The Federal Reserve in early 2012 altered longstanding monetary policy. In January that year, the FOMC had voted to make explicit what everyone already knew, that it considered 2% inflation to be the definition of “stable” consumer prices, casting off one of the last vestiges of 1980’s era regimes where central bankers felt silence was the best course. It had been for some time one of Ben Bernanke’s goals, in order to, as he claimed, make the Fed more transparent and aligned with the procedures of other central banks around the world.

In its statement announcing the change, the Fed claimed:

Communicating this inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored, thereby fostering price stability and moderate long-term interest rates and enhancing the committee’s ability to promote maximum employment in the face of significant economic disturbance.

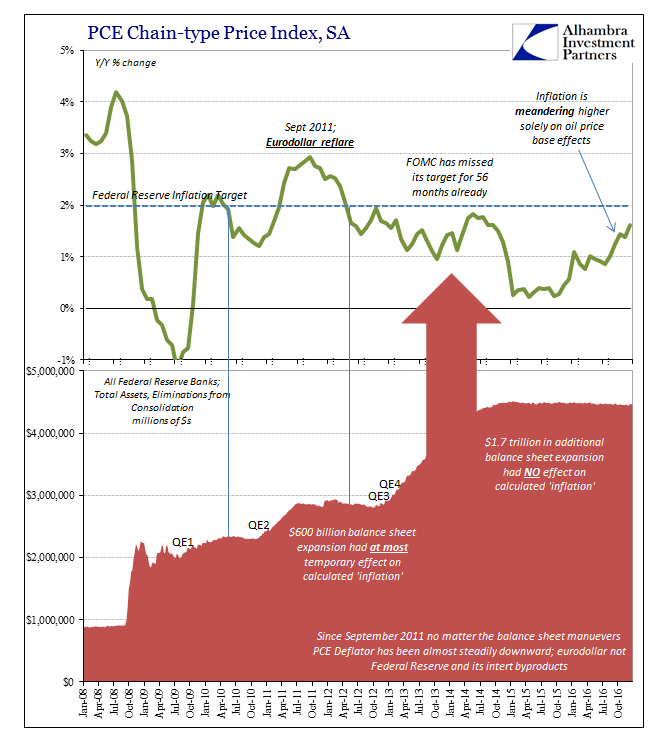

We cannot help but notice the irony of the timing, as the explicit 2% target lasted only three months more. The Fed still holds out 2% as its target, it’s just that inflation hasn’t been at that level at all (in terms of their preferred inflation index) in the almost five years since. The PCE Deflator remained less than 2% in December 2016, the 56th consecutive month where Federal Reserve monetary policy has failed to achieve its stated goal.

Inflation has been “better” of late, of course, from the perspective of monetary officials who despise actual stable prices. Modern monetary theory assumes it is far more preferable to have a little inflation than to risk having none; the latter condition, policymakers assume, leaves the economy no room for error, meaning the risk of deflation and depression too high. Empirical evidence over the last few years, nearly a decade now, shows clearly the fallacies in the argument.

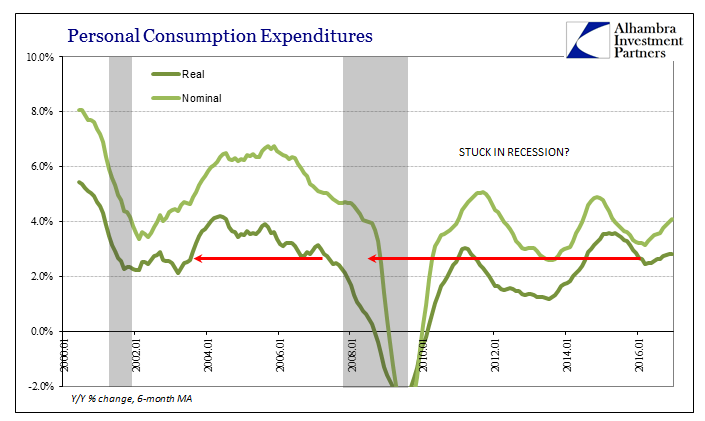

The PCE Deflator was just 1.62% in December, even though oil prices were up between 40% and 50% last month. Oil prices are hot, the rest of the economy isn’t. The meandering of consumer prices indicates more purely the commodity difference rather than actual economic acceleration. The rest of the PCE report indicates just that, a clear lack of momentum.

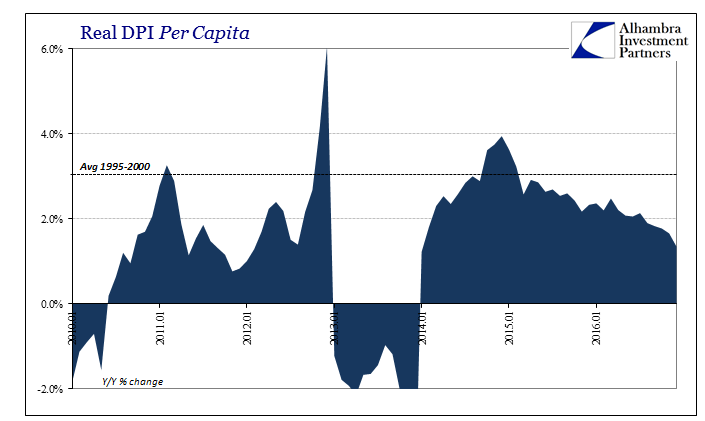

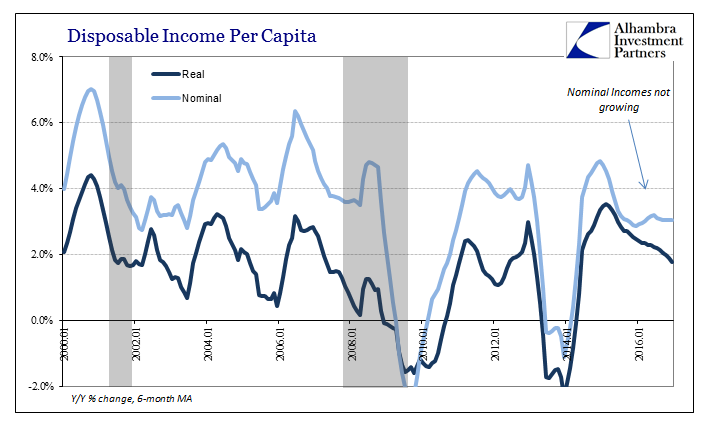

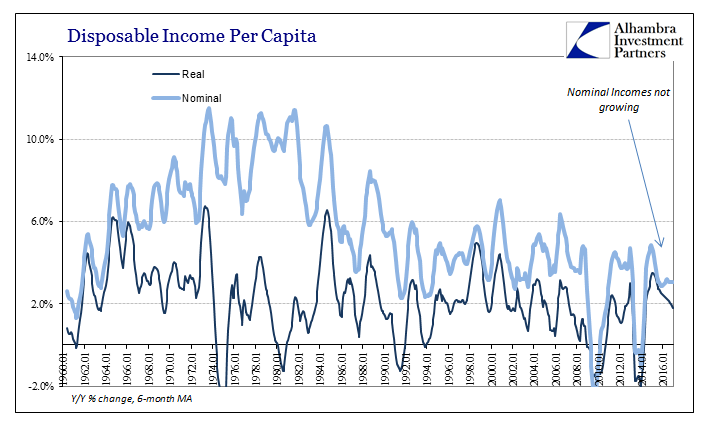

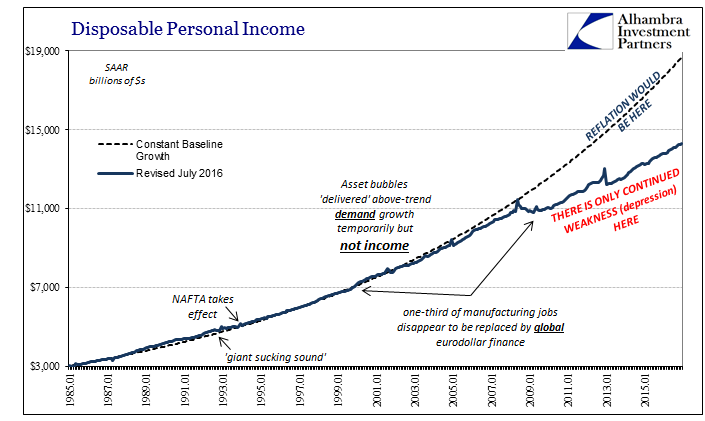

As always, that starts with income. Real DPI Per Capita increased by just 1.35% in December, the lowest growth rate since 2013 and more like the rough 2011-12 period than “the best jobs market in decades.” The gentle rise in the PCE Deflator has had a deleterious effect in estimating real income because nominally incomes remain stuck. Nominal DPI Per Capita grew by just 3% in the latest month, continuing a trend that dates back 22 months to early 2015.

This data is consistent with BLS figures that show the same absence of acceleration in wages and earnings, completely contrary to what would be consistent with an unemployment rate at 5% and less. At just 3% nominally, it is at the lowest end of the historical spectrum, a condition usually found in recessions (apart from the Great “Recession”).

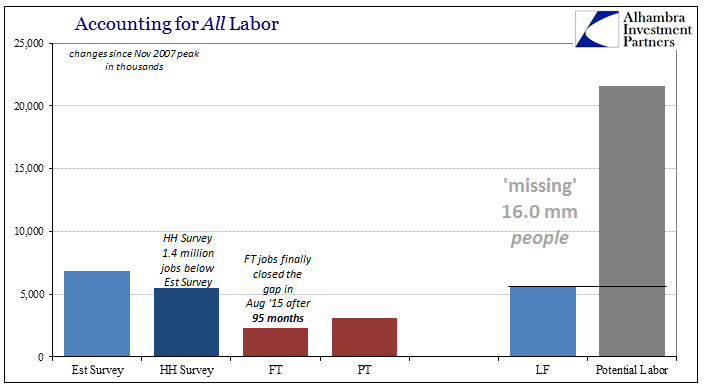

Though economists favor real over nominal, consumers respond to their actual paychecks first, particularly where it isn’t growing much if at all. Add to that an overall labor environment where underneath the BLS headlines there is a great deal of suspicion and caution about the true state of economic determination, it is little wonder that consumer spending is likewise anemic.

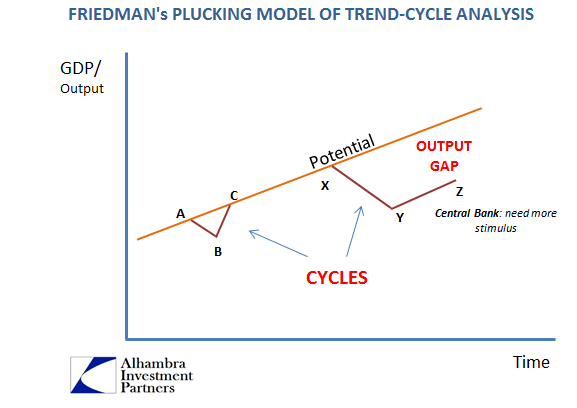

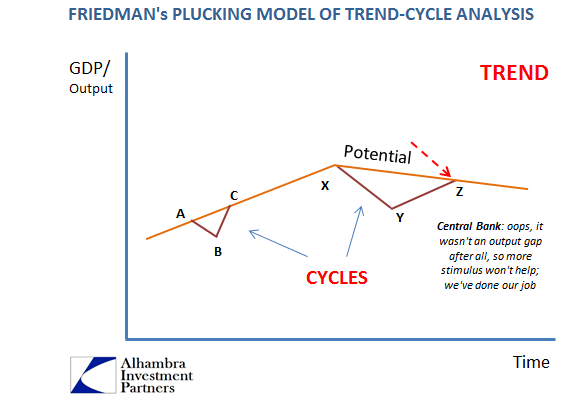

Economists can use the words “full” and “employment” together but there is absolutely no indication that is the case. Monetary policy, however, operates bureaucratically meaning econometrically, thus if policymakers view 2% inflation as the likely intermediate condition at the same time the unemployment rate is 5% or less (the 2 and 5 point) they can claim to have achieved their goals even though where it counts that is so clearly not the case.

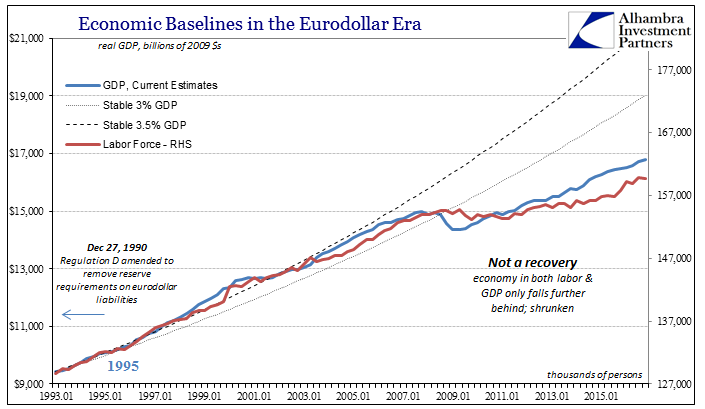

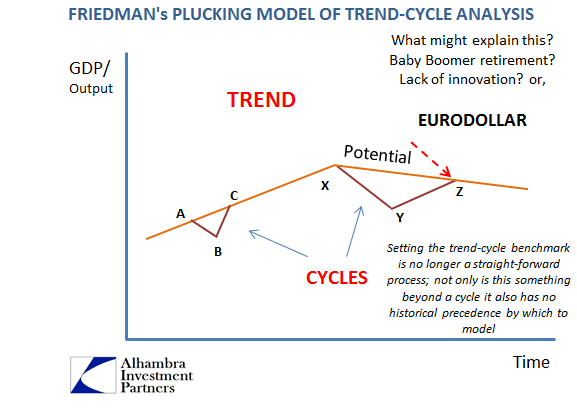

The major problem now is that though Fed officials have finally taken a more realistic review of especially QE, in doing so they now leave the economy to only other options beyond monetary policy – and I don’t mean whatever comes after QE’s. While in the past that would have meant a desire to see “fiscal stimulus”, at 2 and 5 there is no real reason for it (which is why Fed officials, apart from politics, have been cool toward Trump’s expected spending burst). Therefore, economists will now be looking exclusively in other places for answers and explanations rather than examining further the monetary system.

At 2% inflation and 5% unemployment it would seem that the central bank did its job and therefore there is nothing left to be used or determined from the money side of things. In the real economy, however, it isn’t so simply to set aside everything that is missing, especially when you consider that what is missing is considerable and far more meaningful. By accepting 2 and 5, the Fed is essentially accepting that the Great “Recession” wasn’t a recession and more than that the US economy shrunk permanently.

Despite the massive disparities here, the Federal Reserve is trying to let itself off the hook for them. That can’t happen, and I suspect that it won’t because what we are seeing with inflation is simply the repeating “reflation” “dollar” cycles in its latest iteration (in this specific aspect more like 2011 than 2013). In other words, the Fed may no longer wish to talk about money but it isn’t their choice to make. Not only is there still the “dollar” system to be concerned about, there is also the far bigger matter of the social and political consequences of the global economy having shrunk, and having done so almost ten years ago.

Stay In Touch