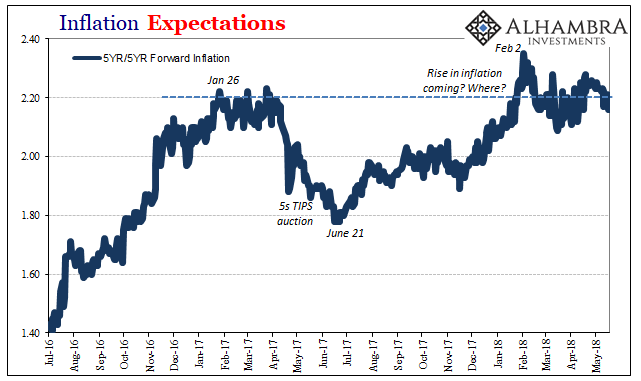

It’s the kind of thing you’re supposed to overlook and not think too deeply about. Recall the basis of inflation hysteria: the economy was poised to take off and do so convincingly; that plus the ubiquitous LABOR SHORTAGE!!! meant that wages then inflation were going to break out higher; accelerating consumer prices were then to force the FOMC into a steeper, condensed trajectory of rate hikes; the combination of all the above would lead to an epic, biblical BOND ROUT!!!! the likes of which we haven’t seen since at least 1994.

A corollary to all that would be, according to convention, a higher dollar exchange. Interest differentials, as are commonly understood, would be more favorable to dollar assets compared to overseas financial opportunities. The better it got for the US economy, the better US assets would appear by relative comparison.

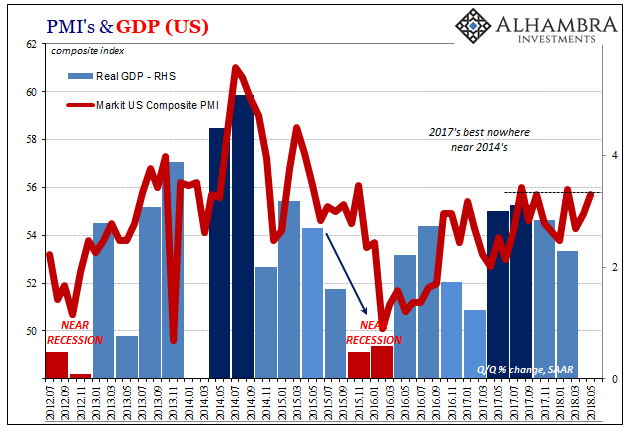

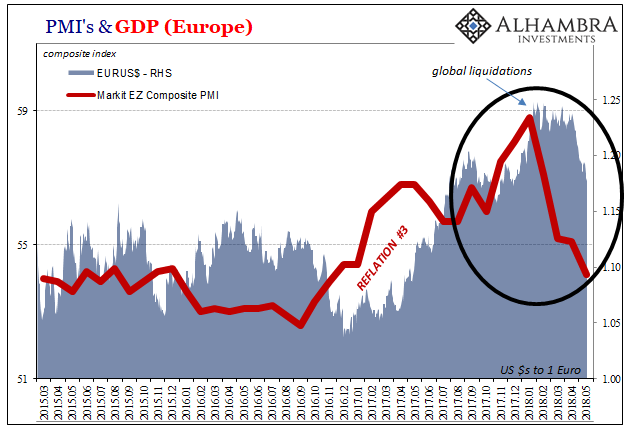

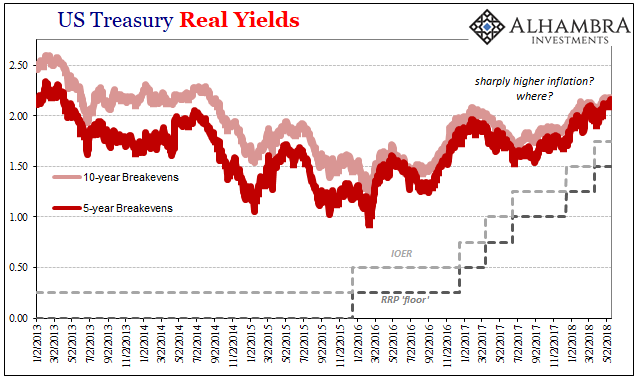

The “dollar” has risen, but inflation has not nor has the economy showed signs of being poised for liftoff. Wages continue to grow at depressed rates no matter how low the unemployment rate falls. And now foreign currencies are caught up in a whirlwind that doesn’t look like its beginnings trace back to “it’s going to be so good.” The glaring discrepancies aren’t exactly hiding themselves of late.

Global stock liquidations aren’t exactly consistent with that premise. Nor is a possible European economic slowdown the product of US$ tightening, as FOMC policy is presumed to be. If the narrative is missing a lot, so is the FOMC.

The minutes of the May policy meeting read like a disorganized ball of confusion. You could understand to a narrow extent such perplexity at times like February or March 2016. This is May 2018, more than two years after the last downturn, and monetary officials are still stuck in the future tense. The word “if” appears way, way too much for how late it is getting.

An example:

Most participants judged that if incoming information broadly confirmed their current economic outlook, it would likely soon be appropriate for the Committee to take another step in removing policy accommodation.

The fact that even now they aren’t willing to say the economy is shaping up like it was expected to be is telling. If you require a few months of data to confirm your projections, that would be normal. Two plus years? That’s not. The lack of conviction is conspicuous.

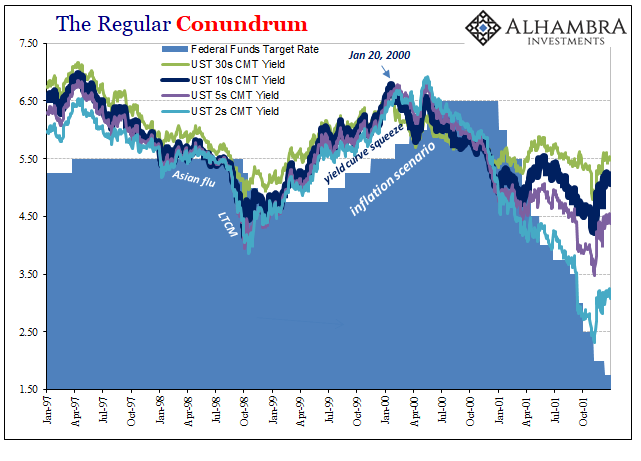

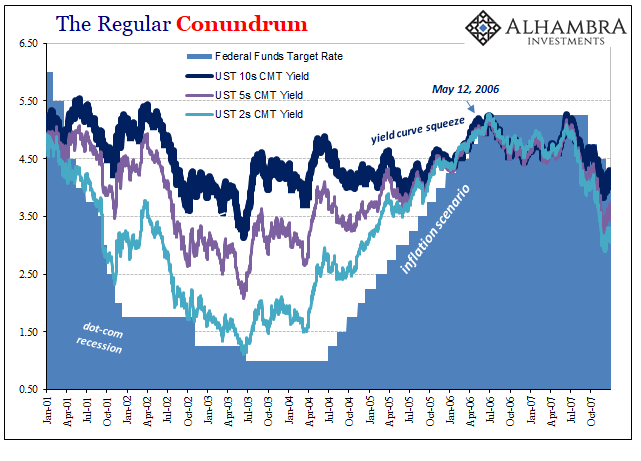

Instead, the Committee goes to extraordinary lengths to try and explain the one market that matters, and how that market totally disagrees with their assessments (with, of course, time on its side rather than theirs).

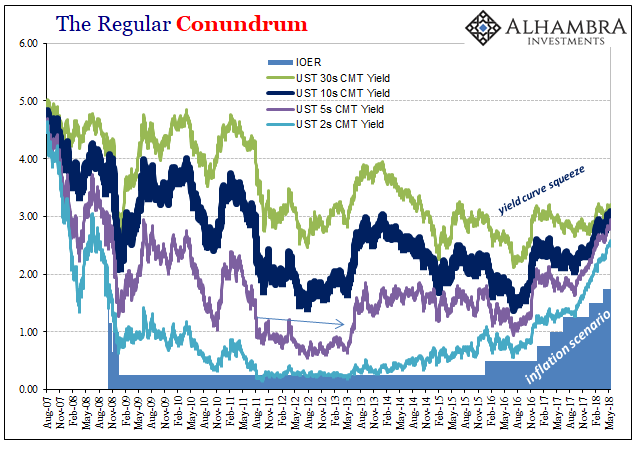

Participants pointed to a number of factors contributing to the flattening of the yield curve, including the expected gradual rise of the federal funds rate, the downward pressure on term premiums from the Federal Reserve’s still-large balance sheet as well as asset purchase programs by other central banks, and a reduction in investors’ estimates of the longer-run neutral real interest rate.

A few participants noted that such factors could make the slope of the yield curve a less reliable signal of future economic activity.

This is plain ridiculous, the depth of denial on display. In other words, the bond market just can’t be saying, “hey morons, you’ve got it wrong yet again.” It’s not just that the curve is flattening, though that’s an important part of it just as it has been in the past two conundrums. More than that, the curve is flattening at such low nominal yields that there really is no other interpretation, which is why these Economists have left themselves with little other than the absurd.

Even the idea of “transitory” remains a matter for internal debate. The PCE Deflator registered 2% last month, but barely despite several factors all in its favor. You would think there would be more declarative statements, rather:

In particular, the recent readings appeared to support the view that the downside surprises last year were largely transitory. Some participants noted that inflation was likely to modestly overshoot 2 percent for a time. However, several participants suggested that the underlying trend in inflation had changed little, noting that some of the recent increase in inflation may have represented transitory price changes in some categories of health care and financial services, or that various measures of underlying inflation, such as the 12-month trimmed mean PCE inflation rate from the Federal Reserve Bank of Dallas, remained relatively stable at levels below 2 percent.

We now have officials arguing whether being at or above 2% is now transitory (it almost certainly is, but that’s the point).

There should be no debate about any of this, but it’s ongoing and at times confusing and contradictory simply because the economy is not behaving as it was supposed to. Not even close. If the economy were to really take off, there would be no argument or disagreement. The very distant day recovery actually shows up no one will need point it out for anyone else, it will be obvious to everyone simultaneously.

That’s the thing about actual growth.

Inflation hysteria has largely dissipated because the “dollar” is back in the picture, and one big reason why is how nothing ever goes as it is “supposed” to. It’s the middle of 2018, and they are still arguing “if.”

Stay In Touch