For a central bank, deflation is the starting point which makes inflation the emphasis. So long as there is a “small” amount of positive inflation then economists have suggested deflation, thus depression, becomes impossible. The reason for that belief is twofold, first having to do with the margin for “error”; that is a small positive inflation rate acts as a buffer with which monetary policy can react before any disinflationary impulse or shock gets out of hand.

Primarily, however, the assumptions of orthodox economics are built upon expectations regimes. By targeting a 2% inflation rate and keeping to it, a central bank builds up a long-term “anchor” for private economic agents’ expectations for future inflation conditions. As long as people expect a credible monetary response that central banks will over time smooth out any variations (transitory) it will be difficult if not impossible for deflation to take hold since everyone simply assumes that whatever in the short run 2% is the future. This is critical in mainstream monetary theory, which is why you hear Janet Yellen and Fed officials refer to the “anchor” quite often; it is, in fact, placed in every FOMC statement and minutes for that very reason.

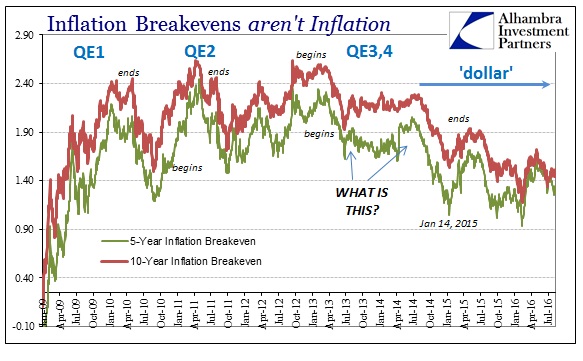

The inclusion of verbiage about the anchor is quite different in the past few years, however, simply because market-based inflation expectations are acting as if there is no longer any anchor attached to the 2% target. This is a shock to economists at least as far as how they talk about it in public, though it shouldn’t be surprising since the Fed hasn’t been close to its target in several years and below it consistently for now more than four. To counteract this growing distrust about Fed efficacy and ability, the FOMC repeatedly references some hidden supply of “professional forecasters” who continue to see no movement in the long run inflation “anchor” no matter how much markets continue to disagree.

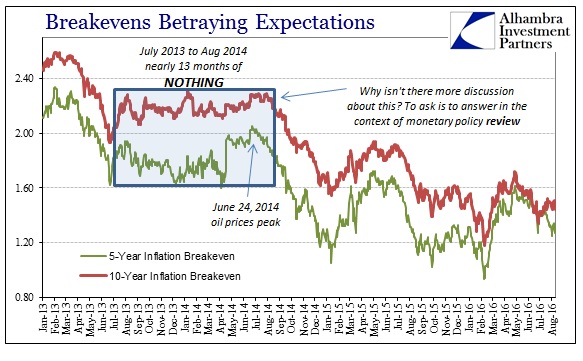

In the realm of moving inflation expectations, there was a period between July 2013 and August 2014 where the 10-year TIPS breakeven “yield” did nothing. The 5-year breakevens followed in somewhat similar fashion, though with a small measure of greater vitality if still almost totally sideways. How this thirteen month period in inflation measuring has escaped constant mainstream reference is yet another crime of negligence. Not only did the market for inflation expectations suddenly appear to be dead or at least stumped, this all occurred at perhaps the most pivotal point of this entire “recovery” period.

From the middle of 2013 forward, the Federal Reserve (as ECB and other central banks) judged their primarily 2012 responses as taking hold and thus fostering the relevant predicates for normalization – the recovery at long last was, they believed, coming into actual view. Yet, while that was supposedly happening in their eyes, credit and “dollar” markets were moving in the opposite direction. At the crucial juncture between policy and economy in inflation expectations these competing tendencies met.

Economists had always maintained that skepticism about QE and ZIRP were transitory factors that would be overcome in the bloom of full recovery. After all, the myth of especially Federal Reserve power, the leftovers of the “Greenspan put” remained as a powerful pull on any market psyche. Though the bond market was closer to the real economy than other markets, it was essentially a titanic struggle between competing narratives of the most enduring kind. As I wrote in March 2014:

Such a static inflation indication I think goes along with these divergences in various segments. On the one side, there is constant reassurance that inflation will pick up at some point, and that the Fed will “normalize” itself to that inflation paradigm. Yet, for all that talk there is the evident problem that inflation is actually going in the “wrong” direction without anything other than assurances that will change. The net result appears as neither position obtains momentum, and the “market” devolves strangely into this static state.

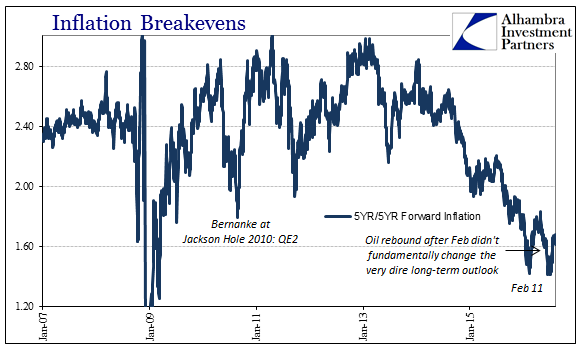

In other words, a tug-of-war in expectations between hardening reality reflected in the bond market (as well as the PCE Deflator) and the lingering mythology of “money printing” had developed and to that point yielded no conclusions. This was already in sharp contrast to behavior in TIPS during prior QE episodes where just the whispers of it, as in late August 2010 in anticipation of Bernanke’s Jackson Hole speech referencing the coming QE2, had elicited a direct response.

Yet, for thirteen long months the issue remained undecided at, again, perhaps the most critical period of the post-2011 world:

Credit markets appear almost confused about the most basic factors of credit and interest rates. Could it possibly be from too much monetary interference through the lack of clarity regarding stance? The FOMC talks about forward guidance as if it were almost a direct line to credit “markets”, but these strange indications show that there is very little consensus anywhere about anything.

Ultimately, of course, the decision was rendered and quite unfavorably – that June when the “dollar” turned. First it was the 5-year breakevens followed not far behind by the longer-term TIPS as it was determined that the bond market, not Bernanke and Yellen, was right all along. The sudden appearance of the “rising dollar” tipped the scales in favor of what should have been obvious, especially when either the CPI or PCE Deflator had been falling in equally obvious fashion since early 2012 in the aftermath of that great eurodollar event.

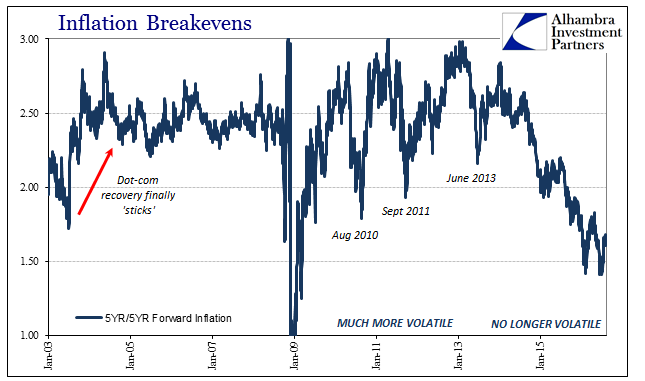

But the 10-year inflation expectations have been falling faster relative to the 5-year, which in the difference are these 5-year/5-year forward inflation rates. This is relevant to the inflation anchor, as noted previously, as 5-year/5-year forward rates had remained remarkably steady until Lehman:

Throughout the middle 2000’s, that proved to be the dominant theory. The Fed, it was believed, could limit the fallout even from the crash of a bubble as enormous as the dot-coms. It was this superstition that provided comfort throughout the early stages of the Great Recession, that though it might get rough it still wouldn’t be anything more than recession, severe or not…

Long run inflation expectations haven’t been quite so volatile since the start of 2014, however. Their direction seems much more determined, sinking deliberately toward the startling conclusions (to economists, anyway) that, yes, the Great Recession wasn’t ever a recession and that monetary policy won’t fix this one. You can make the further argument, as I would, that the treasury market is repudiating “stimulus” altogether for as long as monetary policy remains within this arrangement, but it is at least a collective agreement that in this specific paradigm there is no more magic; certainly not like 2003.

Though policymakers have denied it for several years since then, even their own kinds of evidence are turning against them. As discussed last week, the theme of late inside central bank circles is reckoning, though to this point it is but inchoate self-reflection.

In terms of “professional forecasters” and long run inflation anchors, last week saw the publication of a paper written by researchers Tomasz Łyziak and Maritta Paloviita of the Polish and Finnish central banks. Their own interpretations of their evidence was not encouraging, at least as it relates to Europe’s parallel monetary struggle:

Our analysis suggests that in recent years, a period characterized by low inflation, increased economic uncertainty, zero lower bound and unconventional monetary-policy measures, inflation expectations display some signs of deanchoring. [emphasis added]

The evidence they find is all regressions and statistics, but that is how economists think and talk about everything. In other words, on their own terms they are starting to see evidence that markets were right.

We provide evidence of increased sensitivity of longer-term SPF inflation forecasts to shorter-term ones and to current HICP inflation in the post-crisis period. At the same time, less weight has been given to the inflation target in the formation of those expectations.

That was, essentially, what took place between July 2013 and June to August 2014; in the US, as well as Europe, market-based longer-term inflation expectations began to trade in increasing reflection of shorter-term inflation expectations regardless of whatever monetary or central bank chatter to the contrary. As the economy worsened, it only increased the tendency of longer run expectations to the view the shorter run indications as, again, proof that the bond markets were right and conversely central banks all wrong (from top to bottom; theory to execution). In that case, there is no reason to expect a monetary policy target to be achieved, let alone maintained, and thus expectations in the long run can “de-anchor.” Monetary policy is being totally disproven.

Though I doubt economists will find the humor in it, the European paper did manage to also highlight this continuing divide between actual evidence and “forecasters”.

However, our analysis also suggests that the ECB projections, which play a central role in ECB communication strategy, have recently become more important for professional forecasters, as they provide benchmarks for their short- and medium-term inflation expectations.

In short, markets no longer assume any monetary efficacy and the real economy is becoming de-anchored but professional forecasters, whoever they are, continue to reprint whatever numbers the ECB puts out (just like those the Fed constantly references). And these are the people upon which rests the outcome of the global depression? These economists (really statisticians) don’t realize that the issue has been settled since June 2014.

This would be the worst of the worst cases in orthodox monetary terms, unwinding the last of the great buffers against the deflation/depression case. Further, because that would mean the increasingly complete repudiation of monetary credibility, central banks would have to work that much harder to gain it back – raising the possibility of an even greater error than we have seen so far. There is no mystery as to why there has been more and more absurd policy “alternatives” being floated in the mainstream of late in 2016 as opposed to 2015 and really 2014 when this debate actually ended. Economists lost and even their regressions are, belatedly as always, finally starting to address it.

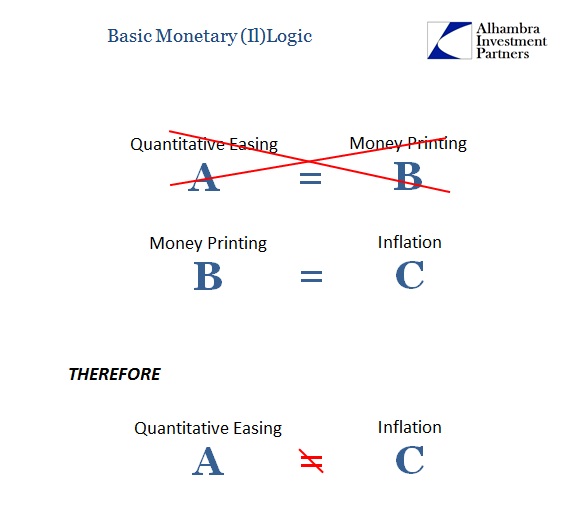

Because of ideology, if something changes in the economy economists will always be the last to know about it. The idea of “money printing” was settled years ago; if 2008 first planted the seeds of doubt, the “rising dollar” harvested them in full.

Stay In Touch