Of all the economic accounts where last year’s big tropical storms would have had the greatest impact, any substantial boost in construction spending made the most sense. What is destroyed is most often quickly rebuilt, particularly in the public arena. One of the core functions of local government is infrastructure, and no local politician can survive long in office if constituents are reminded daily of massive lingering deficiencies.

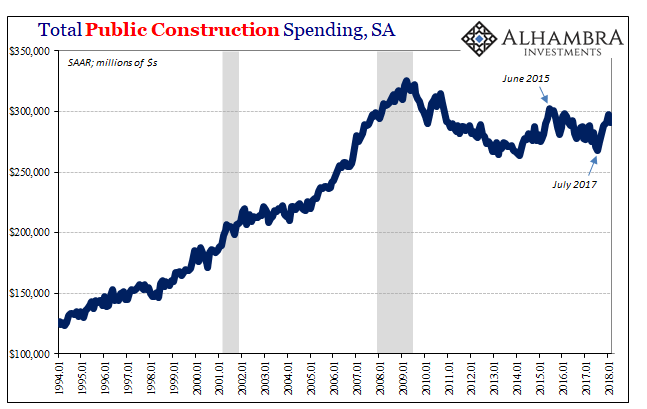

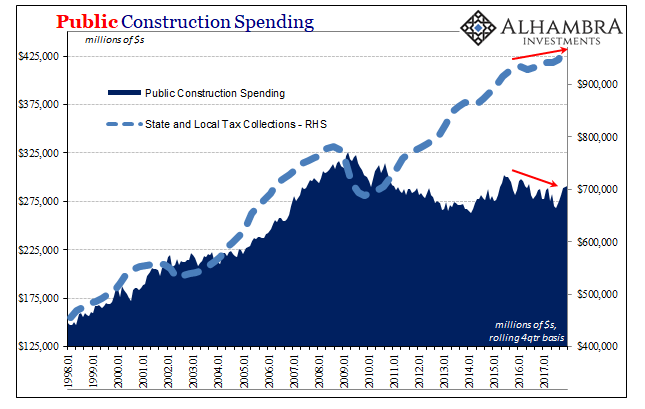

Public construction, however, has been stuck in a decade-long lull. The reason for the abatement is the housing bubble, a period when especially Southern and Western municipalities saw their real estate levies surge. Economists might disagree, but it’s not really austerity if you are made to live within your actual, non-inflated tax base.

Public construction spending rose in August 2017 along with Harvey’s initial arrival and landfall, and then gained more in September and October. There was another rise in January, though the reason for it is unclear. The latest figures for February 2018 show a sharp decline from January. It may just be that January and February average out at a lower level than November and December.

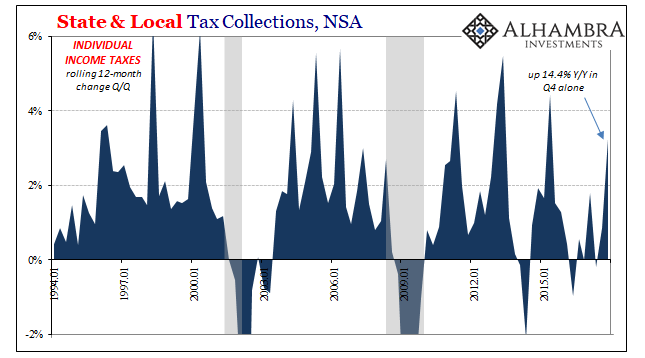

That would be consistent with the fading effects from Harvey and Irma. Analysis on this account will be further distorted by tax law changes, however, which in Q4 2017 boosted state and local receipts derived from individual income taxes by 14% year-over-year.

It’s possible that municipal governments could increase their project budgets even in response to a temporary increase in tax receipts. There is always a desire to do more and any windfall could provide the opportunity to boost infrastructure. Taken together with hurricane effects, there is no clear direction indicated at this point.

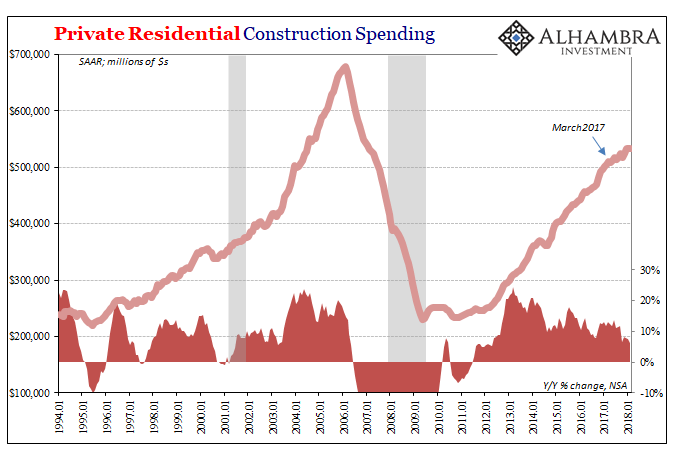

That’s not as much of a problem on the other side, private construction. Residential project spending continues to grow, but still on a weaker trajectory going back to last year. From other real estate related construction estimates, such as permits and starts, we know that it is largely the multi-family segment that is holding back overall residential spending. It is a particularly negative reflection on the labor market and labor incomes.

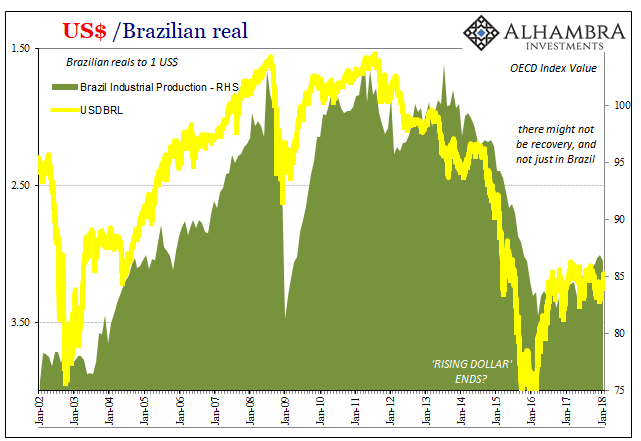

Not that the single-family portion is overly robust, but after a mini-boom in apartment building up to 2015 the slowing labor market coincident to the “rising dollar” downturn continues to take its toll.

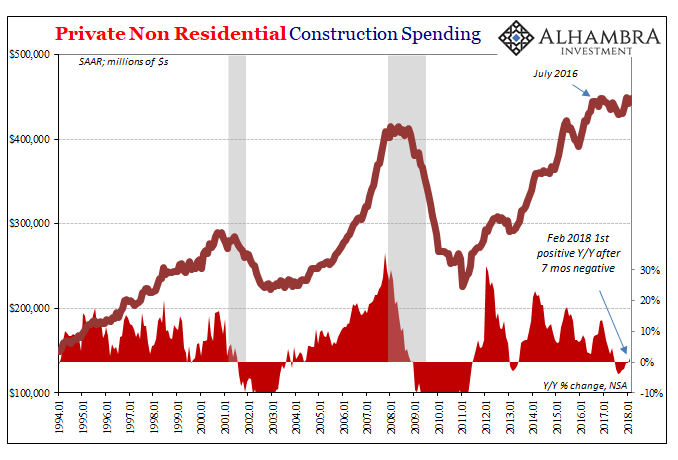

The real problem presented by the construction estimates, however, is the non-residential sector. Representing a significant portion of total capex in the US, private non-residential construction spending continues to be more like the weak labor market than act consistent with “globally synchronized growth.”

There was a substantial increase in spending in both November and December, and now two lesser months in January and February. It is entirely possible, figuring some minor lags, that trend is also hurricane-related. Until September 2017, construction levels had been declining for 13 months dating back to mid-2016.

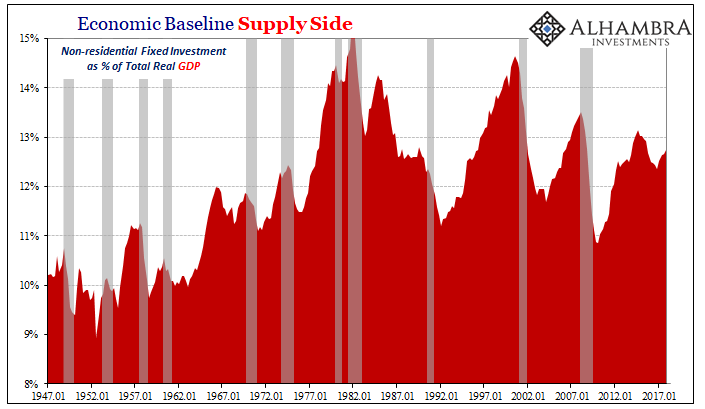

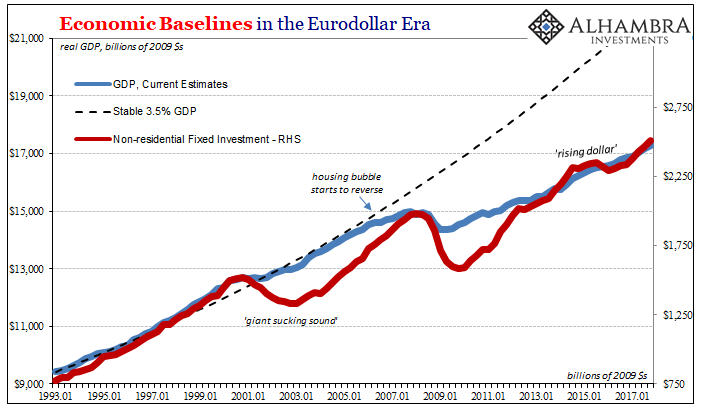

Like the housing sector, capex has been lagging during this “recovery” particularly since 2014 and the arrival of renewed monetary difficulties. But it’s also not strictly a matter for the last decade, either. The supply side has been a drag on economic growth going back to the turn of the 21st century.

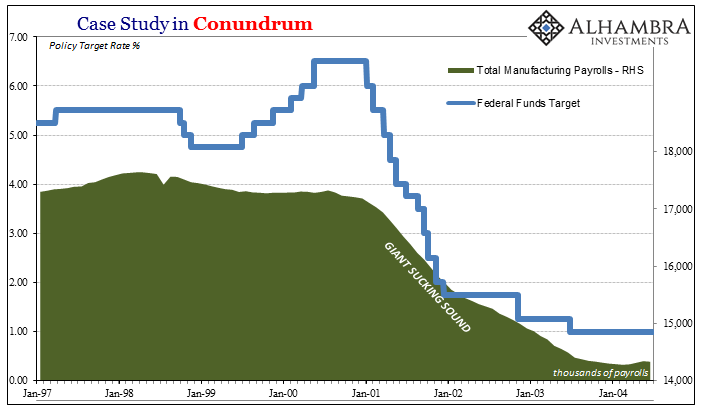

It was at that point Ross Perot’s “giant sucking sound” was finally mobilized, and US industrial capacity was outsourced overseas. The economy of the middle 2000’s obscured the deficiency to a considerable degree. That’s in many ways what is at issue today, including in academic and policy debates.

To many in the so-called establishment, the loss of capacity and really the jobs that would have gone along with it is taken for progress. Low-skilled, low-value employment in manufacturing was replaced by high-value, high-skill opportunities in the 21st century information age economy; or, at least that is what they contend.

The middle 2000’s, however, wasn’t characterized by a substantial boom in IT; quite the opposite, actually. Rather, what replaced manufacturing jobs was one angle of FIRE or another; either in the form of consumer debt largely mortgages, or as jobs selling one kind of financial product to as many people as possible. Take away the debt bubble and what’s left is the economy stripped bare to its shrunken industrial base.

This is an important distinction on several accounts. The first is political, as in the current debate largely centers on the ramifications of whether the current (and growing) tide of populism is legitimate or not. If you see the loss of manufacturing as a necessary precondition for social advance, then what’s left are a bunch of whiny racists voting against their own interests; if you instead find the loss of supply side capacity as the giant sucking sound at best temporarily assuaged by the worst economic instance (over-indebtedness) what followed from it is no less than a national emergency.

It’s also vital to understand the timing. Why 2000? Ross Perot was talking about this very process in 1992. It was genuine concern throughout the 1980’s (US manufacturing employment peaked on an absolute basis in 1979), leaving the timing as something of an important mystery.

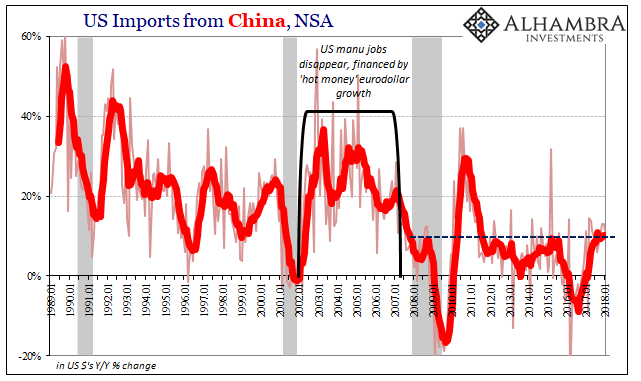

The first precondition was certainly the global eurodollar; it’s simply never enough to have only labor capacity waiting in far flung emerging market locations. It takes what every economic process takes in order to realize the individual benefits; willingness and ability. Without the mobility and flexibility of the eurodollar system, offshoring was more of a niche encounter for American labor during the eighties and nineties. The eurodollar provided the ability.

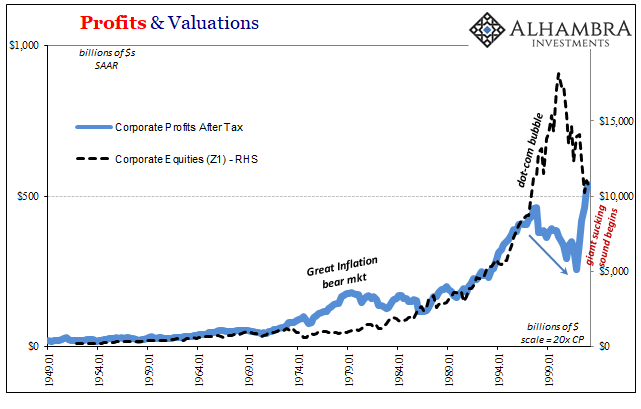

What changed in the early 2000’s was the willingness. Corporate executives throughout especially the dot-com bubble era got “paid” whether their companies made money or not (this was often literally the case). It all changed when the bubble went bust; suddenly, corporations and their executives who wanted to be compensated the same way via stock incentives had to find actual earnings and fast. Since economic growth, meaning topline revenue, was slack (it was a recession at first), the easiest route to profit growth (and hopefully resurgent stock prices) was for the industrial sector to move capacity to China in a big, big way.

This is the same process or thinking that has led to further supply side issues in the form of stock repurchases. If the stock market was a perfectly rational and efficient discounting mechanism as is commonly claimed of it, then none of this would really matter. Industrial firms and others would have been punished for their short-term thinking rather than rewarded for making up for the lack of revenue growth by essentially manipulating EPS.

The US in the nineties and especially 2000’s developed a severe supply side problem, often to the benefit of China and other economies overseas. That cannot be in dispute. On the other side of the eurodollar system’s chronic dysfunction, however, the domestic supply side problem is even worse – but it doesn’t benefit anyone else, either. The EM economic “miracles” are all gone now, and many have turned into nightmares.

To fix this requires a trade war with China and others? No. The first step is to understand better what actually happened, and then to appreciate that because it happened and why it did (eurodollars) it benefits nobody at the current time.

Stay In Touch