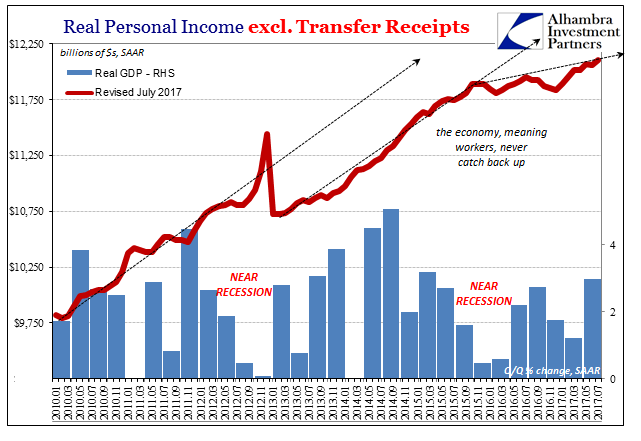

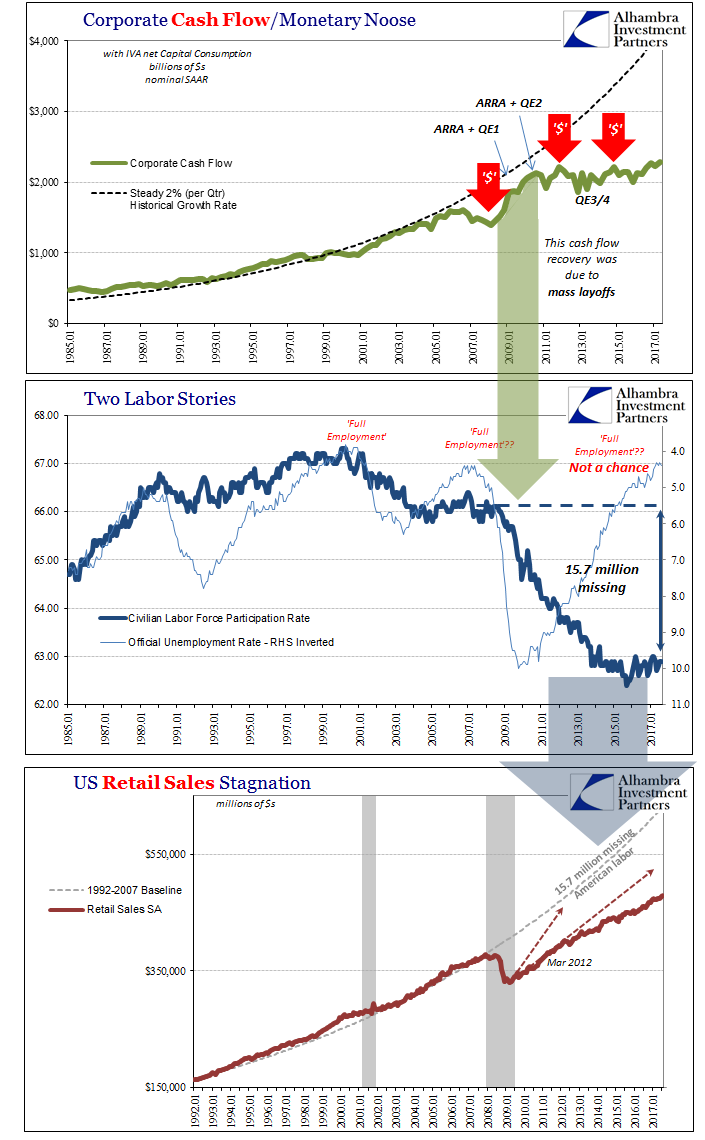

Can we finally put to rest all notions that the US economy is at full employment and doing well, and therefore wage inflation is right around the corner? I suspect not. This dance has been ongoing for years now, continuing through what was nearly a recession, so there is little reason to believe that economists are so data dependent.

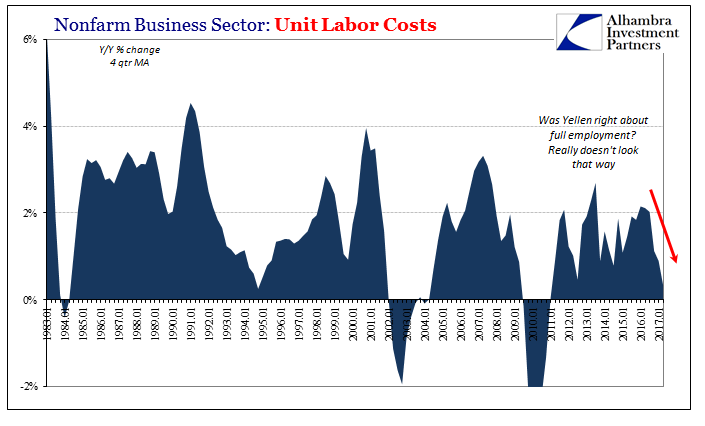

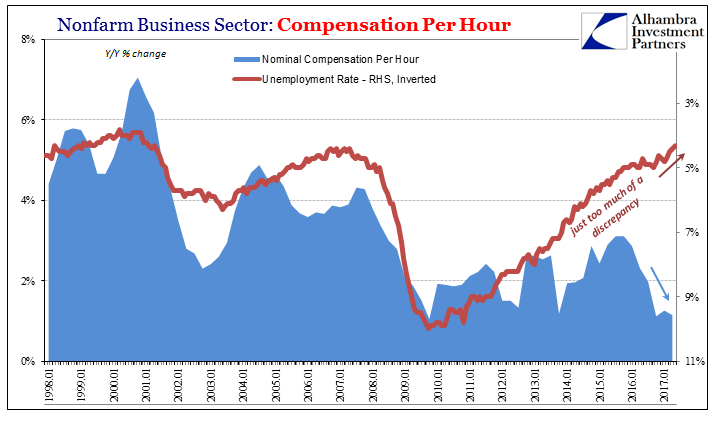

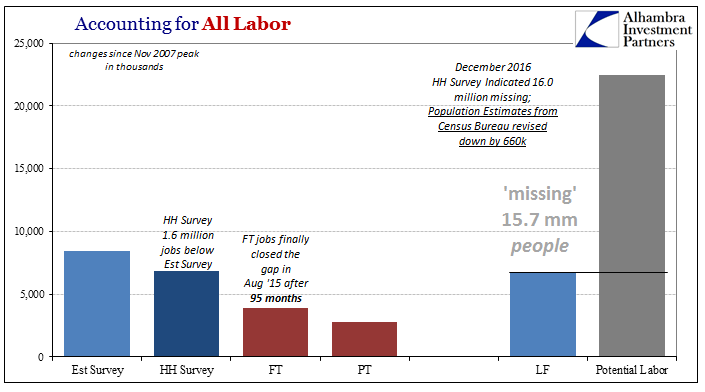

The BLS reported today that Unit Labor Costs for the nonfarm sector (practically the whole of the private economy) declined in Q2 2017 for the second time in the last three quarters. As the unemployment rate has dropped well below all orthodox definitions for “full employment”, and therefore the assumed exhaustion of any leftover labor slack, there is no evidence at all that is anything more than a statistical problem brought about by the 15 or 16 million Americans the unemployment rate ignores.

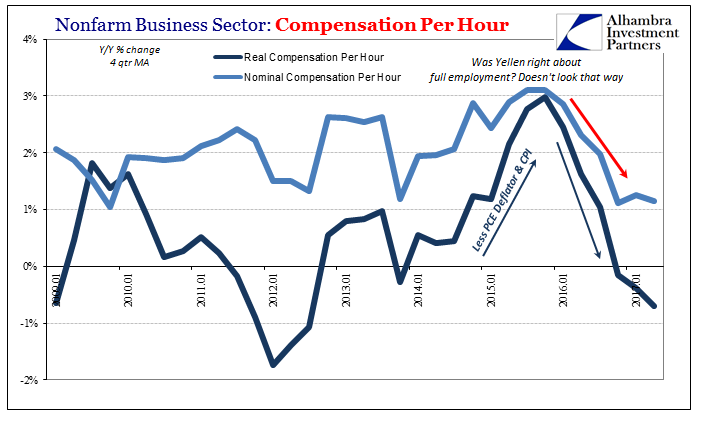

In terms of Hourly Compensation, real pay and benefits has been falling again though over the past nine months for more than just a rising CPI or PCE Deflator oil price artifacts. In nominal terms, which is where full employment would matter, compensation growth has decelerated sharply, too.

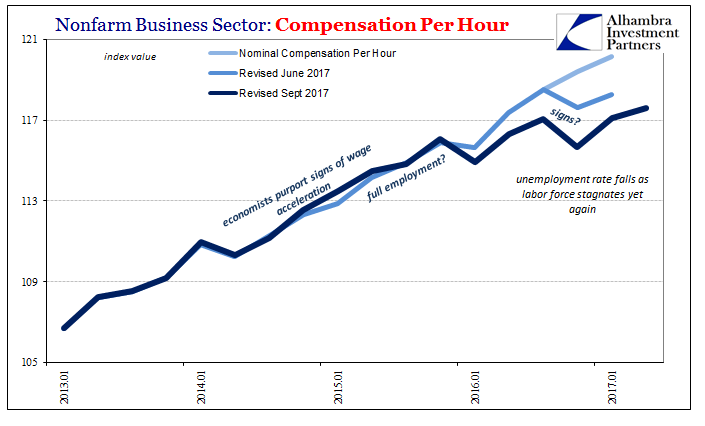

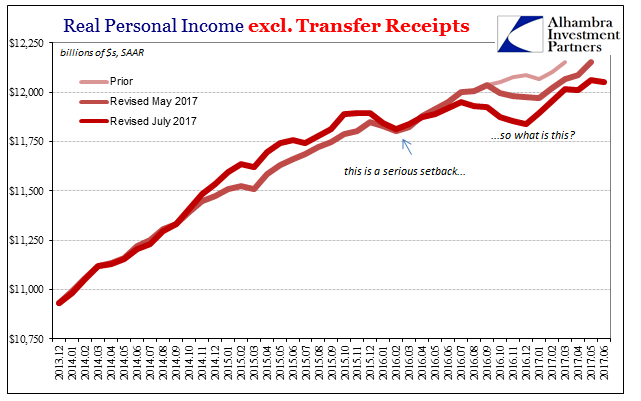

And it’s not as if hourly compensation was robust before this downturn. At a peak of 3% toward the end of 2015, wage/labor compensation growth is far less than what would otherwise be indicated by a sub-5% unemployment rate – especially one that has gone on for more than two years now. Continued revisions of these estimates rather than suggest what economists believe have instead figured more the opposite case (as in national income estimates).

The unemployment rate is isolated and uncorroborated; the full accounting of the labor force, that which includes the “missing” American labor, is more and more verified and validated as the correct interpretation of actual conditions (as if we needed any more) overall; and not just in terms of wage rates.

The constant media reports (anecdotes) of a labor shortage, or more suspect sources like the Fed’s Beige Book, are nothing more than stories combined with wishful thinking. The economy today is still, unfortunately, the economy of the last ten years. The only thing that has changed is the one statistic that can’t account for what really happened.

All the rest are unequivocal that the US and global economy shrunk and remains that way. More than that, it grows only weaker for every time one of these “dollar” events happens.

Stay In Touch