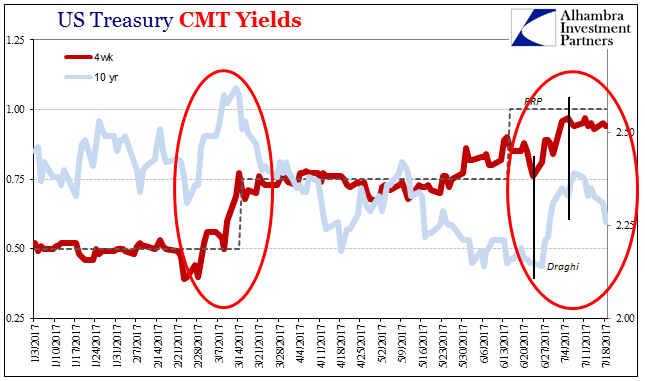

On June 27, ECB President Mario Draghi opened that central bank’s international conference in Sintra, Portugal. Most media never made it past the first two sentences of his prepared remarks. For them, the verdict was already delivered in those few lines. They declared that Draghi declared monetary policy was working and the world was on its way at long last.

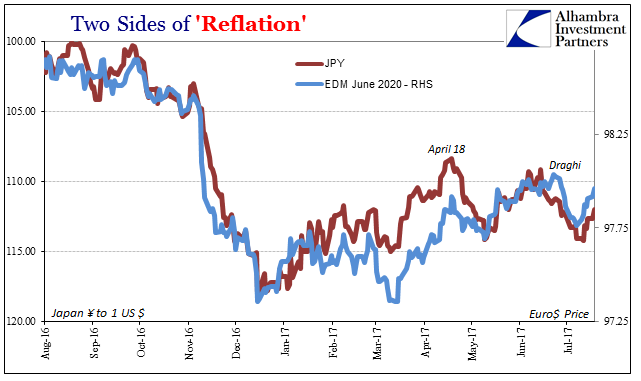

From there, inferences around the world flew in dizzying fashion. Much of the commentary focused on what that might mean for European monetary policy; the scaling back of QE and then the eventual raising of policy rates. It was further assumed that it must be true for the global economy if the ECB was so sure about its own case; his words were applied to the global economy, including the US, not just Europe’s.

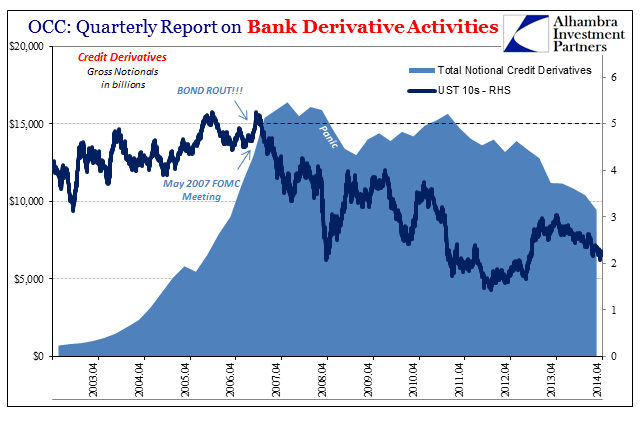

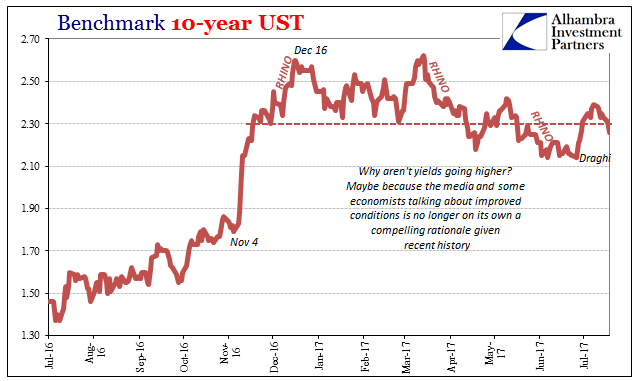

The effect was a bond market selloff globally that in the context of just those two lines was immediately branded as the latest BOND ROUT!!!

ECB president Mario Draghi’s upbeat speech at the ECB Forum stole the show on the markets, boosting the euro against the pound. Mr Draghi’s bullish appearance, which saw a very slight softening of his rhetoric on the ECB’s monetary policy, also strengthened the currency against a weak dollar.

That wasn’t really true, as a great many such things turn out to be quite different if you actually read past Paragraph 1. A more comprehensive, and appropriate, examination of Draghi’s remarks would have noted instead that it was his standard speech. It wasn’t anything that he hadn’t said dozens of times over the entirety of his tenure.

Thus, by saying the same thing again, the head of the ECB was actually saying quite a bit – just nothing that was really good. The main emphasis was, as always:

For central banks, this means addressing an unusual situation. We see growth above trend and well distributed across the euro area, but inflation dynamics remain more muted than one would expect on the basis of output gap estimates and historical patterns.

An accurate diagnosis of this apparent contradiction is crucial to delivering the appropriate policy response. And the diagnosis, by and large, is this: monetary policy is working to build up reflationary pressures, but this process is being slowed by a combination of external price shocks, more slack in the labour market and a changing relationship between slack and inflation. The past period of low inflation is also perpetuating these dynamics. [emphasis added; Really? A changing relationship between slack and inflation?]

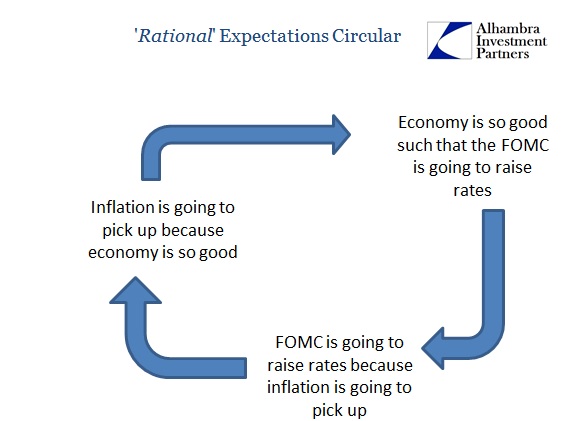

A more accurate summation of his speech is as follows: central banks navigate by inflation; inflation isn’t behaving no matter what we do; we don’t really know why; but we also believe that this “contradiction” is temporary because we believe it is temporary.

It’s the same part of a speech given by Janet Yellen, Haruhiko Kuroda, and any number of other faceless empty suits sitting atop the organizational charts of major central banks. They all think low inflation is temporary, and yet they continue to say that year after year after year. At some point even the speechwriter has to point out the meaning of the word “temporary.”

It is the sequence behind it that ultimately has driven the media narrative, though backwards. Mario Draghi believes inflation will in the intermediate term (which is today, from the view of 2014, let alone 2012 when he really started) go to 2% by way of a strengthening, sustainable economic advance (which he would and does admit as being low-grade). In other words, he doesn’t see it now, he just believes in it because inflation will go back to 2% and that is how it will get there.

The media, on the other hand, focuses on what he says as a matter of faith and blows it up into a matter of analysis. This is why these cycles only repeat, because the economy isn’t doing what it is supposed to, as proved consistently by persistently low inflation despite already massive QE’s, NIRP, and a thousand other (ABS, covered bonds three times, etc.) monetary interventions over the intermediate term.

European Central Bank President Mario Draghi sparked a broad wave of selling in government bonds of the developed world, highlighting investors’ vulnerability when major central banks pivot toward a less accommodative monetary policy.

Except that is proving as fleeting as the last time a similar cause/effect paradigm was asserted. The bond market doesn’t care at all about “central banks pivot” except when one might be because it worked. The next time that happens will in the 21st century be the first time, set up as we are on already the third great “conundrum” not even two decades into it.

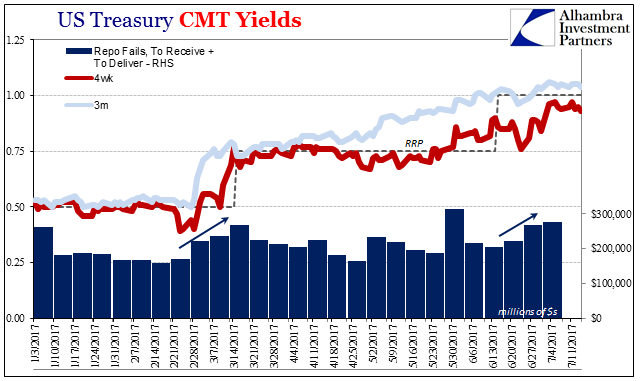

From my view, the media’s positive spin on Draghi’s speech might have been a catalyst for the selloff, but it was as much the bill market (in dollar bond markets) being relieved as the ECB’s chief repetitive monetary confusion. Even if the first two lines of his speech accurately depicted the rest of it, then at most his prognosis of better global conditions would only have lasted until it became clear that just wasn’t the case – which really didn’t take very long.

And so that whole BOND ROUT!!! will be in just a few months, perhaps weeks, forgotten for all the same reasons. Draghi’s speech will likewise be lost in time, which for all the central banks has become a barren sea of the same analysis offered over and over and over again, complete with the same “contradiction” belief that though they can’t explain what’s going on now they will at some unknown point in the future not have to.

It bears repeating for the thousandth time just this year; there is no conundrum.

Stay In Touch