The problem with the Federal Reserve is that it is corrupt. I don’t mean that its staff is busy filling their days thinking up ways to cheat the American taxpayer, rather it is a philosophical sort of debasement. Many people think the Fed is evil and nefarious, others that its policymakers are plain stupid. Neither of those is true.

Ben Bernanke, for example, is clearly a very bright man. Despite a high level of intelligence and years of study at peak academic levels, he presided over the worst monetary and economic circumstances in generations. Not since the Great Depression has the country been caught in such devastating fashion.

The contradiction makes the conspiracy sound plausible; the only way one of the smartest guys anywhere could end up with that result is if that is what he wanted all along. It seems otherwise disqualifying incongruity.

We often conflate intelligence with competence. Richard Feynman was a brilliant physicist and mathematician, a dizzying intellect of unbridled imagination (Feynman’s diagrams a true stroke of genius) who you wouldn’t want fixing your car. The analogy doesn’t seem to hold for our economics example if only because we have been made to believe banking and money is like physics rather than auto repair.

It’s not. The monetary system has more in common with the latter than the former. It is Economists like Ben Bernanke who have tried something of a magic trick to disguise this fact, if only that they may be treated with Feynman-like celebrity rather than toil unnoticed in the obscure if necessary monetary garage.

The method of this rearrangement is mathematics, though not even really math. Econometrics is pure statistics, which is something altogether different in this context. Unlike in physics, hard equations have proved often unsolvable because of the complex nature of the economy or market systems. There is no physical test for aggregate feelings.

Because of this, Economics has been stuck somewhere in the No Man’s Land of pseudo-science; in trying to be like physics, it uses incomplete mathematics while at the same time that focus on thinking up the most elegant equations has come at the expense of everyday knowledge. Policymakers are left both mathematically and mechanically incompetent.

That was somewhat apparent in the years before 2007, with all doubt clearly erased thereafter.

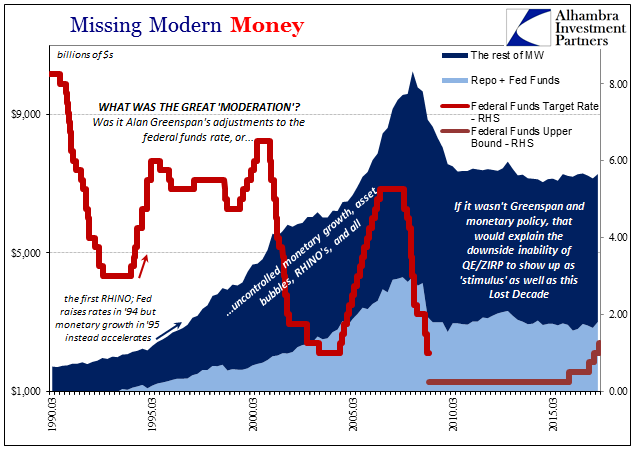

The case of bank reserves proves these points. Quantitative Easing has been given equivalency with money printing. Reserves are, after all, base money in every Economics textbook.

But, as FRBSF President John Williams noted in a speech given all the way back before QE3 in July 2012:

The important point is that the additional stimulus to the economy from our asset purchases is primarily a result of lower interest rates, rather than a textbook process of reserve creation, leading to an increased money supply. It is through its effects on interest rates and other financial conditions that monetary policy affects the economy.

QE wasn’t really money printing but might work as such if you believed it was. Monetary policy in an official world of regressions and correlations is more about feelings and manipulated expectations than actual money. In that way, Economics is more akin to astrology (the gloss of math and science) than either physics or auto repair.

The proof was available before Williams spoke, especially the part about interest rates. But if it was debatable prior to QE3, it is no longer so after its invention and conclusion. Interest rates fell more without QE than with it. In fact, almost three years after its completion, long treasury rates (those tied to economic perceptions where “stimulus” should be active) are lower now than at that time.

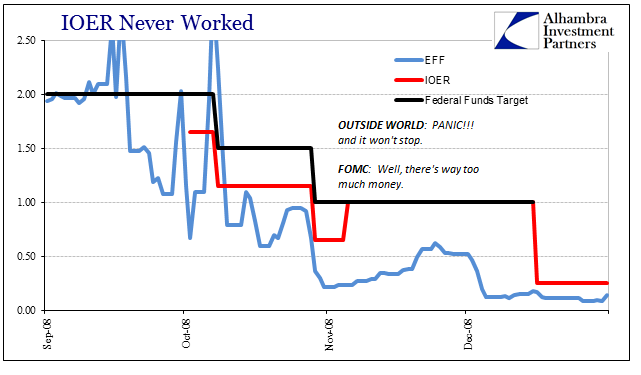

To address the disparity, some Economists have fallen back on IOER, the interest paid on excess reserves. Almost all of the excess is a byproduct of the four QE’s. As Williams claimed in 2012:

As a result, in a world where the Fed pays interest on bank reserves, traditional theories that tell of a mechanical link between reserves, money supply, and, ultimately, inflation are no longer valid. In particular, the world changes if the Fed is willing to pay a high enough interest rate on reserves. In that case, the quantity of reserves held by U.S. banks could be extremely large and have only small effects on, say, the money stock, bank lending, or inflation.

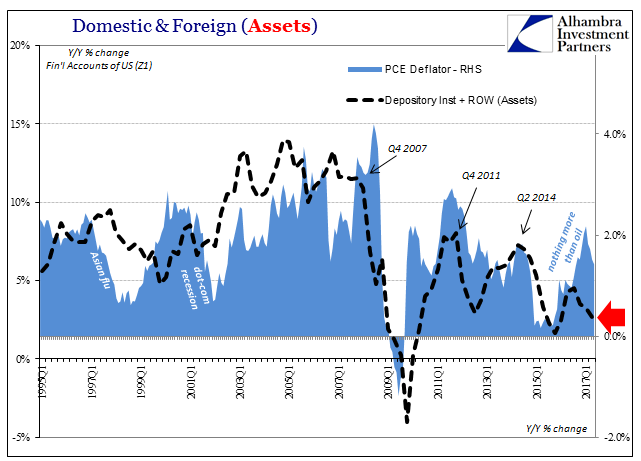

Up until the last few years, however, the rate of IOER had been constant. Even now after four “rate hikes” it hasn’t moved all that much. The global money system by contrast has been anything but constant. It has been charged and beset by two additional, enormous irregularities all the while IOER hadn’t budged.

Therefore, Williams is right that the “mechanical link between reserves, money supply, and, ultimately, inflation are no longer valid.” He just doesn’t have any idea why because his competency is statistics not science or mechanical money experience. Worse, because of the focus on math he and those like him lack the imagination to think outside the paradigm into which Economics has locked itself.

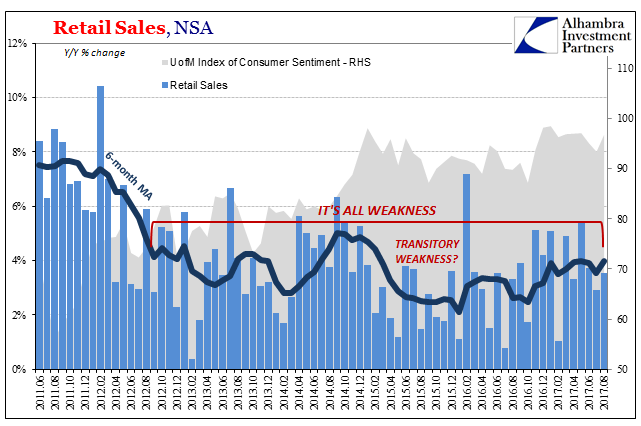

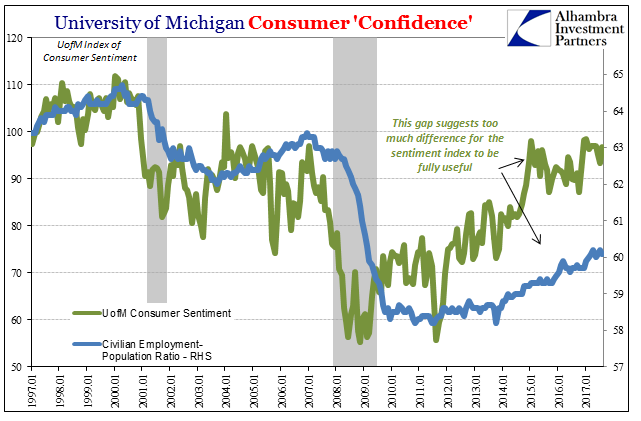

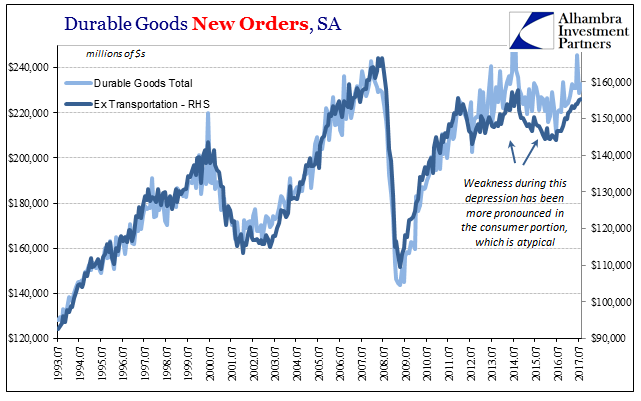

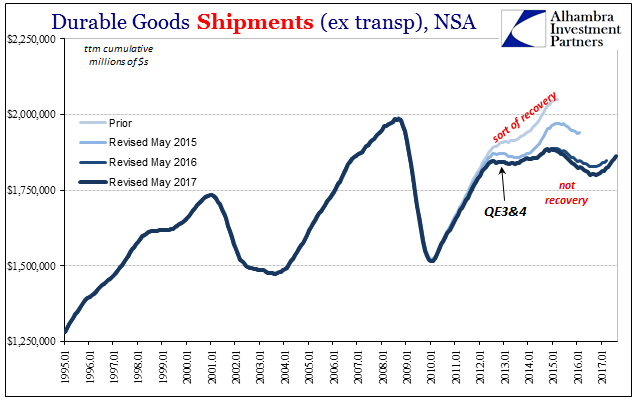

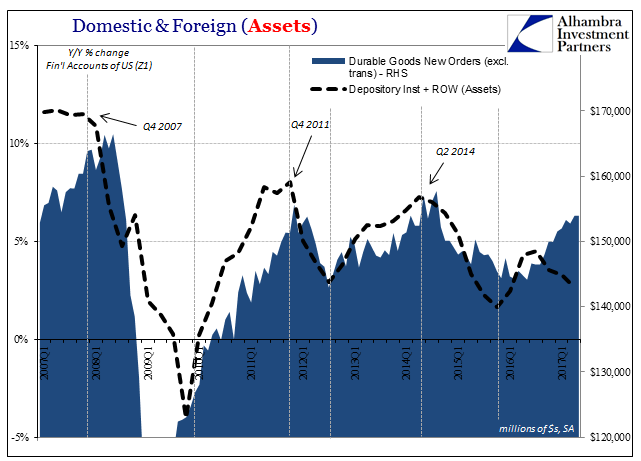

There are so many ways to establish these points. The latest is durable goods. Orders and shipments (both with and without transportation) continue to grow at lackluster rates (new orders excluding transportation equipment +5.9% Y/Y NSA; shipments +5.5%). An improvement over last year, to be sure, but not really much of one and that confounds traditional monetary expectations as described by Williams above (in the first quoted passage).

Consumers are purported to be happy, perhaps quite happy, stock prices are high, and interest rates remain low. By every orthodox expectation the economy should be unequivocally booming, not sputtering for a third time after another “unexpected” near-recession experience.

Not only does Williams’ views on money fail to explain these ups and downs, mini-cycles if you will, he can’t come close to illuminating the big one; telling us why the economy shrunk in the first place, and so remains stuck gyrating from one monetary event to the next and being increasingly worse off for each one.

Durable goods are up on the month and the year, but they are not growing. To figure out why requires little special knowledge; anyone can read a simple chart and see these peaks and valleys and the times at which they occur. What happened in 2008? 2011? Mid-2014? None of those were changes in IOER, nor really the level of excess reserves. But they were monetary in their character each and every time, just not of the kind John Williams or Ben Bernanke might ever appreciate for the Fed’s philosophical corruption.

The issue isn’t stupidity, at least not straightforward in that way. Economics is the very definition of a mutual admiration society, and is therefore incapable of both imagination and technical competence. Even when they develop what seems to be that, like IOER, it ends up doing the wrong thing, for the wrong reasons, with the wrong results.

Stay In Touch