The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open to the possibility that perhaps maybe their constituent central bankers don’t know what they are talking about.

So it was with some surprise to find that the piece was quite positive overall. It concludes that the market is, “not suffering a dollar shortage as in 2008-09.” This is misleading, for the statement is qualified in two very important ways. The first is the comparison to 2008-09, which is only somewhat an appropriate baseline given how the eurodollar system has evolved in the almost ten years since (more FX than deposits).

Second, and what is really the central idea, I believe, is that the BIS only makes this statement in reference mostly to the non-bank eurodollar channel.

Despite the loss of dollar funding owing to money market mutual fund (MMMF) reform in the United States, non-US banks’ aggregate US dollar funding rose to all-time highs in Q3 2016. In particular, deposits outside the United States have risen strongly, offsetting reduced funding from MMMFs.

This is an important distinction, and it suggests why there was a great deal of (legitimate) angst with regard to money market reform (2a7) last year. I’m not referring to the mainstream view of it, where 2a7 became the ultimate bogeyman for everything and anything that didn’t look right last summer and autumn. Primarily, those who referred to money market reform in the media were doing so without having the slightest idea what they were actually talking about. Instead, there has been an internal debate about the non-bank channel and specifically the role of money market funds within it, and it is within this discussion that 2a7 narrowly applied.

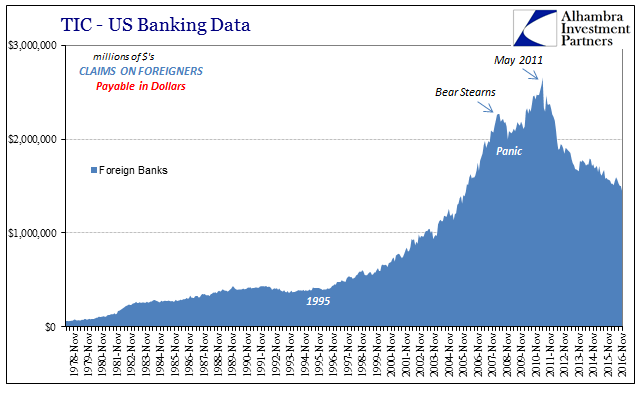

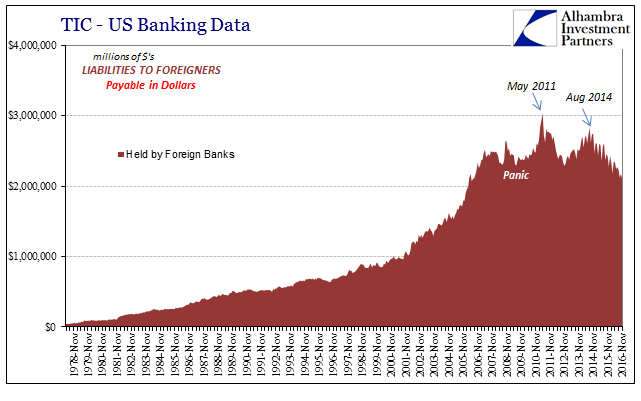

The eurodollar is a credit-based currency regime, but credit that can be offered by either banks or non-banks. It is far more straightforward in the former, which is why banks were before 2007 the primary purveyor of money growth in “dollars.” The events of 2007 and 2008 took banks out of the running for restoration, a paradigm shift that was completed with the events of 2011. There are those who have theorized that though banks (money dealers) are no longer a viable solution to money growth non-banks can be.

If you believe that, then 2a7 was a serious challenge. For non-banks to have survived money market reform and with only redistribution effects is to this theory a big deal (as Joe Biden might have said). For the BIS, where this concept has been generally nurtured, their Quarterly Review expresses the academic equivalent of relief.

Outside the BIS, however, there is no such thing as I discussed my own doubts several years ago (where A was money dealer banks, B central banks who tried to take up the slack as A exited in 2007 and 2008, and finally C who are the non-banks that are supposed to replace both A and B):

While I respectfully disagree about the RRP providing a floor (repo fails, specials and all that), I think his suggestion about the IOER going up with “no consequence for other money market rates” is likely correct. But I also think the fact that some money rates, including the dead federal funds rate (effective), have already taken flight also suggests another scenario altogether – that B to C could or will be a total mess. This is essentially the same scenario that I think has been acting out since November 20, 2013. In other words, there will not be any normalcy, and any attempt to go backward undertakes what amounts to incalculable risk of being disastrous…

I personally find way too much complacency in blindly believing that going from B to C will be only a minor inconvenience. It would be dangerous even under the circumstances where the system shifted from the dealers to the Fed and back to the dealers, with an infinite series of potential dangers even there. But to undertake a total and complete money market reformation from dealers to the Fed to money funds? There are no tests or history with which to suggest this is even doable under current intentions. Poszar and Mehrling’s contributions more than suggest that difficulty, but I think that still understates whether or not we ever get that far.

For one, when should we expect C (non-banks) to actually take up the eurodollar mantle? It’s been just about ten years already with only an ever-increasing disaster on the ledger. How much longer will this transformation take before the global economy will actually recover? If ten years or so isn’t enough, it might be time to consider that the idea was never a valid one to start with.

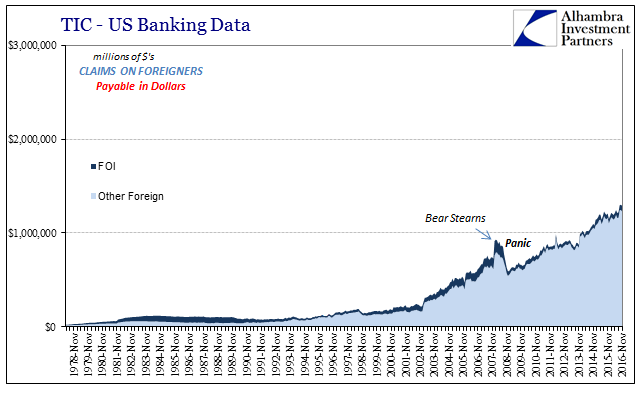

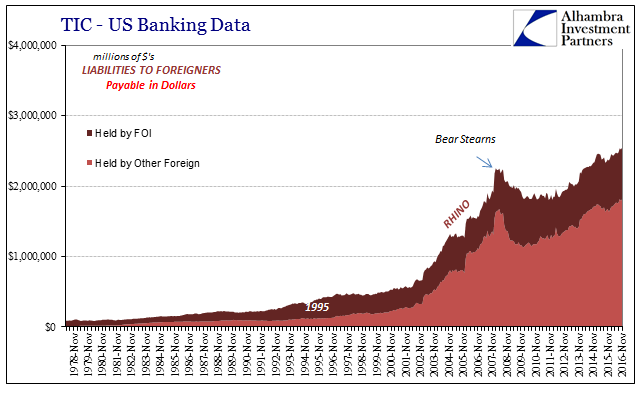

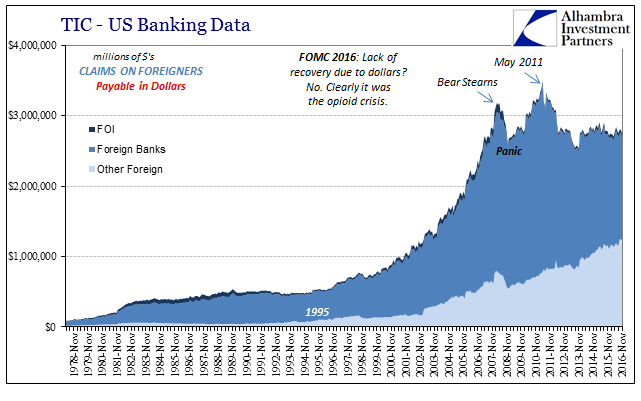

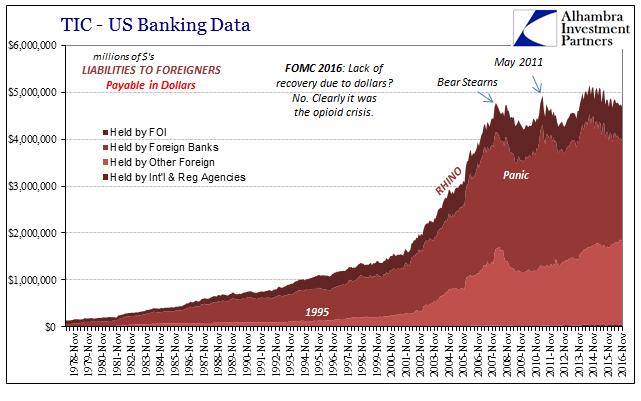

The few statistics that we have show why this is the case. Referring again to cross border dollar flows (of the deposit/repo type) in statistics prepared by the Treasury Department’s TIC data, we see that the non-bank channel is still growing largely unbothered both inbound as well as outbound.

Both sides shows record dollar balances to the non-bank segment (I have included foreign central banks and governments, FOI, in this category though the conclusion would be the same without them). I will note that this is not the same data which the BIS has used, and the TIC figures are taken solely from the perspective of US banks rather than banks plus non-banks. Even with that limitation, the trend is established where non-bank dollar growth (including FOI’s) is growing at increasing record balances.

The problem, however, is that growth is nowhere near enough even after so much time to offset the contraction in the banking portion of the eurodollar system.

On the inbound side (red), the amount of dollar liabilities to foreigners from banks is only surpassed recently by the non-banks if we include central banks and foreign governments (which is why I did). On the outbound side (blue) there isn’t even parity yet. But those are the wrong standards (as always) by which to judge money or economic contraction, which is what the BIS is doing. The Quarterly Review asserts that record dollar balances at non-US banks is proof there is no dollar problem. There is no positivity in absolute terms, even at so-called record high balances, as the whole world runs on trends. Though the non-bank dollar channel may be growing that doesn’t really matter as what does is the overall fluidity as it relates to the pre-crisis/post-crisis divide.

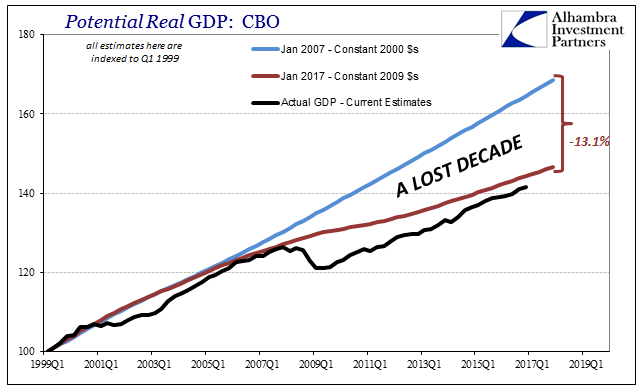

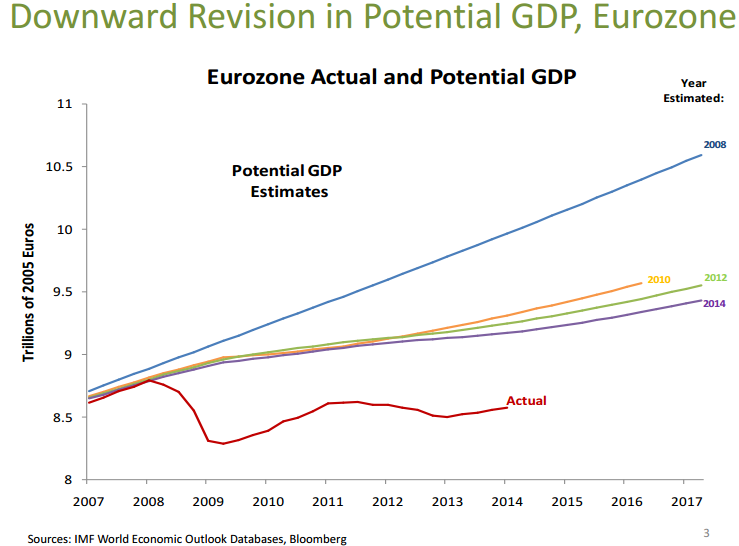

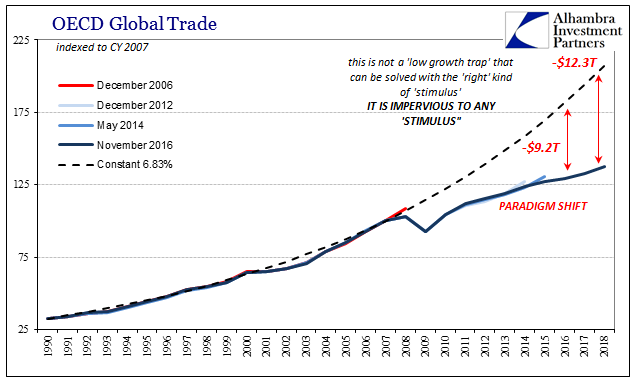

In other words, there is nothing to celebrate where dollars are redistributed but all within a severely shrunken system. The consequences of the overall trend unlike the assumed benefits of redistribution to the non-bank channel are already apparent and already ubiquitous:

Even if the non-bank channel would be the eurodollar savior at some point in the future, is the costs shown above worth waiting for the transition? That is why the first qualification highlighted at the outset is inappropriate; we do not judge the “dollar” shortage by what it did in 2007 and 2008, we judge it by what it “should” have been doing in the absence of that inflection. Record dollar balances mean nothing. I stand by my pronouncement from two years ago, where I still question whether we ever get that far; the costs in terms of time and lost opportunity are already too great for what seems more fantasy and hope than rational analysis.

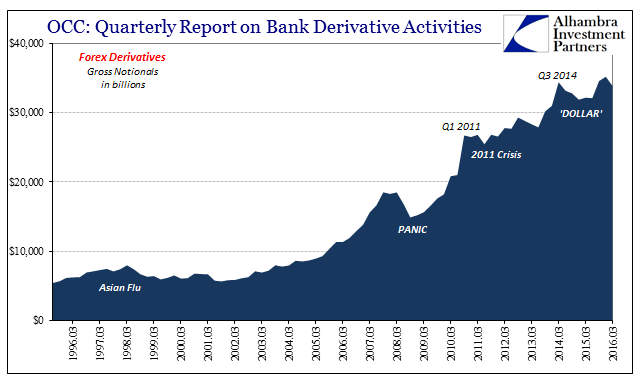

And I should further state that the discussion here is limited to the more traditional global monetary framework, leaving out entirely the FX dimensions that are exclusively driven by the bank side and left totally untouched by non-banks (and left entirely out of the discussion).

That leaves one other important suggestion that must be entertained. The BIS is a separate institution that while doing some good work in the eurodollar area is still “owned” in some large proportion by the US through the Federal Reserve. On September 11, 2000, the BIS announced that it was withdrawing all shares held by private shareholders, leaving only central banks (55) as its technical owners. And these owners meet regularly every two months (General Meeting).

Therefore, we have to be mindful that the BIS has some significant (but unknown and certainly unconfirmed) interest in presenting a positive outlook on the eurodollar system as a going concern. That would include both the latest quarterly outlook as well as the non-bank theory as a whole. The fact that the Federal Reserve is right now undertaking its “exit” would only seem to amplify the pressure to present the dollar in eurodollars as a total non-factor even though, as you can see above, it is the farthest from the truth.

Stay In Touch