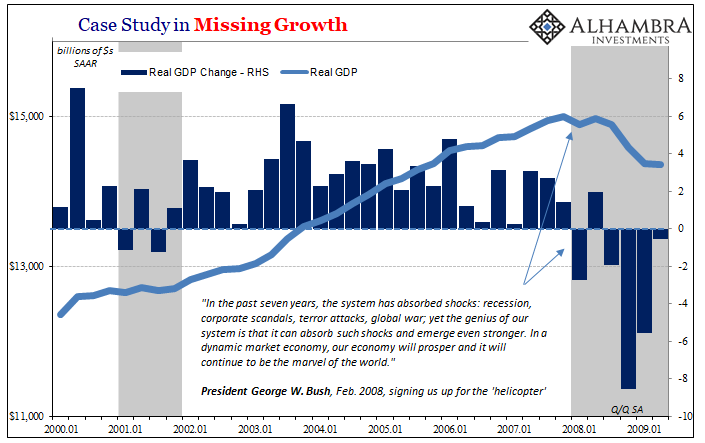

The housing bubble began to reverse in the middle of 2006. Strangely, Economists presented with the possibility were almost uniformly confident that it wouldn’t matter. Forgetting the market and liquidity issues, even by the middle of 2007 it was clear the end of the housing bubble had already restrained economic growth. Confidence abounded anyway, largely a result of the mistaken belief that the Federal Reserve could and would cushion any downside.

By early 2008, that confidence started to erode somewhat such that the federal government felt compelled to be involved. Their genius answer was the “helicopter” option. In other words, by the mere fact of being a living, breathing taxpayer you were given cash in the form of a tax credit or rebate ($600 for singles, $1,200 for married couples, with another $300 per qualified dependent).

The idea of “jobs saved” not yet invented, President George W. Bush in the twilight of his second term confidently declared:

In the past seven years, the system has absorbed shocks: recession, corporate scandals, terror attacks, global war; yet the genius of our system is that it can absorb such shocks and emerge even stronger. In a dynamic market economy, our economy will prosper and it will continue to be the marvel of the world.

I bring this up not to single out or embarrass President Bush. This was bipartisan failure, one which the Obama Administration would repeat about a year later. The point is that it doesn’t matter which party is in control of which part of the government. The problem is Economics and the cross-party acceptance of Economists’ advice on the economy.

Economics has devolved instead into an expertise solely of mathematics, correlations and regressions in particular. How and why things work in the actual economy aren’t much studied anymore so much as comparing the significance of potentially parallel data points. And if something happens that hasn’t happened in the past, forget it. The math can’t adjust.

That’s what really mattered then, and still does today. In other words, Economists when confronted with something absolutely different from all prior living experience, they still saw “a dynamic market economy” that would “prosper” if given the right dose of stimulus – one measured and designed based on how the economy of the past fifty years had reacted. They should have been aware of its fragility and struggle, a frailty that couldn’t and can’t be fixed with a wave of the magic stimulus wand.

So much of how this is all assumed to work depends upon (pop) psychology. The government acts, forcefully, and you’re supposed to behave positively for the confidence the mere intent gives you. If you think stimulus works, then you act as if it does, therefore it will. It’s the same for all forms, monetary as well as fiscal.

That’s ultimately what was insane about the 2008 helicopter. Sure, some people benefited from the extra $600, but they also lived in the real world, the one where things were going really wrong really quickly.

Economists were satisfied with the results of the plan. In August 2008, VoxEU wrote, “Our findings imply that the rebates are providing a substantial stimulus to the national economy, helping to ameliorate the ongoing 2008 downturn.” We shouldn’t forget that the Great “Recession” wasn’t even a recession until the NBER declared one in December 2008, a year after its official beginning. Up until Lehman, most officials were still convinced there would be no recession at all, a minor downturn mitigated masterfully by the skill of Economists in all levels of government.

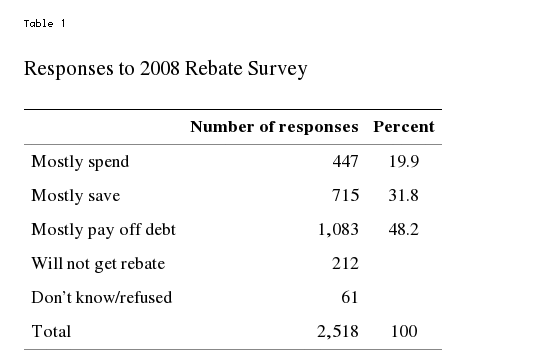

Also at the time, the University of Michigan in its regular survey of consumers added a rider to it from February (when the Economic Stimulus Act of 2008 was passed) to June 2008. It gave consumers five choices as to what they would do with the coming tax credits/rebates.

Unsurprisingly, only one in five of respondents who believed they were eligible for the rebate reported plans to spent “most” of it. Eighty percent of the rest either anticipated saving the money, or pay off existing debt. These are very low results for “stimulus” that people assume aims to increase the level of economic activity more directly.

Again, however, it simply offers more evidence for what really goes on; stimulus is largely psychology. Even if they plan on saving or paying off debt (same thing), Economists assume that of those people they believe others will be spending to a higher degree. Thus, they feel better about the economy as a result even if they don’t personally contribute directly.

That’s, of course, one reason why it doesn’t work. Psychology can mean a great deal at times, but meant very little in February 2008. It was all too easily overwhelmed by a starkly different reality that consumers were more immediately confronting even if officials preferred to ignore it.

Late 2017 was not early 2008, obviously, but the contours are similar enough. The US and global economy is talked about with concern at times but often characterized most charitably and lately in the almost hysterically positive terms. And still there is a disconnect that lingers on.

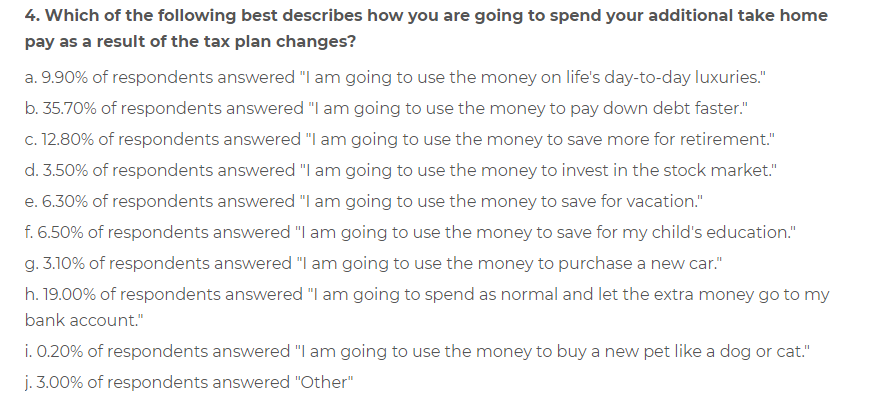

To try and change what the Japanese had called “a deflationary mindset” in trying to explain their first lost decade, the new Trump Administration has once again taken to tax cuts. These are not of the “helicopter” variety, more serious instead in attempting a permanent rather than one-time change in paychecks. Economists often argue over the Permanent Income Hypothesis (where consumers react very differently to a single windfall versus an expected permanent change to their income streams), but in this case it may already appear far too much of the same no matter which way.

Last week, LendEDU released the results of one of the first surveys of Americans focused on last year’s tax changes. Sixty-four percent expect to take home more pay as a result. Fifty-five percent reported being more confident in their financial future, while 60% believed it would strengthen the economy. Stimulus gonna stimulus.

Yet, just like 2008, the overwhelming majority reported that they planned to either save the new money or pay down existing debt.

In fact, an unnervingly similar proportion (about 84%, or again four out of five) though given more choices than the broader rider to the 2008 UofM survey chose one form of saving or paying off debt anyway. That this latest tax “stimulus” is of the permanent form doesn’t appear to have altered the equation, either.

It’s just one survey, of course, and isn’t in any way definitive. But it is further and consistent evidence that tax cuts, like the corporate tax holiday, are not a rational basis for expecting the entrenched economic stagnation of the last eleven years to have suddenly changed based almost entirely upon its passage. There is, yet again, far too much that is the same (not even counting the global monetary condition).

I’m obliged to write that none of this makes any commentary on other considerations, particularly the political one where Americans are “allowed” to keep more of their money. That’s a separate issue, distinct from tax cuts as economic “stimulus.”

Like all rest of it that has been tried since 2008, there really isn’t any reason to suspect this one will achieve different results. Einstein, insanity and all that.

Stay In Touch