As my colleague Joe Calhoun likes to point out, nothing is new, everything has happened before. We like to think that’s not the case, as the saying goes every generation thinks it has invented sex. What changes is the form, the format largely remains the same. Human beings in 2018 are the same as they were in 1918.

Quite recently, the stock market suffered a bout of liquidation. Whether or not that has concluded isn’t yet determined. The reasons for it, at least those given in the mainstream, tend to be related to how things are so good. Inflation is about to breakout, the economy booming with it, and so the Federal Reserve will be forced to move faster than its otherwise snail’s pace. This is bad for stocks apparently.

So, we get headlines like this – Inflation Fears Rattle Stocks.

U.S. financial markets suffered severe losses Thursday after data hinted at rising inflation and sent investors running for the exits, fearing the Federal Reserve might live up to…recent warnings and raise interest rates before too long.

Sounds familiar enough, but it was written July 29, 1999. If you didn’t know when it was said, or that Alan Greenspan was the Fed Chair who said it, you would be forgiven for thinking it was Janet Yellen in 2017 or now Jay Powell in 2018. Greenspan’s actual words were:

Should productivity fail to continue to accelerate and demand growth persist or strengthen, the economy could overheat. That would engender inflationary pressures and put the sustainability of this unprecedented period of remarkable growth in jeopardy.

There were more rhetorical flourishes in Greenspan’s public vocabulary than has become custom for his successors in these later years, a very small silver lining within the black legacy of 2008. Still, the message was the same. Things are picking up and looking good, perhaps too good, so as to force the FOMC’s hand to act faster than they or anyone else might want.

What a fascinating time to be alive. We’ve got the economy of 2014, the weak dollar of 2010-11, and the markets of 1999. And that last one contains more than just stocks at obscene valuations. The bond market was saying something back then, too.

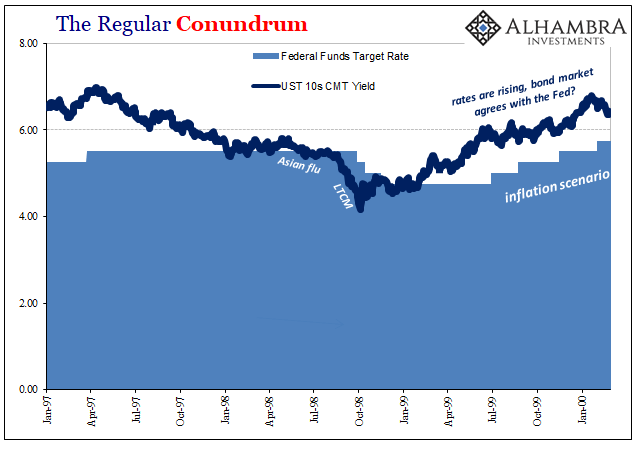

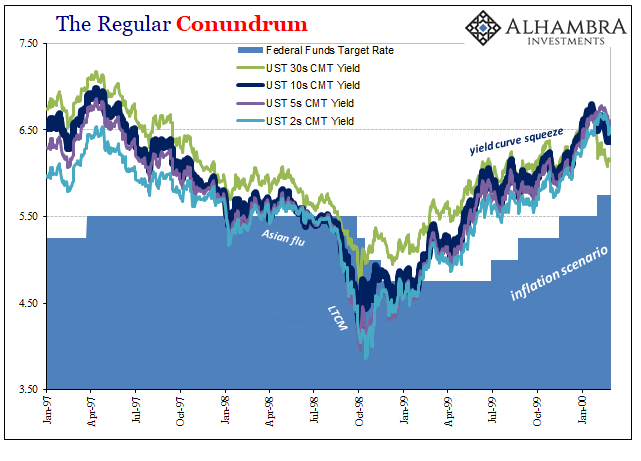

Only the message from Treasuries wasn’t the one most people wanted to hear. Officials like Alan Greenspan were convinced that inflation was about to breakout after some tough couple years with the Asian flu. In response to the tail end of that crisis, once LTCM showed the FOMC just how serious it was even if it was pointed more so toward overseas “dollars” (should also sound familiar), policy action was taken to reduce the federal funds target three times in the later months of 1998.

Greenspan didn’t want to be at just 4.75% for his main target, largely because he couldn’t comprehend the full, enormous implications of his own message. In February 1999, the FOMC took up the discussion of money and related markets like UST’s to try and make sense of what was to them conflicting signals. Among other things, the entire UST curve in October 1998 all the way out to the long 30-year bond had dropped quite a bit beneath federal funds. It didn’t take a genius to figure out that wasn’t good.

CHAIRMAN GREENSPAN. I must say that I have not changed my view that inflation is fundamentally a monetary phenomenon. But I am becoming far more skeptical that we can define a proxy that actually captures what money is, either in terms of transaction balances or those elements in the economic decisionmaking process which represent money. We are struggling here. I think we have to be careful not to assume by definition that M1, M2, or M3 or anything is money. They are all proxies for the underlying conceptual variable that we all employ in our generic evaluation of the impact of money on the economy. Now, what this suggests to me is that money is hiding itself very well.

Though he said it, the maestro never really got it; particularly the UST market and what bond yields were expressing in this very context. How can a central bank even be open and running knowing so little about money? It is, after all, the entire point of one.

Rather than figuring out exactly what had gone on in 1997 and 1998, by the middle of 1999 the Committee was sure it was all over with whatever it was. They moved on to inflation because they moved on to inflation, fretting more about that 4.75% target than stubborn bond yields. Rates were pushed up starting in June 1999, a month prior to the article referred to above. Though inflation is a monetary phenomenon and they had no idea how to define money, monetary policy was adjusted anyway (sounds familiar).

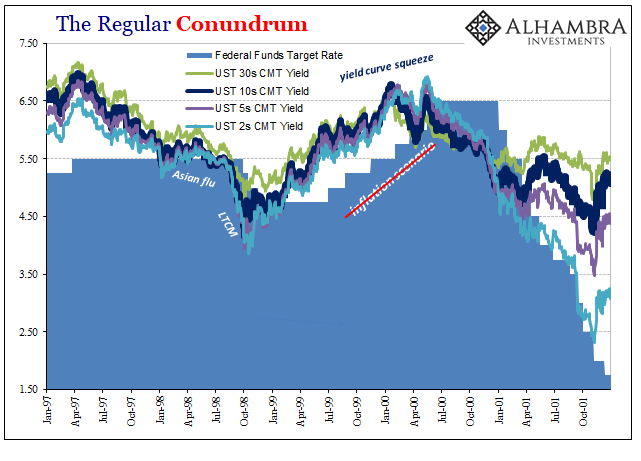

Greenspan took it all the way to 6.5% by the middle of the next year, but by then it was too late. Not that inflation broke out, it never did. Rather, the opposite occurred as first the stock market then the economy both reversed. By the end of 2001, just a little more than two years after he started the rise, the FOMC had by then reversed federal funds all the way down to 1.75% (and the wouldn’t stop until 1% in June 2003).

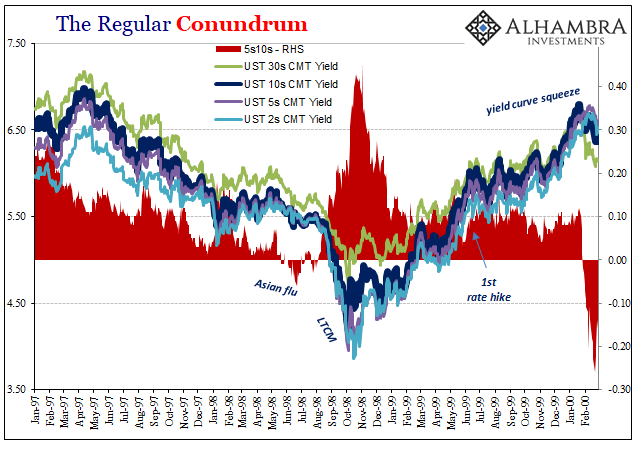

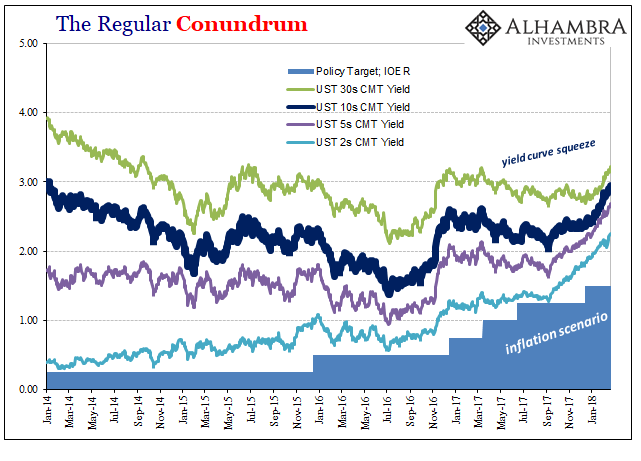

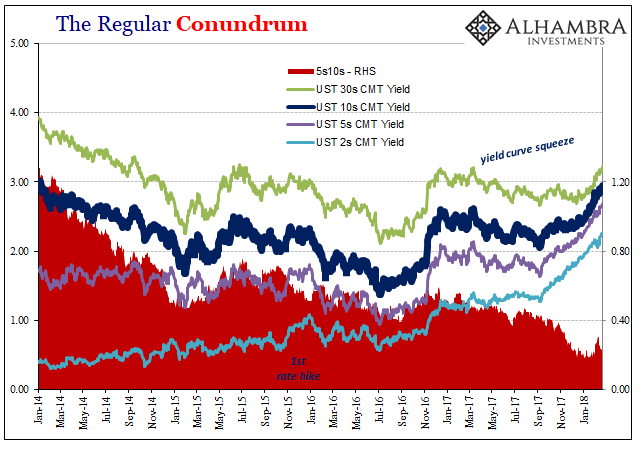

While monetary policy was being “tightened” in late ’99, the bond market was disagreeing, politely, with the mainstream assessment. Nominal rates, of course, were rising but not in the manner consistent with what the inflation scenario always envisions. Pushed up by monetary policy from below, the curve was squeezed, flattened, and then broke before the FOMC ever got to its last “hike.”

Why believe the bond market’s reluctance over the maestro’s confidence? The Fed doesn’t get these things wrong, does it?

When you look back at the history of the last thirty or forty years, there are any number of striking surprises and curious inconsistencies. The evolution of money is, obviously, at the very top of that list. Another is the repetition of bond market conundrums. The one in 2005-06 was more famous, made so only by the fact that Greenspan himself gave us the name for it.

But it was a fairly regular occurrence, and speaks to the blasphemy when referring to bonds in general as a bull market. The nature of modern money disabuses any such notion, predicated as this often clear dichotomy between official perception and market reality is upon the very critical, and utterly basic, notion that central bankers really don’t know what they are doing. In the media, they are almost gods, the apex of technocracy; to anyone with money on the line, they are the Keystone Cops.

It’s a shock to the mainstream consciousness, perhaps, but all you have to do is listen to them when the speak in their more honest moments. Rising nominal rates and a flattening yield curve pushed up by monetary policy (therefore monetary substitutes at the front end) just isn’t an inflation scenario. It is policymakers attempting to create one out of nothing. That’s why they have to refer to it always in the future tense (and puzzle lately about wages).

Central bankers want us to believe that it is real, as if this time is different and the bond market should just obey by ditching all objections no matter how reasoned and rational. One group knows a thing or two about money, the other is populated almost exclusively by Economists.

Stay In Touch