Sometimes you just have to laugh. A lot has been made on the inside of LIBOR’s assumed demise. The suite of interest rates is not being discontinued really, merely relegated to the backbench. As usual, the rationale for doing so is perfectly sound:

As noted by the Financial Stability Board’s Market Participants Group, there are many current uses of LIBOR which would be better suited to a rate that is closer to risk-free. Indeed, given that banks’ borrowing in unsecured term money markets has declined noticeably, there is little need for a rate that reflects the cost of such funding. More importantly, the secular decline in short-term unsecured wholesale funding has made the market underlying LIBOR both less liquid and much less resilient.

Prior to August 2007, LIBOR meant something because there was a lot of actual business going on to make those rates. Some of it was monkey business and outright fraud, but that is more of a media conflation than a true plumbing issue. The real problem is that if LIBOR doesn’t represent real trades at real volume (liquidity), then the pyramid of derivatives that are priced by it is at risk of being priced inefficiently. It’s unnecessary systemic risk.

The funny part, the usual bureaucratic stuff, is what the Alternative Reference Rates Committee (ARRC) came up with as an alternative. Again, it seems quite logical that if unsecured lending has dried up (it has and then some) leaving LIBOR more irrelevant that it should be replaced by secured lending rates where volumes are surely robust, right?

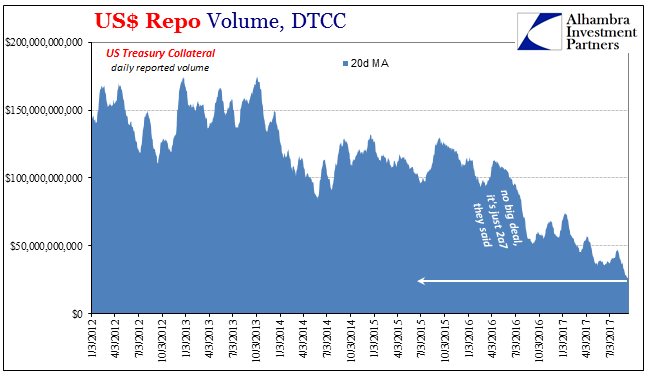

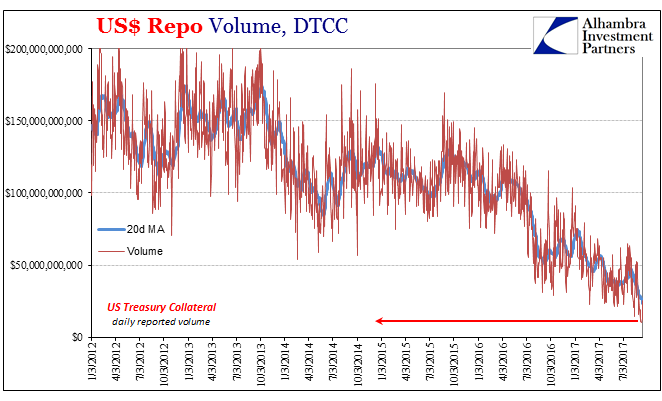

So the ARRC picked the US$ UST GC repo rate to take over for LIBOR several years from now (after a lengthy and slow transition period?). It took them almost three years of discussions (while what you see above was going on) to make this decision. You can see (part of) the problem.

Repo markets aren’t monolithic, even characterized in two parts on-exchange and off. The chart above represents the on-exchange stuff at DTCC. There isn’t very much of that anymore, and it had/has little to do with last year’s 2a7 bogeyman. The ARCC was well-aware of this issue because the committee is comprised of the sort of inside bankers who aren’t much repo trading on exchange anymore.

The ARRC itself has expressed a preference for a more widely inclusive repo rate, if a repo rate is in fact ultimately chosen, but will need to consult with market participants to see if this view is shared. It is possible that including data from several different segments would create a more complicated rate. However, some participants appear to fund across several segments interchangeably, suggesting that there are some elements of commonality across them, and it may be the case that including more segments would allow a reference rate to more flexibly adjust to changing market conditions if market structures change over time.

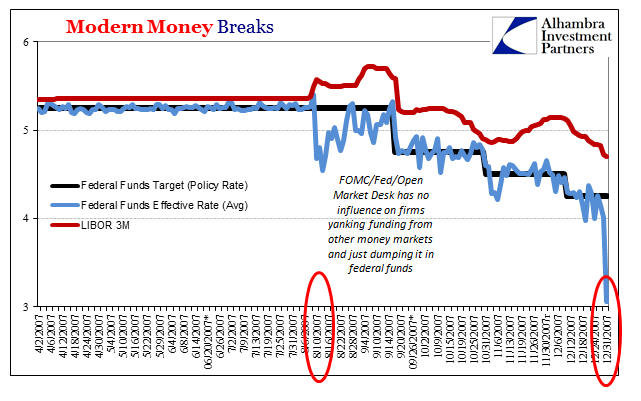

Here’s the thing; authorities assumed pretty much the same of LIBOR and EFF precrisis. It was taken on faith as a rule because “some participants appear to fund across several segments interchangeably” until they didn’t. Market price assumptions counted on a close link between those two rates, as did monetary policy, where one could represent the other (everyone assumed that if the Fed could affect one, it would spillover to the other and therefore liquidity and risks embedded in one was also representative of the other). That is actually why LIBOR is being scrapped in this context.

The problem wasn’t really LIBOR or unsecured interbank lending but this assumption and what it really meant and still could mean in terms of plumbing. We really could run into the same situation in the future using a GC UST repo rate that is calculated by FRBNY along with the Treasury Department’s Office of Financial Research (OFR), taken from only parts of the repo market they can see and measure. There would be no consideration as to possible fracture points or faultlines to using a reference rate that is thought to be solid but is in reality as fragile as these segmented markets can become (see below).

In other words, the ARRC is picking a new reference rate that is incomplete in ways they don’t fully understand to replace the old reference rate that is incomplete in ways that they have belatedly come to. As I so often write, eurodollar decay is in many ways understandable. It is always and everywhere risk/return, where that calculation has to take into account just this sort of bureaucratic bungling. Nothing instills confidence within the monetary paradigm quite like authorities just winging it (again).

Stay In Touch