One equal part of inflation hysteria had been that as the US economy recovers and growth accelerates, foreign buyers would flee US Treasuries. The bond market would be hit with a double damning of higher inflation and and substantially reduced overseas purchases. Under such pressure, no way could yields hold under 3% for very long.

To often make the case, whomever might be trying typically addresses the FOI’s (foreign official institutions). There has been no publicized sector that has been so actively selling government bonds like it. Upon first glance, it appears that overseas central banks, governments, and other institutions can’t get out of the Treasury market fast enough.

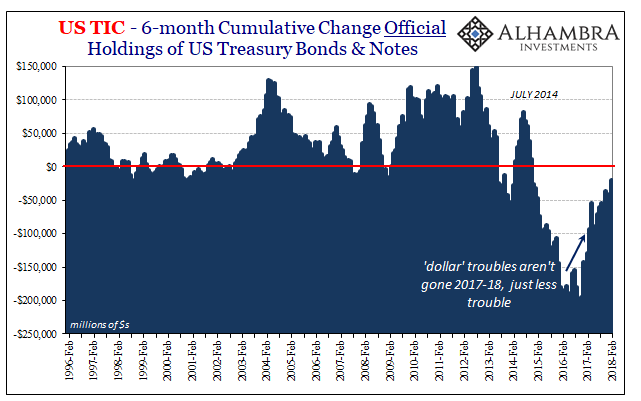

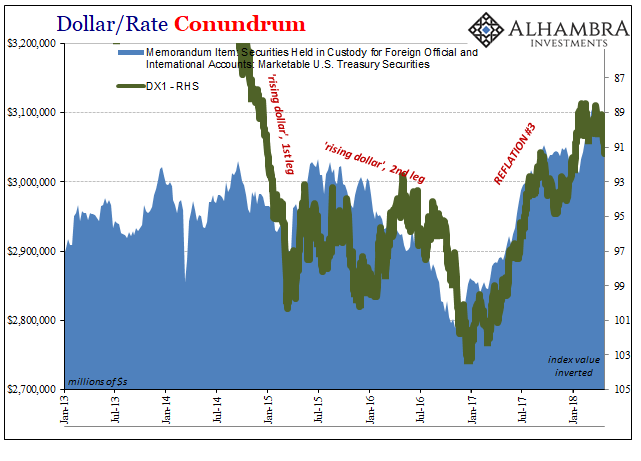

The problem with the narrative is, obviously, the timing. Nearly all the selling took place when everything was backward – UST yields were falling, not rising. It was in 2014-16 that FOI’s suddenly became very active, as the dollar rose and suggesting the true reasoning behind it all. In other words, whether they are bought or sold appears to have very little if not nothing to do with inflation or the direction of their yields.

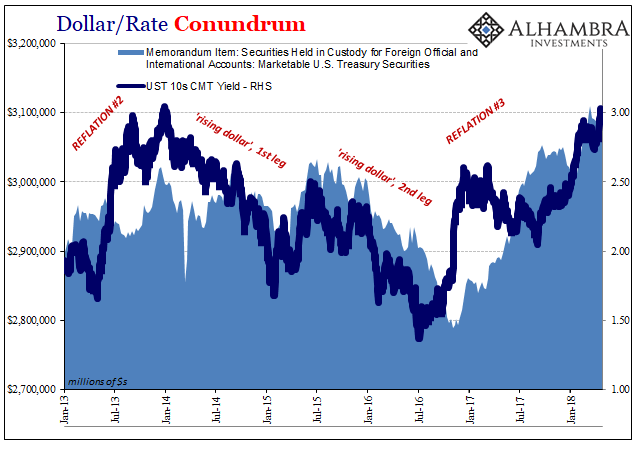

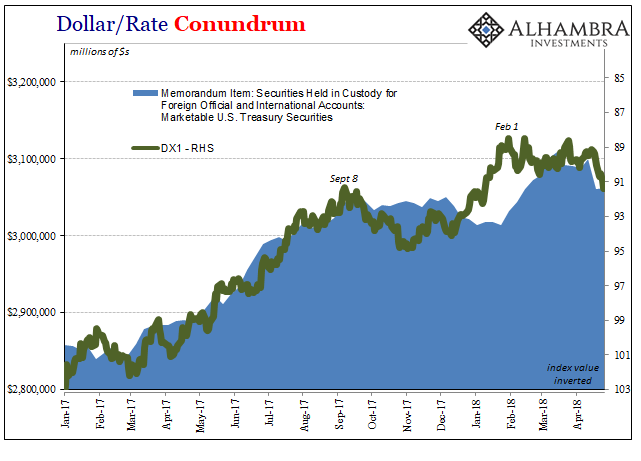

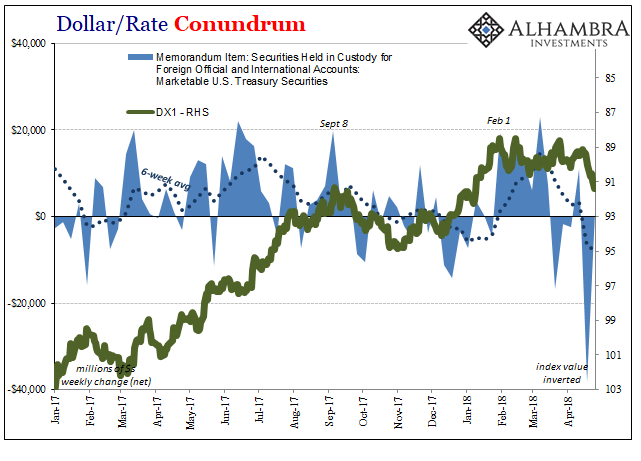

The Federal Reserve reports its custody holdings of UST securities held on behalf of FOI’s. For the week of April 18, 2018, the level plummeted by $38 billion. What followed was the predictably stark warnings about how foreigners were now in full flight from bonds. It was the same week when long end yields rose sharply, with the 10s increasing and moving above 3% for the first time since January 2014 the week after (last week).

As with the TIC data, they aren’t really disturbed until 2014. There isn’t much correlation before, and not a great one after, either. Still, the pattern that emerges over the last few years is the reverse of the conventional claim – FOI’s are, for the most part, selling when they should be buying (yields falling) and buying when they should sell (yields rising).

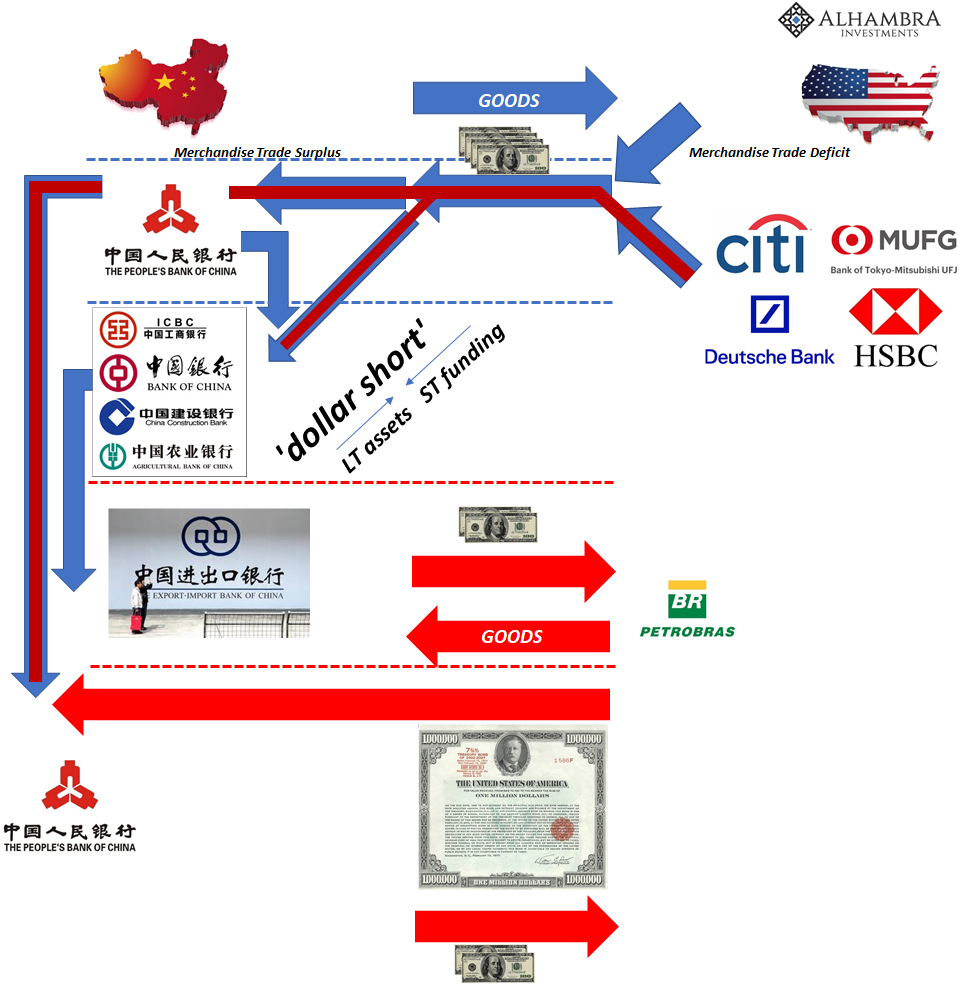

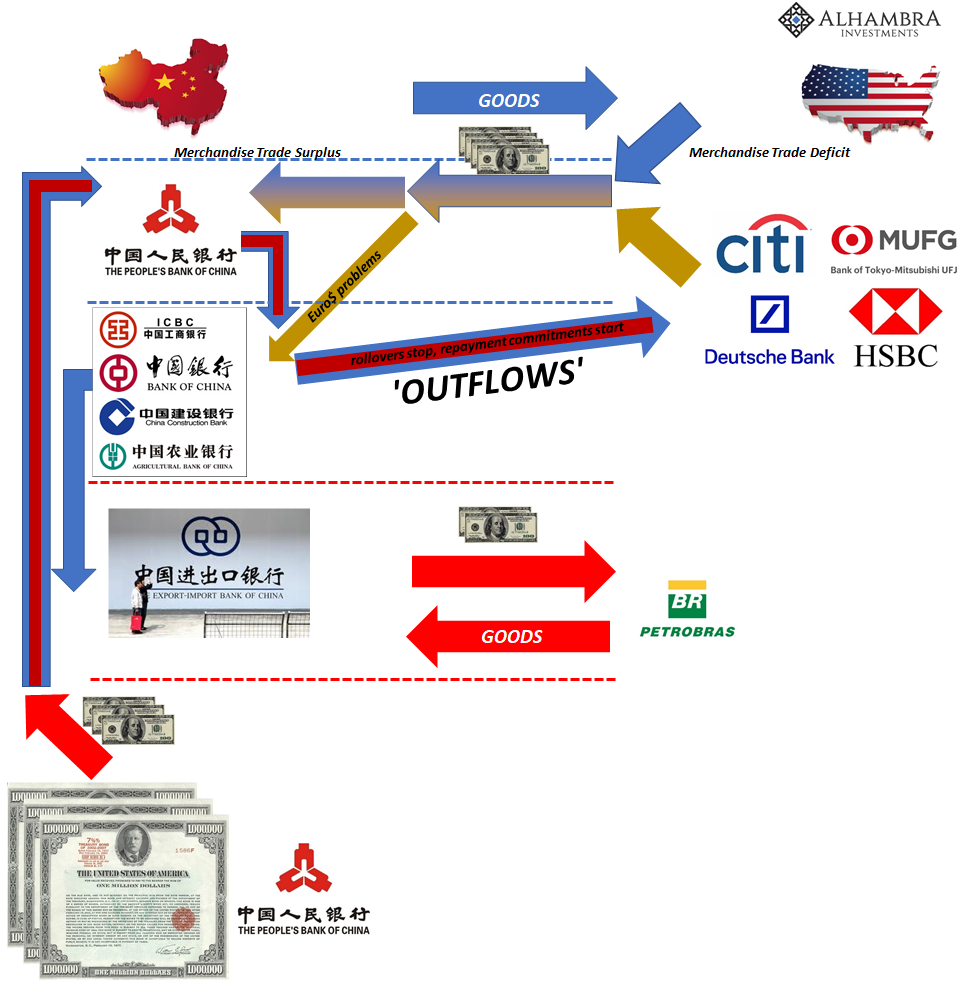

It already proposes an entirely different cause, one that we know very well from studying the eurodollar system and particularly its behavior during this period. Central banks are “selling” their UST holdings as something of a highly imperfect public liquidity backstop in each domestic “dollar” market. They have to liquidate their assets (forex reserves) to aid local banks who run into big trouble sourcing “dollar” funding on eurodollar markets.

Systemic funding problems are like a “dollar” squeeze, therefore the dollar’s exchange value has tended to rise in varying degrees whenever that happens. In other words, FOI selling of UST assets has, again, starting around late 2014, more broadly correlated with a rising dollar than the other way around (which is more consistent with the narrative of inflation, globally synchronized growth, and all that bad stuff for the bond market).

The tendency to sell UST’s has been notable of late, as have broad indications of global liquidity pressures (in eurodollar markets). FOI’s were, according to this view from the Fed data, buying near constantly up until that one week in September 2017. That was consistent with “reflation” in eurodollars, where relatively fewer funding pressures end up with positive flow into the hands of FOI’s.

Since the first week in September, they have been more likely to “sell” including the middle of December on into January – just before the wave of liquidations pressured stock markets globally. Therefore, the heavy selling indicated here since mid-March would be added to the UST bullish column rather than otherwise.

Again, it’s not a perfect indication nor correlation. In broad terms, if eurodollar conditions are such that it leads to heavy UST liquidations especially on a sustained basis, then that funding pressure over time will as likely be positive for bond prices. Higher liquidity risk, and a rising dollar, as all that would indicate, favors overall buying in UST markets (liquidity preferences).

If anything, that one week of selling (reduced custody holdings) was in all probability related more to what is behind DXY than inflation and global synchronized bond vigilantes.

Stay In Touch