It is often very difficult not to smile even though there is little lately to smile about. Every so often the world produces an absurdity that proves yet again God has a sense of humor, or that cosmic irony is a real thing. In economics and finance, all of the past few decades have revolved around actual money, which has been nothing like what the textbooks say. Though there was some great debate about 2008, in reality most people were just too stunned to see through the wreckage for what it was, more concerned with just surviving it than the full truth of it.

That left the events of last year as the great pivot. On the one hand there were the economists who made much out of very little in 2014 in order to claim as often as they could that QE had worked and the global economy was finally moving in the right direction and at the right pace. On the other side was the bond market, predicting worse than the malaise that had been obvious up to that point, suggesting that the insufficient economy was about to instead become the deficient economy.

In early 2015, it all came to a head with mostly oil. To economists, it was a temporary problem of too much economic success in finding and producing the black stuff; to the bond market it was an “I told you so” moment. For several months it looked like the economists might have been partially right, that lower crude prices and whatever weakness would accompany them were actually “transitory.” Then August happened, first with China shocking economists not just because of the “devaluation” or the intensity of it, but more so because they had no idea the monetary significance of it. It was revealed to them a few weeks later.

Just as all that was taking place, for all intents and purposes ending the dreams of “transitory”, the ECB decided it would install a sculpture by Giuseppe Penone outside the primary entrance of its headquarters in Frankfurt. Standing an impressive 17.5 meters, the piece depicts a tree made of bronze and granite clustered with gilded leaves. Benoît Cœuré, chair of the art jury and Member of the ECB’s Executive Board, said, “Giuseppe Penone’s tree conveys a sense of stability and growth and is rooted in the humanist values of Europe in the most beautiful way.”

I, and many others, saw it quite differently:

It is quite figuratively a “money tree” – at the headquarters of a leading global central bank! It is, perhaps unintentionally, but perhaps not, a giant middle finger to the rest of the world and especially the global economy, as if to say out loud they are all style devoid of any measurable and useful substance.

As I wrote at the start, sometimes you have to smile; just as they were extending their collective central banker middle fingers to all the rest of us, they were also right at the moment on the receiving end of a far, far greater comeuppance. The artwork wasn’t a symbol of “stability and growth” but rather a perfectly aligned representation of everything that the modern central bank actually is – a myth, a children’s tale, and, if we ever get past so much apathy and political inertia, a parable about how in the hopefully near future not to operate a vital global system.

The problem is, again, very simple. The global economy screams out in the most obvious way for textbook “deflation” or “tight money” – starting with commodity prices. A few weeks after the ECB unveiled their symbol of futility, Janet Yellen spoke in what was described at the time as her most important speech. Following the somewhat shocking decision to forego the September 2015 rate hike that all that summer had been seemingly assured, her topic was mostly how inflation expectations remained anchored even though there was less and less evidence for that interpretation. I wrote then:

This is the mind of an academic, filled with equivocation about ceteris paribus. As the “dollar” has clearly shown in these cycles (perhaps supercycle), liquidity and economy are not separable. The “dollar” drives down oil prices, roils asset markets and currencies all over the world and suddenly the economy is no longer so certain (in her mind; worse in forming perceptions) but none of those are related? It would be a logical stretch even under actually benign conditions, but in September 2015 with the financial world still bombarded by maintained duress and the economy looking at least shakier with every passing data point this is deliberately obtuse.

If economists were forced to work backward from what we actually observe they would have to admit to “tight money”; all the signs are there and have been there for years even by then. In fact, one of the first signals that the post-2011 global “dollar” system was experiencing only increasing trouble was the gold crash of early 2013. Economists were, as I put it last year, practically giddy about gold though they truly had no reason to be. They once again were mistaking QE for money:

So much happy emotion was never really much of a “stimulant”, of course, but the negative factors on “dollar” circulation were very real. In many ways, the collapse in gold presaged this latest stage or leg in the collapse of the global “dollar”, eurodollars in particular, which starts to account for the economic behavior these past few years as well. Gold, then, since early 2008 has been telling us a lot about the tendency of the eurodollar standard toward outright imbalance and dysfunction. That is a condition that is not in any way conducive for a global recovery, which is one big reason why, despite orthodox giddiness over gold prices, it never came.

To the vast majority of economists, QE remains as if money printing or a close equivalent. Others are finally starting to see reality for what it is rather than monetary policy only (greatly) delayed in delivering what “should be.” Writing for Project Syndicate yesterday (thanks to Jason Fraser of Ceredex Value Advisors for sending this), Harvard economist Carmen Reinhart finally says it:

Today, seven decades later, despite the broad global trend toward more flexibility in exchange-rate policy and freer movement of capital across national borders, a “dollar shortage” has reemerged. Indeed, in many developing countries, the only thriving market for the past two years or so has been the black market for foreign exchange. Parallel currency markets, mostly for dollars, are back.

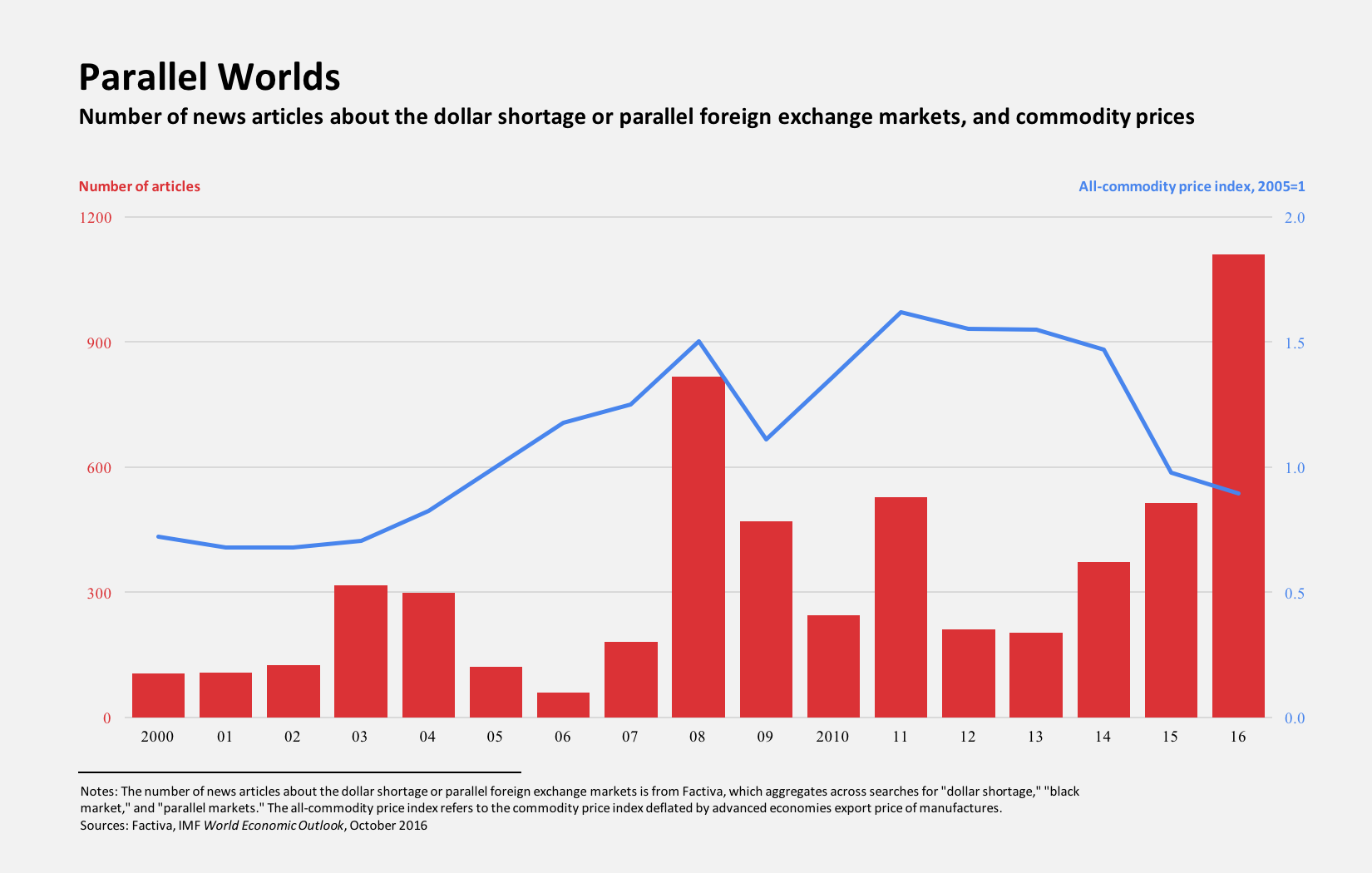

She blames mostly oil prices and commodities in general for the shortage, which is a symptom of “tight money” not its cause, but at the very least it is a step in the right direction. The chart she includes with her article says a lot about the condition, showing a huge surge in news articles about a dollar shortage or conditions related to it at exactly the times you would expect when you appreciate how there is no money in monetary policy, including QE.

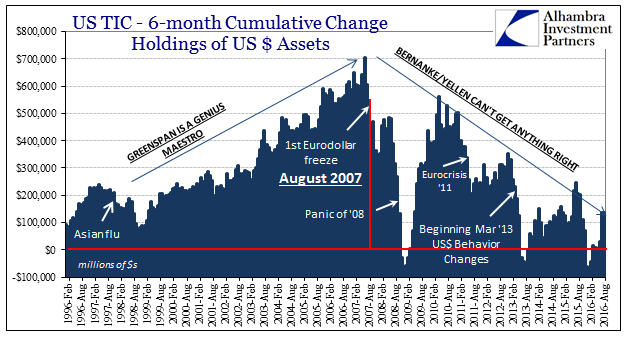

The world is finally waking up to its dollar problem, though in reality it is much, much more than that; it is a full “dollar” shortage. What will likely be most shocking to those who had subscribed to the Bernanke view is that this “dollar” condition is nearly a decade old, actually explaining why Bernanke should have been dismissed at least by the time Bear Stearns failed. The FOMC in every way demonstrated conclusively its utterly criminal incompetence because money wasn’t what they thought it was – even though that was the one task they were supposed to be totally unchallenged by.

It might sound utterly crazy, but it is perfectly and astoundingly consistent with the past 3,100 days and is thus the trajectory put in place by everything described above. Central banks have only resorted to greater lengths of lunacy and nobody has yet looked at their record and demanded a merciful end. If the politics of our current time don’t stop it first, then the actual laws of finance will one way or another. The fact that central bankers not only have failed but can only fail makes this a plausible concern.

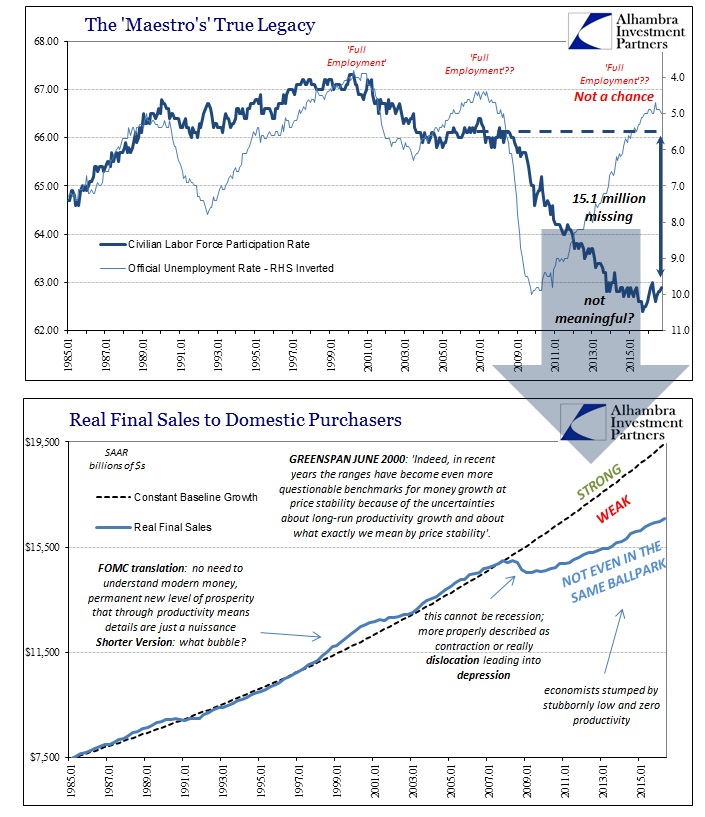

It gets more plausible by the day because there is only one possible explanation; and it’s exceedingly simple and straightforward once you ditch QE and blind dogmatic devotion to monetary policy. Central banks, especially the Fed, don’t have a printing press in their “toolkits.” They had been using the myth of the money tree to some effect for decades, Alan Greenspan the most prominent accidental “genius” maybe in world history because of it. When it counted the most, however, meaning since August 2007, a money tree has proven exactly as useful as it sounds. The “rising dollar” is and has been a euphemism for “dollar” shortage but only the latest stage of it, finally proving even to (some of) the previously obstinate orthodox faithful they have no idea what they are doing.

The next step is appreciating that they never did.

Stay In Touch