There bond selloff intensified the past few days in the wake of the election. I still believe that the potential Trump represents, rather than anything that has been specifically proposed, is the likely catalyst. I am also quite certain that goes along with the change in Chinese behavior where RMB are far more plentiful now than just a few weeks ago. But while that is good for global sentiment, that things could possibly change from an official perspective, it still leaves a good deal to be desired.

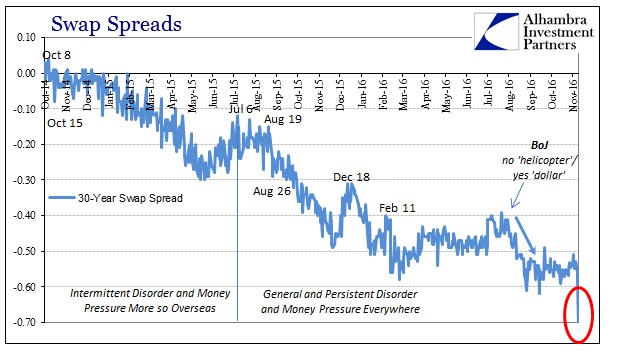

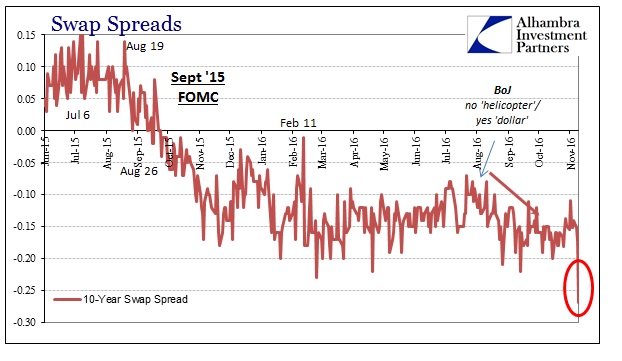

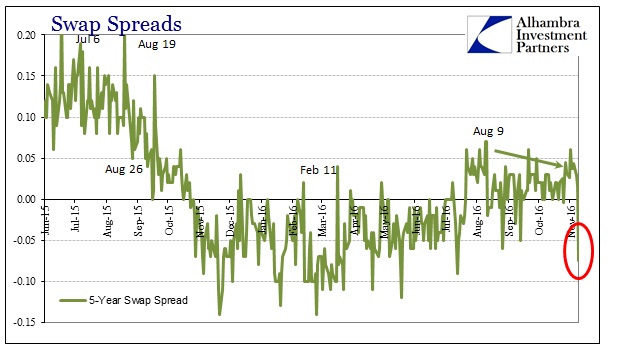

It starts with global liquidity, including the bond market. We don’t really have to wonder why the bond rout has been so vicious since it is pretty clear somebody (or several) got blown up. It’s all over the swap curve; hedging was furious and seemingly limited. It undoubtedly created a feedback loop that spilled over not just in more UST selling but in other places. As a reminder, we have seen something like this before, on November 20, 2013.

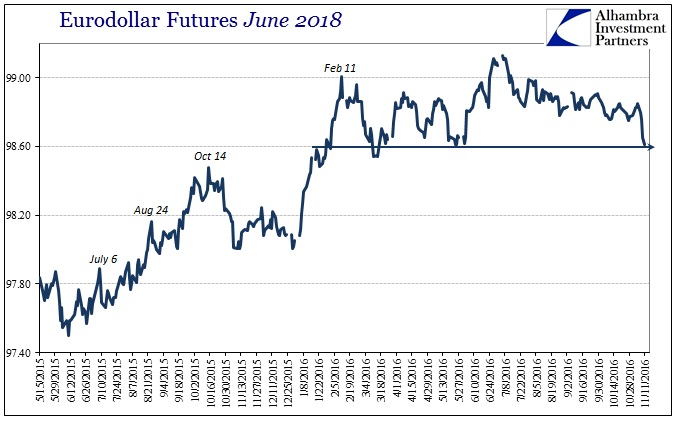

One of those places was eurodollar futures, the close companion of interest rate swaps. The futures range on Wednesday not surprisingly was huge. The benchmark June 2018 contract had an enormous range, more than 31 bps (price) with a high of 98.9275 before settling down at 98.65, close to the bottom end of the pre-Brexit range. It wasn’t nearly so ferocious in trading today, so it appears like the post-election session was truly devoid of liquidity in many forms and set the conditions for today in UST’s and elsewhere.

UST’s weren’t alone in that regard, as there was the usual suspect(s) playing along. The downside of the PBOC focusing inward on RMB liquidity is that it leaves Chinese banks that much more naked. If there is a regime change in Beijing (meaning a drastic policy shift rather than coup or more sizable political shakeup), and I believe there is, then the PBOC simply can’t step in to the “dollar” market to aid the downside. In other words, if they were to do so they would only create more “devaluation” pressure since “selling UST’s” or really supplying wholesale “dollars” would have the effect of stripping even more RMB liquidity in the process, leaving the PBOC (or Chinese banks on its behalf) to do that much more in RMB to make up for that deficit plus the one that they are trying to alleviate in the first place. That extra “dollar”-related deficit would only lead to more “devaluation” pressure, making it all that much more difficult to accomplish at any point.

Some perspective is warranted here. Though the action is violent, it seems more so compared to the conditions that prevailed from mid-July. In eurodollar futures, there had been little trading volatility for those months, where the big move over the past few days is in context almost the perfect reverse of trading after Brexit.

We can’t know what those swap or eurodollar futures prices actually represent until more trading in the coming days or weeks confirms those are something more than just desperate illiquidity. Even if they are legitimate fundamental views, it would be as I suggested yesterday that in the full context of where these markets have been the shift since July is one that went from a desperately bleak outlook (short and long run) to now still bleak but not quite so desperate.

But in a low liquidity, functionally tight environment, even what should be positive ends up blowing out someone in dramatic, market-shattering fashion. Given that swap spreads and eurodollar futures are actually trading at odds with each other here, which I think is, again, significant as a measure of overall systemic capacity, it seems much the same indecision where all the shifts and changes of the past few months could be good, but still not as yet eliminating or even dampening that lingering dark side. I think markets like the opportunity that if confronted again central banks won’t just reflexively offer up another QE or similar that everyone now knows is a waste of time and emotion; but are careful about the very real chance that central banks, like the PBOC, might be put back all over again into just that situation.

Stay In Touch