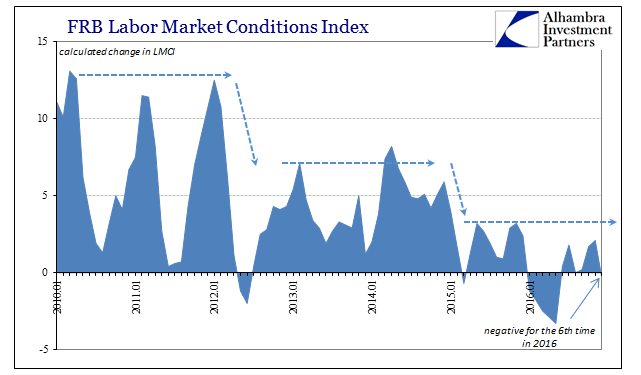

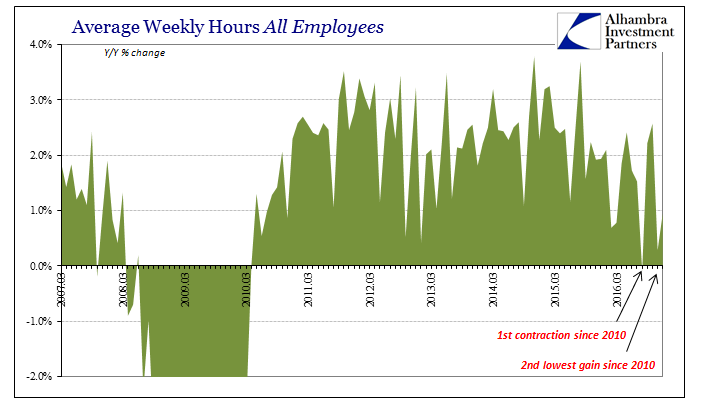

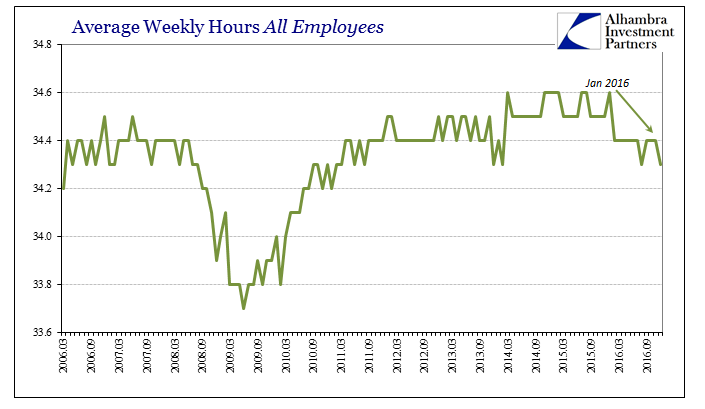

With two months of an increasing index, the Federal Reserve’s alternate, comprehensive factor model for the labor market turned negative again for December 2016. The Labor Market Conditions Index (LMCI) was down 0.3 points after gaining an upwardly revised 2.1 in November. Though there are 19 components in the overall index, the lackluster headline number for the Establishment Survey as well as the continuing slowdown in hours (and therefore pay) were clearly primary factors in December’s retrenchment.

That was echoed to some degree by survey estimates released by the Conference Board. That group’s Employment Trends Index was down also in December, as five of the eight subcomponents turned negative, a change that wasn’t anticipated.

December’s decline in the ETI was fueled by negative contributions from five of the eight components. In order from the largest negative contributor to the smallest, these were: Percentage of Respondents Who Say They Find “Jobs Hard to Get,” Percentage of Firms With Positions Not Able to Fill Right Now, Number of Employees Hired by the Temporary-Help Industry, Initial Claims for Unemployment Insurance, and Job Openings.

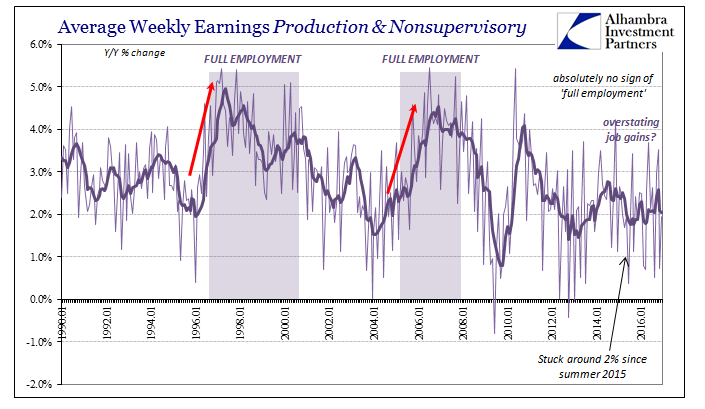

As usual, the Conference Board does not believe this will amount to much, reassuring anyone paying attention to this metric that, “However, the ETI’s trend suggests that job growth will remain solid in early 2017.” It has been the same story month after month, where the jobs market or whatever attending payroll report is classified as “strong” or “solid” even as the fundamentals of those reports recede (and economic accounts around them reflect and confirm that softness).

It’s not so much that any of these statistics are contracting, it is more so that they are not actually surging and accelerating. The lack of visible and obvious growth is itself very damning, not just about economic interpretations as they pertain, wrongly, to specific adjectives like “strong” and “solid” but more so the actual economic climate. By all these labor measures, 2016 ended no better than it started, and in many cases across the jobs market was somewhat worse.

That was especially true in labor utilization (hours as well as productivity) which is perhaps as close to “demand” as we might be able to find. In many important respects the conditions of the labor market are lagging indications, and therefore might reflect the past economic weakness of 2015/early 2016. That is what is so important, potentially, about the LMCI as it includes several forward-looking indications on the list of components that attempt to create a more balanced view.

Among those parts looking ahead are the Hiring Rate derived from JOLTS, a composite “help wanted” index, the rate of transition from unemployment to employment, “job leavers” taken from the CPS, and the Conference Board’s survey of “Jobs Plentiful” vs. “Hard to Get.”

Year-over-year the LMCI was down nearly 6%, the largest decline by far since the “recovery” began. Thus, we have to conclude that though there is much in the index that is lagging and therefore a reflection of past weakness, there isn’t anything looking forward that is close to enough to offset it and suggest actual (as opposed to the uniform commentary of “strong” no matter what any of these numbers really are) acceleration and economic improvement. To the contrary, there is still the hint of further weakness with the arrows still pointing slightly negative in far too many places.

The issue, as ever, is not imminent recession or not, but rather an end to the depression; to truly exit what has been a distinct lack of any actual cycle. That expiration is just not there, though by all orthodox standards and expectations it should be this far after “global turmoil.” It seems the drag of the “rising dollar” is not yet finished.

Stay In Touch