Earlier this year it was reported that a great many OPEC nations were on track to repay China in oil rather than “dollars.” Reuters had calculated that between $30 and $50 billion of prior loans were to be closed out via each country’s crude capacities. As the price of the black stuff has dropped, however, that leaves them with little or perhaps nothing left to sell elsewhere and maintain even meager financial and economic existence that had become even more insufficient by 2015. It is almost feudal in its ruthlessness.

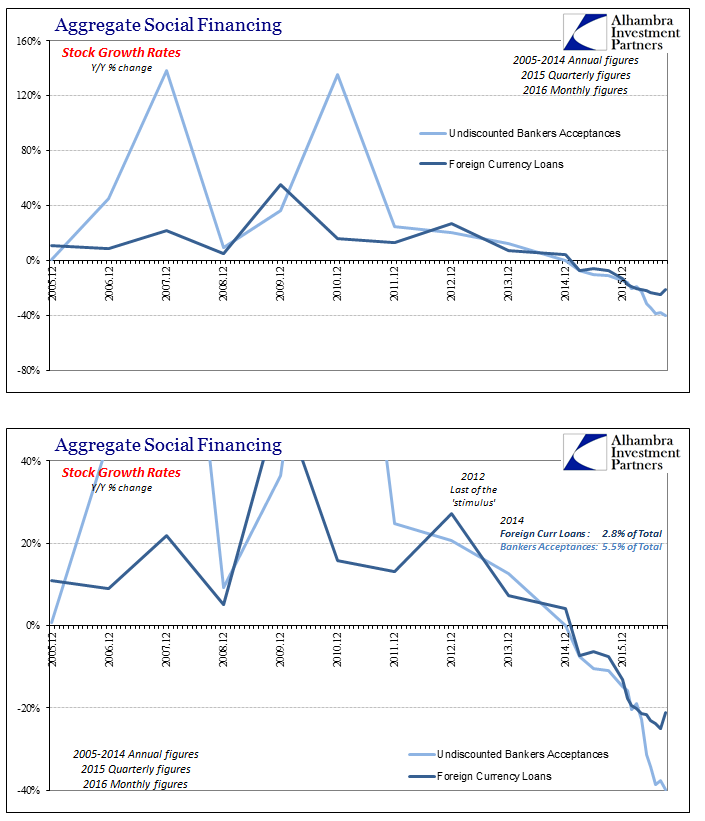

Not that the Chinese have had much choice themselves:

Under credit-based eurodollars, the Chinese lend Africa virtual numbers and get back all their oil. It is a much different result than one run by physical money and currency because there is really no value in the financial trade components (you may not be able to eat gold, but you can’t even define a eurodollar other than to know you really need it). That seems to be the biggest change, not just in financial factors becoming dominant but how that manifests into these sorts of processes. It is, in the purest sense, as if the Chinese have figured out how to exercise convertibility in a phantom currency without any such inherent aspect because they know all-too-well what “dollar” runs mean. It gives new and far more appropriate meaning to the term “petrodollar.”

For China, they can reduce their “dollar” footprint by having prepaid for oil with “dollars” they used to have readily available, while at the same time helping stabilize not just oil markets. “In other words, the Chinese need not borrow more ‘dollars’ to buy oil, while at the same time removing what seem to be enormous quantities from sale on global markets.”

Sure enough, recently released customs data shows that the Chinese by August and September now “prefer” Angolan oil above all others. From Reuters again:

Angola became China’s largest crude supplier for the second time in September, taking the top position from Russia, customs data showed on Monday.

China imported 4.19 million tonnes of oil from the southern African nation last month, up 45.8 percent from a year ago. That meant Angolan shipments stood at 1.02 million barrels per day, below 1.11 million bpd seen in August, the last time the country was the top exporter to China.

Though these reported figures stand up for themselves, the meaning behind them escapes the mainstream grasp. For Reuters in this story, the Chinese are bargain shopping for a rainy day.

China imported record volumes of crude oil last month, eclipsing the United States as the world’s top buyer of foreign oil as Beijing’s state reserves shipped in cheap crude to fill new storage tanks.

That is technically correct but misleading all the same. Rather than filling up the balance sheets of Chinese banks with “dollars” that largely African nations cannot source, the Chinese are building new storage and taking their oil instead because they are squeezed by “dollars”, too. The difference, of course, is obvious; China has all the leverage leftover from when it was the eurodollar’s prime destination and can thus still dictate repayment terms (some have included RMB swaps that lock the African partner into further one-way trade with China exclusively).

It is another case, and a pretty important one, where the traditional dollar perspective leads to confusion. From that view, the Chinese are being prudent consumers aiding the global market still beset by a supply glut, helping their African neighbors weather “transitory” factors.

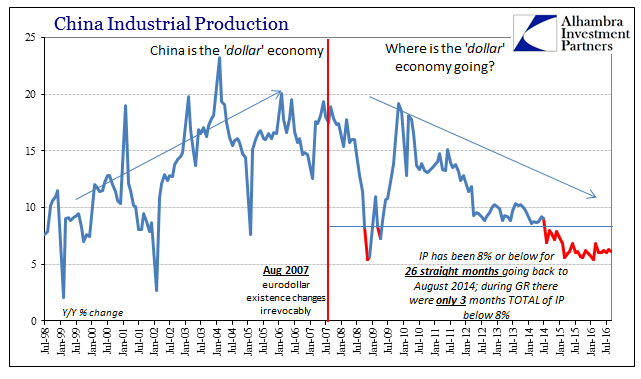

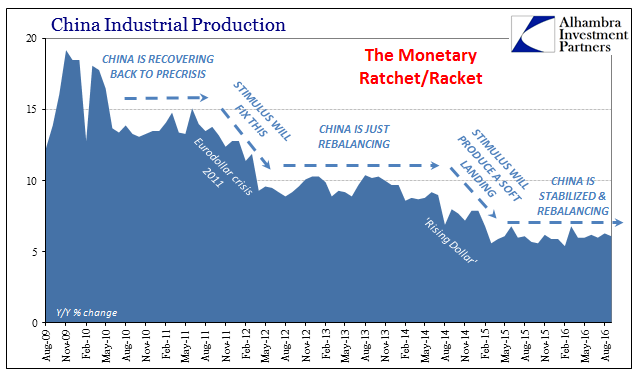

From the “dollar” view, by contrast, the Chinese apparently feel it better to take oil that they can’t use than to force “dollars” the oil producers can’t get. There are no winners here. While Angolan oil is certainly better than nothing, it won’t help SHIBOR, CNY, or the Chinese economy get back on track. Unlike what would have been of “dollars” had the world followed as economists promised, the oil will instead just sit there as a reminder of how this is nothing like it used to be, or was meant to be again.

Stay In Touch