Everyone is now a euro watcher. The European common currency’s exchange value against the dollar has been on the rise, to put it mildly. Despite decades of declaring floating currencies the optimal framework, it really is quite entertaining to watch the furor when these things actually float one way or the other.

This recent trend has been attributed to the ECB and its head Mario Draghi. Not that in the mainstream there is belief Europe’s central bank and its central bankers want the euro moving up, rather conventional opinion opines that because the ECB has been effective with its “stimulus” the European economy is now in a very good place.

“Draghi could have been more forceful on the euro,” said Marco Valli, an economist at Unicredit in Milan. “But the Governing Council seems to think that at least part of the appreciation is a consequence of the economy’s strength. Therefore, sounding too concerned would have not been credible.”

It’s a bit more basic than that. After having said nothing but good things about Europe’s economy and the performance of its central bank for ten years as it all fell apart, economists aren’t going to now say something different. There really is great dissonance about why central banks from the US to Canada to Europe are thinking of none but the exit. The problem lies in what really is a common policy window, not several individual ones.

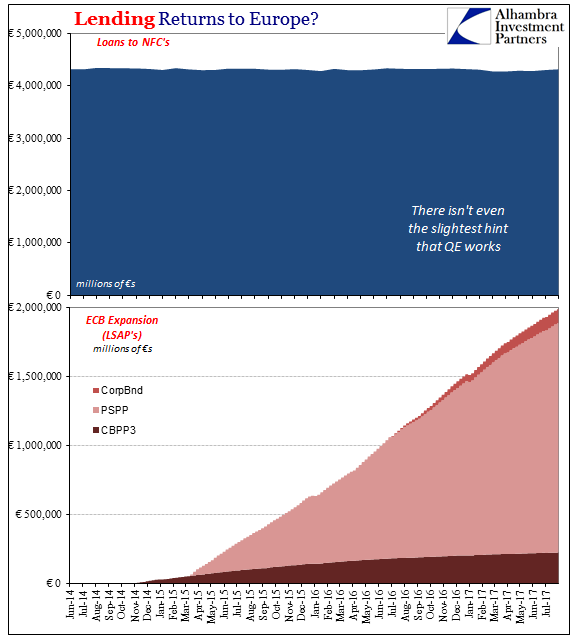

For the first part, there isn’t any trace of “stimulus” on that side of the Atlantic. If convention is right, we should be able to detect the effects of QE and the other LSAP (large scale asset purchases) programs. We can’t.

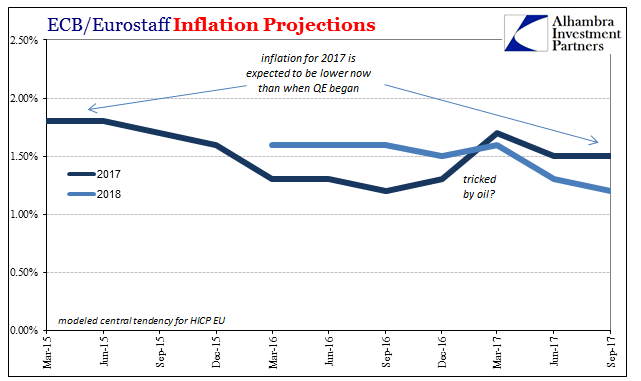

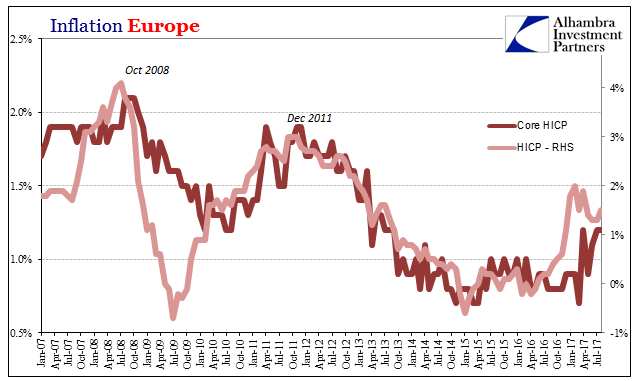

Starting with inflation, the ECB’s staff of economists and their models still forecast just 1.5% HICP growth in 2017. That’s down from 1.8% projected in March 2015 at the start of the PSPP part (QE). In addition, projections for next year continue trending down already being lower than this year.

Economists and policymakers (redundant) might claim that without the ECB’s interference it would have been much worse during the global “rising dollar” downturn last year, but that’s a reduction in standards to “jobs saved.”

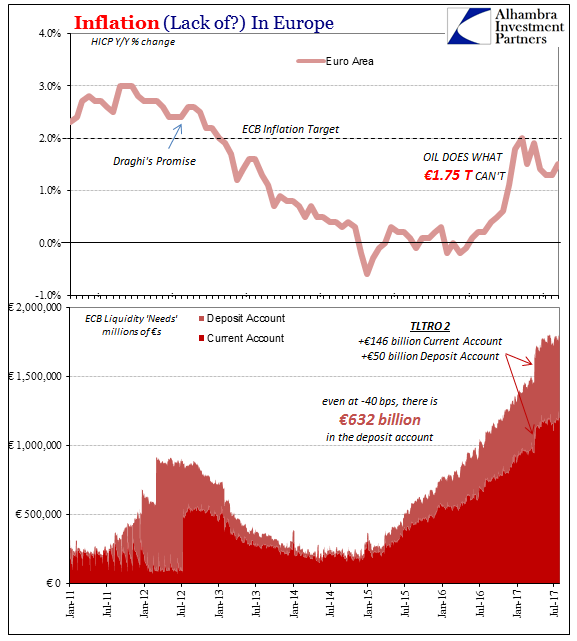

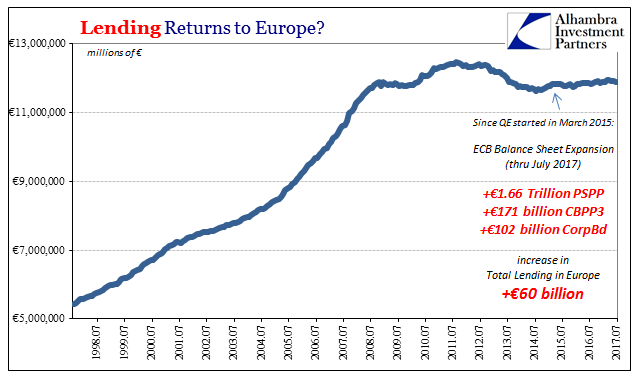

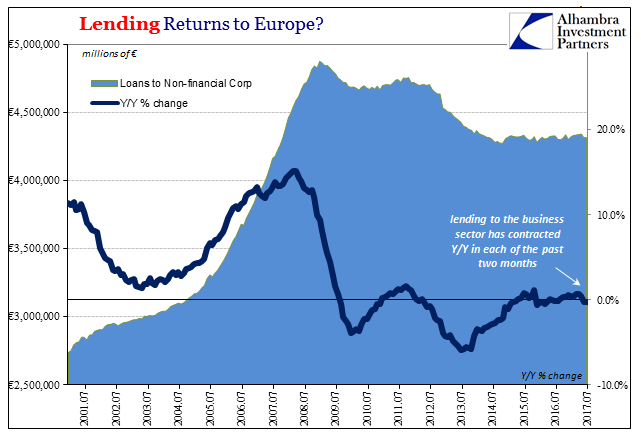

Furthermore, there isn’t any evidence of meeting that lower threshold, either. As I wrote above, we can’t find any trace of QE in any part of Europe where it really should show up. More immediate than inflation is lending; loans are, in fact, the vehicle by which QE and the LSAP’s were supposed to affect real economic outcomes, washing out in the end as consistent and stable 2% inflation.

Lending in Europe remains instead at a standstill. Total loans in July 2017 were a paltry €60 billion more than in March 2015 despite €1.93 trillion in asset purchases among the three major LSAP channels.

One major point of emphasis with these monetary policies was to get lending and credit flowing into the business sector. Yet, the total volume of loans to NFC’s (non-financial corporations) was actually €9 billion less in July than when QE made its first purchase more than two years before. It doesn’t matter in the slightest, it seems, that Europe’s central bank also purchased more than €100 billion in corporate bonds dating back to last June.

Or maybe it does? Perhaps Europe’s non-financial sector has moved to bonds rather than loans for credit. Even if that was the case, it still doesn’t count for the banking sector and what is in the end the real monetary base of the global money system – balance sheet capacity. That begins, and often ends as we see, with the willingness to take on and overcome risk. The biggest risk of the past decade has been liquidity.

That’s largely the point in Europe’s economy as well as monetary agency. These are monetary policies, at least in name, but they don’t move the monetary needle no matter how many trillions are offered ostensibly in euros. The product of monetary policies, all of them, is not an increase in effective money.

So why is the ECB like the others paving the way for its exit from QE and then ZIRP?

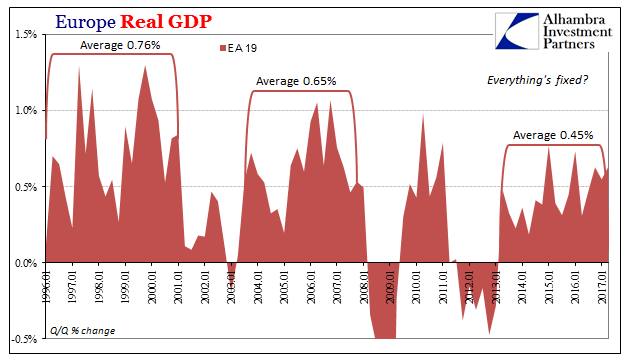

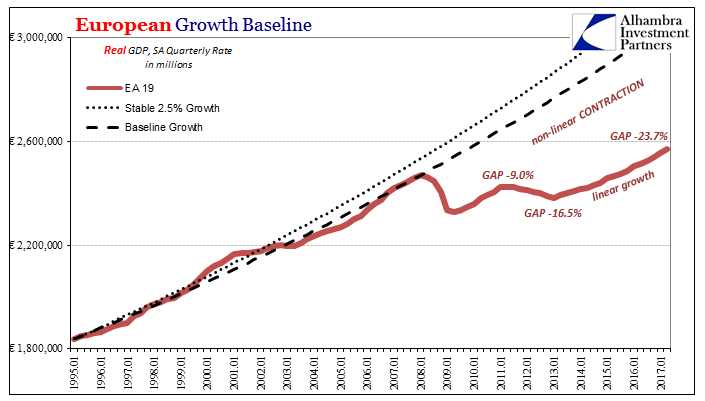

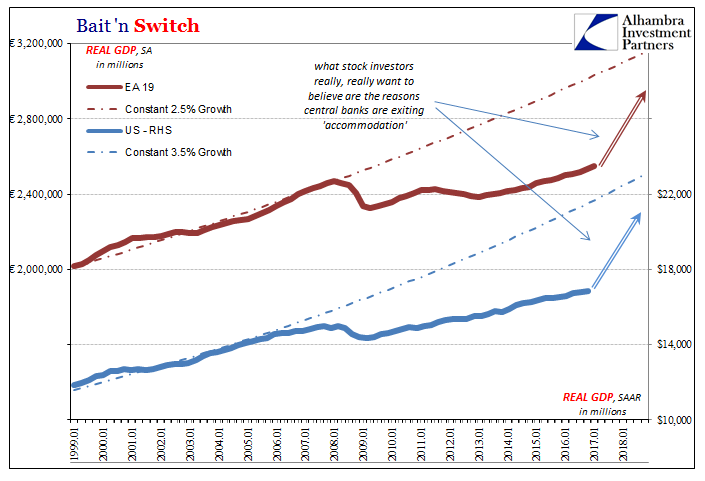

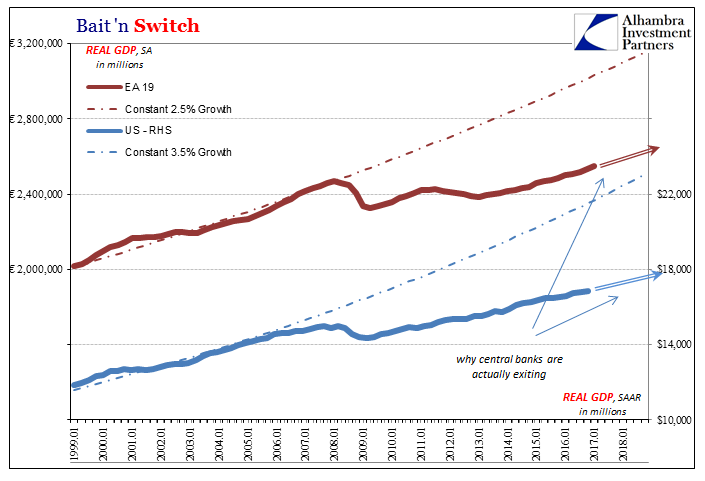

It’s the same answer as in the US or anywhere else. Right now there is no visible reason for them not to. Though the European economy is described as somewhere between awesome and really awesome, it isn’t in reality anywhere close. The best that can be said is right now it isn’t getting worse.

In real GDP terms, the Euro Area as a whole hasn’t seen a negative GDP number in 17 quarters. That’s not nearly as impressive as it sounds; the US economy has produced just 2 with a minus sign of the 32 since the Great “Recession” officially ended, and neither of those actually occurred during the two near-recessions that have come up in between.

In other words, monetary officials around the world have run out of excuses not to stop. The “rising dollar” provided an enormous amount of downside risk that kept them on hold, or, as in Europe, adding more to whatever was already offered. Now in the space in between the “rising dollar” and whatever surely is coming next there is no such perceptible and immediate downside.

It is for Europe a repeat of 2011, or 2008. In both of those years quite like this one European authorities believed the intermittent calm more than it was. They handled quite well, they thought, the rumblings of crisis in 2007 (remember that it was the ECB that moved first on August 9; and it was the ECB that requested from the Fed dollars swaps that December), so well they raised rates in 2008. Foolishly they repeated the pattern in 2011 after believing they had done more than enough about the PIIGS in 2010.

So here they are in 2017 thinking the same of their efforts in 2015-16. The ECB today really has no evidence for its own efficaciousness just like before apart from that apparent calm that it merely assumes was created (“jobs saved”) by its interventions. For monetary policy, the mistake was both not factoring the “dollar’s” decay but more so that the decay doesn’t happen all at once or in a straight line.

As long as balance sheet capacity in the overriding eurodollar system stays impaired, there are quite large downside risks – including the nontrivial matter of continued non-linear contraction. It doesn’t matter at all that negative GDP is so far in the past because the real negatives, and the evidence for them, continue. Trillions of “stimulus” has done nothing except waste time, and that is why the ECB can’t wait to stop QE.

Stay In Touch