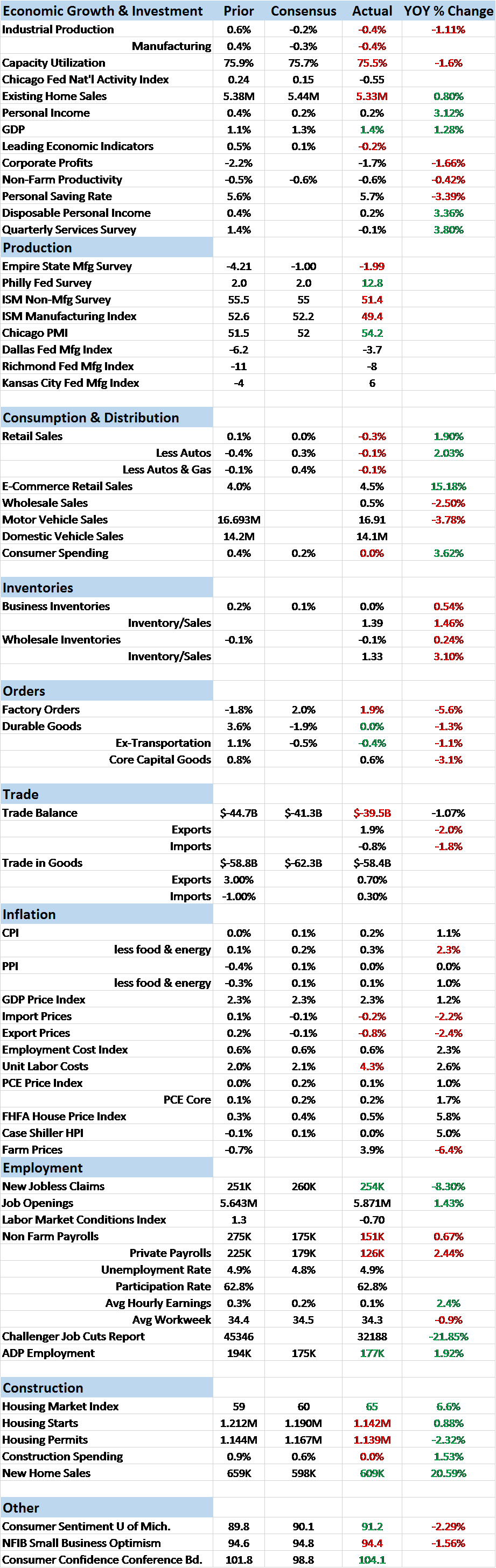

Economic Reports Scorecard

The US economy continues to trend, as the Fed finally noticed in its most recent dot plot, at a low rate of growth. The Fed downgraded their long term growth outlook to 1.8% and that’s just a rounding error from the 2% we’ve been tracking for quite a while now. The fluctuations around that number have basically been a function of inventory building or drawing and it isn’t changing. If anything, one would have to point, as the Fed has, to a slightly weaker trend. Slight improvements in one area are met by slight deteriorations in others.

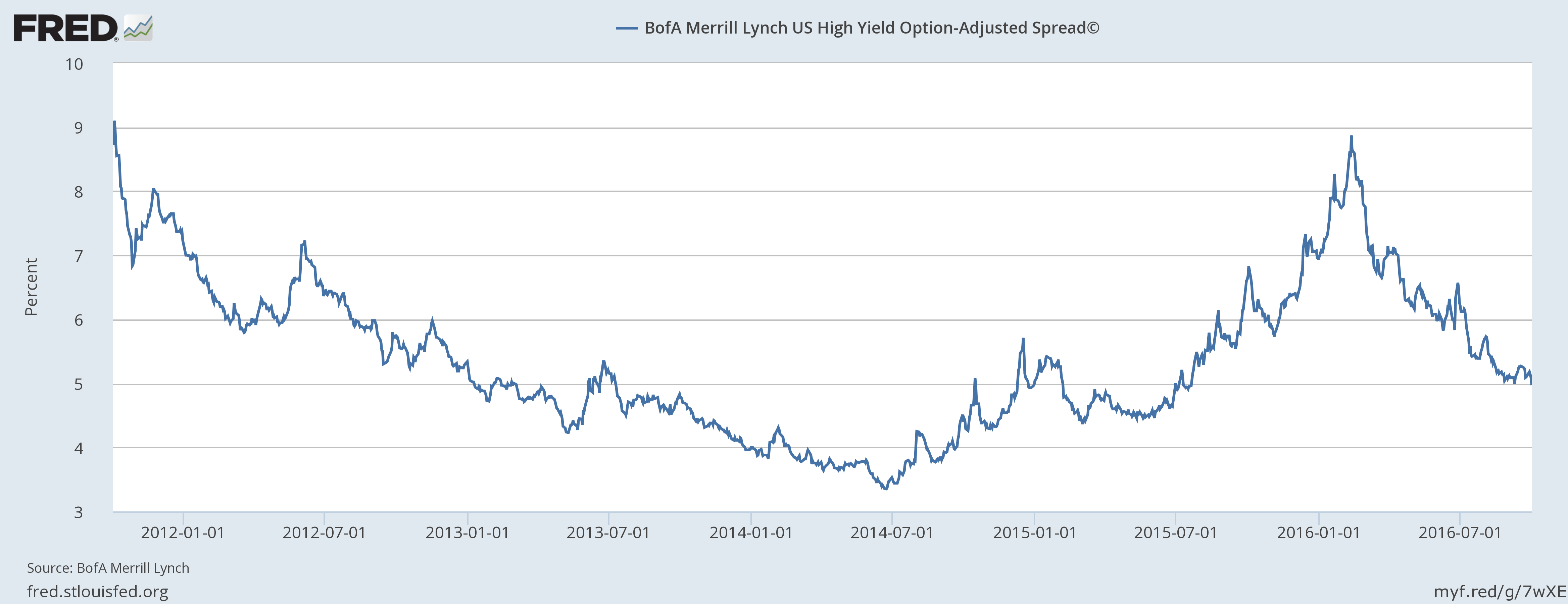

The slight improvement over the last two weeks are very slight indeed and are mostly just anecdotal stuff rather than hard data. There was some improvement in the KC and Dallas Fed manufacturing surveys but the harder data offered by the Durable Goods series was worse. But the Chicago PMI was a bit better than expected and positive at 54.2. I mention the KC and Dallas Fed surveys mainly because they are sensitive to the shale industry and improvement there is consistent with the stabilizing crude oil price. If crude can stabilize near current prices, we may have seen the worst from the oil patch. That’s important because it was the shale industry that pushed junk bond spreads wider earlier in the year and caused so much recession angst.

But, again, that doesn’t mean the economy is suddenly on the verge of some growth surge. As has been the case for the last few years, improvement in one area is often offset by weakening elsewhere. In this case, it may be housing that is starting to finally pull back. New home sales actually set the high for this cycle, finally breaching the 600k level but starts and permits were both disappointing. Existing home sales, which are less important to GDP growth, were also less than expected.

Also weakening was the personal income and spending series. Spending was flat and now up just 3.6% year over year, a fairly anemic rate with the balance of the rise in income being devoted to savings (5.7% savings rate, up a tad). Income was up but the year over year rate continues to slow. In the spending series durables, non-durables and service spending are all slowing. Slowing spending is a serious issue for this economy since investment has yet to revive. If spending falls off, it may Houston we have a problem.

For a comprehensive view of the economy one can look to the Leading Indicators that were down 0.2% in the latest reading or the Chicago Fed National Activity Index which returned to negative territory at -0.55 after a brief foray into positive territory. The three month moving average is -0.07 which is consistent with an economy growing slightly below its long term trend. That isn’t, however, a number that is associated with recession. The Chicago Fed says a three month average of -0.75 would be a reliable recession signal so we aren’t there…yet.

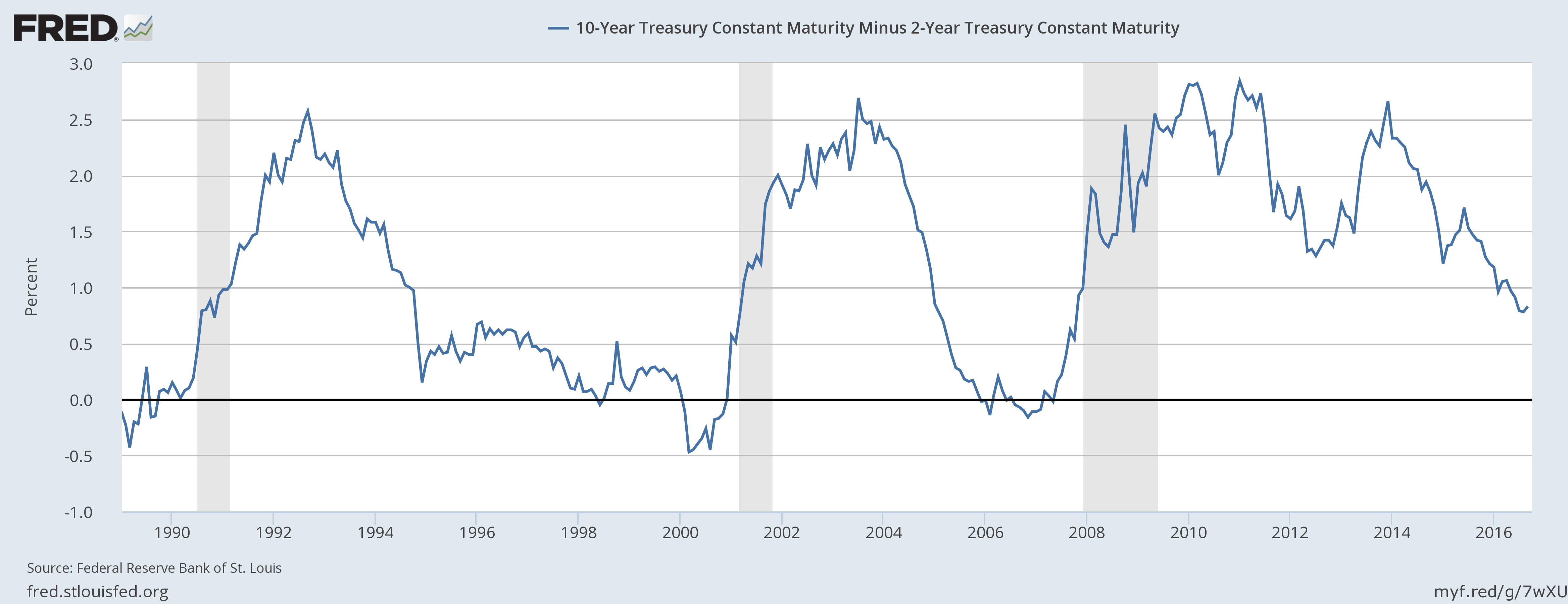

That view is confirmed by the yield curve which resumed its flattening over the last couple of weeks. Assuming the curve does actually flatten before recession, we’ve still got a ways to go:

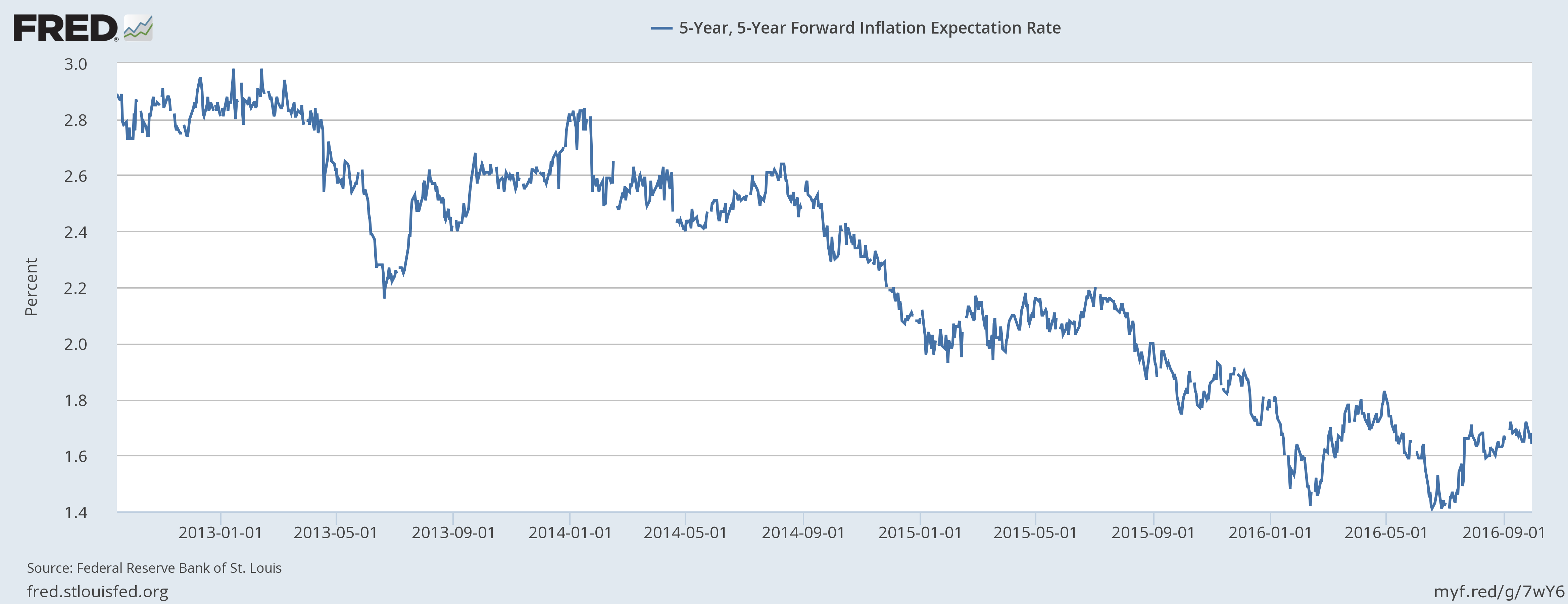

Inflation expectations haven’t budged:

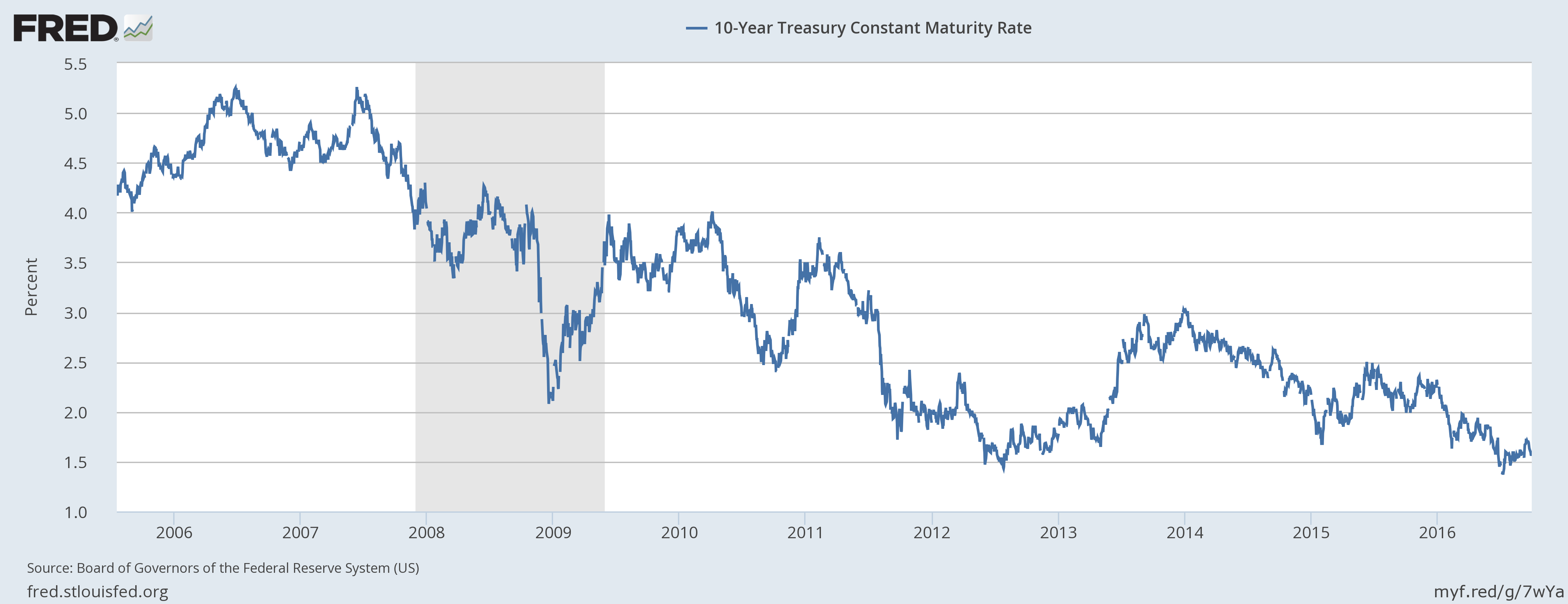

The 10 year yield fell over the last two weeks:

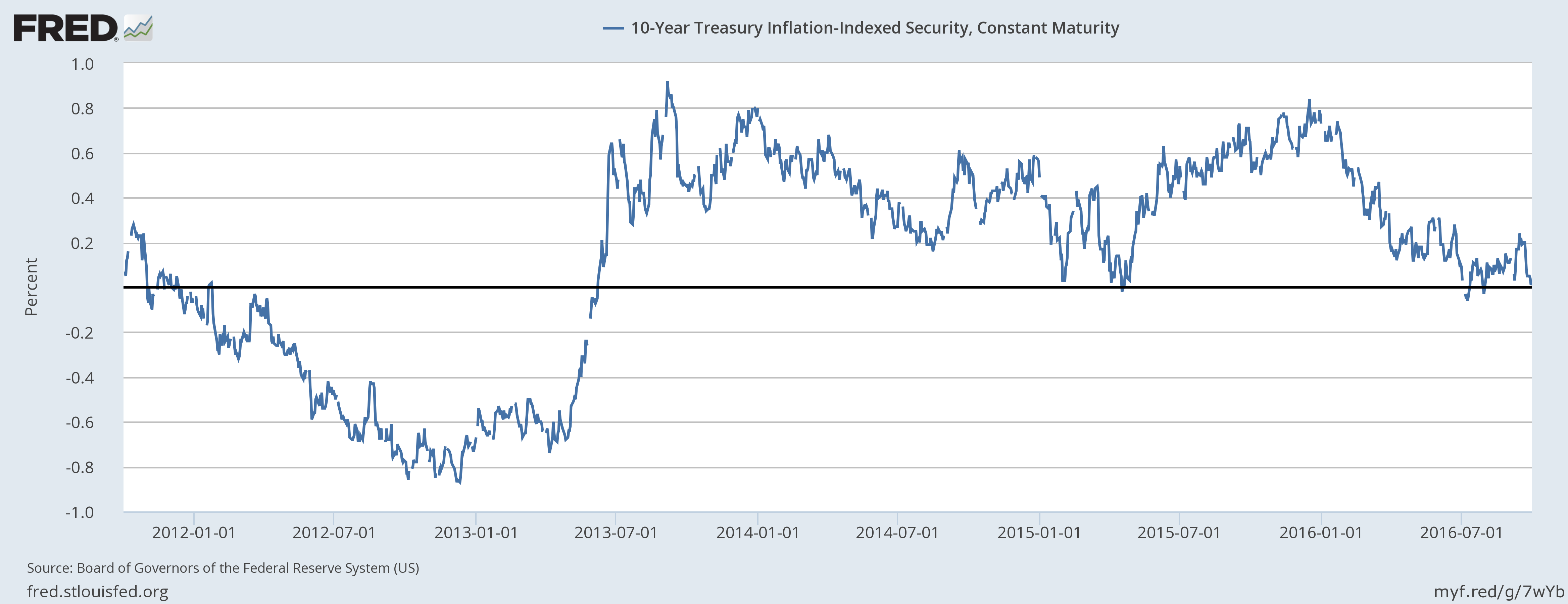

And that was essentially matched by a drop in real yields to keep those inflation expectations steady. That makes sense in the context of weak economic data; growth expectations fell over the last couple of weeks:

The rise in oil prices and the improvement in the KC and Dallas Fed surveys moved credit spreads narrower:

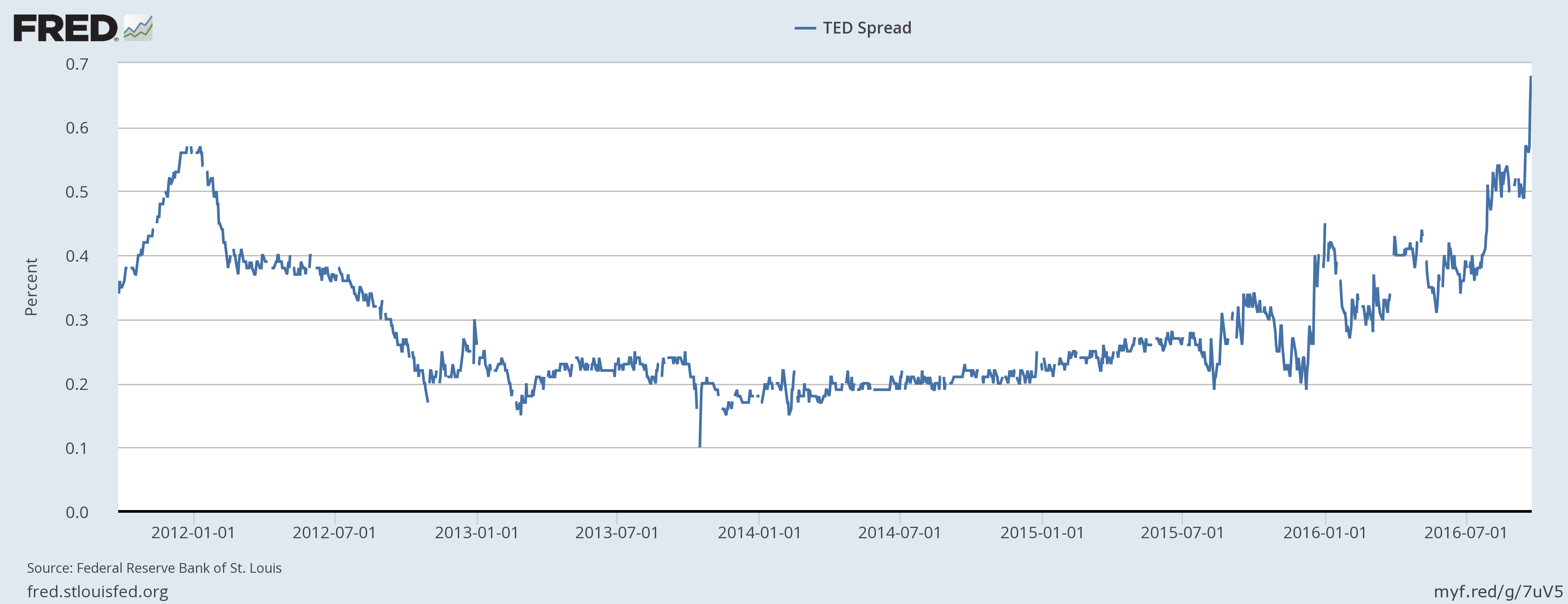

But the TED spread continues to worry:

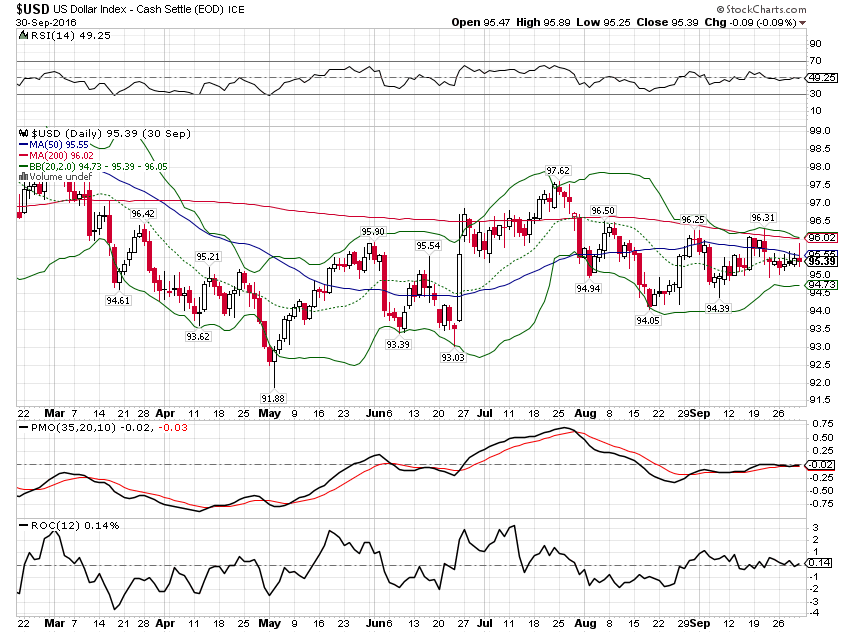

The dollar index pulled back slightly:

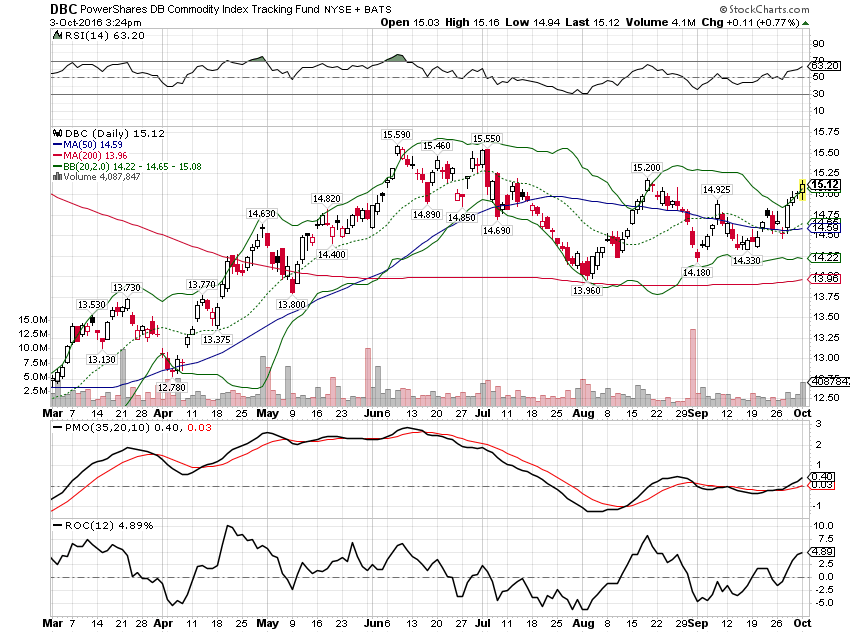

Which pushed up commodity prices

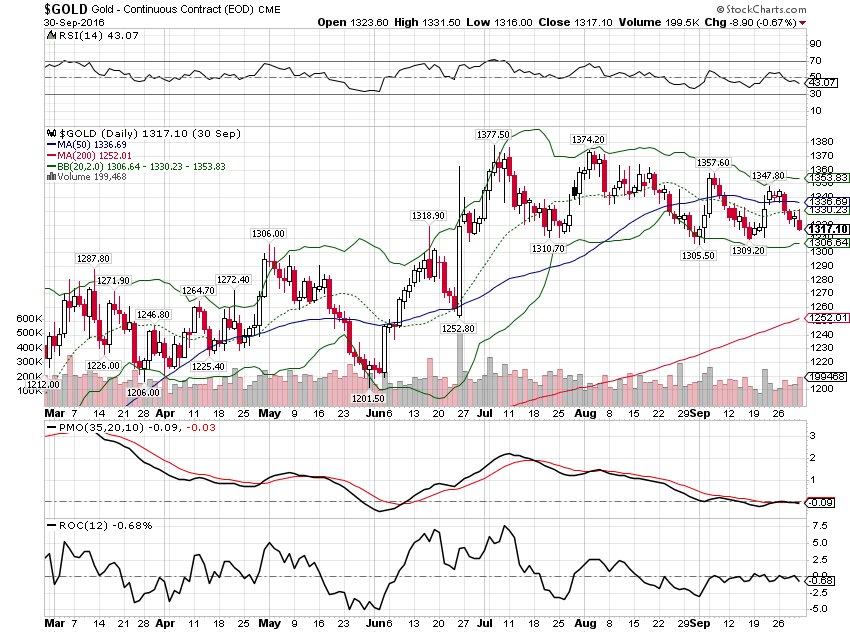

Although gold prices continued to consolidate:

The economy continues to grow but the rate is slowing ever so slightly. We don’t have nearly enough evidence to support a recession call but we are slowly, ever so slowly, moving in that direction. This cycle has been stretched out by policy intervention something we talked about when it started 7 years ago. If one thinks of the business cycle like a sine wave, policy interventions – fiscal or monetary – act to suppress the height and depth of the wave. But you can’t just shave off the valleys without shaving off the tops too. And if you compress the wave you inevitably extend the wavelength. But you can’t extend it forever and eventually we will return to the valley. A good bet, based on history, is fairly soon after the next inauguration.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch