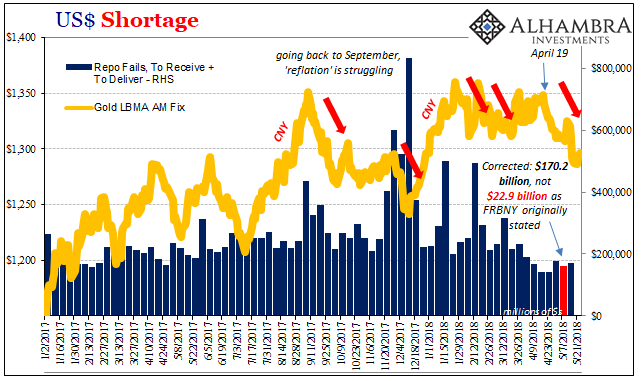

Last week, I reported on a sharp drop in repo fails for the week of May 9. The decline was so much that FRBNY indicated there were essentially no fails during those five trading sessions. It was way out of line with recent history and opened up little more than wild speculation as to what might have caused it.

One possibility that I raised was error:

This is some pretty weird stuff. Perhaps it was a misprint or typo in the FRBNY data. While that’s not impossible, it would have had to been applied to both sides (“to receive” as well as “to deliver”) making it less likely.

As it turns out, that’s all it was. FRBNY, without notating any correction, changed the figures. Fails during the week of May 9 were presumably $170 billion, not $23 billion as originally stated. Big difference, that.

It’s important to point it out given the context of what has happened since mid-April (as indicated above by gold prices). The current figure is far more consistent and doesn’t lead us off chasing a possible phantom collateral lender (as much as I like digging through SNB or BoE statistics).

Stay In Touch