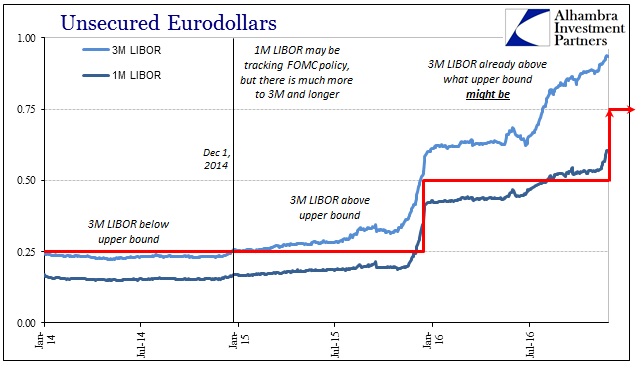

After sticking around 53 bps since the middle of September, 1-month LIBOR has jumped almost 7 bps since November 11 to register above 60 bps for the first time in years. With the December 2016 FOMC meeting fast approaching, it is quite natural to assume eurodollar markets are picking up what has been “hawkishness” over recent weeks. This would be a repeat of last year, where the 1-month rate didn’t really start upward until November 17 in anticipation of what did happen one month later.

The other maturities of LIBOR, however, argue for more nuance and complexity, perhaps mystery. The 3-month rate passed 93 bps, a great deal more than what the upper boundary of the federal funds rate would be if the FOMC lives up to itself next month.

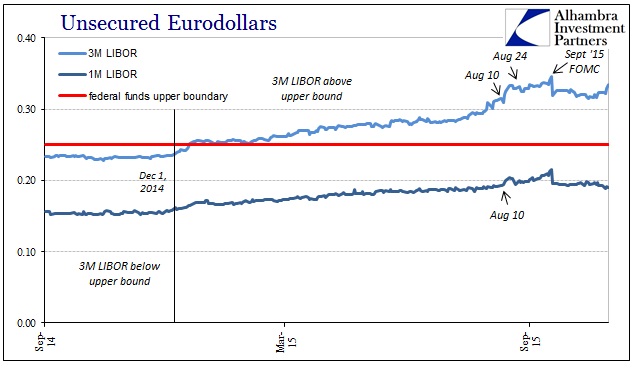

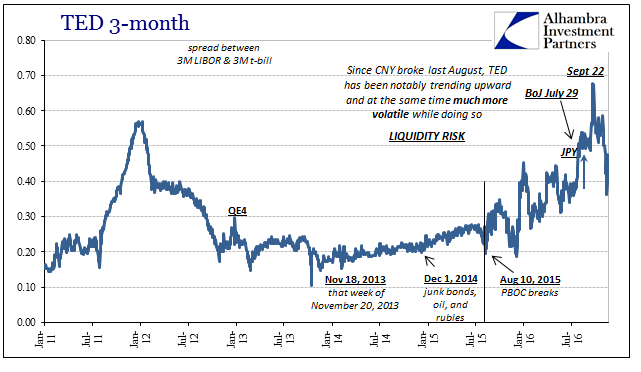

So where the 1-month rate is more likely following the monetary policy channel, further down the curve there is more to it. The history of the past few years displays these changes quite well, dating back to December 1, 2014. Before that date, 3-month LIBOR and shorter fixed below the FOMC’s upper boundary without question. That date is notable as it related to rubles, oil, the UST curve and therefore “dollars.”

By summer, the 3-month rate picked up a persistently positive spread to the boundary. That spread hasn’t diminished over 2016, and, in fact, has only grown to the point it will be enlarged even if the FOMC does hike another 25 bps next month.

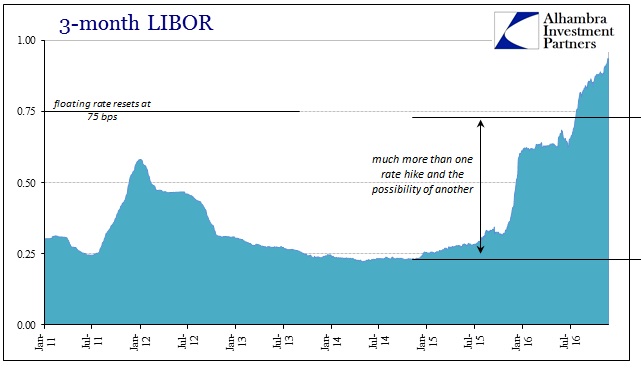

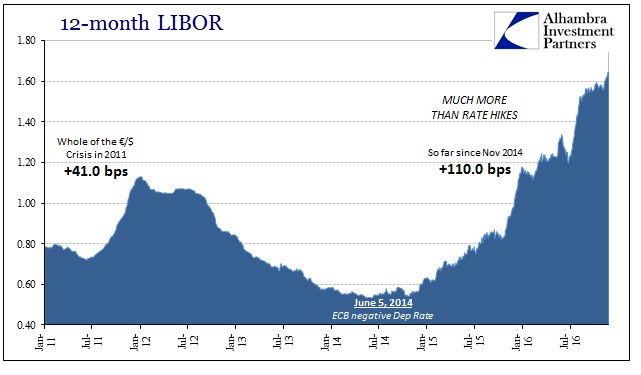

It is possible that eurodollar participants are thinking about more than a single rate hike in December 2016, but that in my view is highly unlikely as even FOMC officials are reluctant to generate those kinds of expectations after being so embarrassed by having already done so last year. What we find instead is that the LIBOR curve is blowing out toward the farther ends; where 3-month LIBOR has jumped already more than two 25 bps hikes, 12-month LIBOR is pushing toward five.

The difference has been in some places attributed to money market reform (2a7) but that is already six weeks in the past – and LIBOR rates still rise far more than what might be fairly indicated about monetary policy. Because of that, we have to go back to December 1, 2014, and the further corroboration of “dollar” events beyond unsecured eurodollar lending.

In July 2015, for example, 3-month LIBOR started to rise noticeably from its already positive spread to the upper boundary. That may have been related to expectations for a September 2015 first rate hike, but there was a conspicuous crescendo in LIBOR in the middle of that August that even the 1-month rate registered.

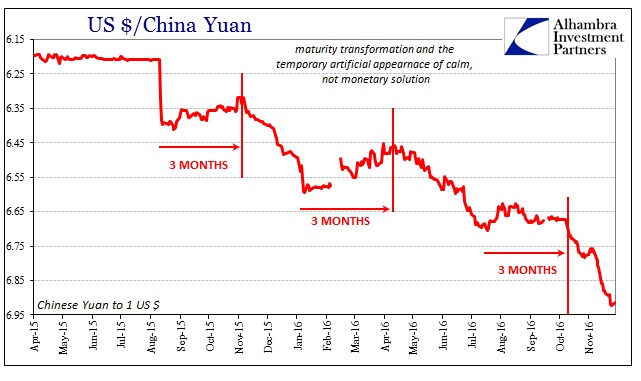

That bump in 3-month LIBOR dates back to the days just before the PBOC broke against CNY – and the dramatic global liquidations that followed just two weeks later. It is difficult to argue that prospects of a single 25 bps rate hike or even the start of a series of them caused that much damage in such condensed fashion. The asymmetry of it, including its origination on December 1, 2014, strongly asserts causation in the other direction.

It is yet another disturbance in global “dollar” markets that finds a direct link to CNY and the worst events of the “rising dollar.”

We are running out of coincidences with which to ignore this or excuse it all in some absurdly benign way. Even the interrelation among LIBOR rates suggests this concern. If the 1-month rate is “content” to hug the possible future path of FOMC but other maturities are not, then that itself argues of greater demand for termed-out funding above and beyond what would register as further rate hikes. The only reason for such a shift would be if eurodollar participants are less confident in being able to smoothly rollover the shortest funding arrangements; and are therefore in greater demand for funding at longer terms, paying a larger and larger premium for the privilege.

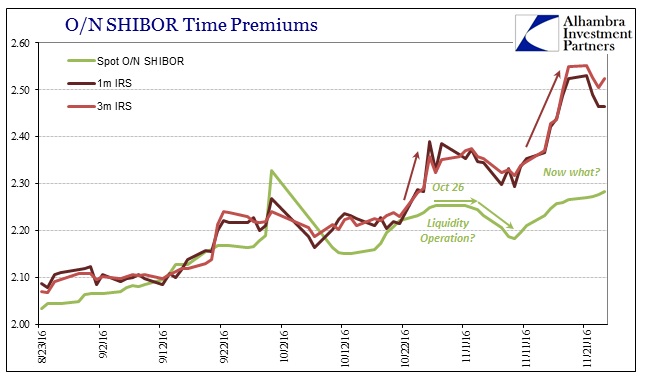

It’s not panic; it is, as the TED spread also relates, growing liquidity concern. It’s something that isn’t just left to eurodollars themselves, however, as we have seen the same risk expressed in markets from China to Saudi Arabia to Hong Kong and beyond. Interest rate swap prices for onshore RMB liquidity, which is directly connected to “dollar” availability for rollovers, are trading as if exactly like LIBOR time values. IR swaps on overnight SHIBOR show huge bursts of hedging/term funding demand that would only arise if Chinese money market participants were increasingly worried about RMB availability in the short run.

What do we make of all this? It is, of course, impossible to discern who or what is short of “dollars” and how exactly that might be affecting perceptions about the smooth operation of “dollar” funding and rollovers. The connection to CNY but also first December 1, 2014, to me suggests an alternate avenue for disruption that hasn’t been considered. The PBOC has been engaged with an intermittent intervention policy for most of the past few years, but they aren’t alone in that effort nor are we really sure exactly how they and those like them have done so.

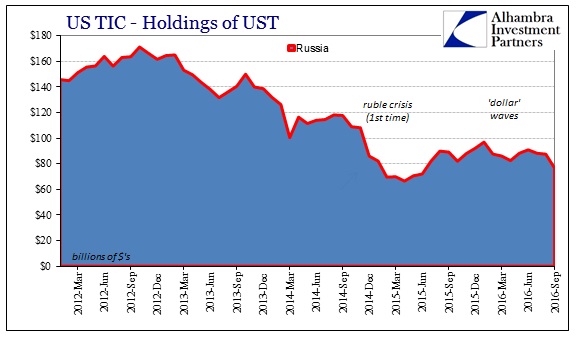

The events specifically of December 2014 were more heavily retained by Russian factors than Chinese. And it was around that time that the Bank of Russia (the central bank) initiated an emergency FX swap/repo arrangement. Unlike the Chinese, the Russians have been far more open about it:

In the second half of 2014, restricted access of Russian companies and banks to foreign financial markets together with oil price drop resulted in increased volatility on the domestic FX market, higher devaluation expectations and deviation of the ruble exchange rate from the fair value. This posed considerable risks to price and financial stability.

Due to the strong interdependencies between different financial market segments, tension in the FX market may impact short-term money market rates. As a result, money market rates can deviate significantly and sustainably from the Bank of Russia key rate which determines the monetary policy stance, and hamper the achievement of the Bank of Russia operational target and distort the functioning of the monetary policy transmission mechanism.

So the Bank of Russia has been providing additional “dollars” to Russian banks that are, like Chinese banks, perpetually short of them but finding it more difficult to maintain working order (to the point of bringing in the central bank). While that may be indicated by the rising LIBOR rate as a consequence of growing eurodollar inelasticity with regard to Russian banks (or Chinese), we have to ask ourselves the consequences of these central bank actions; or, as I put it yesterday (subscription required):

The real question, one that I won’t examine here, is where is the Bank of Russia obtaining dollars for these ongoing repos? This is where it really gets fun, and starts to provide more of the key linkages that make the “rising dollar” a variable “dollar shortage” that isn’t always strictly about supply; it is as much about distribution of “dollars” and also collateral for “dollars.”

I will examine the possibility here by asking, Whose “dollars” are they? They are any number of possibilities, but we can’t help but notice that the $50 billion ceiling for the emergency FX repos (that are still in place, minus the 12-month program that was shut down in June 2015 likely because too many Russian banks were lining up to use it, concerned as they were about this familiar “dollar” rollover risk) aligns rather nicely against Russia’s reported holdings of UST’s – down sharply to $76.5 billion in September according to TIC from $87.5 billion in August.

What that suggests is that the Bank of Russia might be sourcing the global “dollar” markets for redistribution to banks inside Russia. In other words, if Russian banks find it difficult to borrow “dollars” in whatever form, including FX derivatives, then the Russian central bank will borrow them itself on their behalf as a far more appealing option as far as the eurodollar market would consider.

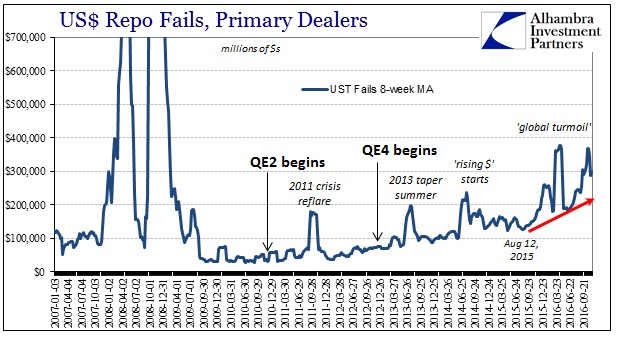

But this would not be strictly one for another, the Bank of Russia standing in “dollar” for “dollar” for what its constituent banks might have otherwise rolled on their own. Central banks have a tendency to leave a large wake from their efforts no matter what those efforts might be intended to accomplish. Furthermore, as “dollars” are channeled more and more to the Bank of Russia, it might come at the expense of other Russian and non-Russian borrowers (shorts) who by comparison to the Bank of Russia don’t quite match up. If you as a global eurodollar bank have limited spare “dollar” capacity and you have the choice of lending them to either the Bank of Russia (who, by the way, has a “silo” of spare UST collateral which is globally in short supply; as demonstrated by repo fails in UST’s) or some nondescript bank in another troubled location, you are going to charge a premium and perhaps a growing one to that second option(s).

Replace Russia with China in the paragraphs above and the CNY as well as ruble picture begins to fill out with more needed “dollar” color. A succinct way of putting it would be to suggest that central banks sourcing “dollars”, as I have suspected all along, from the eurodollar market as a non-economic bypass might be one factor in spreading the “dollar” problems that we see in LIBOR and beyond. As with so many things about central banks, sometimes the “solution” only makes for a bigger problem (“ticking clock”).

I want to be careful to clarify that this is speculation on my part, one possible interpretation drawn from what I think reasonable inferences about “dollar” and foreign money behavior. It is certainly far from conclusive, nor is it comprehensive (I am not claiming that the possible presence of the Bank of Russia or the PBOC is the only problem). It is just another prospective piece to a very complicated puzzle to consider amidst “reflation” that would need an end to “dollar” problems to actually become reflation.

Stay In Touch