It’s always cute when most commentary is left hanging with “better than expected.” The straight fact is that the US CPI was lower for the second consecutive month, but since it wasn’t as low as some “analysts” were anticipating, that counts, apparently, as “hot” and in some places “blistering” inflation. There’s no other way to characterize deceleration as scorching other than pure hysteria.

This is a sickness born from desperation. Ironically, if there was so much similar concern about the economy it would be a good thing. After all, that’s what we’ve been waiting for more than ten years now. Someone of substance and standing to stand up and say, “this isn’t right.” Trump was so far the closest, until his inauguration.

Instead, the desperation is all pointed in the other direction. The status quo must hold for many people who already occupy positions of authority and influence. Unfortunately for them, and us, a broken economy is an immediate and direct rebuke of the status quo. A permanently broken one argues for more radical solutions still.

Thus, what has happened is that those in the so-called establishment have tried, unsuccessfully, to argue time and again that the economy isn’t really broken. There are, and have been, variations on this theme. The first is the Bernanke version that the economy has actually been good and that people are bitching about it because that’s what they do, and their ignorance stands in the way of really understanding and appreciating his pure genius.

A modification of that narrative is the current one about globalization. In this branch, the economy is still largely good but because globalization is disruptive it’s inarguable societal benefits have accrued unevenly on the ground. At the most extreme, it has been a net negative for certain populations (like the racists in the Rust Belt, according to this theory, who in the end were responsible for Mr. Trump’s winning margin).

To counter the populists, the establishment has gone insane. In 2014, they were far more careful about their rhetoric though they had more reason then compared to now not to be. Even in the shadow of two 4.5% plus quarters of GDP growth in a row, optimism was overdone but at least somewhat grounded in reality. What is happening now is something altogether different (h/t M. Simmons):

The Economist has been one of the most vocal proponents of globalization, and therefore one of the most vociferous opponents of Brexit and populism more generally. As they see it, these negative, reactionary forces threaten not just to upset the positive direction the world had been moving in, but actually lead toward the most negative results imaginable.

In March last year, one column in the magazine put it simple, “Globalisation has retreated before. The results were disastrous.”

It explains the hysteria, what happened between more cautious optimism in 2014 as compared to this unhinged madness in 2018. There is, for them, no more room for calm rationality. Shrill exageration is in demand.

You would think that in order to save the desire to further integrate across boundaries that Economists (not just those at The Economist) would propose saving the global economy first; rather than characterizing what is already bad as good. It is this point where the hysteria becomes understandable if still fully unsympathetic and unsupportable.

They have no answers.

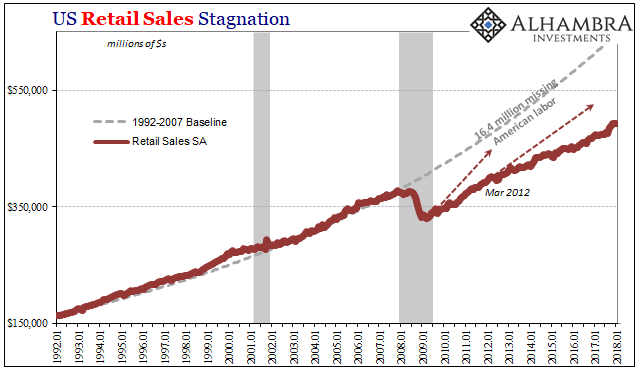

To defend globalization in the 2010’s, then, they must increasingly assert what is provably false. Today saw publication of not just continued lackluster CPI estimates and weak retail sales, both for the US where a “running hot” inflationary boom contains neither inflation nor a boom, but also the BLS release of Real Average Weekly Earnings (which by its nature is tied to the CPI).

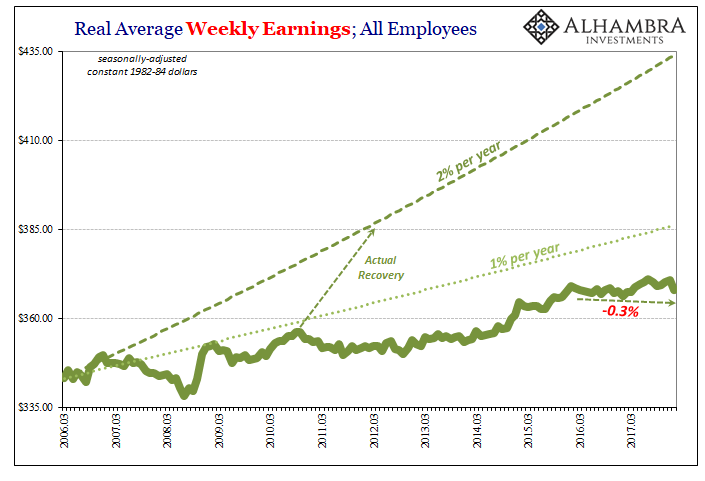

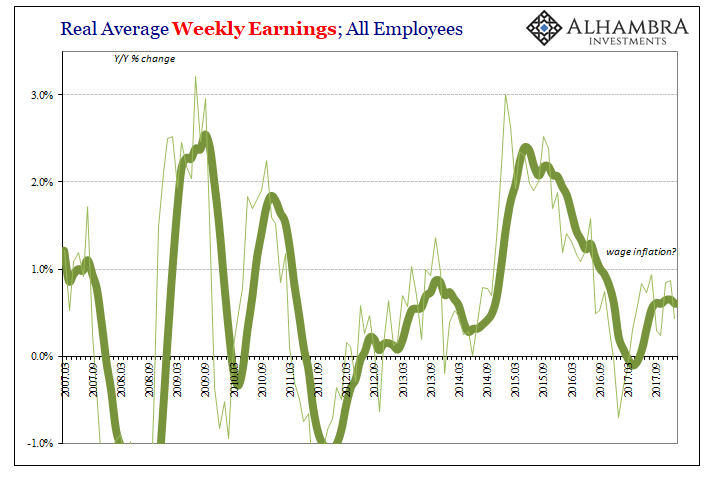

The unemployment rate has been low for years now, the basis for almost every boom declaration. And yet, real average weekly earnings for American workers are down in January 2018 when compared to January 2016. That’s right, since the bottom of the last downturn, real pay for consumers has gone nowhere.

This is clearly not Rust Belt dynamics. It is much more than that, as is the stagnation in worker pay that stretches back to before the current iteration of the series began in 2006.

In that way, The Economist is actually working against its own interest – as well as ours. They claim, and the claim is widely parroted as if from an authoritative source, the economy is hot yet what most workers experience is what the data from the BLS (a far more objective source) shows. Thus, for those who might believe the narrative, they think they are being left out of a boom benefiting always someone else.

That does nothing to help sell globalization even under false pretenses; in fact, it does the opposite by sowing further seeds of disconnect and discontent against that very status quo. There may be a boom in DC and New York, London and several other similar places, but for the rest of the world there is building anger and resentment as the global economy has ground to a halt.

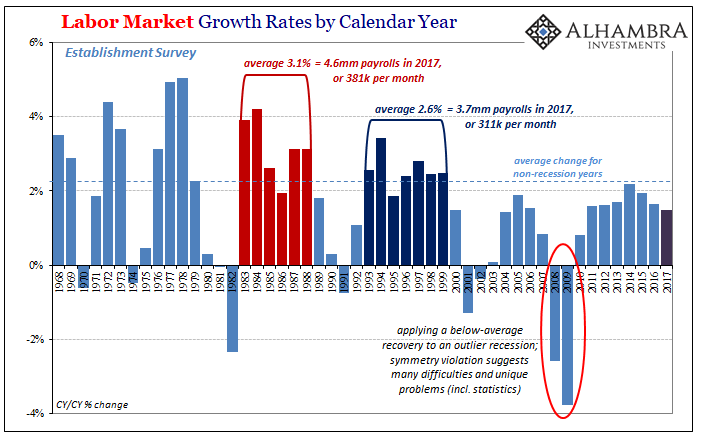

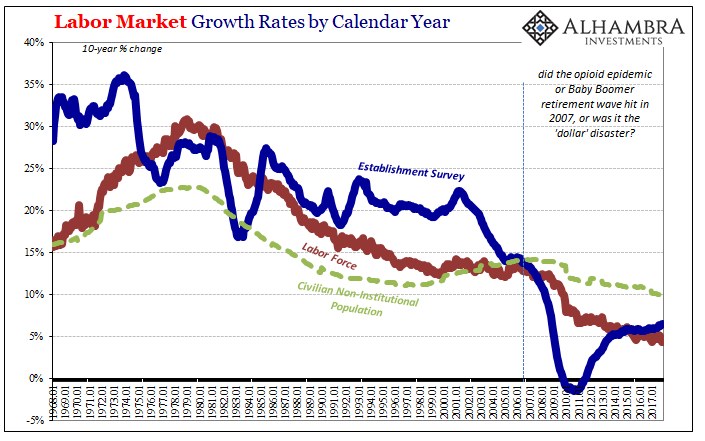

A lot less of which would occur if someone would just put these numbers on TV and cop to them. Candidate Trump called the unemployment rate “fake” because it was. That hasn’t changed, though who embraces it in many instances has. The US labor market is as weak as it’s been for fifteen years, but since it is better than 2009 (positive numbers) it allows the false narrative some thin room on the grounds of plausibility.

The estimates for Real Average Weekly Earnings are devastating to that case. What they establish instead is a real economy that can’t even produce nominal wage gains sufficient to address only a partial rebound in oil and gasoline prices. Think about that. The reason real pay is down for that two-year period is because oil moved from less than $30 to a little more than $65. Nominally, pay hasn’t budged and is even slightly less for these past few years.

That’s nothing like a “hot” economy. What it really says is that given our current predicament something big will have to change for it to finally act according to the rhetoric. Tax cuts and fiscal “stimulus” failed time and again to achieve just that result, and in fact have left the economy in this pathetic state to begin with.

The inflationary boom, then, is nothing less than the dictionary definition of propaganda. The unemployment rate is FOUR POINT ONE, and yet, wages and earnings are what you see above. And it’s been this way for far, far too long already.

Stay In Touch