The Congressional Budget Act of 1974 requires the Congressional Budget Office (CBO) to produce and release its economic projections and assumptions every year. Typically, the CBO does so under initial assumptions each January. Those estimates are then revised, if necessary, later in the year with more complete information.

This past January, however, the release was delayed. As anxious as most mainstream commentary was over tax reform and what positivity it could contribute to economic acceleration, if not provide the actual catalyst for that acceleration, the economists at the CBO wanted more time to tweak their statistics and regressions in light of what had been passed through Congress and signed by the President.

The new figures for 2018 through 2028 were released yesterday.

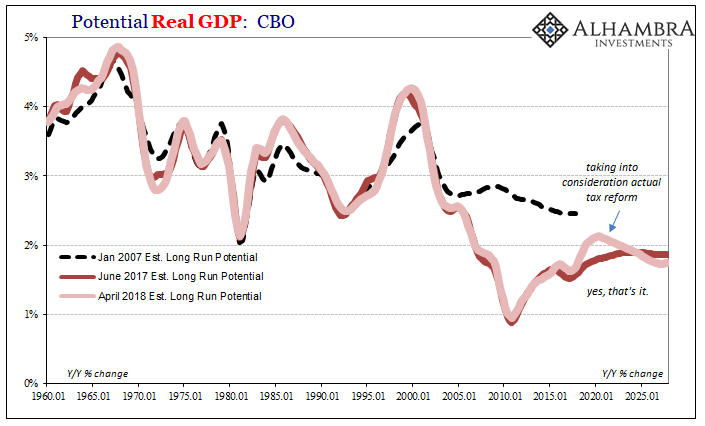

Unsurprisingly, for the first time in years the projected forward baseline for economic potential was raised. It couldn’t have worked out under mainstream models any other way. Economists assume that something like tax cuts and more so tax incentives for productive business investment will always work.

The history of “reflation” sentiment going all the way back to Trump’s election is often in direct relationship with tax changes. Think back to February 2017, for example, when the new President promised a “phenomenal” and ambitious agenda. Though he provided no specifics at the time, pledging only that they would be released two weeks hence, markets were gripped by renewed “reflation” enthusiasm.

The UST 10s had fallen to 2.34% in yield on February 8, rising to 2.40% that frenzied, optimistic day. Though they would revisit 2.30’s toward the end of that two-week window, by early March as tax reform grew louder the BOND ROUT!!! would finish at its local high (2.62% for the 10s) proportional to perceptions about it getting done.

For anyone seeking some weight for the inflation/acceleration scenario, it would be provided by the CBO first and foremost. These econometric models, as noted above, are the best bet for incorporating the greatest contributions over how good tax changes might be. There would be no more charitable view for the anticipated positive effects.

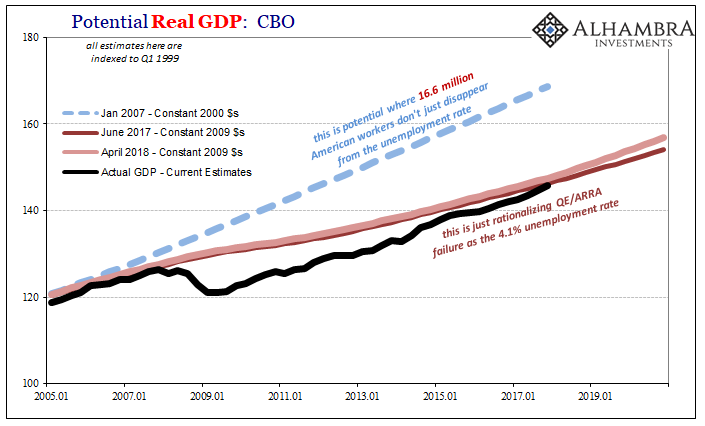

And since that’s the case, inflation hysteria took a significant hit with these new figures. Estimates for economic potential were raised, of course, but not by very much at all. The total contribution the CBO expects from Trump’s tax reform is +0.3% to baseline GDP out to 2021. That’s it.

Even if you believe the future economy will unfold in that way, it’s a drop in the bucket given the far more pressing and substantial problems still pictured in the CBO’s forecasts. In other words, the economy is still shrunk (going back to the monetary break more than ten years ago) and no amount of taxation maneuvering is likely to change that condition. If there ever was a serious chance, these are the mainstream models that would have put them into these forecasts.

Some people might make the argument that there is a political agenda hidden inside these figures, an intentionally dampened baseline coming from a partisan agency aligned against the President purposefully downplaying a major achievement. To do so, though, requires those people to explain why the CBO would also have been anti-Obama, year after year reducing baseline potential no matter what the Obama administration (and the Fed) did during its entire tenure.

In reality, the CBO’s models have been consistent (incorrectly optimistic) for a very long time; in the fashion of orthodox econometrics. What’s actually changed, and therefore allows the models to predict a slight pickup in potential this year and next, is that the calculated output gap would have been completely absorbed under 2017’s assumptions. Actual GDP today is right about where the CBO last year thought potential would be.

But since inflation hasn’t accelerated despite 4.1% official unemployment, that can’t be the case according to orthodox theory. Therefore, there must still be some output gap, though how much is obviously a contentious issue.

That means at least some of the upward revision in potential has nothing to do with tax reform at all, making it as even less impressive than it already appears.

It leaves another one of the presumed major pillars of inflation hysteria ruthlessly picked apart. As noted yesterday, this really isn’t different than the mountains made out of similar molehills throughout the past six or nine months of it. Just as Germany’s bund yields never truly changed, they improved marginally at best in relative fashion, not even the CBO is expecting anything more from tax reform than rounding errors.

In truth, it was never really much more than words and mainstream commentary. The justifications behind the hysteria were blown way out of proportion, and quite often intentionally.

Stay In Touch