Since the announced conditional cut in China’s RRR won’t begin to show up in various figures (particularly for the MLF) until next month, the updated PBOC balance sheet for March 2018 is somewhat anti-climactic. Not only is it too early for what may follow given the policy shift, there are the usual if not more than usual Golden Week distortions especially on the liability side.

It may or may not be what’s remaining there that has spurred the Chinese central bank to take action, but we will have to wait until next month to find out.

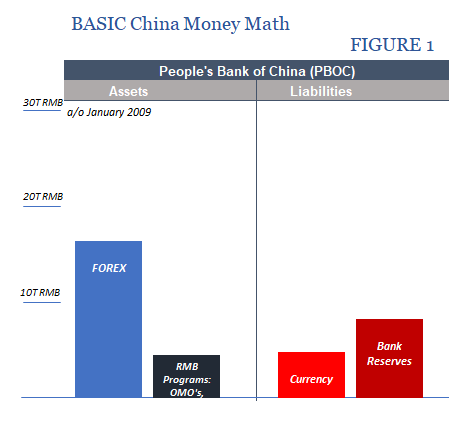

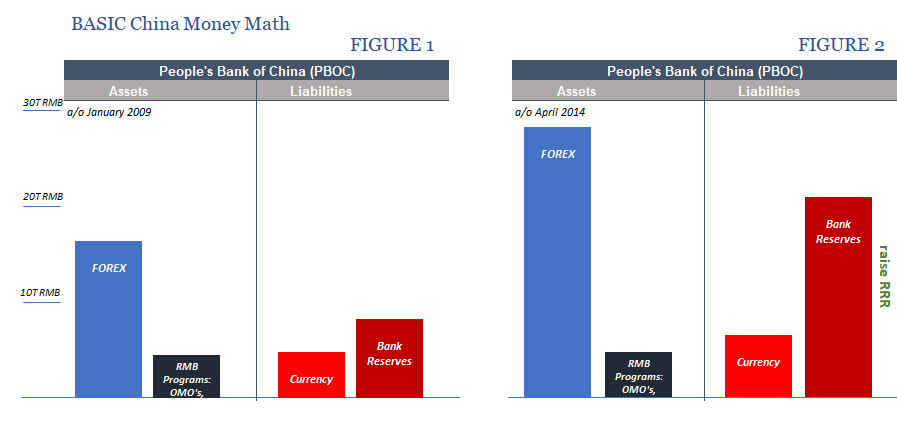

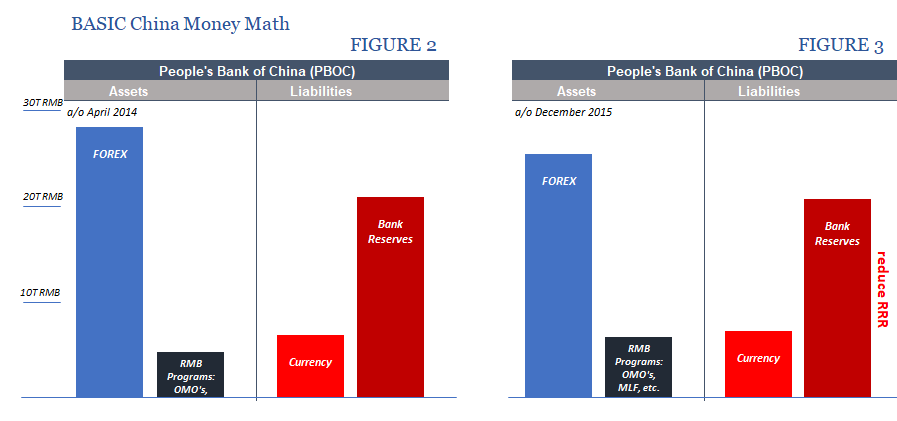

Given that, it’s perhaps an opportune time to review how China’s money system works at its basic level. Like any central bank, the PBOC’s balance sheet is governed by the asset side. Leftover after various smaller programs and requirements (including government deposits) is RMB money. The money side, liabilities, is divided into two main parts – currency and bank reserves – as it is everywhere else.

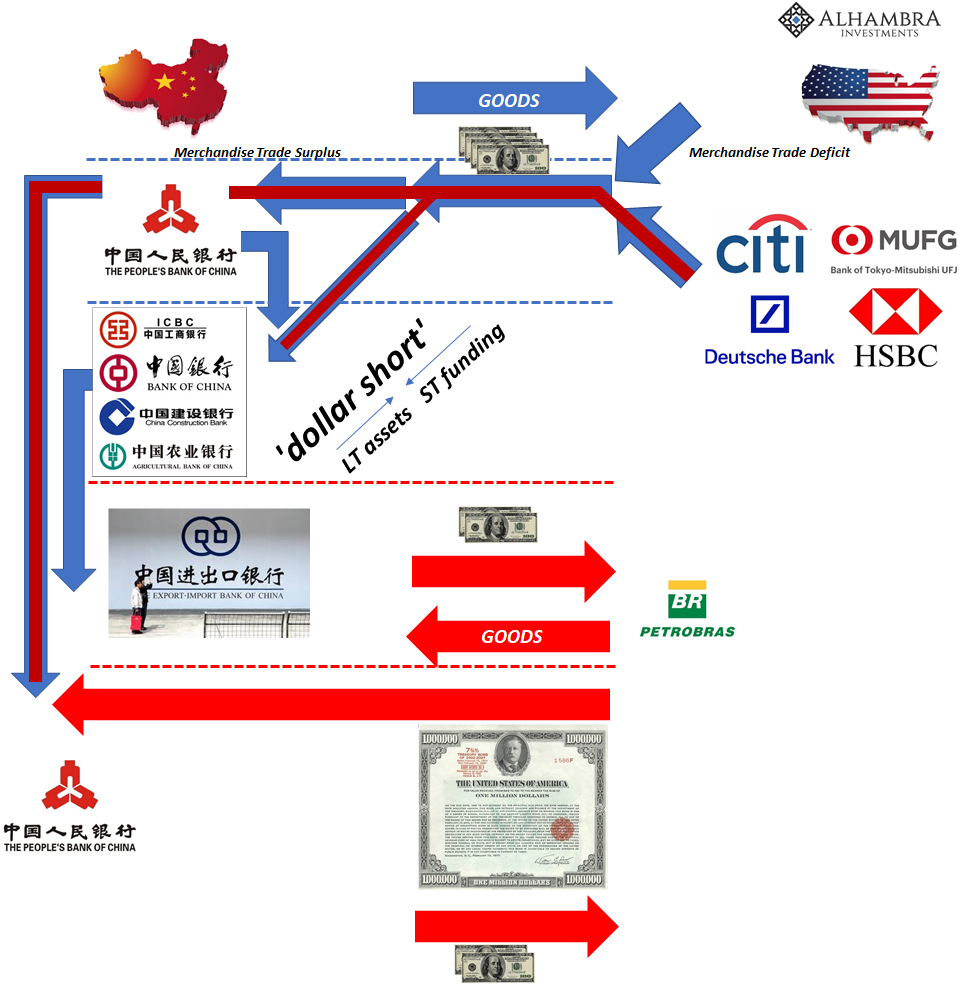

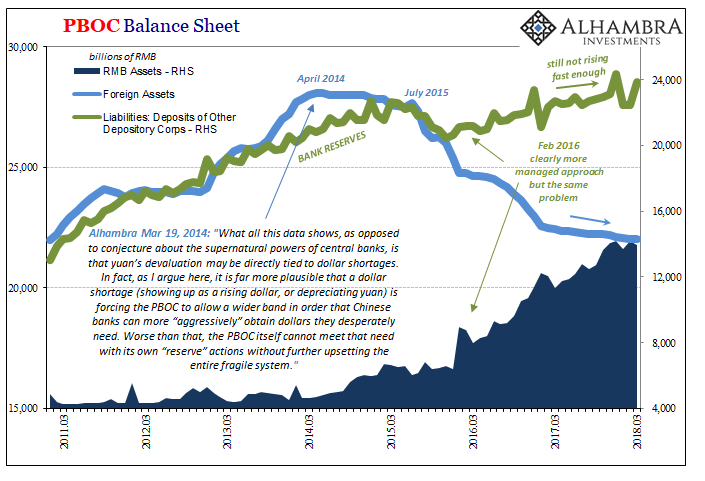

What’s different about the PBOC from other Western central banks is the asset side. Whereas those like the Federal Reserve have to go out and purchase additional financial assets to increase it (LSAP’s), China’s central bank needed to only sit back and capture forex assets as they showed up in the country (from the trade imbalance as well as financial “flow”). This forex component is the largest segment, and therefore because it is an exogenous factor unless it behaves predictably it leaves Chinese monetary policy as almost a secondary matter.

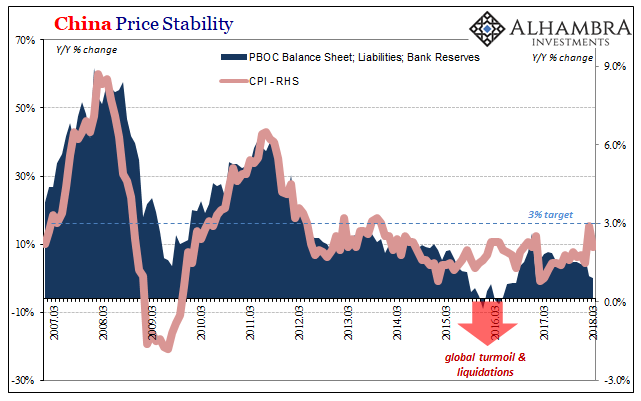

In the years following the eurodollar panic 2007-09, there was limited impact upon China’s monetary condition. The 2011 event caused some disruption (leading to RRR cuts), but for Chinese money it wasn’t until 2013 that negative pressures really began to build. Between 2009 and 2014, the system continued on largely as it had in the pre-crisis era.

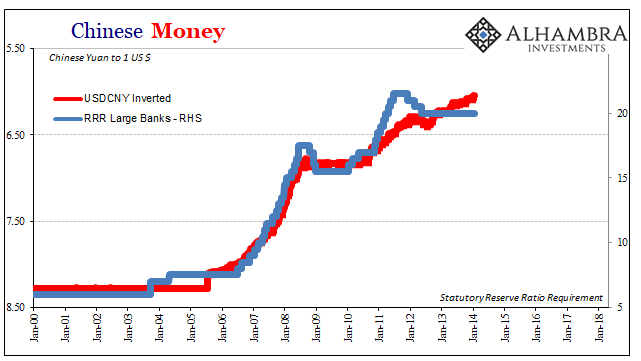

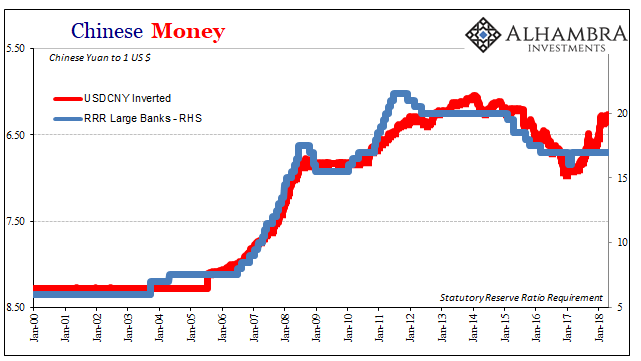

A substantial increase in forex assets meant that given a relatively constant growth rate in currency required the balance would flow into bank reserves. To restrain that massive internal monetary growth, the PBOC raised the RRR several times to increasingly lock up that additional monetary capacity within the banking system (it was only partially successful).

This is the external/internal link between China’s currency exchange and RMB liquidity and money.

Beginning April 2014, it was all radically upended. CNY began to fall rather than rise, suggesting a reverse in “dollar” flows. That placed immediate strain on the RMB system, largely in the bank reserves segment. This setback was first met with minor RMB adjustments (MLF) but by and large the level of bank reserves was heavily restricted (and even contracted between March and December 2015.

It might seem easy enough to just move everything in reverse, to reduce the RRR to counteract the reduction in bank reserves just as it was raised when they were increasing. But there are other factors to consider, mainly risk perceptions in a restrained monetary environment, leading to asymmetric responses on the part of private banks. Rather than free up those private banks (mainly the largest) to substitute their own reserves for the PBOC’s liability constraints, they might instead hoard all additional liquidity (which they did).

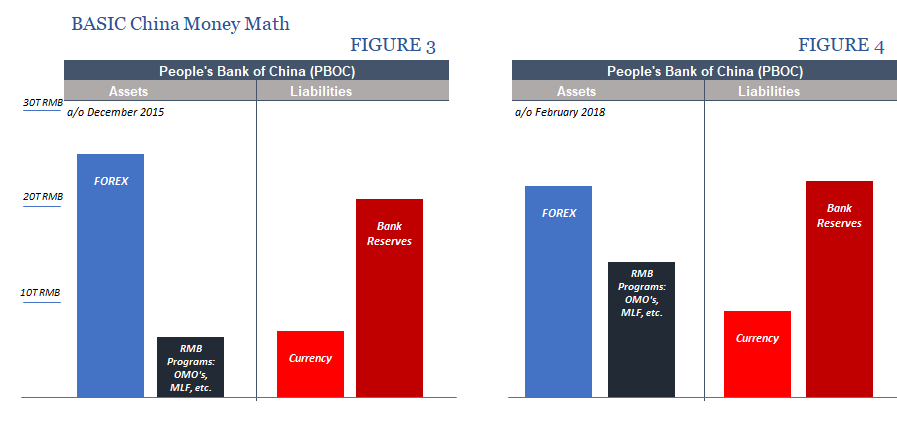

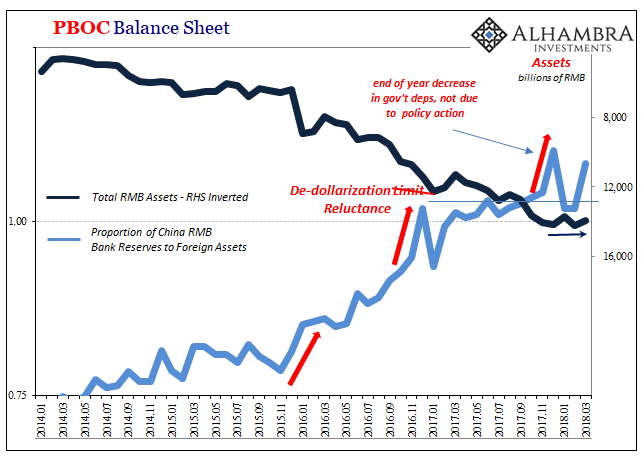

Because of that this formatted response didn’t work, leading to all sorts of bad things around that time all around the world. But with forex assets continuously declining even to today, as “dollar” flow was never actually restored, it has left the PBOC with only two choices. It could continue on the same way as 2015, lowering the RRR to let banks use more of their reserves and hoping that they actually might at some point, or increase RMB assets independent of forex.

Starting late in 2015, but really in January 2016, they opted for the latter.

This sounds like an easy choice, one in which China would have total control over. As Ben Bernanke once claimed, central banks have this thing called a printing press and can in theory use it at will (the difference being Bernanke remaining unaware of how bank reserves don’t much matter in the US$ system unlike in the RMB system that maintains its mostly traditional characteristics). Nothing is cost-free, however, and there are tradeoffs to everything.

As you can see above Figure 3 becoming Figure 4, the PBOC’s liability side between 2015 and 2018 continues to be constrained but is at least growing. The asset side, on the other hand, has been radically altered for that little progress. Forex assets have never rebounded despite 2016’s “reflation” and all the talk about normal in 2017. China’s central bank has been left to increase the RMB portion at its discretion but doing so carefully and incrementally (where possible).

The problem remains the asset side, not just in the ongoing “dollar” problem (forex reductions) but the rising proportion of “printed” RMB. China’s monetary system has been fundamentally transformed from one backed by “dollars” and thus the world monetary “reserve” to one increasingly led by China’s printing press. No matter your view of the eurodollar’s tremendous faults, this result is highly CNY negative (increased risk).

Again, it’s hard to tell because of the holiday distortions, but the PBOC seems to have become a little more cautious in its RMB expansions this year because of this substantial alteration. Given the continuous decline in forex, that places a great deal of additional pressure on bank reserves and therefore RMB liquidity. As a pure accounting matter, bank reserves jumped in March as currency outstanding retreated as it usually does following the New Year Golden Week.

That increase, however, may be the cause of the PBOC’s April RRR action; as a consequence of the confluence of all these trends leaving the central bank little margin surrounding what seems to be a policy line in the sand:

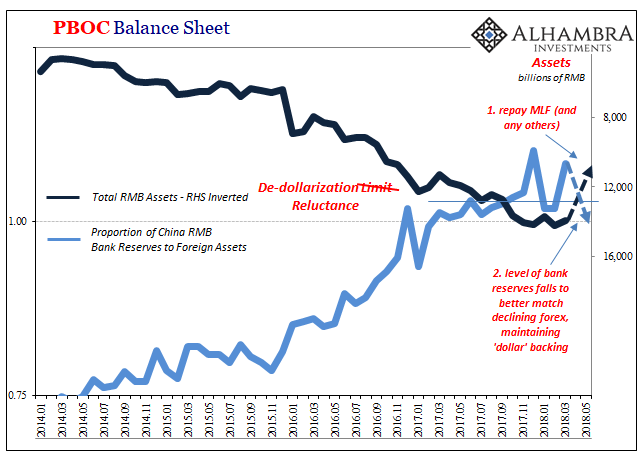

As discussed last week, it provides a consistent rationale for what is happening this month:

So, you don’t want to destabilize CNY by leaving RMB (bank reserves) more and more unbacked, so why not then make big banks pay down the MLF? That would create more margin for the central bank to deal with the prospects for further forex drawdowns in the months ahead.

The obvious downside to withdrawing bank reserves is immediate liquidity. To address what would otherwise be an acute shortfall, shift the burden onto large bank private balance sheets by cutting the RRR. They’ve been hoarding it anyway. The central bank reduces its RMB footprint to better align with “dollar” levels, leaving the private banking system to pick up the liquidity slack in a way that doesn’t endanger CNY.

How do you draw back that big jump in “unbacked” bank reserves in March? Exactly how I described it above. China’s central bank isn’t some all-powerful wielder of supreme monetary power, Bernanke’s printing press, it is almost a bystander trying desperately to react to forces entirely beyond its control. It sure leaves next month’s update all the more interesting.

Stay In Touch