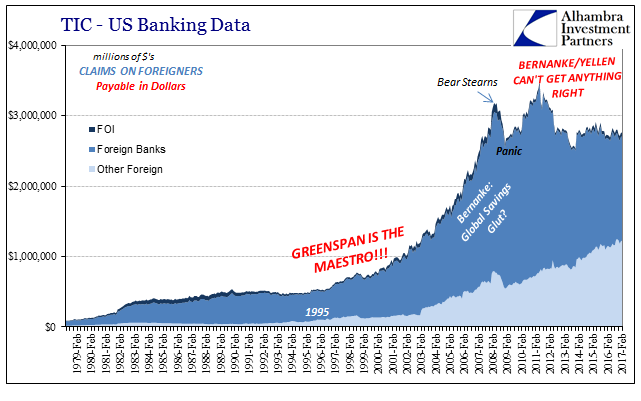

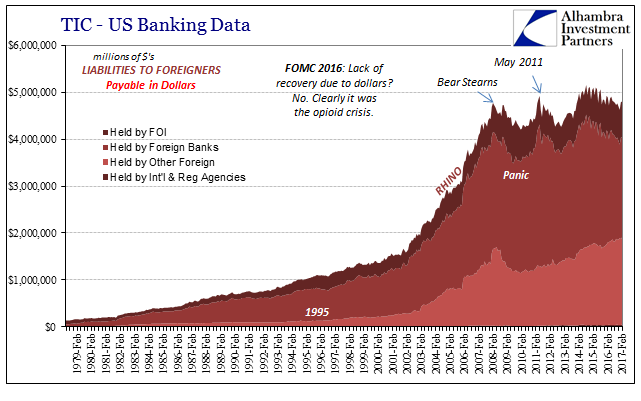

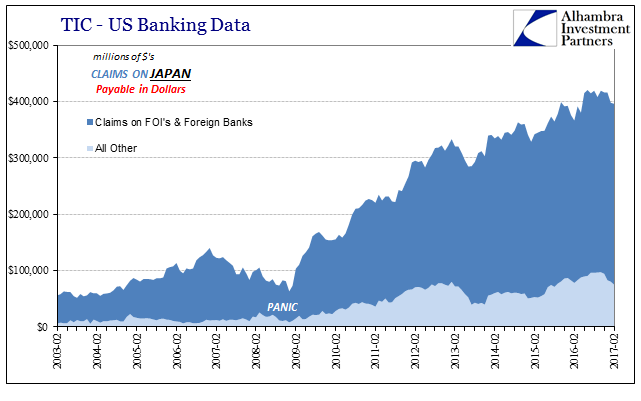

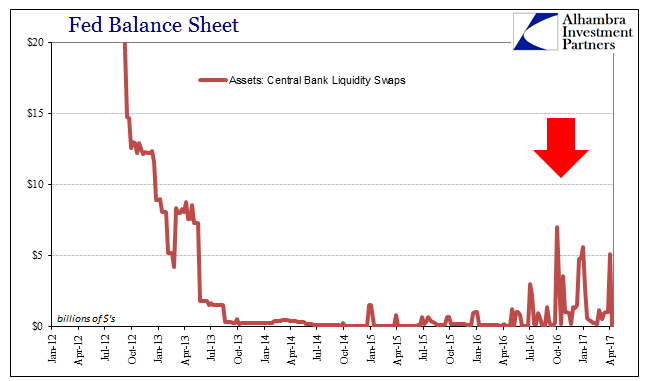

One of the defining characteristics of the 2011 crisis was dollar swaps. Almost all attention was paid to PIIGS and focus on the European banks holding their debt, as well as the very real possibility that all would break up the euro. Behind all that was the same dollar troubles as in 2008, and for the very same reasons. The offshore “dollar” market was once again under severe strain, so much so it convinced the majority of participants to get out of the business as best as possible (leaving, as noted yesterday, mostly the Japanese).

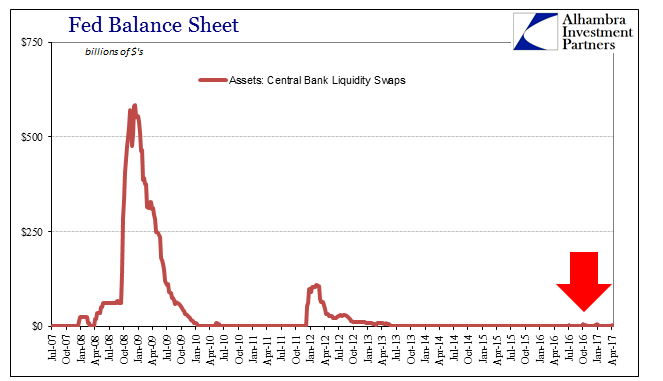

The original dollar swaps originating from the Fed to foreign official institutions, augmented during the 2008 crisis in both volume as well as the number of central banks participating, expired on February 1, 2010. That sunset provision says a lot about early recovery expectations. Policymakers all over the world really believed that things would go back to normal, meaning for dollars and dollar policies all the emergency measures like these swap lines were a one-time-only last resort.

Barely three months after that expiration, in May 2010 concurrent with Greece’s arrival in the mainstream (and the related liquidity flash-crash in stocks), they were brought back but once again on a temporary basis. As before, the events starting in 2010 and culminating in the winter of 2012 were thought to be transitory. It wasn’t until October 2013 that Fed dollar swap lines were made a permanent feature of the global landscape. It was not understood as defeat nor trumpeted as belatedly catching up to global monetary reality.

The highest volume was registered in December 2008 at just more than $580 billion, a truly astonishing sum that translates only a small part the scale and really scope of the global “dollar” issue. In February 2012, volume was at most just under $110 billion, which may propose some progress in that vast difference in scale between the funding strains 2008 to 2011. In other words, it may at first seem as if the Fed was successful in reducing the amplitude, but what was actually important was that there was recurrence at all, not the volume attained by it.

It may be surprising that these now open and perpetual swaps have been accessed to a greater degree since early last year. It is by no means anywhere close to 2011-12, and unlike anything of late 2008, but again that misses the point. Ten years after the initial offshore rupture, why are there foreign banks accessing (through their own central banks) these programs at all? These are not regular funding tools, like the Primary Credit Window (former Discount Window) delivered at a penalty rate.

Further, we know from Russia and other places where central banks have taken it upon themselves outside of these dollar swaps to obtain “dollar” financing and redistribute on their own back to local banks.

So the Bank of Russia has been providing additional “dollars” to Russian banks that are, like Chinese banks, perpetually short of them but finding it more difficult to maintain working order (to the point of bringing in the central bank). While that may be indicated by the rising LIBOR rate as a consequence of growing eurodollar inelasticity with regard to Russian banks (or Chinese), we have to ask ourselves the consequences of these central bank actions.

We started seeing these very small takeups in the swap lines right when you would expect, at least after you stop seeing QE as “money printing” – the “rising dollar” period. More importantly, they ramped up during 2016 and have remained somewhat active even recently (more than $5 billion was accessed in the first week of April 2017).

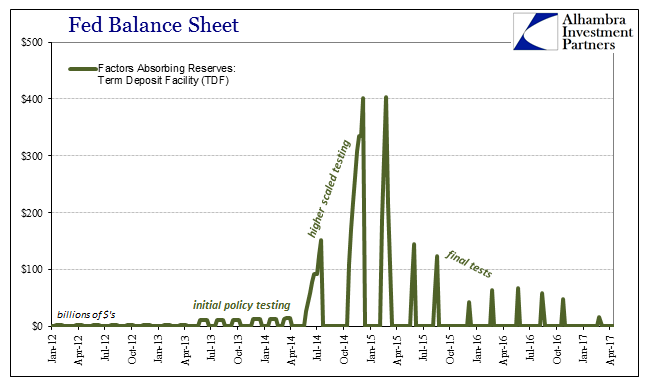

On the other side of the Fed’s balance sheet is something called the Term Deposit Facility (TDF). It was, like the Reverse Repo Program (RRP), designed to aid in the Fed’s expected “exit” from all these “emergency” “accommodations.” Having printed so much money, in reality mere idle bank reserves, Fed officials expected to have to use these alternate means in order to maintain control of federal funds, and by extension all dollar markets (as they define them, not as the eurodollar actually does).

The TDF like the RRP absorbs reserves only as the name implies for longer than overnight. This would help with raising rates by locking up excess reserves in a way that FRBNY, through its Open Market Desk operations and capabilities, was thought able to predict. Testing began during the “taper tantrum” summer of 2013, and as always with these ideas and programs the FOMC judged it by late 2014 a raging success.

Curiously, however, the TDF has largely sat idle outside of continued testing that wasn’t completed until February 2016. The Fed has only auctioned the program four times in decreasing amounts since that lest test, with the last occurring the week of March 1 this year (undoubtedly in anticipation of the mid-March “rate hike”), absorbing but $16.6 billion. In other words, once more like the RRP, there really doesn’t seem to be any problem of excess reserves.

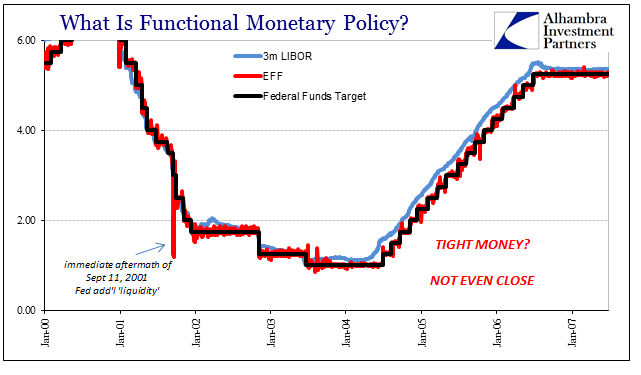

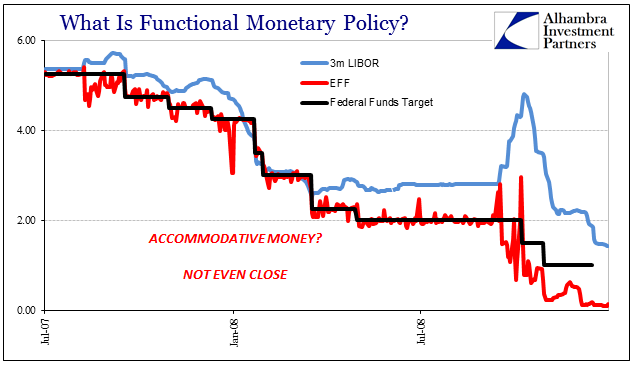

Before August 9, 2007, the federal funds rate set the conditions for everything else, so at least in self-denial about all the rest of “dollar” activities the FOMC believed it was in control of money markets at that time. The problem was in thinking the federal funds rate applied predictable control over everything, which is really kind of naïve and foolish to simply assume so but especially for a central bank whose whole job is to be sure about money. Thus, the additional money market controls of TDF, RRP, IOER, etc., merely recognize that the dollar markets are now (just as they always have been) perhaps a bit more complex.

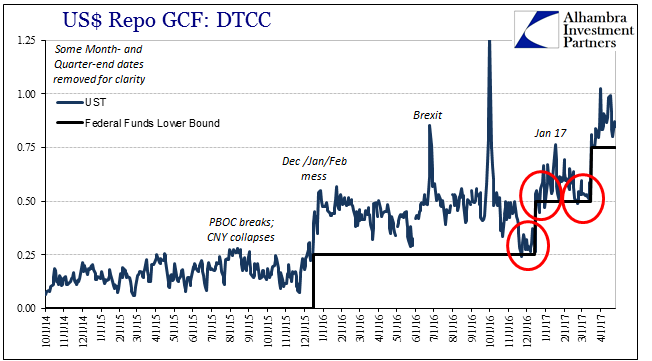

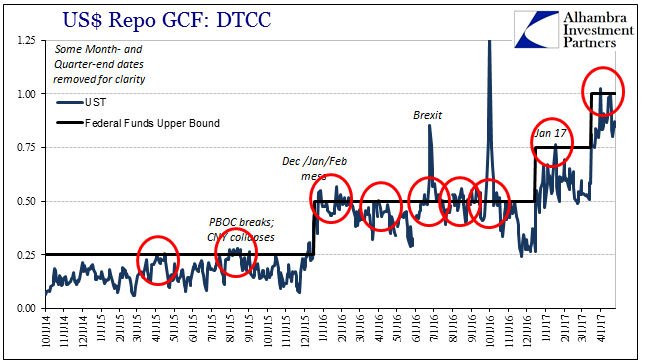

There was once a very close relationship between repo rates and federal funds, as really there should be given association of risk (secured vs. unsecured). Ever since 2010 and especially 2011, it has been much less so though by official account that is because of so many bank reserves. In reality, the difference in repo is the difference in money and how policymakers just don’t get it (even now after realizing how irrelevant federal funds have become). As noted a few weeks ago, the Fed has anyway been careful to define its success in “raising rates” in the very narrow terms of just federal funds.

There is absolutely nothing commendable in that statement, nor anything relevant to the greater considerations. Practically no one trades in federal funds anymore, and those who do are primarily the pocket change of GSE’s. If that is the one addition to the good side of the FOMC’s ledger, they are in more trouble than they are letting on – which is entirely the point of Potter’s quite lengthy speech.

The repo rate has been lately all over the place again. The GC rate has at times flirted with and submarined the RRP “floor”, while at others, like last week, found itself in MBS GC above the “ceiling.” This continued dispersion is what caught the attention of Fed staff, leading to the statement by Simon Potter, VP of FRBNY’s market group, referred to in the quote above, in order to try to reject and deny the work of his own personnel.

There remains even a decade later “something” going on in money markets that the US central bank, the assumed agency most responsible for dollars, can’t solve. After four QE’s and two and a half trillion in bank reserves, there is constant business in dollar swaps as well as overseas central banks undertaking all kinds of ad hoc workarounds to achieve funding. At the same time, after now three “rate hikes”, the best and most that can be said is federal funds have behaved and easily so, an interest rate applied to nothing in a market almost completely devoid of volume using instruments that are of use to practically no one.

Sometimes the world really does make sense.

Stay In Touch