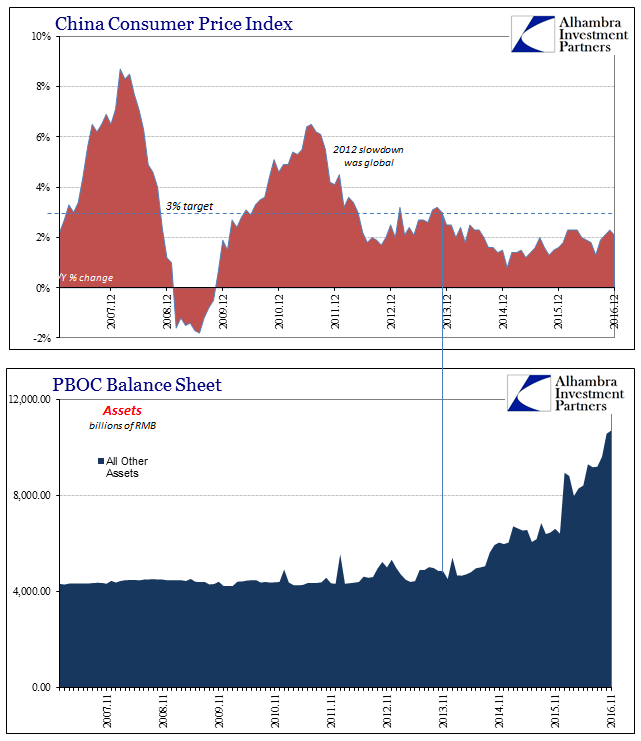

Inflation in China slowed somewhat in December, as the Consumer Price Index decelerated to 2.1% from 2.3% in November. Very much like in the US, Europe, and Japan, the CPI level in China continues a lengthy stretch significantly below the official monetary target. For China, the PBOC has set 3% as its definition of “price stability.” The last time inflation was at that level was for November 2013, meaning that for the next thirty-seven months the central bank has been unable to achieve its basic mandate.

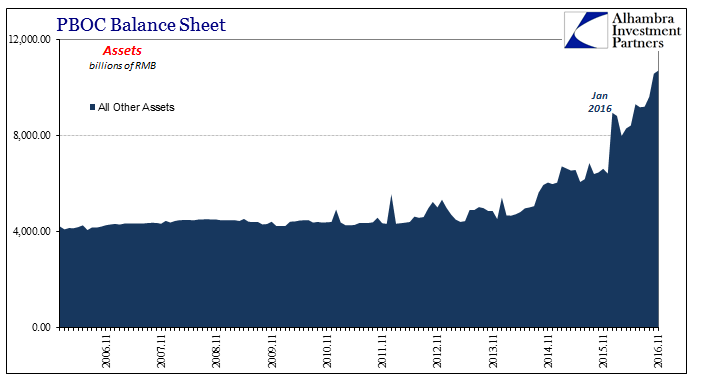

The measures it has deployed to try and do so have been catalogued here in this space for some time, most recently yesterday. Given the PBOC’s balance sheet construction, it is quite clear that as far as RMB liquidity has been concerned there has been an intentional program of expansion.

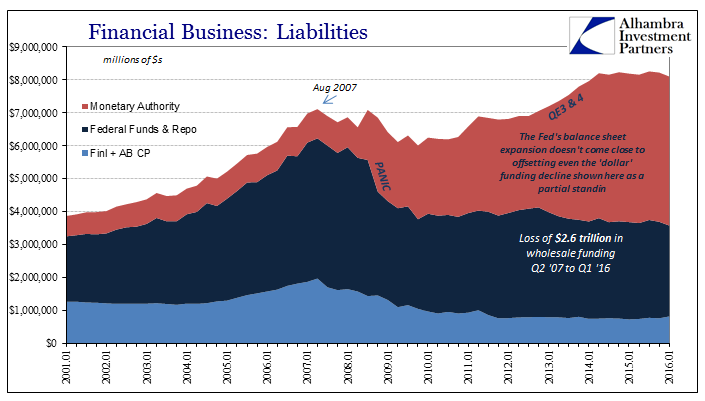

As noted yesterday, this is similar in type to balance sheet expansion undertaken at other central banks, though, it should be pointed out, far less in terms of size (so far). Under announced QE’s in any of the US, Europe, or Japan, balance sheet expansion of varying sizes and durations had similarly limited effects (meaning none) on inflation. In the US, the PCE Deflator has been less than the Federal Reserve’s 2% target for a ridiculous 55 months despite a balance sheet of $4.5 trillion. The only explanations Fed officials have offered is either IOER or “transitory” effects of “other” matters, including oil prices, that are still somehow conferred that qualification as if applicable after just about five years.

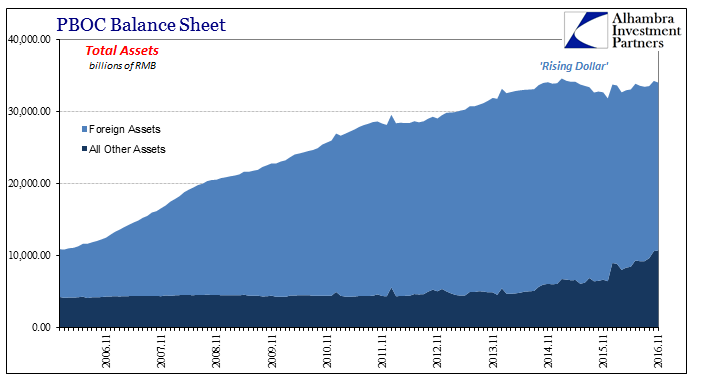

From the lack of plausible account for their failure we can easily and reasonably infer unseen monetary factors (they remain unseen primarily because if they were recognized it would be a simultaneous admission of dereliction of duty). Unlike the Fed’s balance sheet, however, the PBOC’s actually displays these same factors, if only in part. In other words, the full account of China’s central bank on the asset side has been rapid expansion in RMB terms the past few years, but greater contraction in “dollar” terms coinciding and even preceding it.

Thus, what the Chinese have faced during that time is really no different than what stymied other central banks in less explicit form. They have all been overwhelmed by “dollars” that at least for the PBOC are in part included directly in the accounting for China’s functional monetary basis. The primary difference is that China’s “dollar” problems are of a more recent development, and so its increasingly more forceful response is likewise comparatively younger.

So far, however, it has achieved mostly the same results. So even if it isn’t technically balance sheet expansion or QE, that is only because the Chinese are more explicit about functional money and the overall impact of comprehensive contraction. If the Federal Reserve’s balance sheet were combined with integral parts of dollar markets, too, it might look strikingly similar.

Because of that, it is not surprising that inflation has behaved similarly in China as everywhere else QE was tried. The “dollar”, more open on that side of the Pacific, is visibly larger than the monetary policies meant to offset it. Though we can’t directly observe the dynamic in other places, that we can in China provides an explicit example of what the global economy remains up against.

Stay In Touch