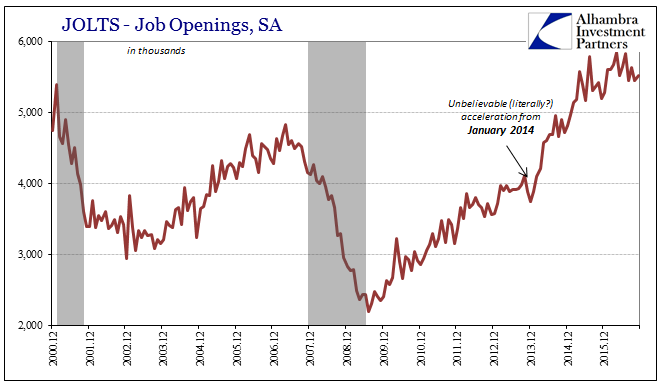

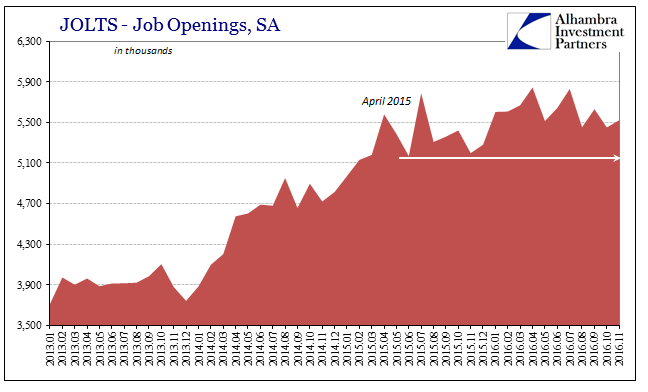

The updated estimates from the BLS for its JOLTS data largely confirm observations from other labor markets figures. The rate of Job Openings in November 2016 was slightly more than October, but still not appreciably different than what it has been over the past two years. The JOLTS survey indicated Job Openings first reached 5.5 million for the first time ever in April 2015, so November’s 5.5 million continues what looks like a possible plateau.

Under normal conditions, we should expect that all parts of the labor market would reach some maximum levels given the emphasis of “full employment.” Thus, if this is the correct interpretation, even sideways is still robust if consistent with the unemployment rate. That has been the case, where the unemployment rate first fell to 5% in October 2015, and has largely remained near that level since.

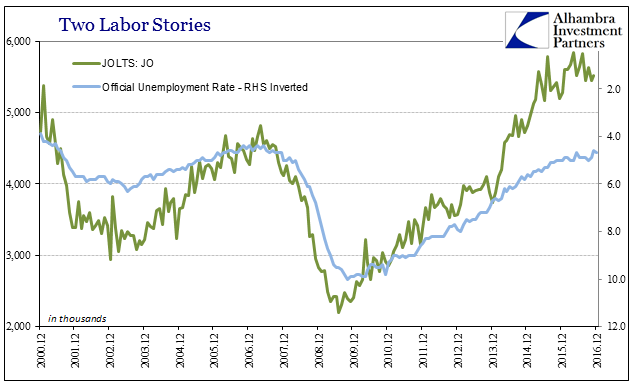

Though there is some apparent consistency in that short run, longer term there is the same discrepancy that from the mainstream has been given no real answers. If we compare the unemployment rate to Job Openings over its entire history (dating back to December 2000), there is clearly far more indicated enthusiasm or “strength” in the latter than the former even at so-called full employment.

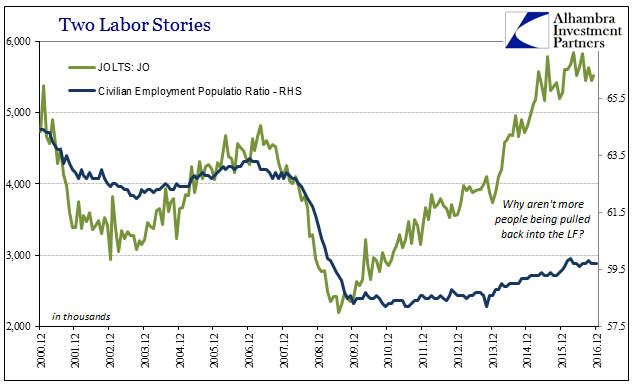

It’s as if the demand for labor is at a level where the economy is back and above its prior “cycle” peak, yet we know too well that the unemployment rate applies to a far smaller proportion of the prospective labor pool. Economists have contended that the difference is due primarily to Baby Boomer retirement, so it appears as if companies in demand for this labor are for unknown (and illogical) reasons still expecting a labor force that isn’t past retirement. In 2006 a similar unemployment rate was equal to a Job Openings level of almost 1 million less per month.

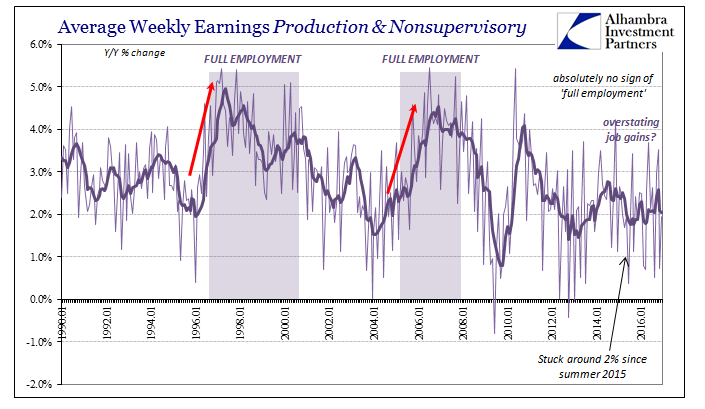

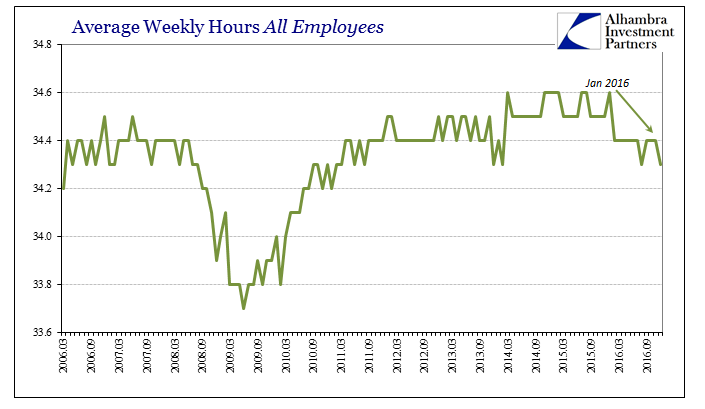

If this were truly the end of “slack” as it would appear on the surface, then we should expect wages and earnings to reflect that vast difference in demand over supply. And if wages and earnings are not accelerating, as they are clearly not, then the only other possibility would be if those prospective laborers, Boomers or not, are flooding back into the labor market to take advantage of so much high demand, which they are clearly not, either.

If wages aren’t rising and the labor force remains stuck, there aren’t many possibilities left to explain this huge discrepancy. One that has been put forth is some undefined “skills mismatch”, though it still wouldn’t be clear as to why wages aren’t skyrocketing. After all, if there is such high demand for workers and there aren’t enough workers suitable for that demand, you better believe that companies would be paying up to obtain and secure those who are. There is just no evidence that that is the case.

The only other alternative is what I have been suggesting since around the time the Job Openings rate departed all other labor metrics (early 2014), even those that have been themselves highly and conspicuously over-enthusiastic, that there is a statistical problem in the data construction. That would create significant difficulties in terms of predictive capacity especially in the mainstream as Job Openings in particular are a highly watched and considered statistic relevant to future expectations.

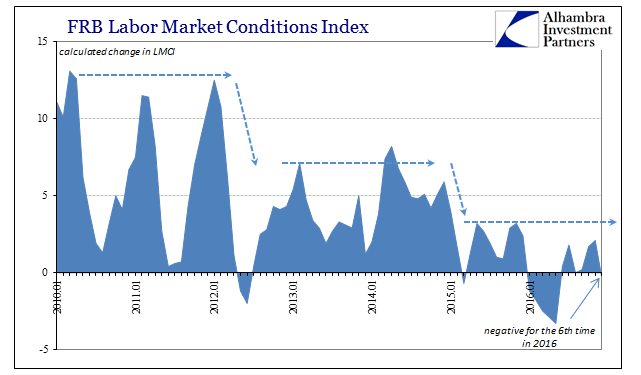

If I am and have been right, economists like Janet Yellen would have been considering Job Openings as they were/are and expecting any economic weakness that “unexpectedly” arose to be temporary or “transitory.” Using such faulty numbers would explain more about why Janet Yellen was so surprised in 2015 and 2016 rather than how those are accurate numbers that reflected so much obvious incongruity and misalignment. The former would lead us back to the flat trajectory over the past year and a half or two years not as the expected plateau of “full employment” but rather as picking up the same serious weakness as actually and consistently indicated by the other parts of the BLS paradigm, as well as estimates from other agencies (like the LMCI).

The payroll and labor stats have been leading economists in the wrong direction for a very long time, and now that policymakers have finally come to terms with the direction they should continue to investigate why that was. It traces back to biases particularly about QE and “stimulus”, biases that are now the biggest impediment to economic growth. After all, by believing this broken economy is Baby Boomers or a “skills mismatch”, they are essentially throwing in the towel on our future, giving up and meekly accepting that this dangerous, disorderly state is just the way it is. Taking Job Openings and other labor stats, especially the unemployment rate, as flawed, inappropriate, and misleading has the effect of forcing the explanatory search to eventually find the appropriate causes (eurodollar) and reopening the door to a much better future (replacing the eurodollar).

The labor stats are all sorts of problems.

Stay In Touch