There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

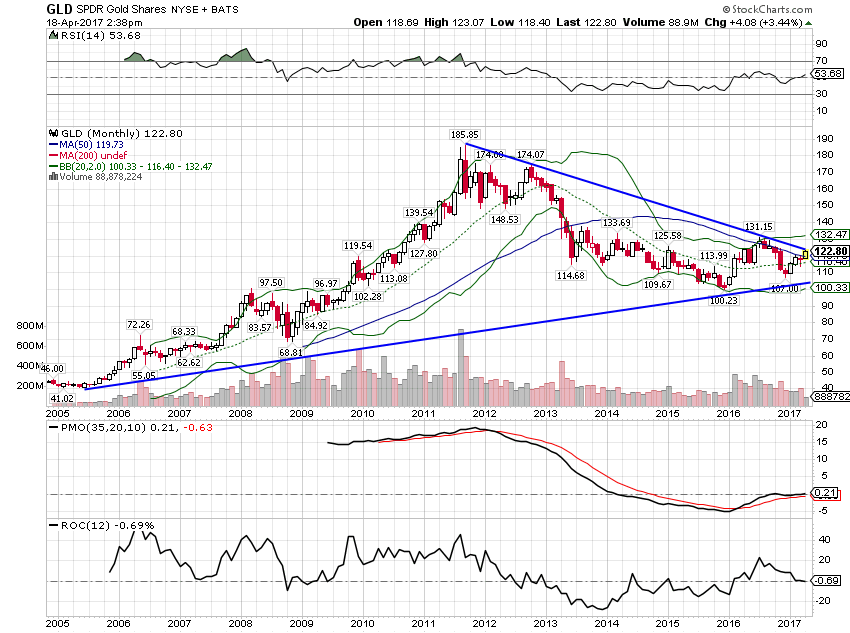

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new administration if they are responsible then they seem to be making foreign markets and gold miners great again sooner than America. Gold outperformed stocks by a pretty wide margin over the first three months of the year and foreign stocks outperformed their US counterparts. The gold move should be the more concerning as it isn’t generally a good sign for growth when investment is flowing into the barbarous (to some) relic.

Bond market performance in the quarter didn’t support the rising growth expectations scenario either and that has only gotten worse in the first couple of weeks of the new quarter. The 10 year note started the year at 2.45%, ended Q1 at 2.46% and was more recently trading at 2.25%. Rates were already falling after peaking in mid-December so i think it is safe to say that this is a trend at this point, although one that is a bit extended. How far it goes may have something to do with the administration’s ability to get tax reform or healthcare reform or some kind of reform through Congress this year. Or not. I think it is easy to credit or debit the President with economic performance but frankly the ability of any President to influence the direction of the economy is more limited than most seem to think – as President Trump is finding out first hand.

The S&P GSCI index was by far the worst performer of the asset classes we track for our Global Asset Allocation portfolios, down a tad over 5%. And again, not what one would expect if growth were expected to accelerate. Performance has improved in Q2, cutting the loss about in half, as oil prices rebounded but further gains will probably be harder to come by in the quarter. Technically, crude oil is approaching some stiff resistance, inventories are continuing to build and the rig count is rising pretty relentlessly. More generally, commodity prices have come off the lows they set in early 2016 and have mostly trended higher since. In fact, the long term technical picture looks pretty good right now and I wouldn’t be surprised to see the rally continue. But I suspect that will have more to do with the direction of the dollar than the economy.

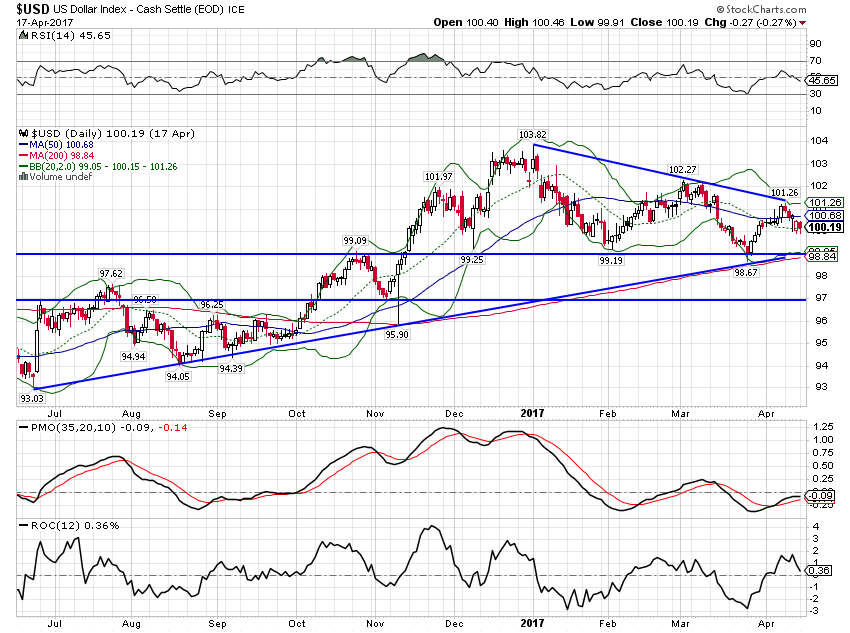

It is the recently weak dollar – another indication of waning growth expectations – that is driving the outperformance of gold, platinum and foreign stocks so far this year. The dollar index started the year at 102.29, ended the quarter at 100.22 and broke below the 100 level today – again. That isn’t a particularly large loss but the direction and the verbal intervention of the Trump administration – including President Trump himself – probably made the impact greater than it would have been otherwise. The overwhelming opinion coming into the year was that the dollar had to go up which, like the near universal belief in higher interest rates, turned out to be dead wrong. It has been my belief since the election that the administration would push for a weaker dollar as part of their misguided trade agenda. The idea that a weak dollar will help cure our trade deficit – as if it needed curing – is one that just won’t die despite ample evidence to the contrary. I don’t know how much the administration jaw boning is responsible for the drop so far and how much should be attributed to US GDP growth that looks to clock in with a Q1 rate of less than 1%.

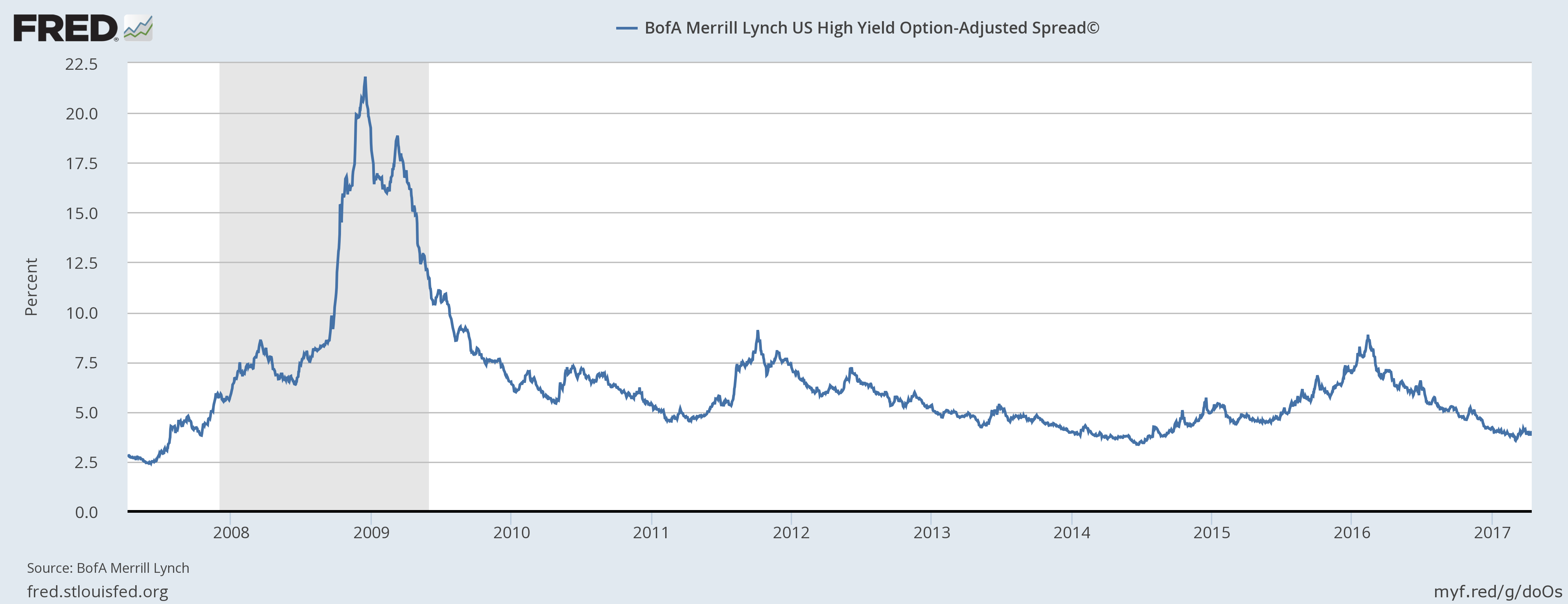

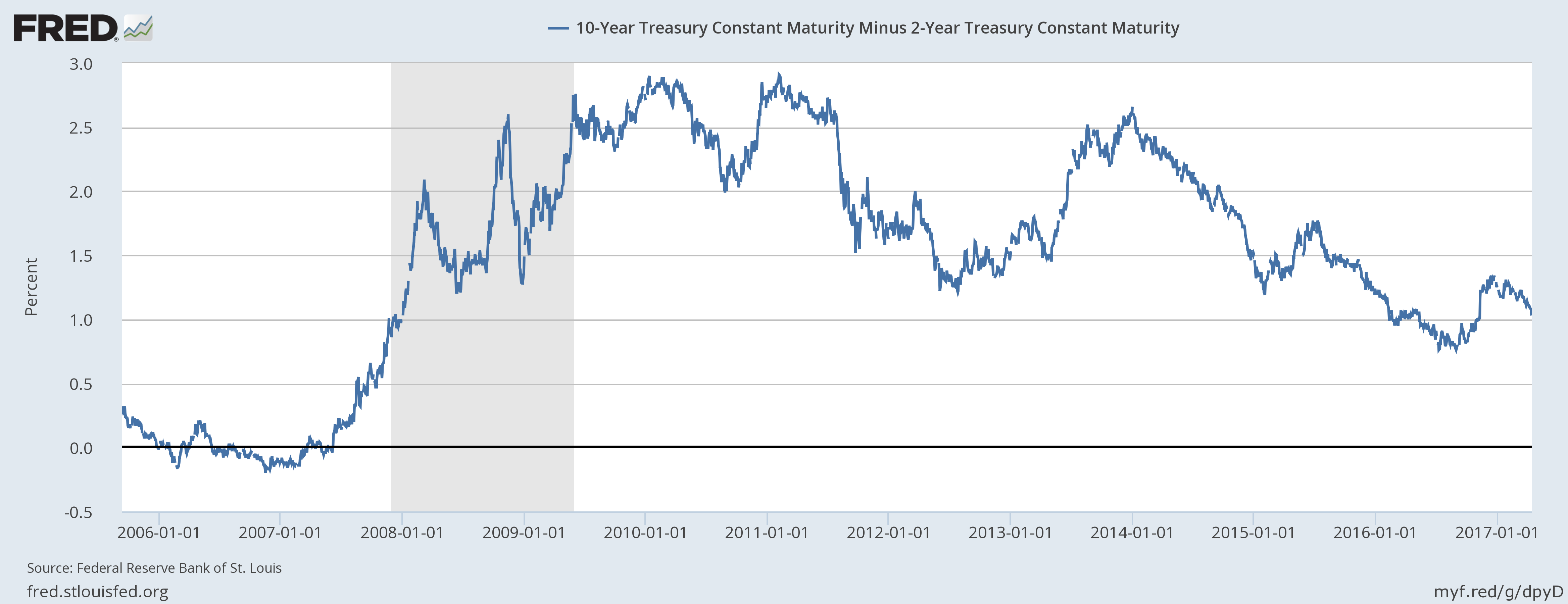

Other market indicators reflect the same weakening growth expectations as the dollar and commodities but have not changed sufficiently to justify any change to our risk budget. Credit spreads have stopped narrowing but are basically unchanged since the update last month. The yield curve moved more, continuing the flattening trend that has been evident since the reflation peak in mid-December.

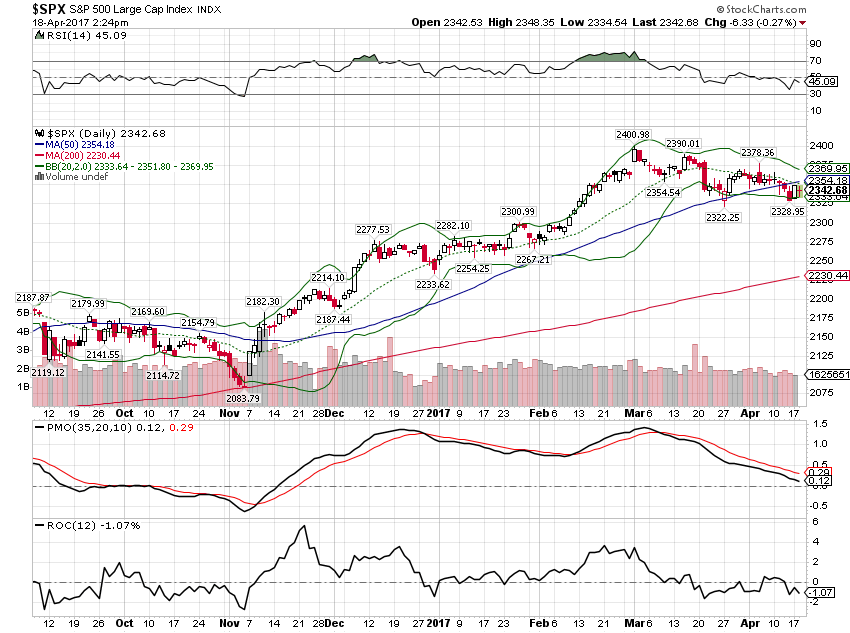

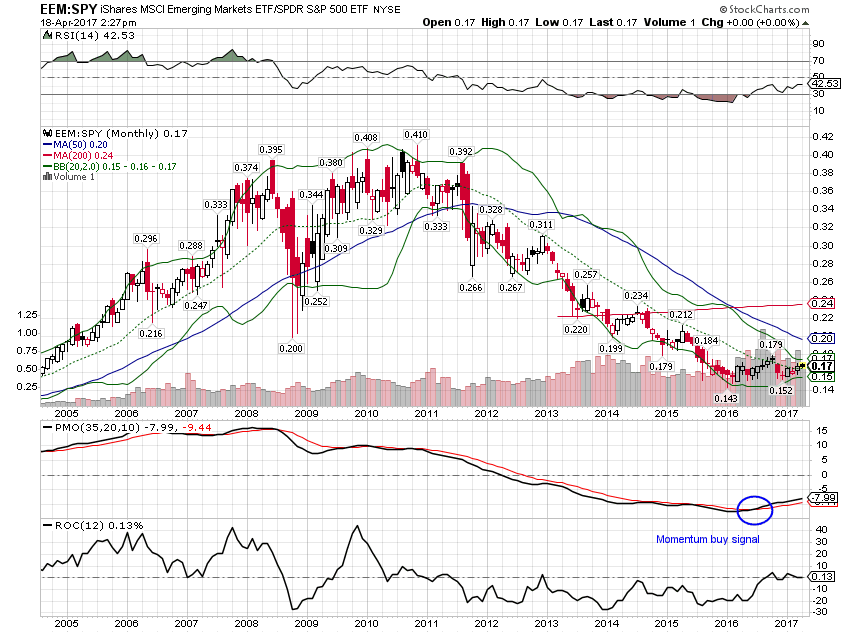

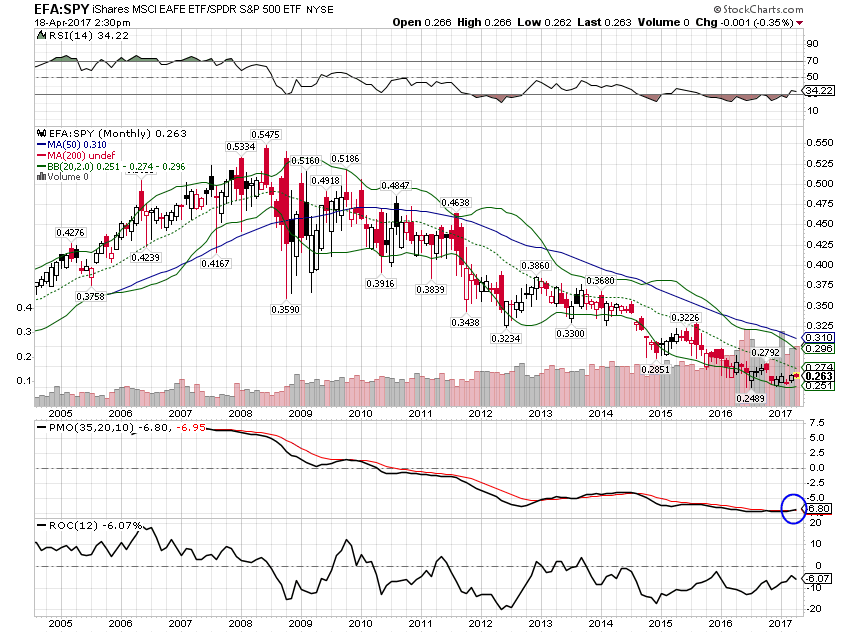

Valuations for US stocks are still sky high although some earnings growth in Q1 may reduce them somewhat. A surge sufficient to make stocks cheap though seems highly improbable. Momentum started to shift back to bonds over the last month but that may be just a correction of an oversold condition on bonds and an overbought one for stocks. The shift in momentum from US stocks to foreign also accelerated since the last update but again, it is too early to say this is a long term change. That, as I’ve explained numerous times, is largely dependent on the direction of the dollar. If it keeps falling – and the US doesn’t fall into recession – then international markets will likely be the better choice. Emerging markets continue to outperform among international indices. We are maintaining our overweight to weak dollar beneficiaries.

Credit Spreads – Credit spreads were basically unchanged since the last update, down two basis points from 4.05 to 4.03. It is interesting that spreads did not narrow with crude oil up about $5 since the last update. It may be that energy is no longer the key sector. Retail seems to be the sector under the greatest pressure right now, a victim of Amazon and a generally weak consumption environment. Credit markets have little upside and a lot of downside at this point so caution is definitely warranted.

Yield Curve – The yield curve continued to flatten since the last update, down 15 basis points since mid-March. The curve is still steeper than it was at its nadir for the cycle last August and the steepening was the right kind – long rates up faster than short rates – but half the steepening since then has been reversed. Overall, we are still in the middle of the historic range and not yet near the flat condition normally seen before recession.

Valuations – Valuations continue to favor international stocks over US. First quarter earnings season is starting and expectations are for a 9.1% gain year over year. Estimates for full year S&P 500 earnings have actually risen a bit since the last update but Q4 earnings are still expected to rise by over 13%. That seems a stretch given the current GDP growth rate but maybe growth will pick up in the back half of the year.

Momentum – Daily and weekly momentum for the S&P 500 have rolled over recently. Monthly momentum remains on a tentative buy but as I said last month, I am skeptical this will last long. As noted above, momentum is shifting to international markets from the US with EM leading the way. EEM relative to the S&P 500 has pulled back a bit recently but long term momentum still favors EEM. Monthly momentum for EFA vs S&P is also turning up and if it can keep outperforming for the rest of the month will provide a buy signal.

These shifts are a function of shifting growth expectations which are also expressed in the dollar index. We are trading under 100 today as I write this, with 99 a key level coming up.

The weak dollar is also driving the continued long term momentum in gold:

Market expectations for growth continue to wane with the yield curve flattening significantly since the reflation peak in mid-December. Stocks are starting to pay attention now as well, coming off their recent highs. Credit spreads have not widened significantly yet so for now, I’d call this more of a growth scare than actual slowdown. The retail sector is showing major signs of stress though with some major recent bankruptcies and store closings. By my count retailers have announced over 3000 store closings recently and retail employment has fallen in the last few reports. Like the energy sector slowdown of two years ago, I have no idea if this stress will lead to a recession. It could be the leading edge of major problems or a secular shift that is inevitable and healthy. We’ll see in due time I guess. For now, our indicators are acknowledging a slowdown but aren’t warning of recession.

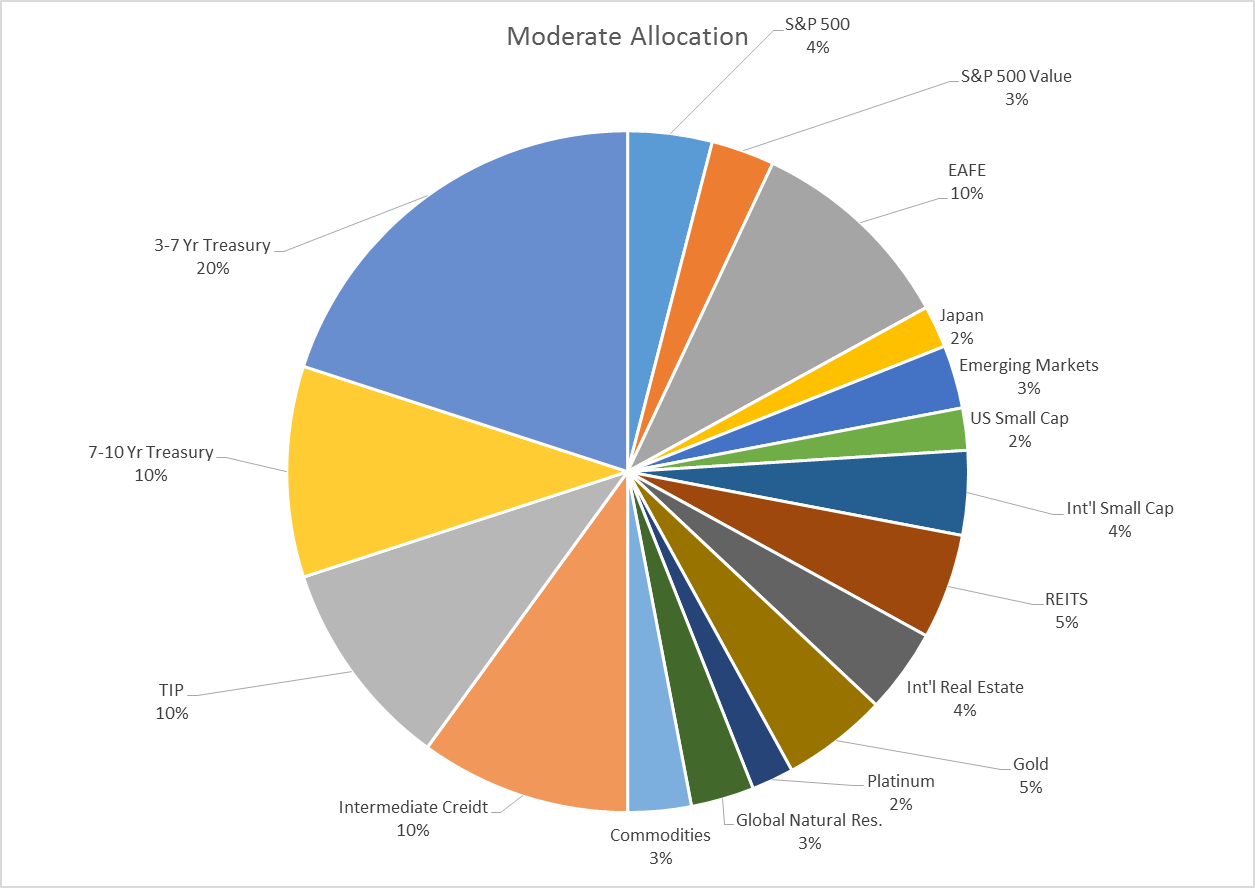

I am making no changes to the moderate risk portfolio this month:

FOR INFORMATION ABOUT OTHER RISK BASED ASSET ALLOCATIONS OR ANY OF OUR OTHER TACTICAL MODELS, PLEASE CONTACT JOE CALHOUN AT JYC3@ALHAMBRAPARTNERS.COM OR 786-249-3773. YOU CAN ALSO BOOK AN APPOINTMENT USING OUR CONTACT FORM.

CLICK HERE TO SIGN UP FOR OUR FREE WEEKLY E-NEWSLETTER.

“Wealth preservation and accumulation through thoughtful investing.”

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch