The entry of the United States into World War I placed a heavy financial burden on the government. The scale of such encumbrance was at the time almost unthinkable, and today is incomprehensible. Federal government expenditures in 1916 were all of $734 million, with $125 million financed by the new income tax authorized a few years prior by the 16th amendment to the Constitution. In 1917, the first year of war, the government spent $18.5 billion.

A majority of the war expenses would be met by borrowing, the sale of Liberty Bonds and other means. In anticipation of the US declaration of war which came on April 2, 1917, US Treasury Secretary William McAdoo on March 28 wrote to the Federal Reserve Board of his desire to obtain short-term financing in advance of bond sales that would take some time. Offering just 2% interest, well below market rates, he said, “This is an excellent opportunity for the Federal Reserve Banks to secure a desirable short-time investment and to demonstrate their usefulness as fiscal agents of the Government.”

The branch district banks did so reluctantly (in that early Fed period, there was little centralized structure leaving the individual branches to conduct their own affairs with some recommendation from the Board in Washington). The Governor of the Boston Fed, Alfred Aiken, was nearly appalled that the Fed would be used as a direct agent of the Treasury. It’s not that he didn’t feel it appropriate to render monetary aid under wartime circumstances, preferring instead that his branch would do so in the form of generous rediscounting after the debt was first sold to private banks.

But even that process in the months that followed would prove tricky. On October 3, 1917, the War Revenue Act was passed greatly expanding the catalog of taxable items as well as the rates at which they would be taxed. Existing income tax rates were sharply increased, and excise taxes like the existing $1.50 per gallon tax on beer, for example, was raised by a war tax of the same amount (for a total $3 tax on beer paid by stamps).

The War Revenue Act also imposed stamp taxes on a wide variety of other goods and instruments (of the same types that led to the Revolutionary War). Playing cards were subject to a stamp of 5¢ per pack of 54 cards (gambling regarded as a serious vice). Financial instruments such as bonds required a stamp tax of 5¢ per $100 of face value. And a 2¢ per $100 stamp was needed for all bank drafts, checks (excluding ordinary bank checks payable on sight), and promissory notes.

That last one fell immediately under the Law of Unintended Consequences. The government badly needed both taxes as well as banks to finance a large share of debt. In taxing promissory notes, however, the one greatly impeded the other.

On November 28, 1917, Fed Chairman William PG Harding sent an emergency telegram to branch Governors authorizing them to rediscount commercial paper from (member) banks, and that they could so without requiring additional stamps. The War Revenue Act in taxing promissory notes included commercial paper in that category, significantly (enough) increasing the cost of funds for one of the banking system’s primary non-depository funding mechanisms.

In a follow-up letter from the Federal Reserve Board dated December 1, 1917, authorities suggested an almost total interruption in commercial paper requiring direct and drastic action on their part.

…and in view of the fact that this tax practically prohibits this form of short term borrowings by member banks at a time when such borrowings are most necessary as an incident to the successful loan operations of the Government, every proper effort will be made to secure an amendment effecting the requisite exemption.

Not only were the branch districts authorized (recommended) to rediscount whatever commercial paper they could on favorable terms, they were also greatly encouraged to use other means to ensure no funding shortfall, or at least as small a disruption as possible. Including:

It should also be understood that the Federal Reserve Banks may further aid the situation by purchasing, either from member or non-member banks, notes or bonds of the United States under similar agreements of resale. [emphasis added]

Thus, repo was born just shy of one century ago and in the frenzied manner of regulatory blind spots created by crisis. The Federal Reserve was prohibited from directly financing certain activities, but Section 14, subsection (b) of the Federal Reserve Act authorized the bank, “to buy and sell, at home and abroad, bonds and notes of the United States.” By structuring this financing arrangement as a simultaneous agreement to buy and at a future date sellback government securities, repurchase agreements could function as a collateralized loan without disturbing further legal proprieties.

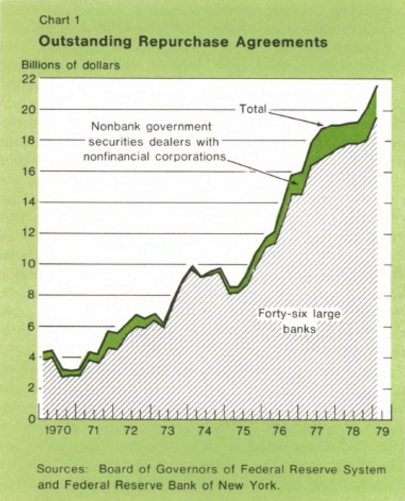

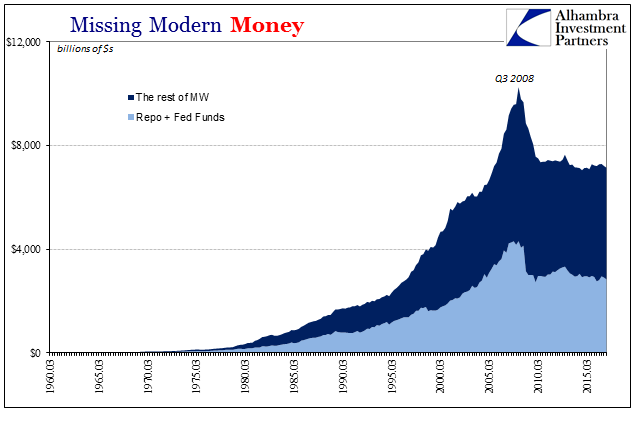

Over the hundred years since our central bank first bent the rules to accommodate banks, most people including policymakers and politicians still know little to nothing about “repurchase agreements.” Before 1970, that was understandable given that the Fed wasn’t much involved with them after 1920, and during the 1950’s and 1960’s there was very little volume apart from securities dealers.

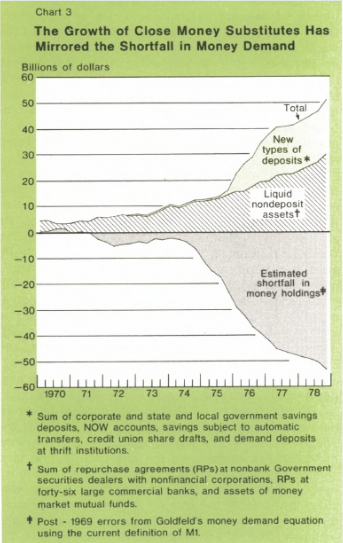

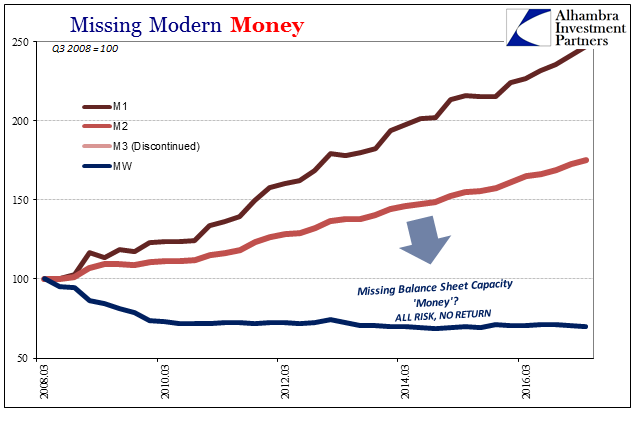

During the Great Inflation of the 1970’s, however, it was repos that formed the vast majority of what Princeton economist Stephen Goldfeld classified as the “missing money” of that era. The Federal Reserve would itself discover that to be true, estimating in the later 1970’s that repo balances were being used as a basis for transactions (largely by corporations who at that time were the only participants) and that growth of repurchase agreements was tremendous; all of it taking place while the central bank was completely unaware.

Rather than appreciate the monetary contribution of the repo market, it was left as largely a remainder item off in an M3 statistic officials never really considered (what repos were included in M3 was only a small fraction of overall repo, which, again, is a chief reason why M3 was discontinued in 2006 though it should have been instead studied more comprehensively long before then). Even after the events of 2007 and 2008, very little official appreciation of the repo market exists. As noted before, in early August 2011 the Federal Reserve debated bailing out the repo market though they hadn’t the slightest idea why they might need to.

The Richmond Fed’s handbook on the Instruments of the Money Market, last published in 1998, with statistics collected only through 1993 (I have to laugh at their section on the eurodollar), shows that repo volumes increased almost tenfold through the 1980’s; from $65 billion in 1981 to $629 billion in 1992. Given the importance of this kind of funding at those volumes and more, there has to be serious consideration for the collateral part of it (see: Salomon Brothers, 1991-92).

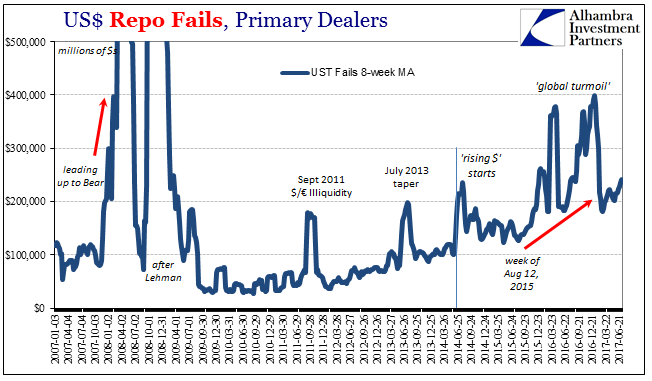

Even in 2017, though, there is almost none. What finally became perfectly clear (to those observing) in the 2008 crisis was that under extreme duress particularly related to collateral quality, such a shortage that may arise turns all collateral from tangible financial instruments used in obscure funding transactions into actual currency. In many vital ways, during the worst moments (highest fails), the practical situation of a theoretical repo was reversed; cash became the collateral for collateral as the currency.

In very broad terms, the shadow system (though it’s the shadows it was and likely remains the vast majority) has never recovered from what was a restructuring and even paring of the eligible collateral pool. Some forms of MBS even subprime that were treated as UST’s, given low and steady haircuts, were (rightly) re-assessed post-crisis such that they became almost if not complete useless. Exactly by how much the repo market has been impaired isn’t known, but we do have some ideas.

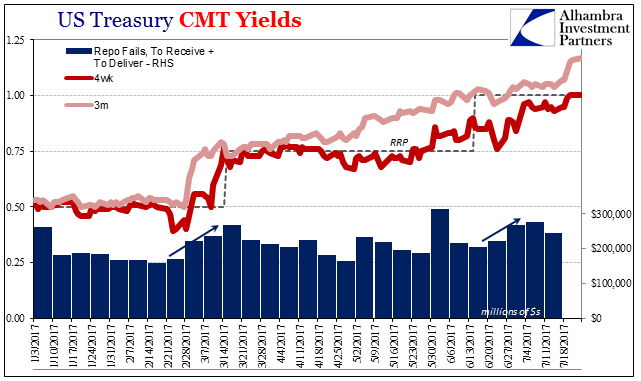

While there are legitimate capacity issues on the one side, the system has not been able to overcome collateral problems of this kind on the other. High quality collateral remains in short supply, even after the US government unknowingly did its part by running massive deficits and nearly doubling the debt and thus the amount of UST securities; I should point out and stress that I am not in any way advocating a quantity solution through more government debt to the collateral problem. The “rising dollar” period was one where collateral fluidity and distribution was clearly a major issue right from the beginning.

What was October 15, 2014, if not a massive collateral warning? Officially it was computer trading, but even those unfamiliar with repo can smell the whitewash. Technically it was a buying panic in UST’s, but in reality it was more complicated as it usually is the shadows.

The system never stands still no matter what, constantly evolving based on circumstances. Before August 9, 2007, very nearly ten years ago, that evolution was straight-forward related to inclusiveness and volume (more inclusive and creative collateral, more volume). In the aftermath of a panic where collateral played a central role (if not the central role), firms have developed several ways to work around the shortage (including the process of QE extracting securities and making it at times worse). The first was European, meaning the exchange of “toxic” MBS for sovereigns including what became labeled as PIIGS (out of the frying pan of 2008 and into the fire of 2011).

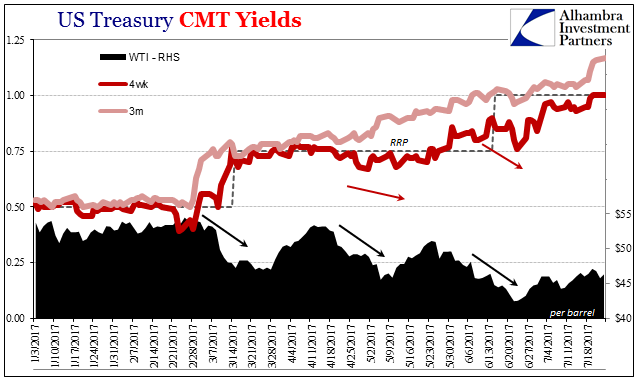

In later years, primarily after QE2, dealers began exchanging (collateral swap) their holdings of UST for corporate debt up to and including junk and EM junk. Because of the economic conditions of the time, a lot of that lower quality paper was issued by, and related to, the oil sector. Thus, we can start to appreciate what might have really happened on October 15, 2014, several months in to what was a very bad time for oil and therefore junk bonds (collateral re-assessment in many ways like subprime collateral years before).

More than a year after perhaps the end of the “rising dollar”, the world is not fixed; the monetary system still very far from it. What level of collateral shortage remains is still unknown, but certainly not nearly as bad as 2015-16 (fails). That doesn’t mean, however, collateral swaps junk for UST are not still being done; after all junk bond prices with oil prices have rebounded substantially. At least until mid-February:

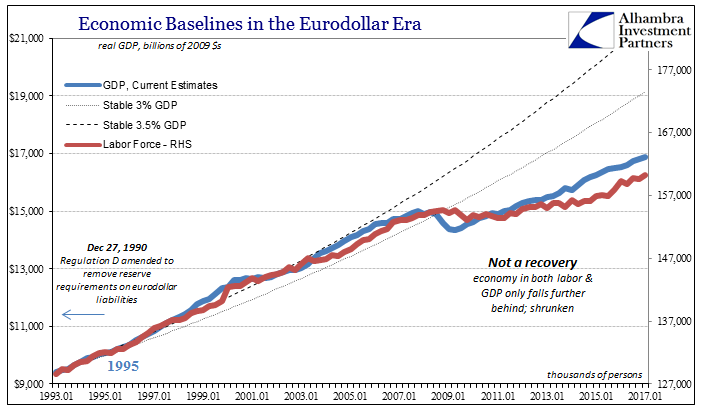

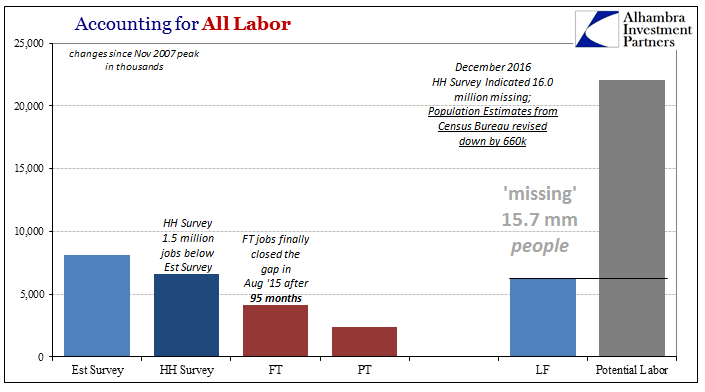

You would think that after a century of repo we would know everything worth knowing about it. Thanks instead to generations of Federal Reserve officials and economists who within and after the 1970’s era of “missing money” reacted with curious indifference, we know perhaps less today than in 1917 when it all began. Because of that, the age of “missing money” was never solved or even ended though it was first proposed more than forty years ago. It instead kept growing and expanding until in the 21st century in monetary terms “we” know practically nothing – and it shows.

Stay In Touch