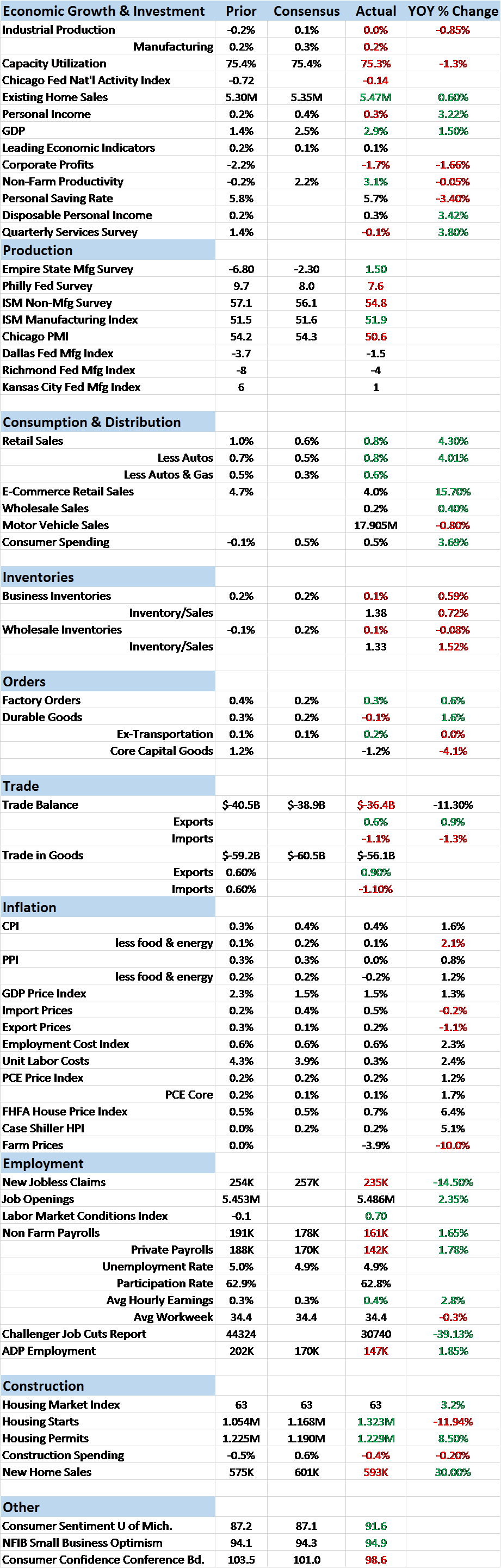

Economic Reports Scorecard

The reported economic data of the last few weeks (it’s been 3 weeks since my last update so I guess technically this isn’t the Bi-Weekly Review) provides about as much direction and insight as the polls conducted prior to the election. To my eye, the trend here is trendless with a decidedly mixed set of data, each positive with an associated, offsetting negative. Thus we had a weaker than expected Personal income report alongside a better than expected retail sales report. We got weaker than expected ADP and employment reports as weekly jobless claims hit low levels last seen when Elvis was Vive-ing Las Vegas. Sometimes the reports seem to contradict each other, as construction spending falls in the face of a 25% housing starts surge.

Manufacturing continues its doldrums with factory orders and industrial production both disappointing. The ISM manufacturing index was a bit better than expected but at 51.9 is showing pretty weak growth. Some of the regional Fed surveys improved – Empire State, Richmond and Dallas – but others retreated – Philly, Chicago and KC. Factory orders improved slightly but capital goods orders continued their decline (-4.1% YOY).

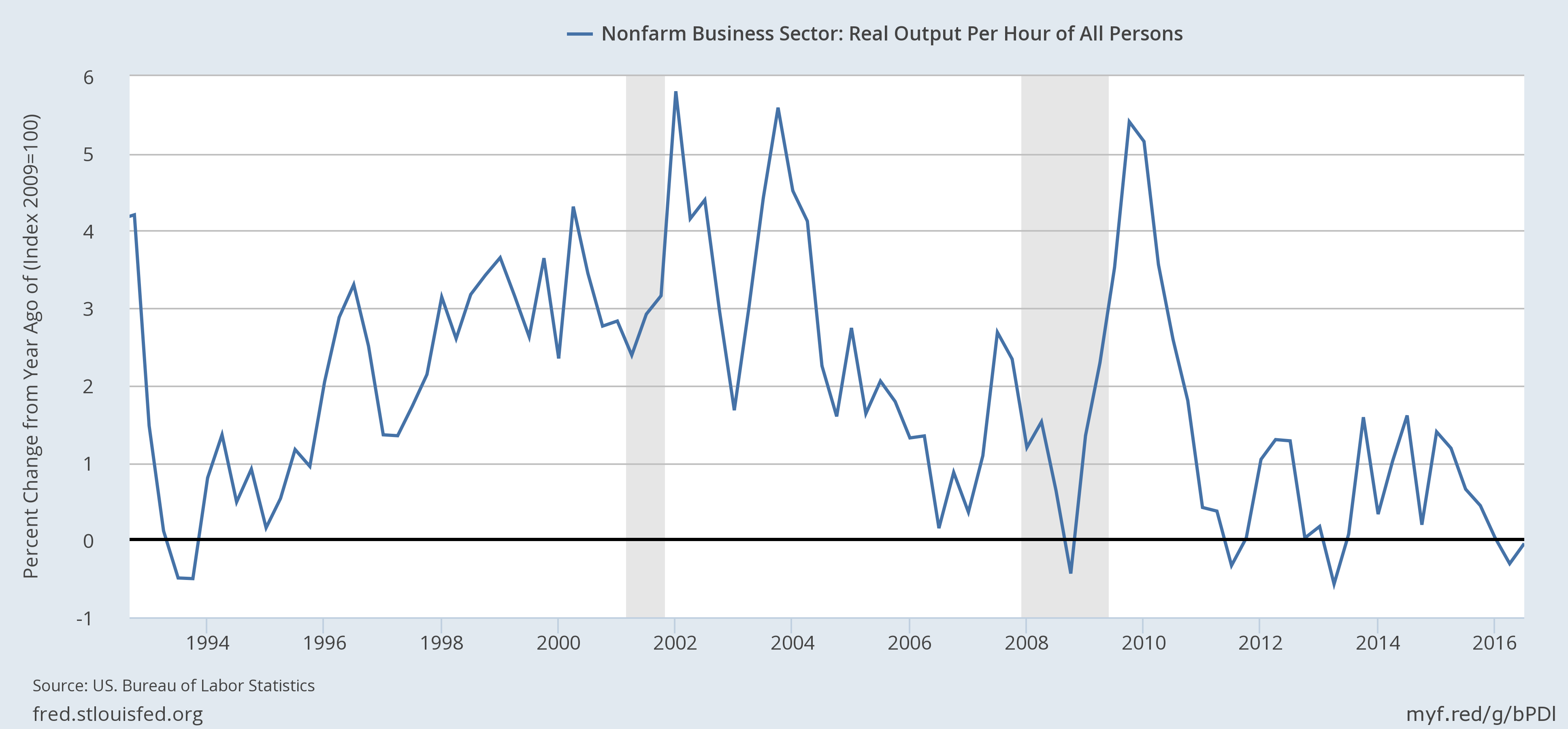

One area of improvement that merits a mention is productivity which grew by 3.1% in the latest quarter. Productivity is the key to future prosperity and it has lagged significantly since the turn of the century. This one report doesn’t mean much of anything since it merely measures output versus hours worked for a very short period of time, but it is at least a positive. Will it last? I have my doubts, based mostly on that trend in capital goods orders. Investment is inevitably linked to productivity gains and we have had precious little of the former the last decade which explains the dearth of the latter. Quarter to quarter things can look okay but those periods have been scarce since 2000:

The market, though, is not reacting to the incoming data so much as the incoming political change. Markets are trying to price in the impact of Donald Trump’s policies even in a vacuum of solid information about what exactly those policies might be. So far, the markets seems to be saying that whatever the ultimate policy mix it is likely to be inflationary but with slightly more real growth as well. Considering the potential huge changes to policy, the market movements so far have actually been rather mild. Of perhaps more interest to investors is the reaction to the market changes. All those analysts who were most recently predicting awful things if Trump actually found enough rubes to put him in the Oval Office, spent last week talking up the virtues of the Trump agenda. In other words, they did what they always do – found a way to spin whatever is going on at the moment as a reason to buy what they’re selling. Trump’s election has already produced growth in one area – instances of schadenfreude.

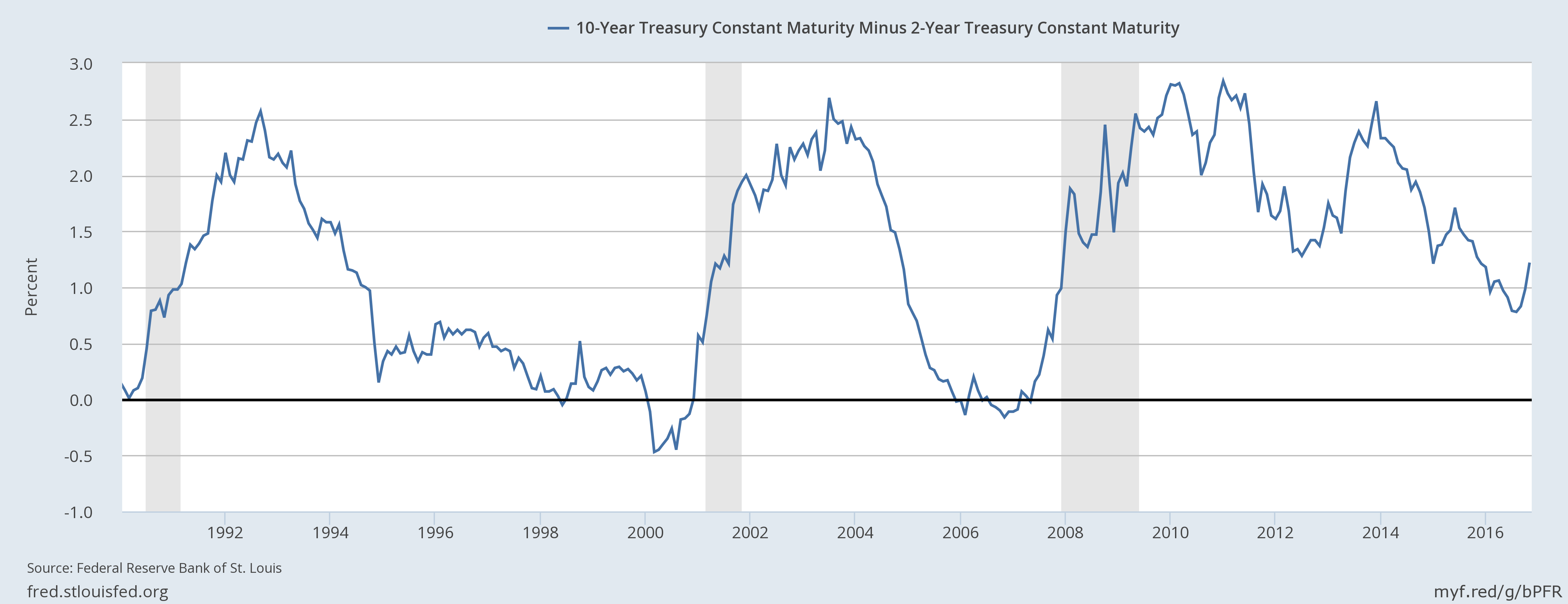

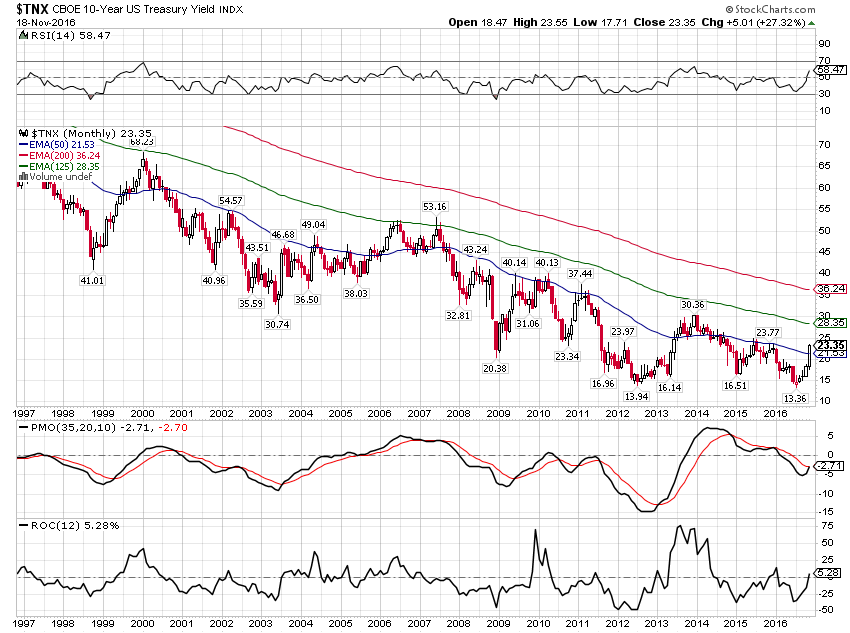

As I said, the market movements weren’t as large as the headlines seemed to indicate. Yes, bonds have sold off but rates are basically just back to where they were at the beginning of the year. And despite all the talk to the contrary, the bond bull market is intact. The yield curve has steepened a bit since the election but it is still a bear steepener, long rates rising faster than short term, and therefore more rooted in inflation expectations than real growth expectations. The 10/2 spread only widened by 11 basis points since the election but it was already moving before the election.

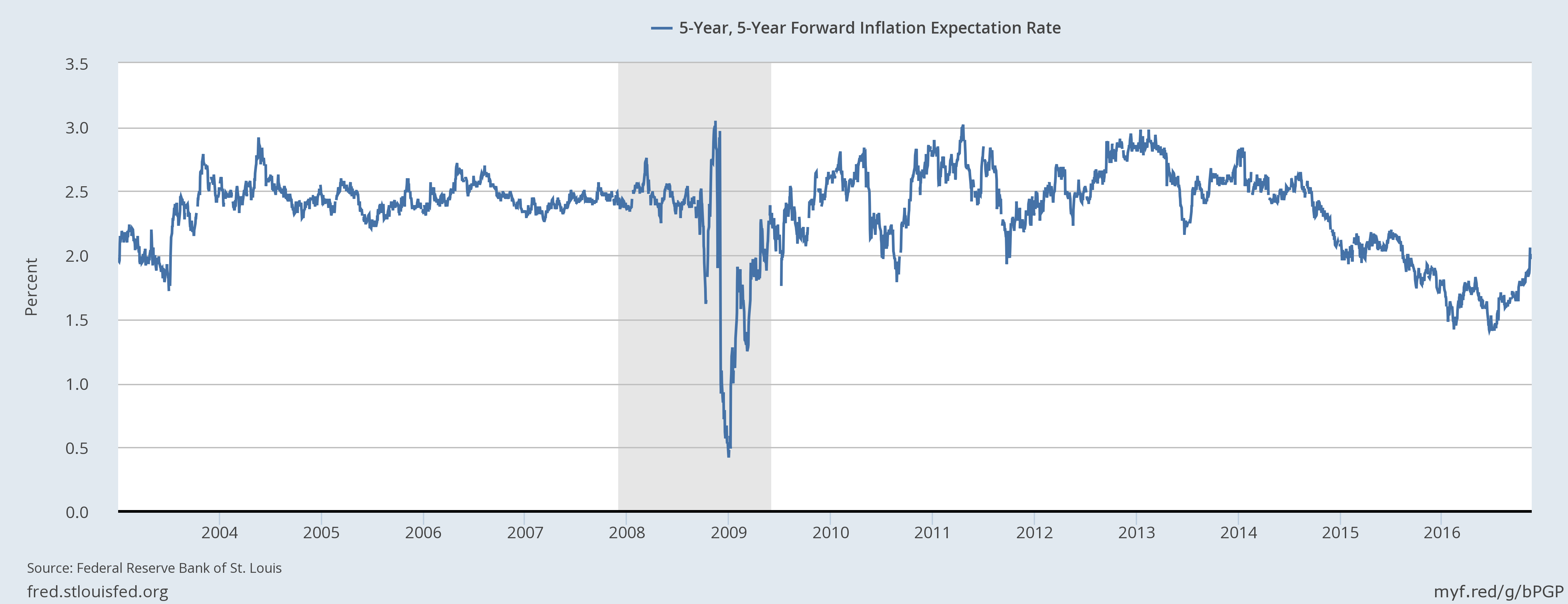

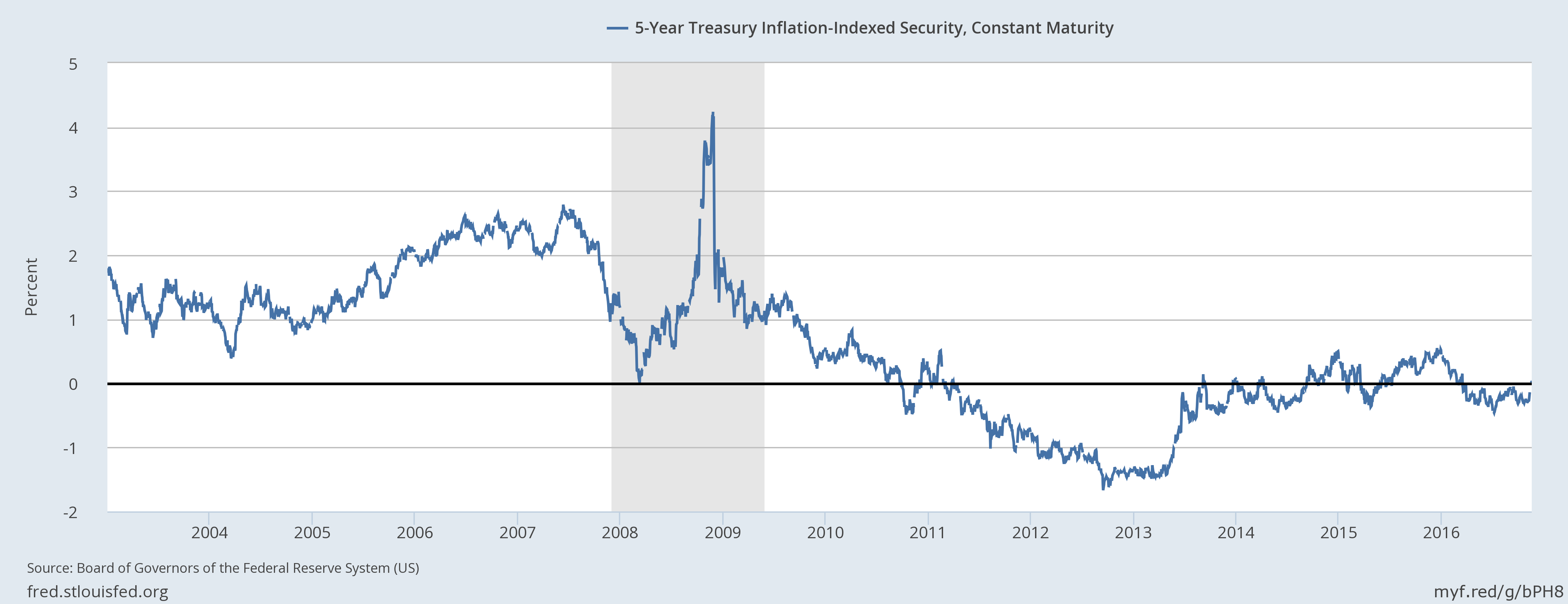

The move in bonds is mostly about inflation expectations. Even with this rise though expectations for inflation are still well below the levels of recent history.

TIPS yields have risen too, indicating a rise in real growth expectations but only back to the zero level and still well below rates that prevailed in the early part of the century.

As I said, the bond bull market is intact. You aren’t going to break this long trend easily:

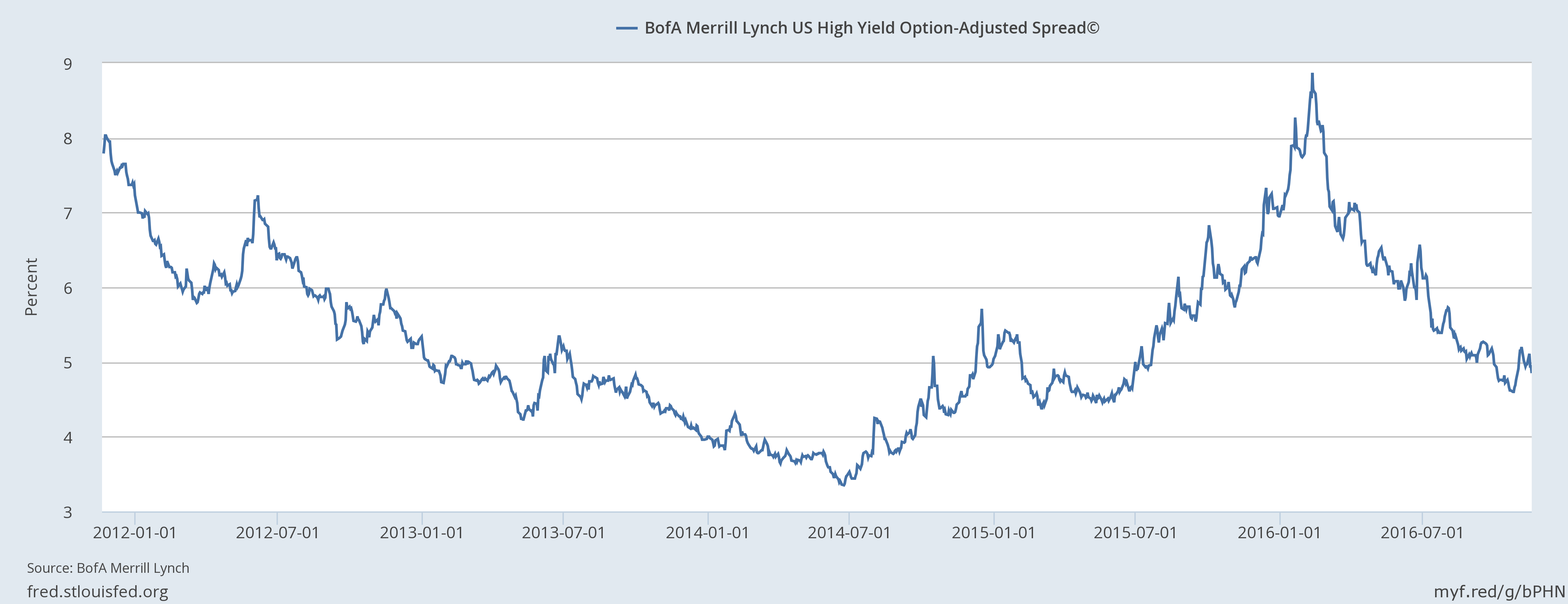

Credit spreads narrowed slightly since the election but only 6 basis points over the last 3 weeks. They aren’t really falling anymore but they aren’t rising either.

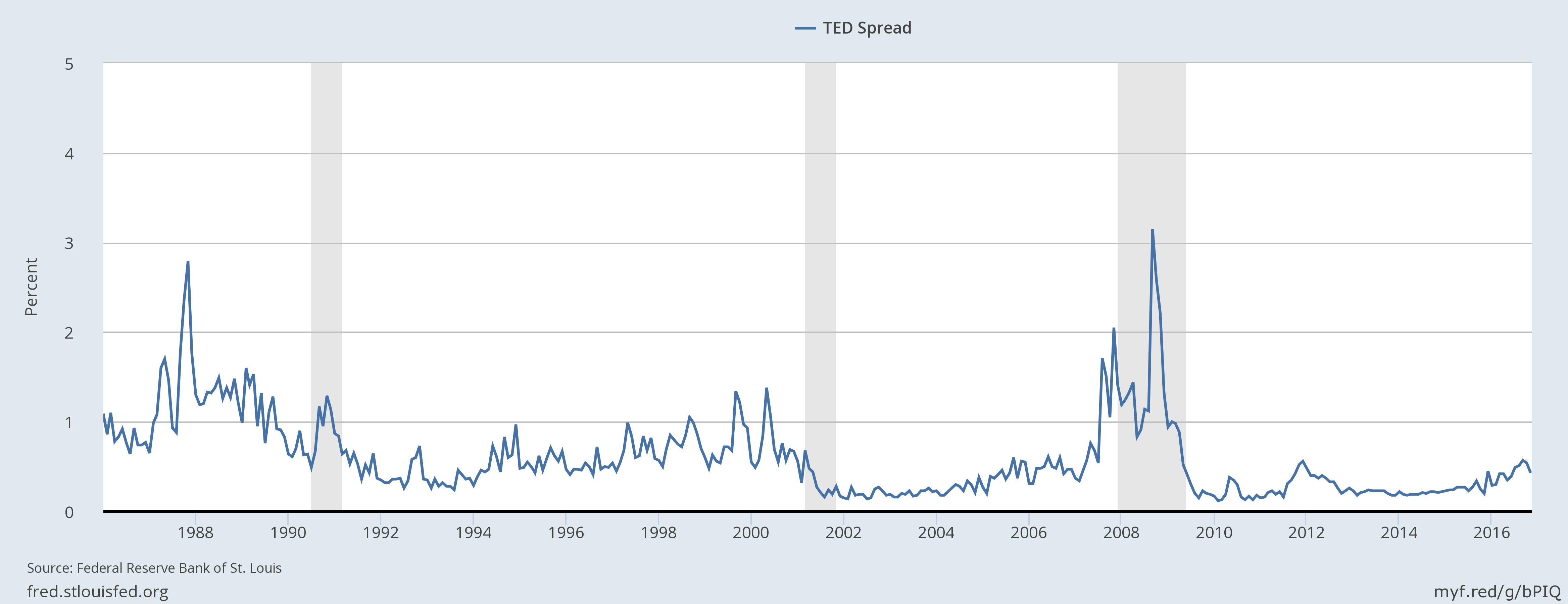

Here’s a positive sign. The TED spread, which we’ve been monitoring closely, narrowed considerably and it appears the recent tantrum is passing. It is still wider than the best levels though and we will continue to monitor:

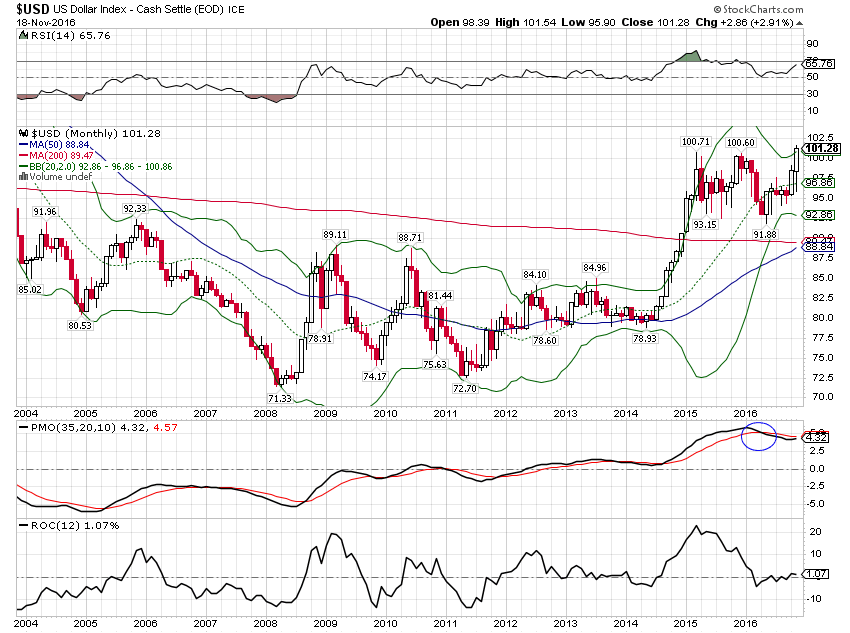

One indicator that did move quite a bit was the dollar. I said in the last update that it appeared the rally had stalled but that was obviously premature. However, as you can see the long term momentum indicator is still on a sell signal. I suspect there may be a bit more upside to the dollar index but if Trump follows through on his campaign trade rhetoric – and every indication from Steve Bannon is that he will – it will prove dollar negative. If the President tells the entire world he wants a weaker dollar – and labeling China a currency manipulator is doing exactly that – he is likely to get it.

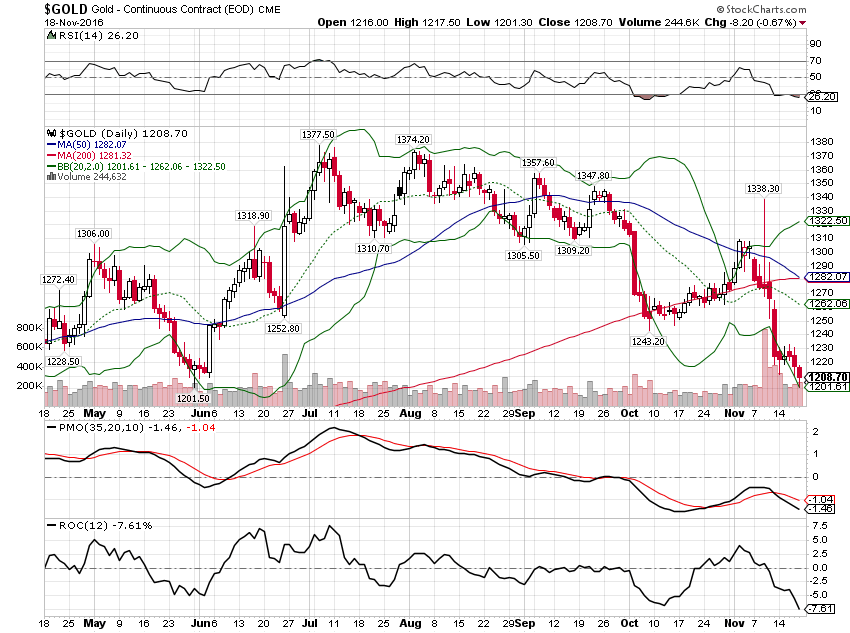

Based on the action in the dollar, I also said in the last update that gold appeared ready to resume its rally. Instead, the yellow metal took another downleg after the election:

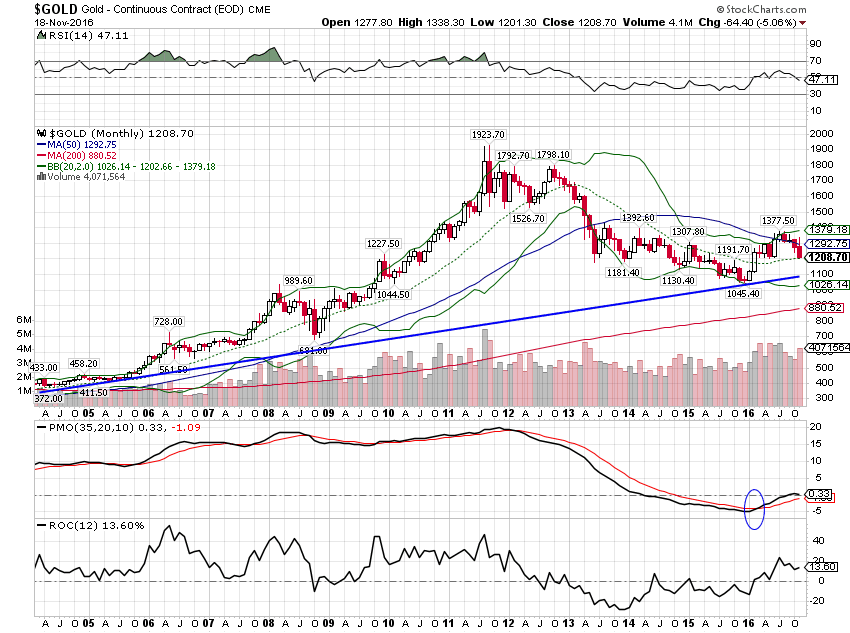

But again, the long term trend – and momentum – is still intact:

The dollar and gold charts are ones that will challenge anyone who lets politics get in the way of their market analysis. The post-election rally in the dollar and the drop in gold (flip sides of the same coin) are very positive indicators for the US economy. It shows a significant rise in the demand for dollars, one not driven by fear but rather by optimism. But the response to the rising dollar, by the Fed but more importantly the new Treasury, will be extraordinarily important. The goal should be a strong but stable dollar. It is the rapid movements – up or down – that create instability. Unfortunately Trump’s economic team isn’t much of a team as it seems to be divided between a hard money faction and a mercantilist faction – economic nationalism as Bannon calls it. I would just point out that the latter group’s views were a major political asset in the recent election even if economically suspect. Which faction gains Trump’s favor? Not a hard question in my opinion but I would be happy to be surprised.

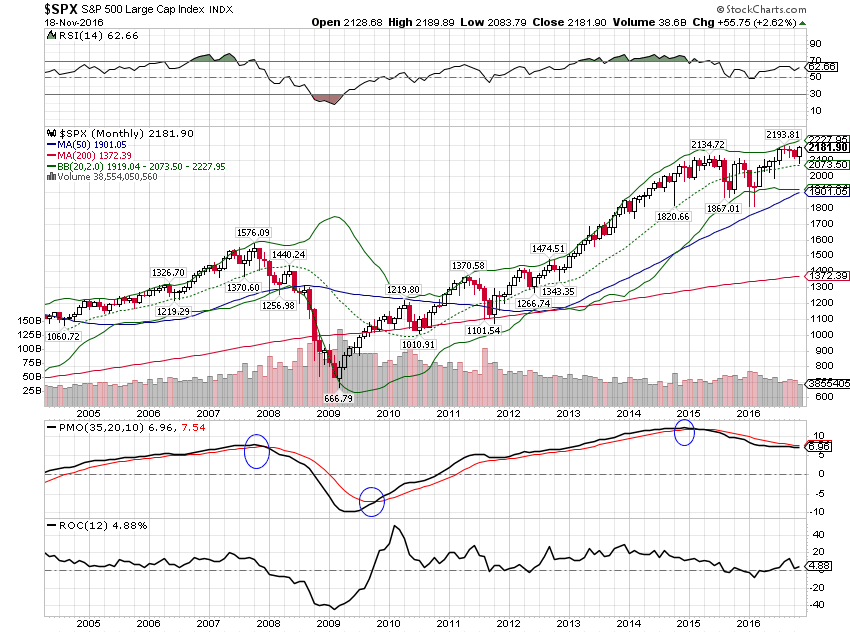

One last chart. The stock market reacted positively to the election result but none of the major averages produced a large enough rally to change the long term momentum outook which remains negative. And while some indices such as the Dow did make new highs, the S&P 500 did not. That could easily change this week and probably will but I would just point out to all those analysts falling all over themselves to raise their growth guesses that the move in stocks is not pointing to much of a change. And neither, for that matter, is the bond market.

Immediately after the election I cautioned that we needed more information to make informed judgments about our investments. That hasn’t changed in the last week. We don’t know any more now than we did the day after the election. The market action is somewhat encouraging but at this point the response has been pretty weak. Maybe that will change as the economic team is named in the coming weeks. In the meantime, the economic outlook has not changed materially.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch