On July 20, 2007, the much discussed slow-walk implementation of the Basel II framework was finally taking its form. The Office of the Comptroller of the Currency, the Office of Thrift Supervision, the Federal Deposit Insurance Corporation, and the Federal Reserve Board of Governors, all government agencies dealing in bank supervisory powers, issued a joint statement that day announcing an agreement had been struck “resolv[ing] major outstanding issues” that would “lead to finalization of a rule implementing the advanced approaches for computing large banks’ risk-based capital requirements.”

As the press released noted, the US adoption of Basel 2 would make it consistent with the international standards already adopted and active. Federal Reserve Chairman Ben Bernanke released a very short statement, saying “I’m pleased that Governor Kroszner and the policymakers representing the other banking agencies have reached a consensus, one that will pave the way for implementation of a modern, risk-sensitive capital standard to protect the safety and soundness of our large, complex, internationally active banks.” Comptroller of the Currency John Dugan was a little more direct.

Our current risk-based capital rules are simply inadequate in addressing the complex risks inherent in our largest institutions.

Presumably the new measures, which all the banks knew were coming, would be somewhat stricter on those large banks, and therefore make their business of complex banking somewhat more difficult. From the timing of the agreement plus the nature of it we can conclude only one thing – regulations caused the Panic of 2008. After all, July 20 was just a few short weeks before August 9, 2007, when wholesale banking as a seemingly dependable business model ceased to be that.

It’s an absurd proposition, of course, the logical fallacy post hoc ergo propter hoc. And in a very short course of time, Basel 2’s adoption was mostly forgotten. For one, just review what both Dugan and Bernanke said about it, which for Bernanke was in some ways worse than when he claimed earlier in 2007 that subprime was contained. Second, the problems and imbalances of that time were clearly far more than just capital ratios; banks had a great many other balance sheet problems (liquidity) to occupy them and their models to be worried about regulatory trivia.

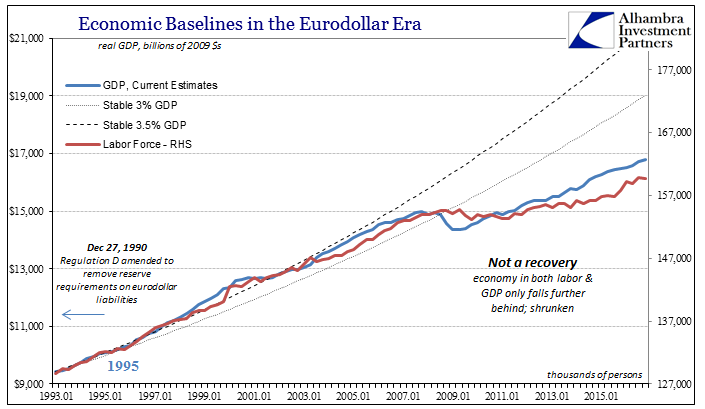

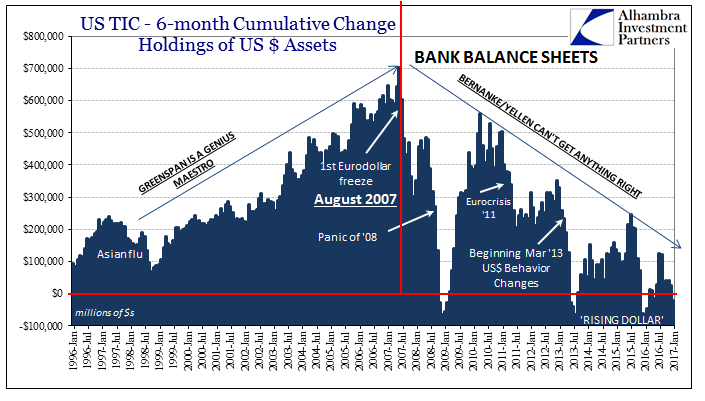

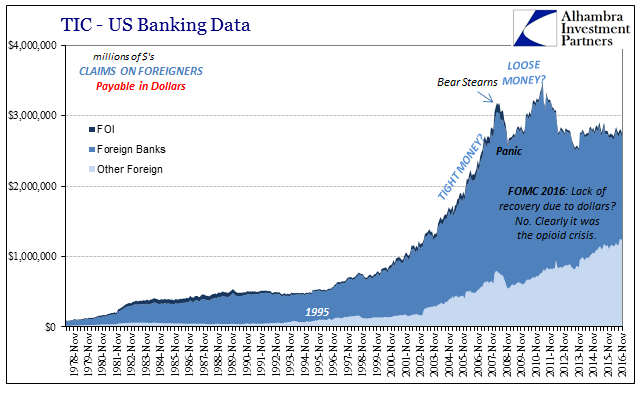

We are still today, nearly ten years later, confronted with many of the same problems. The “dollar” issue of August 2007, the real one, remains the only matter demanding consideration. As the events of the “rising dollar”, one such phase of that baseline monetary decay, conspired to bring about the final proof needed to finally kill the recovery narrative there are still those who refuse to consider anything but a benign explanation for all of it. Though money market reform was made a proposed rule all the way back in 2014, it wasn’t until 2016 that anyone bothered to mention 2a7.

Just last week, Simon Potter, Executive VP of the Markets Group at FRBNY, spoke to an audience at UCLA on the topic of money regulation (thanks to T. Tateo for alerting me). The central point was the state of money markets in an updated form different from how they had operated the last time the Fed “hiked rates.” Potter starts by stating the obvious as if a great measure of success for the FOMC.

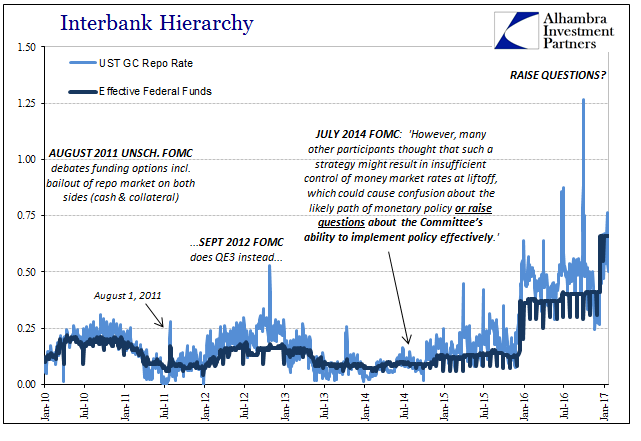

The takeaway from all this is clear: our framework remains highly effective, and has proved quite resilient, even to these significant shifts in market structure. It continues to provide the FOMC with excellent control over money market rates. Indeed, the effective federal funds rate remained within the FOMC’s target range 100 percent of the time in 2016 and this has continued so far this year, as shown in (Figure 1).

There is absolutely nothing commendable in that statement, nor anything relevant to the greater considerations. Practically no one trades in federal funds anymore, and those who do are primarily the pocket change of GSE’s. If that is the one addition to the good side of the FOMC’s ledger, they are in more trouble than they are letting on – which is entirely the point of Potter’s quite lengthy speech.

The irregularities witnessed within money markets over not just the “rising dollar” period but before it, too, are clearly something Federal Reserve officials feel must be addressed. The “reflation” period seems to have afforded them some margin of optimism whereby they might do what they appeared wholly reluctant to last year or the year before when it would have been more appropriate. In fact, this is a condition the FOMC anticipated as late as 2014, where the July 2014 policy minutes record several members worried that the new corridor-like framework (IOER on top, RRP on the bottom) “might result in insufficient control of money market rates” which might then “raise questions about the Committee’s ability to implement policy effectively.”

So here in April 2017 is a FRBNY official finally getting around to addressing them. It isn’t just the repo rate that has misbehaved, either. As he notes in his discourse, there are a great many FX components and spreads that raise these same kinds of uncomfortable questions.

Changes in the federal funds rate continue to transmit in a predictable way to other money market rates, thereby affecting, as intended, the broad financial conditions upon which the price and quantity of private sector credit depend. However, recent evidence on dispersion in overnight and term rates suggests that we should continue to monitor the transmission of the FOMC’s policy stance into money market rates carefully. [emphasis added]

It isn’t just random bloggers and media commentators making these observations and crafting negative interpretations of them. FRBNY’s own staff has studied in the usual orthodox manner these same contentions, and surprising only to policymakers found that, yes, there might be “something” wrong with money markets. In fact, there is enough evidence for them to draw some uncomfortable and concerning conclusions:

Based on these data and on theoretical modeling, Darrell and Arvind conclude that monetary transmission may be less efficient than it was before the crisis. As a result, they expect that, as the FOMC increases the federal funds rate over time, other interest rates might not rise one-for-one with it. [emphasis added]

Fret not, however, for Mr. Potter sees no reason to be alarmed even though his own staff has presented acceptable data to raise alarm.

I think this paper makes an important point about transmission: monetary control does not stop at the effective federal funds rate, and our framework must ensure that the stance of monetary policy is passed through into other money market rates. However, I am less persuaded that the data supports Darrell and Arvind’s concern about the present efficacy of the framework.

First, I think the recent pickup in dispersion we see in money markets might not tell us much about what will happen going forward. A lot of what has happened in money markets in recent years may relate to one-off factors associated with money market fund reform and with liftoff from the zero lower bound. [emphasis added]

It’s not just money market reform that he refers to, as he does note elements of Basel 3 as a possible further explanation for FX and derivatives. Even so, this is pure ideology, not science. Simon Potter wrote this very lengthy speech ostensibly for only one purpose: after ignoring these “questions”, now that his staff has raised serious doubts Potter wishes to make plain their acceptable evidence must all be wrong about monetary policy because he knows based on nothing more than his own perceptions that it was all regulatory changes to blame and nothing else.

As I wrote yesterday, sometimes it is really easy to see how we got in this mess, and more importantly how we never get out of it. No matter how much evidence is amassed against them, policymakers “know” there is no possible way the world has a “dollar” problem because that would mean they messed up, and messed up big. It would be bigger than just 2008, for a whole decade has been flushed based on what?

Stay In Touch