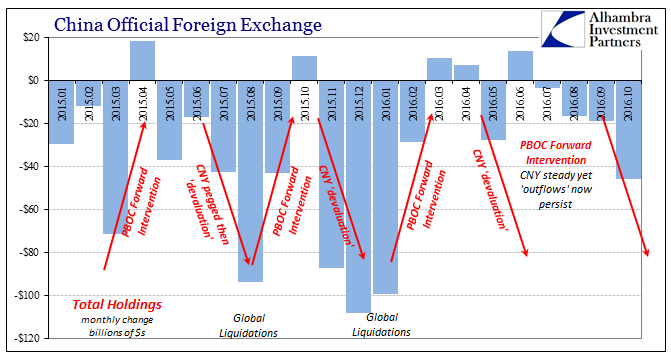

China’s State Administration of Foreign Exchange (SAFE) reported a large drop in forex assets in October. This was unsurprising given what we already know of “dollar” conditions from the behavior of the exchange rate itself. The pattern is by now very well established and quite predictable. At -$45.73 billion for the month, it was by far the largest decline in “reserves” since January (and once more repudiates the constant proclamations from economists that China’s “outflow” problems are in the past; they aren’t because they aren’t outflows at all, rather disappearing private “dollar” sources).

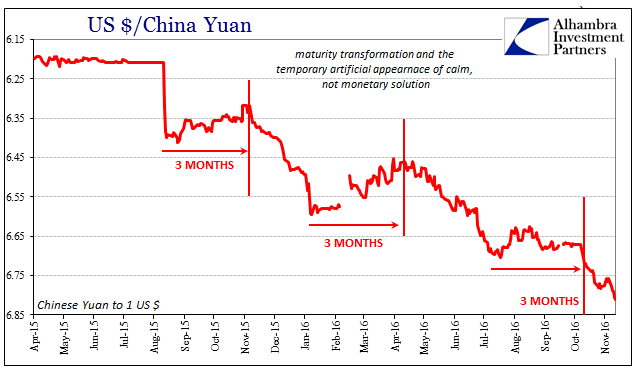

As has been the case throughout China’s unfixable struggle with the “rising dollar”, large declines in their reserve categories occur whenever CNY is falling, as it was throughout most of October. The unseen “dollar” pressure in whatever wholesale format was by all indications, including those in RMB as well, quite severe, owing to recent conditions as well as the maturity of past PBOC efforts (the “ticking clock”).

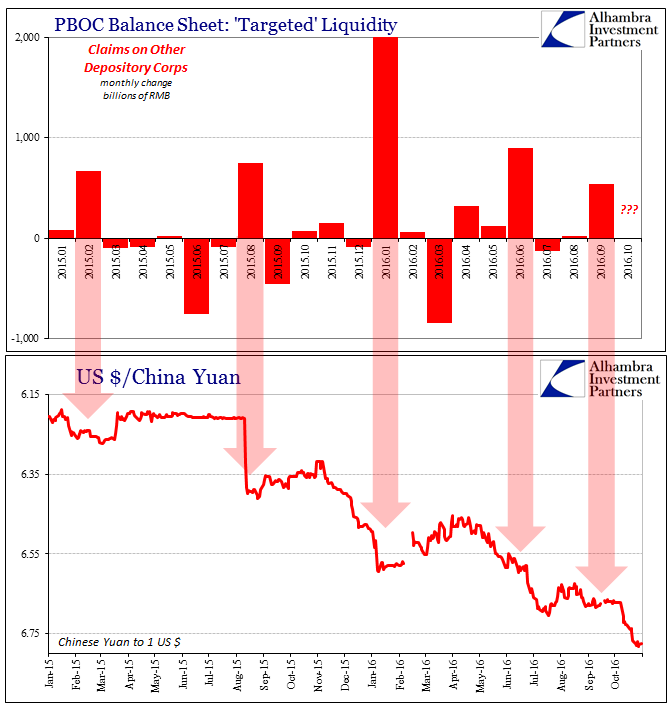

There is also a very clear relationship between RMB operations inside China from its “targeted” liquidity conduits and the CNY rate. That, too, has been quite well-established as a linked factor to what SAFE reports in official forex activity. All of that relates to also the unofficial PBOC (or PBOC sponsored and covered private bank) efforts that we can only infer.

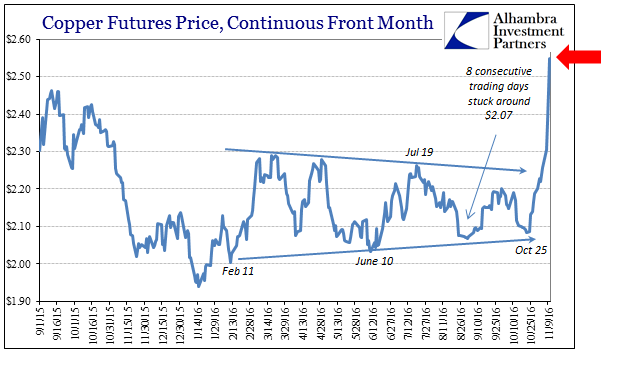

To that end, we strongly suspect not just a shift in recent operational targets and emphasis back to RMB, but also the increasing “dollar” problem that made it perhaps inevitable (so much that it very likely, in my view, claimed the Finance Minister’s job). Around October 25, SHIBOR (as well as repo) stopped its concerning rise while, as noted this morning, copper surged in its tight connections to more “accommodative” Chinese money conditions.

All that means that Chinese banks are increasingly on their own without PBOC aid or cover in order to source “dollars” from the overall eurodollar market (to rollover uninterrupted their “dollar short”). In raw terms, the less the PBOC does in that regard the more those Chinese banks have to obtain privately. The price at which they pay for those market-based “dollars” is, generically, the CNY exchange rate. Therefore, from the Chinese perspective it is far more costly to bid for those “dollars”, but from the market perspective those bids become more competitive.

A funding bank in eurodollars will certainly factor increasing risk and attach whatever CNY premium necessary in order to fill the needs of those Chinese banks, but at some point, assuming no overall increase in the market supply of eurodollar capacity, China’s “dollar” participants (borrowers) are going to start bidding past other banks in other countries who are of similarly troubled condition. At that point, it would look like, as it had in 2015, a bidding war for the limited supply of “dollars” from among primarily EM-domiciled banks.

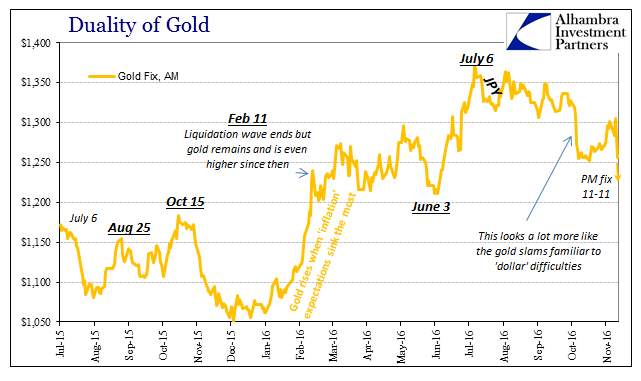

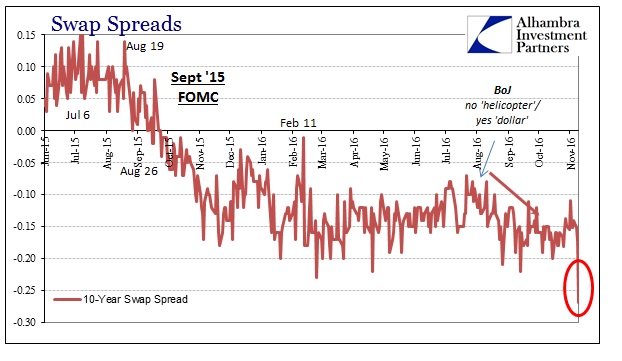

Obviously, the exact conduct isn’t quite like I have described here, but that stylized illustration provides a narrative format for understanding what we see in this context. And sure enough, EM currencies were pounded in the past few days just as global liquidity certainly dropped all over the place – from UST’s, to interest rate swaps, to eurodollar futures.

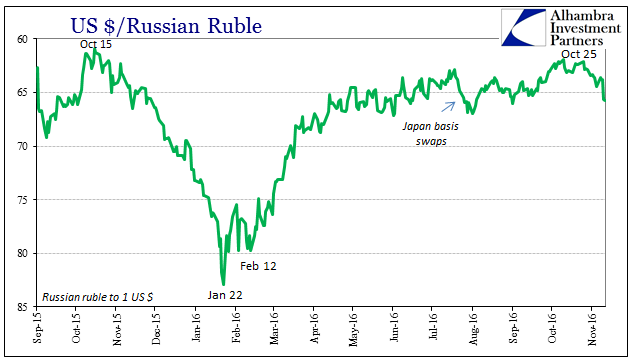

But the problem for EM’s was not strictly the past few days. Reviewing them, we find the date October 25 as an obvious inflection in major EM currencies. The Russian ruble, for example, has been slowly but steadily appreciating from the second massive ruble crisis that hit that nation coincident to the second “dollar run” through January 2016. The steady upward approach was interrupted, importantly, in mid-July as Japan’s FX “dollar” problem reached a higher plane of trouble.

The last ascent after that episode ended on October 10 at just more than 62 to the dollar. This latest downward move started on October 26.

The currency rate had knee-jerked higher in the regular Asian session today, but then sold off again to 66.28 a little after 11am this morning before closing around 65.83.

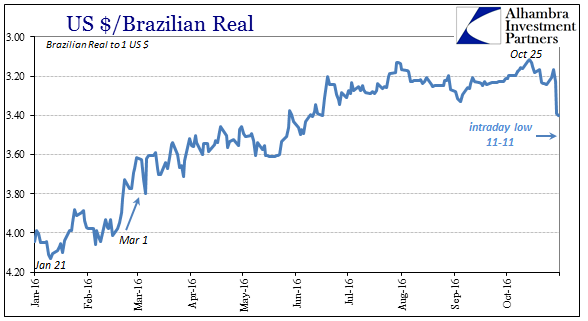

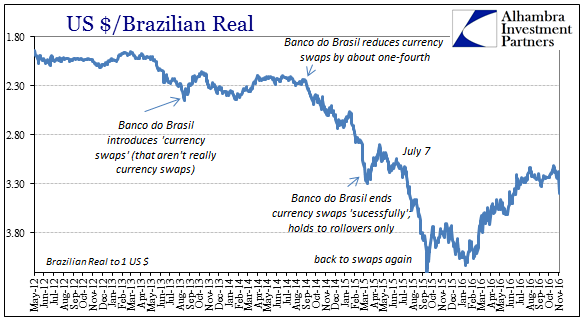

The damage to the Brazilian real is even more pronounced, and thus that much more concerning. In the midst of continued huge economic contraction related to the “dollar’s” recently past disruptive influence, Brazil can ill-afford another bout with starving liquidity. In just the past three trading sessions, the real has been hit with a bloodbath; dropping from around 3.22 to the dollar to as low as 3.50 also at just after 11am this morning (before settling today around 3.40).

As with the Russian currency, however, this was not just a three-day selloff. The dramatic change in Brazil’s currency, thus “dollar”, fortunes started also on October 26.On the 25th, the real had traded as high as nearly 3.11, an exchange “value” not seen since last summer. It, however, had already sunk as far as 3.24 by November 4.

It is during these same days where copper prices have exploded higher undoubtedly, in my view, on Chinese RMB efforts. And I think that establishes easily the chain of causation that runs from “dollars” to China to the rest of the EM’s. The more the PBOC does in RMB, the less they do in “dollars”, leaving a greater deficit for Chinese banks to bid on eurodollar markets at higher and higher cost. Other EM currencies would have to adjust for those Chinese factors absent any additional eurodollar supply from somewhere else (either eurodollar bank balance sheets, or some other source including perhaps unrelated central bank conduits).

If, on the other hand, eurodollar supply was not just constrained but increasingly so, as swap spreads indicate, then what would be a problem for all turns into a rout for some as the competitive balance for a limited number of “dollars” is totally upset.

Volatility is, obviously, a problem all its own in this context, but the real concern is whether this is just the start – a true inflection. If it turns out to be a one-off like July in rubles, then the damage is likely limited and maybe even soon forgotten. The real danger has always been this year where the “rising dollar” is resurrected in exactly this fashion through exactly these Chinese influences. It is at that point that the CNY down = Bad formula is at its most potent, and it raises further the worst case risk of a full break in CNY, thus all currencies, like that of last August.

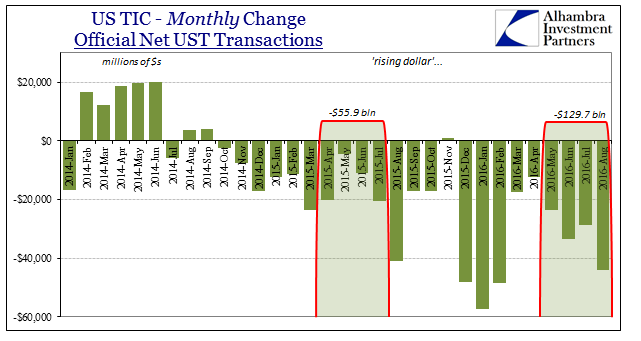

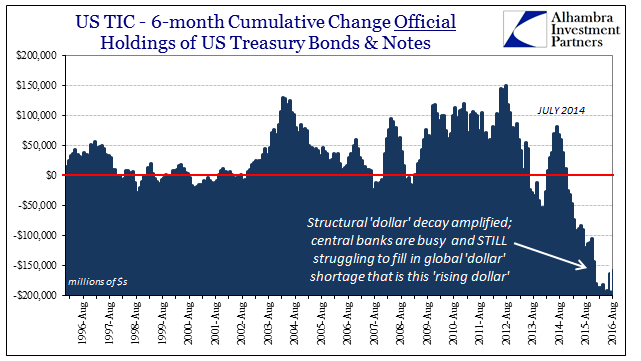

That was the whole point of central banks being far more active this year than last; they have been “selling UST’s” that much harder in 2016 so as to avoid those devastating liquidity conditions of 2015. Remember, “selling UST’s” is really just a euphemism for “supplying dollars” in a variety of forms that aren’t always captured by mainstream accounting. Therefore, the TIC data which supplies one estimate for “selling UST’s” is but a rough proxy, though perhaps a really good one that in review (the data is unfortunately delayed by two months) confirms a great deal about what we suspect of all this.

In other words, we can infer on a very reasonable basis that central banks have been heavily involved in smoothing out “dollar” problems from the private market and its Chinese connections (and disconnections), and by the behavior of EM currencies (up to now) had done a reasonable job at it. If they are suddenly being overwhelmed all over again despite very likely still “supplying dollars” on a significant basis, and that would be the conclusion if the EM selloff continues, what does that say about what might have changed in “dollars”, China, and/or China “dollars”? Nothing good.

The selloff in EM’s might be the only thing that matters right now. It really has nothing to do with President-elect Trump despite the timing (that may have just been the catalyst running from UST positions throughout the whole eurodollar balance sheet), and may instead be the inevitable result of what has been building all summer. Again, it has already claimed the PBOC all over again despite their mammoth interventions, so it isn’t unreasonable to assume that it would progress perhaps violently far beyond China’s borders, triggering all the unwelcome repetitions of last year. And if that is the case, can central banks around the world get it back under control again? At what cost?

We shall see. It is, as a I wrote last September, the nightmare scenario. Every time these central banks intervene at great cost they can at most buy some limited time; before they are hit all over again and have to incur even greater costs, in the form of greater interventions, without ever actually fixing the problem – it only ever escalates. Like the proverbial quicksand, the real problem with the global “dollar short” for these banks and central banks is the short. “Dollars” are but the vehicle or symptom.

Stay In Touch