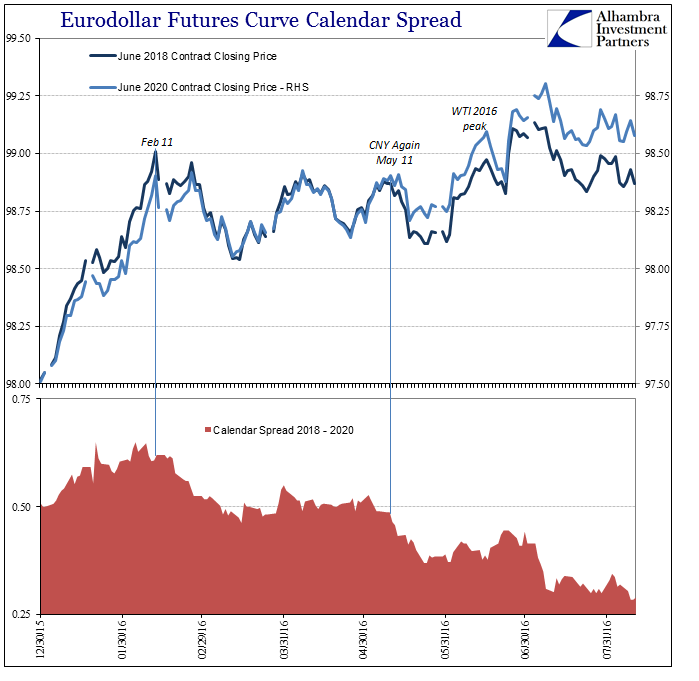

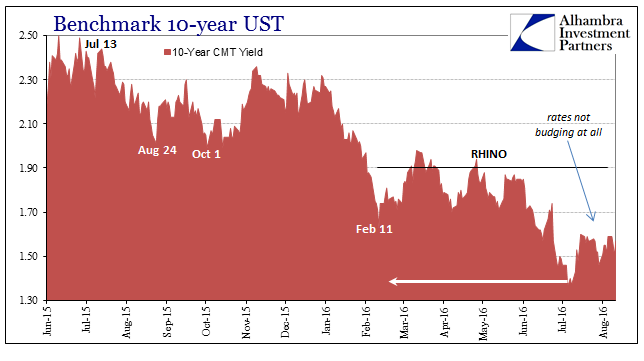

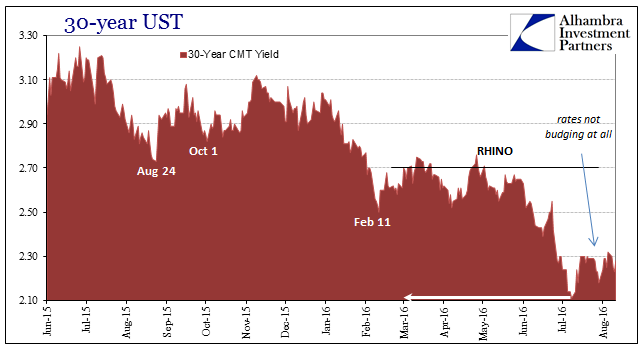

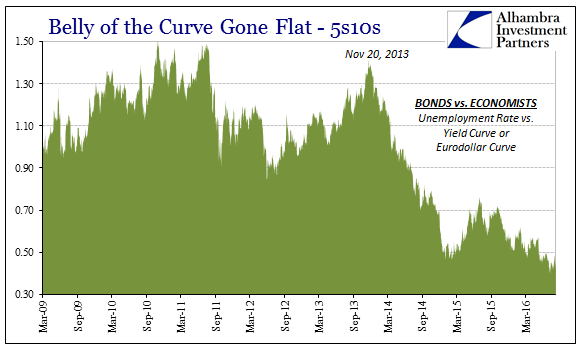

It isn’t just inflation expectations, short or long, that remain so restrained in their economic and financial outlook. The entire credit and funding markets continue along in comparison to 2009. From nominal UST rates to eurodollar futures, and curves of both flattening still today, the hope and faith that pushed stocks higher is notably, dangerously absent.

Even after selling off today as the NASDAQ hits new record highs, US treasuries remain closer to their all-time low than where they were when oil peaked for the year.

Stocks suggest that there is nothing to worry about in either the short or long run. Credit has come to the opposite conclusion and is increasingly stubborn about it. Does monetary policy and FOMC credibility in terms of forecasting and predictive ability deserve yet another chance? Without a specific, highly plausible reason to suspect that the current depression will stop being one, credit markets are at least consistent with the economy as it is, having ceased being fooled by the central bank’s fifth or sixth sleight of hand. There is no recovery hidden up Janet Yellen’s sleeve, and bonds fundamentally know it and what that means for tomorrow, five years from now, and beyond.

Stay In Touch