It doesn’t appear as if the OPEC decision went as the oil ministers might have hoped. Agreeing to a nine-month extension, more than the usual six months, it was still less than the whispered year that had been rumored and seemingly supported as late as yesterday. Still, Saudi Energy Minister Khalid al-Falih was encouraged.

We found out that 9 months with the same level of production that our member countries have been producing at is a very safe and almost certain option to do the trick.

“Almost certain.” It is only one day and still in the knee-jerk phase, but WTI trades indicate more of the opposite interpretation. It was meant and widely described that OPEC’s production cuts would serve as a floor under oil prices, but yet again we see that it is a ceiling that instead predominates.

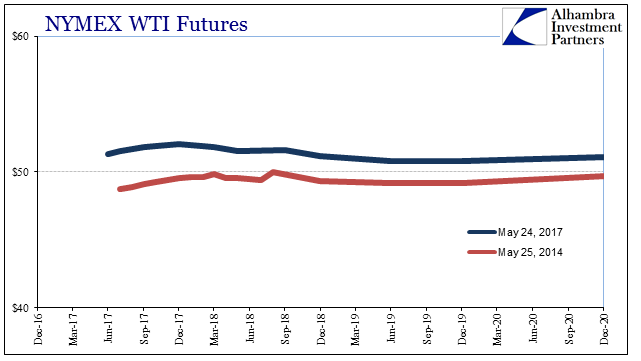

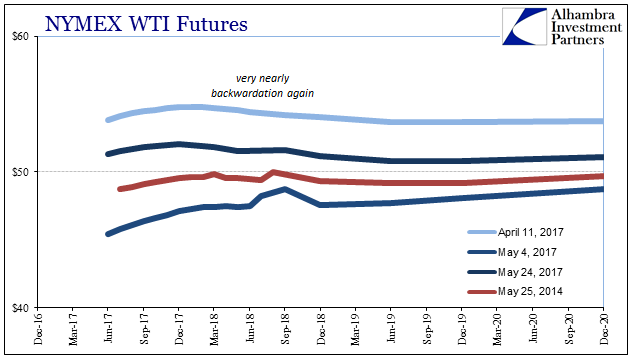

The WTI curve which was slipping toward low level backwardation yesterday found a bit more contango again today after the news and selloff. It’s not much, but after three years and a more than 50% haircut off the spot price the persistence of this contrary condition is the financial expression of enormous doubt.

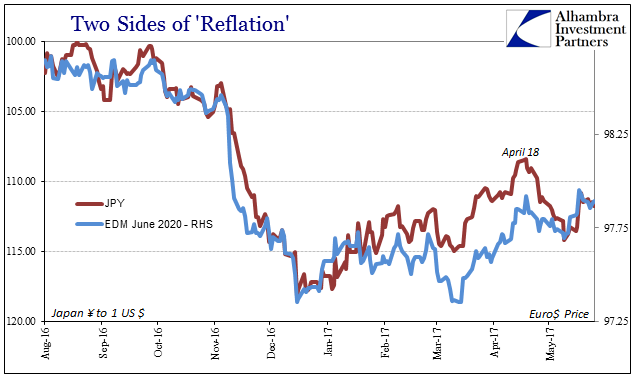

They can’t make the oil numbers balance because they can’t find the demand. The idea of an oil price floor was predicated on economic improvement of the meaningful kind. If that had been the case as was expected, the supply/demand imbalance would have long before now come into focus. Instead, there remain constant worries about whether inventory can be brought down sufficiently next year or maybe the year after. For all the talk of “reflation”, where is it really?

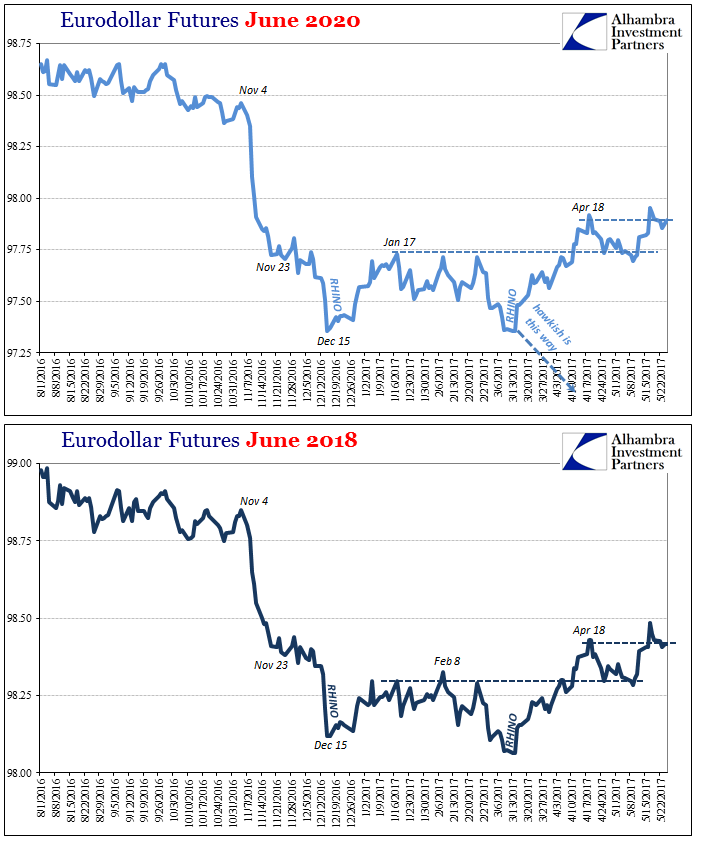

In that respect, oil prices are not alone. The media declared the last FOMC meeting decidedly “hawkish”, with talk of even moved up balance sheet runoff. Yet, the actual discussion was much less so and the markets, the ones that actually matter, like oil, remain so highly skeptical as to trade contradictory to that contention.

Essentially, the oil market like the others is demanding more than “almost certain.” It wants the extraordinary because “almost certain” is almost certain to disappoint. There is much about 2017 reminiscent of 2014, but also quite a bit different. Once bitten and all that.

Stay In Touch