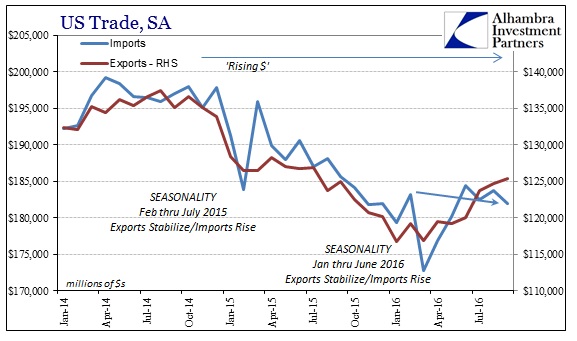

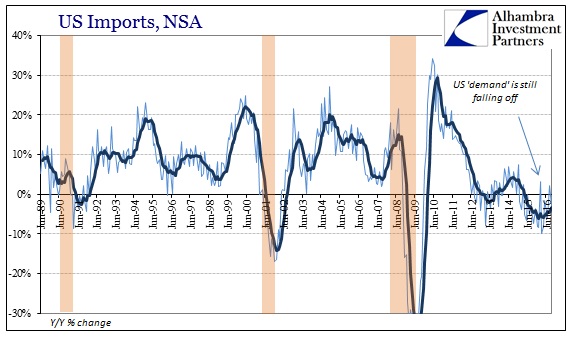

While certain markets continue to dream of the economy that might be, we continue to be stuck with the economy that continues to be nothing like it. Last week the Census Bureau reported that exports fell slightly year-over-year in September 2016 after rising slightly in August for the first positive number in two years. On the import side, marginal US demand remains non-existent; imports fell almost 3% year-over-year in September.

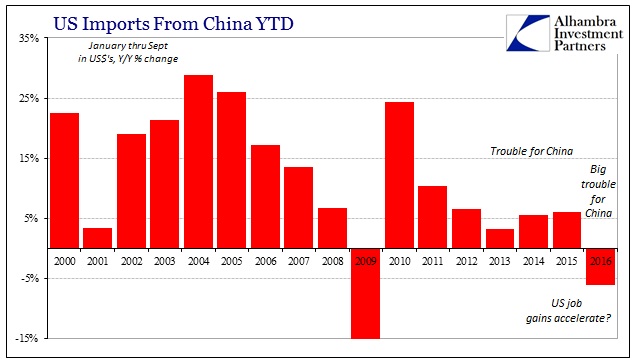

The brunt of domestic weakness continues to fall on the Chinese. This year is by far the worst year for US imports of Chinese goods since the Great “Recession.” Year-to-date through September 2016, imports have declined by more than 6% from the first nine months of 2015. That is a huge downturn from even last year’s weakness, where exports YTD through September 2015 were up 6% over the same period in 2014. As always, Chinese economic and financial baselines were written for 20% growth; single digits are trouble, negative single digits big trouble.

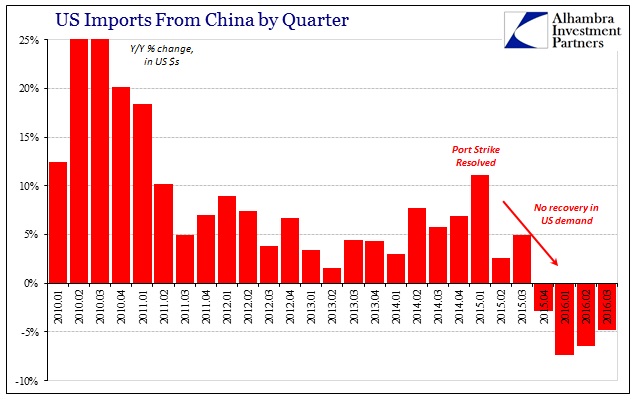

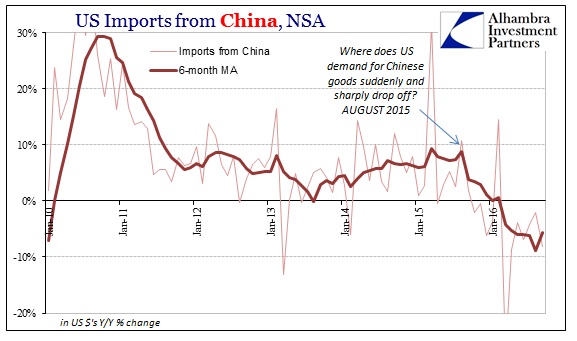

While a good part of that decline in 2016 occurred to start the year with the rest of the global economic disruption, it hasn’t really improved over the intervening months. Since this is US imports from China, a relatively good proxy for the US “demand” as a whole, we have to make the same claim about the US economy as a whole.

In September, inbound trade from China fell another 8%, the worst month since April, making it the third worst month since 2009. These estimates confirm what China’s economic statistics have projected throughout this year. We can reasonably assume that these declines relate to the relatively high levels of inventory that remain in US possession, so retailers and therefore Chinese factories would need an actually robust Christmas shopping season in order reduce those levels and restart a buildup. Black Friday, as has become usual, was described in the media as a blowout just as it was last year (and the year before), to which the Chinese will strongly protest that highly inappropriate characterization. It was another inauspicious start of a crucial economic period.

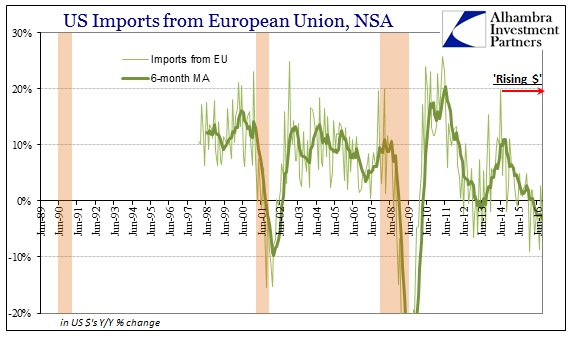

It isn’t just China, however, as imports from Europe fell nearly 3% in September, too. While in the traditional view it may take some time for the euro’s decline to act as a catalyst for more US directed trade coming from the EU, like China the figures so far this year show the same weak but not getting weaker US economy that is holding back the rest of the global system.

Total US imports of goods were $185.8 billion for September 2016, 2.9% less than September 2015. Of the 21 months since the year 2015 began, US imports have gained in only three of them, with August 2016 being the last. In seasonally-adjusted terms, imports rebounded in seasonal fashion from the low in March through June, but since July they have stalled through rest of the summer. At just less than $182 billion for September, total US goods imports are below that June level and are even less now than in February.

This is the same economy as the past two years of the “rising dollar”, one that at best isn’t at this moment getting worse. But it surely isn’t, on the other hand, actually getting better, either. What I wrote about the current view of the same pitiful state of durable goods applies equally to the current view of the same pitiful state of US trade and its “demand” upon the world:

At this stage of almost relatively euphoric sentiment, up-to-date economic statistics will be less meaningful because “markets” are seeing what they want to see about a future that is no longer captured strictly by more of the same. That means central banks no longer so pasted to just QE or ZIRP, but more willing to try different things. As it pertains to the election, there is a Trump administration that could, in theory, provide “stimulus” and not just in the same wasteful, ARRA manner; changes to taxation, regulation, etc.

In other words, the future has suddenly become a blank canvas upon which to project all the positives that were once claimed about “stimulus” in the generic sense.

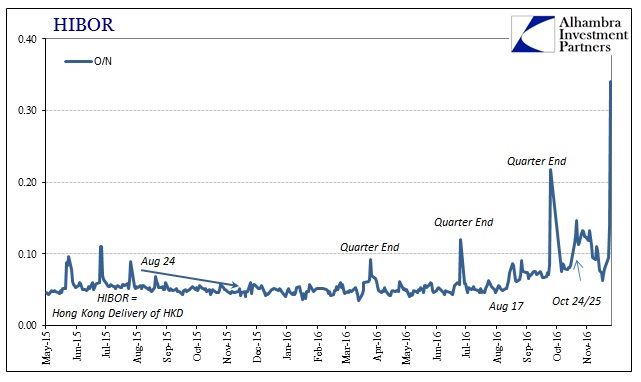

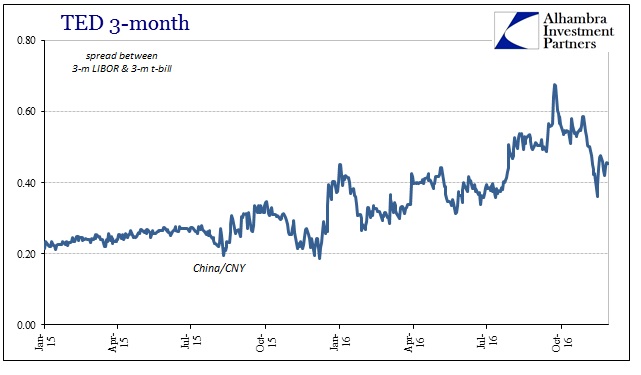

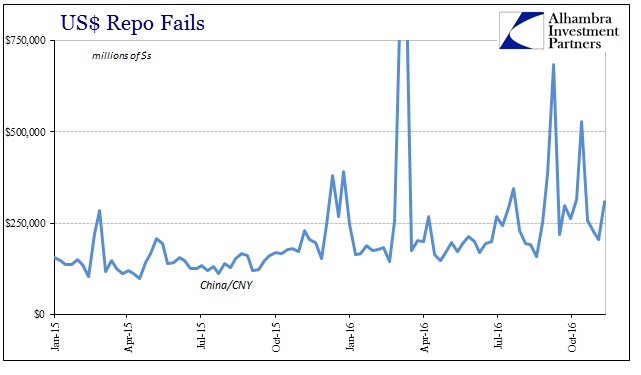

To certain markets, none of this will matter because it’s the old way and the old failed economy that not so long ago most people were extremely reluctant to call it failed. There are, many believe, new things coming that will make all of this go away, just don’t ask anyone for specifics about how that might be. Even if we do assume the new Trump administration undertakes all the necessary adjustments in order to actually fulfill the hopes recently stirred up, it won’t happen overnight; it won’t even happen all that quickly. So even in the best case scenario, which I will continue to argue is a very slim possibility, the Chinese, for example, still will be stuck waiting for a good and unknown amount of time with little actual US demand and the pressures of their financial arrangements continuing to squeeze them and all of Asia during that “cheery” transition.

Maybe at some point everything starts to go right, but we, and they, still have to get that far first.

Stay In Touch