In 1967, the US Personal Savings Rate averaged just a little more than 12%. That was pretty consistent with consumer behavior observed throughout the decades before, and the one that followed. What that meant, in terms of economic theory, was that if you as a central bank intended to accelerate the economy via the manipulation of expectations you at least had some sufficient margin to do so without income growth.

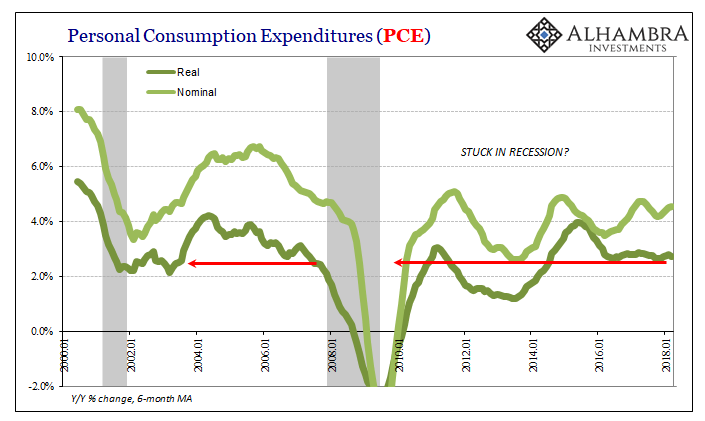

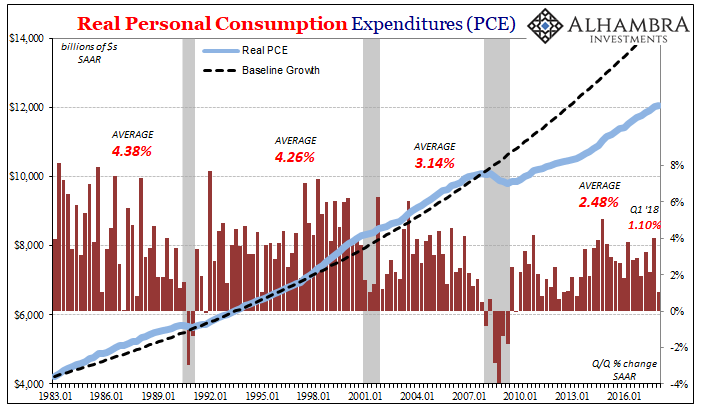

Which comes first, income or spending? It’s actually an unsettled question in the orthodox canon devoted to the concept of aggregate demand. For a long time, it has been believed that the latter can under the right circumstances. Consumers spend a little more of what they make today compared to yesterday, and that burst of spending creates the virtuous circle of recovery. Businesses hire more workers to meet the increase in “aggregate demand” therefore incomes eventually rise to support an overall economic boom.

The catalyst, at least so far as the theory goes, is inflation expectations. Why would you want to spend more of your income, meaning less savings, today versus yesterday? If you think prices are about to rise, that would be one big reason. Monetary policymakers, in particular, have spent a lot of time and QE’s on inflation expectations to get this piece of recovery started.

During the worst of the Great “Recession”, however, the Personal Savings Rate never got higher than 8.1% in May 2009 – and that was a one-month outlier. For all of 2009, the rate averaged 6.1%, including May. After the eurodollar crisis in 2011, the savings rate would actually rise slightly.

We have to ask the question, even if the theory was sound, setting aside any objections to its 1970’s Great Inflation basis, would it have worked with a savings rate starting from such a low level? Or, asking the question another way, even if Americans believed QE1 and QE2 were going to be effective at creating even rapidly rising consumer prices, could they have increased their spending by more than a trivial amount?

It seems they were constrained by the low savings level in addition to incomes that refused to grow in the manner consistent with past recovery. Through four QE’s and years of monetary policy accommodation, all intended to stoke inflation expectations, it seemed destined to its dead end. There was no virtue in this intended virtuous circle.

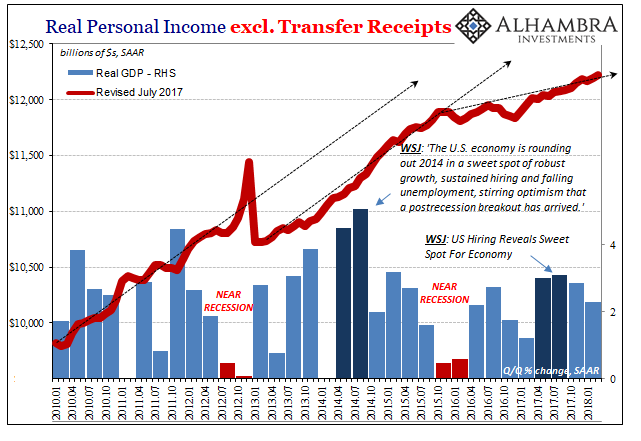

Among other factors, this is what doomed the economy in 2014. Then, as now, optimism was at its highest. The domestic and global economy was on an upswing, to be sure, but people were making far too much of it given the constraint on income therefore savings. I wrote in December 2014, just as commentary was taking on some of its silliest proportions:

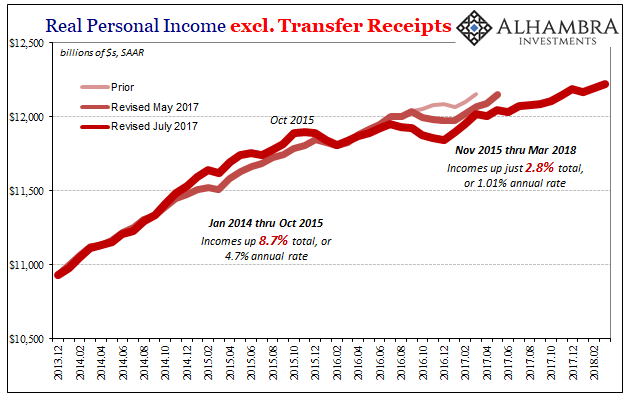

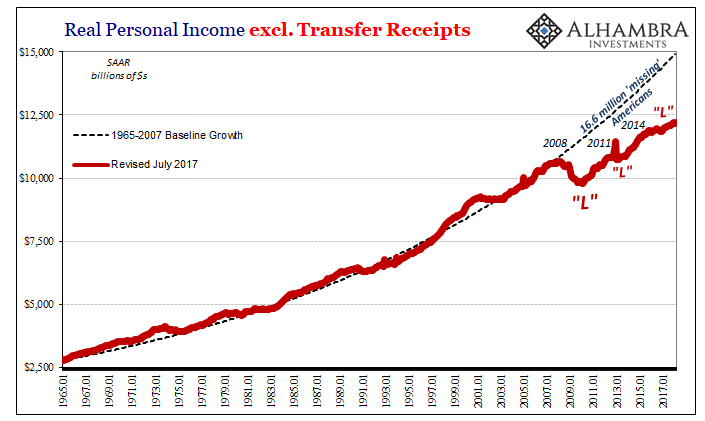

Again, incomes at this paltry level of growth are almost always reserved for recession (the sole exception dating back to 1960 was late 1993). In the latest chapter, it is clear that income growth peaked in 2011 and perhaps 2012, and has only slowed since then with heavy variation month-to-month. The latest revised figures suggest…that there is a much lower ceiling on growth in this slowdown environment than otherwise might appear from more remote views on economic status. [emphasis added]

The only way to have changed what I highlighted was if QE could have been effective at inflation expectations (data suggests that it was only during brief periods) and those expectations could have pushed the savings rate meaningfully lower to increase spending without income gains. Obviously, that didn’t work out very well.

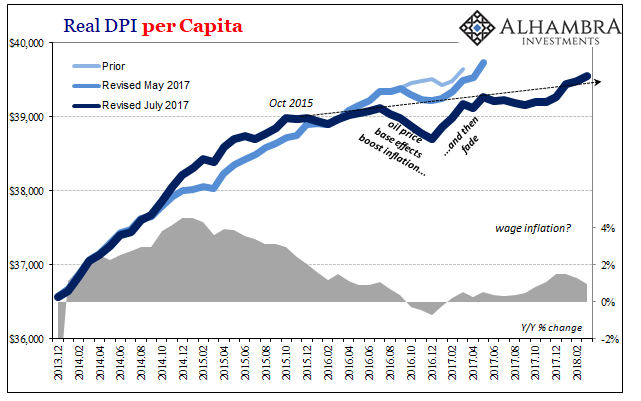

Rather than learn from the mistakes interpreting 2014 and the real economic baseline derived from income, three and a half years later there is renewed talk of a boom, even “overheating.” Now, as then, there is simply no way for that to be possible. Income growth in 2018 is in every way worse, much worse, than it was in 2014 and even much of 2015.

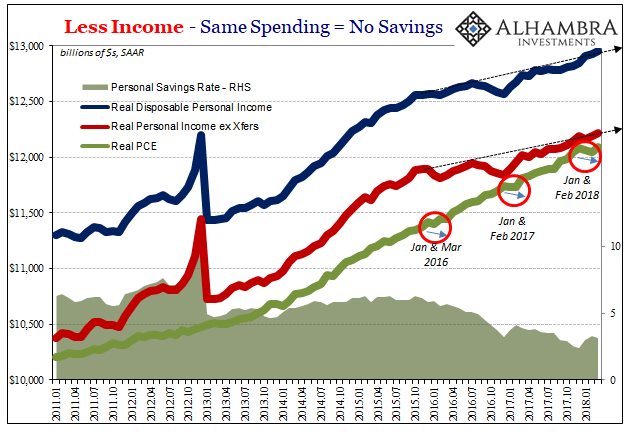

In fact, dating back to late 2015 income growth has been practically nothing. As a result, spending growth could never have accelerated especially with the savings rate set to drop – not on inflation expectations but on that much reduced income trajectory. The result has been what I wrote in December 2014, an even lower ceiling for the economy during this latest upswing when compared to the reduced output of the last one (2013-14).

We are left to ask ourselves again, how can the economy break out of this pitiful state? Income growth is clearly entrenched in an even weaker trend. Some might argue that the current expected inflation breakout (setting aside that debate) could provide the means consistent with the theory, “transitorily” delayed by several additional years. The savings rate, however, is now just 3%, having been as low as 2.4% during the Christmas shopping splurge.

This is a huge problem for the theory; the savings rate can’t drop so Americans can spend more, it already dropped because they have made less (relatively speaking).

It’s not just that there is no boom right now, it is more important to appreciate why there isn’t and therefore cannot be one tomorrow. Rather, these figures suggest an economy in a very precarious position, just as I wrote in October 2015:

Again, there is no way to reconcile these comparisons with the current economy coming out as accelerating or already booming. These [income] figures confirm it simply scraping along the bottom with positive numbers, and thus the microscope upon monthly variations amounts to the ineffectual splitting of hairs. The true state of income, which is derived instead from the bigger trend, leaves the economy in a hugely precarious position unprepared to accept any negative factors.

Not only was the economy entering a near-recession right at that moment, that same thing appears to have left the labor market durably far worse off for having undergone it. If the economy was merely “scraping along the bottom with positive numbers” up until October 2015, and thus little chance it was about to overheat, what do we call what it’s been doing since?

Ripping a chapter out of Nineteen Eighty-Four, though QE’s 3 and 4 began in 2012 and ended in 2014 both worked very well with just a five-year delay leaving the economy finally ready to boom as inflation expectations are now about to be fully rewarded.

Stay In Touch