It is one of those things that will never be stated outright, nor does there exist the kind of unassailable proof that would convict in any legal sense. Regardless, monetary officials here and elsewhere are clearly trying to have it both ways. They know very well what is driving inflation rates upward of late, and it isn’t monetary policy success. If, however, the members of the public all believe differently, they are in no rush to correct them.

Instead, the sanitized FOMC minutes for the March 15, 2017, policy meeting, the last one where a “rate hike” was voted on and approved, includes the following passage:

Subsequently, investors took note of the mention in the minutes of the January– February FOMC meeting that many participants expressed the view that it might be appropriate to raise the federal funds rate again fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations or if the risks of overshooting the Committee’s maximum employment and inflation objectives increased. Late in the period, communications from several Federal Reserve officials led to an increase in market-based measures of the probability that the target range for the federal funds rate would rise at the March meeting.

They are pleased, it would appear, that in their view the rest of the world sees them as in a hurry to raise rates. Throwing around all the appropriate words like “maximum employment” and “inflation objectives” it certainly makes for that very appearance. You would be forgiven if you thought the FOMC was starting to expect 1994 conditions rather than those of the last decade.

But that isn’t what they actually forecast. Instead, the models, which is all that really matters to economists, continue to project the same underwhelming economy far out into the foreseeable (the use of this word is inappropriate in the context of econometric models; nevertheless) future. From the same March 15 FOMC minutes:

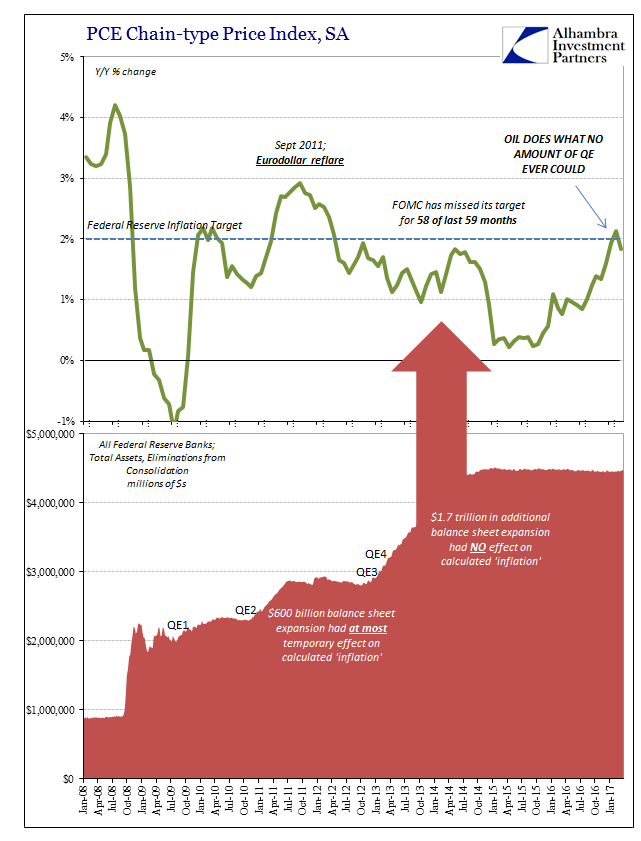

The staff’s forecast for consumer price inflation, as measured by changes in the PCE price index, was unchanged for 2017 as a whole and over the next couple of years. The staff continued to project that inflation would increase gradually over this period, as food and energy prices, along with the prices of non-energy imports, were expected to begin steadily rising this year. However, inflation was projected to be slightly below the Committee’s longer-run objective of 2 percent in 2019. [emphasis added]

The year 2019 will be twelve years after the first eruption of monetary difficulties, and by then seven years since the PCE Deflator was at the official 2% target for more than a single month. Again, they know it is energy prices that have of late delivered the various indexes to their target, but don’t seem to be in a rush to clarify it with the mainstream.

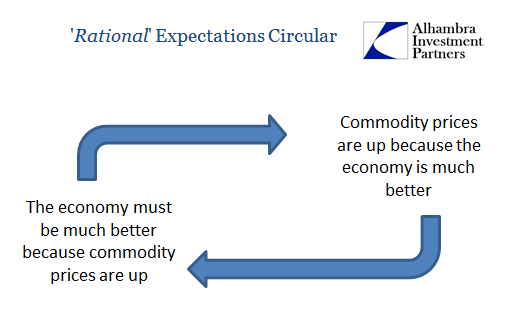

The reason, as always, is rational expectations. In other words, if you think that the Fed is in a rush to “raise rates” because you think they think the world is about to get a whole lot better, then you could act as if that will be the case and therefore bring about the very trend they seek (there is no money in monetary policy, just a heaping dose of pop psychology). It didn’t work in 2014, nor 2011, so it is beyond a long shot but is still better, from the FOMC perspective, that people feel more optimistic even if there is no reason to be. If nothing other than human nature, policymakers have great incentive to get the heat off them, if only for a while.

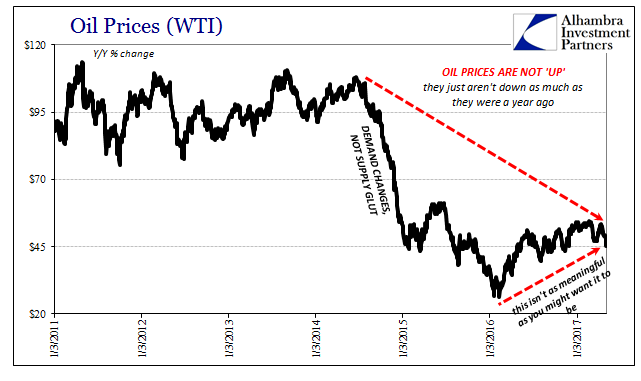

It forms the basis for “reflation” in one important aspect of it, meaning that if the Fed appears to be concerned about “overshooting” and commodity prices are up, then perhaps there is something to this renewed optimism. In February, at least, oil prices had increased almost 80% on average, which sounds downright impressive. If it is moving in the right direction, it seems to be a big one at that.

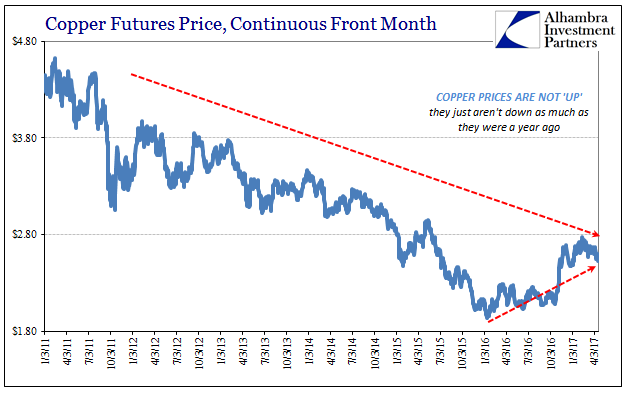

That is where it all falls apart; “reflation” proceeds under a litany of false pretenses. Among them is this belief that commodity prices are up. Technically they may be but only in the strictest sense of annual comparisons. In more relevant terms, commodity prices aren’t anywhere near “up”, as the physical world and the economy that feeds it cannot simply ignore the slowdown of the past few years as if it didn’t happen.

Therefore, a more appropriate background for analysis properly contextualizes commodity prices holistically beyond the narrow contrast to only the most recent trough. They are not “up” in the slightest; they just aren’t down as much as they were a year ago.

It’s a much different assessment than the almost giddiness produced by inflation rates that are constructed in only that narrow sense. And, again, officials know it, but don’t care to correct any misconceptions so long as it maybe in some small way helps their cause (it doesn’t).

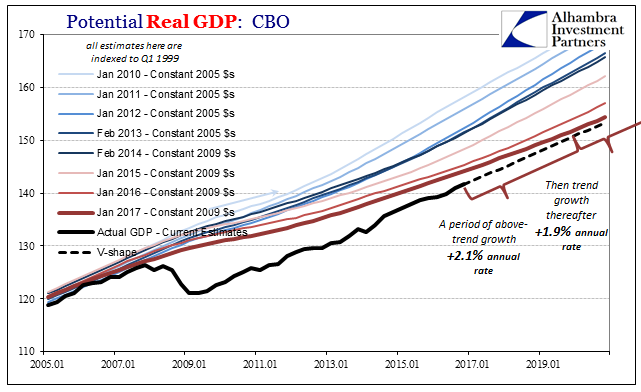

The Fed is “raising rates” for reasons that have nothing to do with actual improvement. Having essentially had the clock run out, there is just nothing left for monetary policy in their estimation. They gave it the old college try and came up short; shrug of the shoulders, move on to the next crisis. It truly does not matter anymore that the US and global economy failed to ever recover from the Great “Recession”, which even Fed officials now quietly concede (R*) was not a recession. That’s somebody else’s problem, either in the Treasury Department (the official writing all the SS checks to the assumed surge in retirees) or at drug treatment facilities.

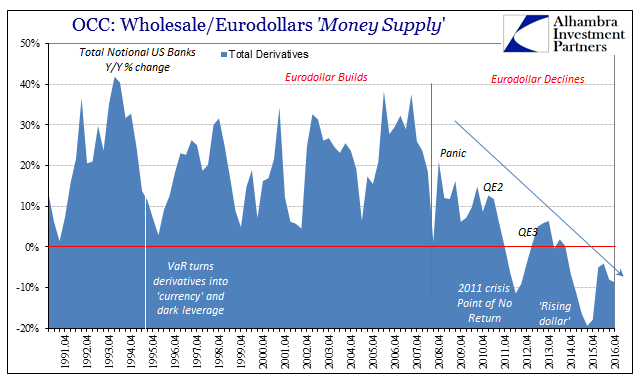

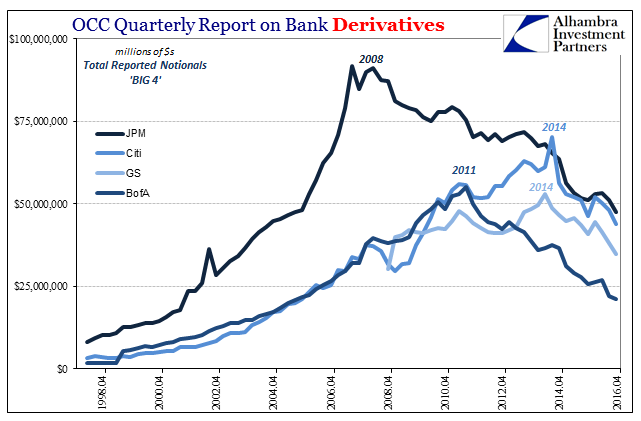

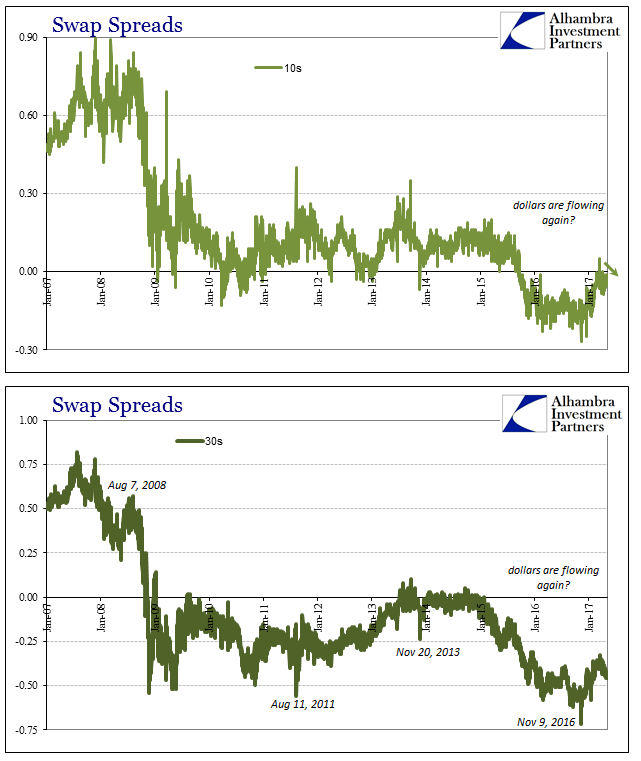

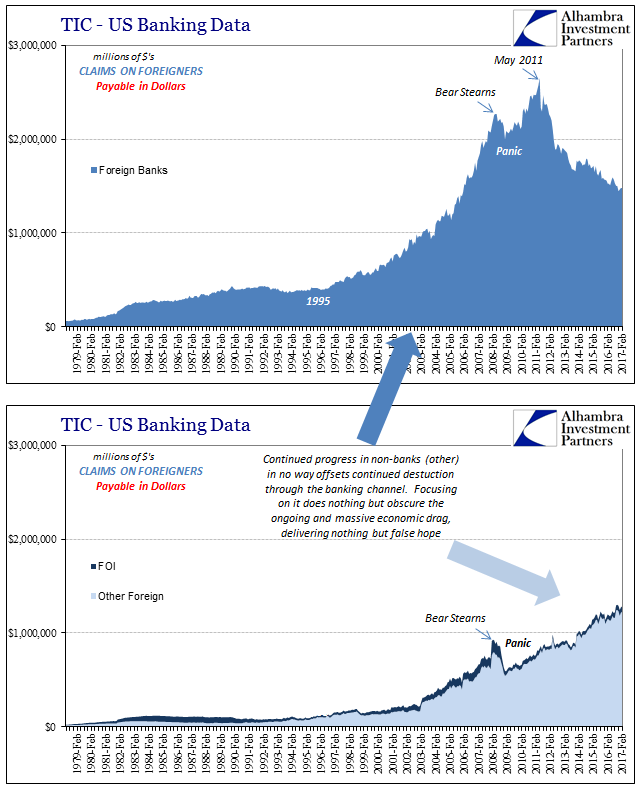

It is a monetary issue, however, just one that will never be recognized so long as policymakers remain as they are. It has been building for half a century without their acknowledgement, taking off in the 1990’s under what has been disguised as the Great “Moderation.” Economists James Stock and Mark Watson told the NBER in April 2002 that the period of low economic volatility was as much due to “good luck” as anything else, including monetary policy. From their view of money, it may have seemed to be a random period of positive externalities, as the (rapid) rise of the eurodollar system would have been outside of the scope of their understanding, thus mere good fortune.

The whole idea of bank and the funding model which supported it was vastly different in ABS than savings institutions, with commercial banks somewhere in the middle but more and more like the former as the Great “Moderation” progressed. There seemed to be a vast reservoir of exogenous funding pools, money even, and increasingly that was derived literally outside the Fed’s jurisdiction or definitions (in the shadows). ..

We have to consider, if not only consider, the unappreciated wisdom of Stock and Watson’s 2002 “unsettling” alternate, where “the quiescence of the past fifteen years could well be a hiatus before a return to more turbulent economic times.” Perhaps the whole thing about “good luck” was no luck at all, but rather a vast and misunderstood (indeed often purposefully ignored) radical change in global monetary dynamics. There was no hiatus in volatility that wasn’t the eurodollar system (which wasn’t and isn’t limited to just eurodollars, but all forms of wholesale funding formats including FX derivatives in all major denominations, however bank balance sheets might consider expansion or contraction) building up.

Like the opening scene in a big budget thriller, “turbulent economic times” returned with a bang in 2007. We still haven’t been able to move past it, though monetary officials would prefer that from time to time you think we have so as to occasionally feel better about the depression. All these economic periods classified by the word Great really deserve the quotations because they are so clearly not the thing they are made out to be; just like “reflation.”

Stay In Touch