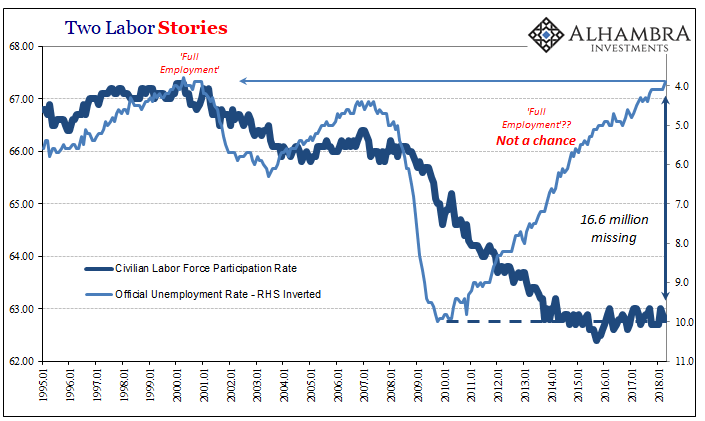

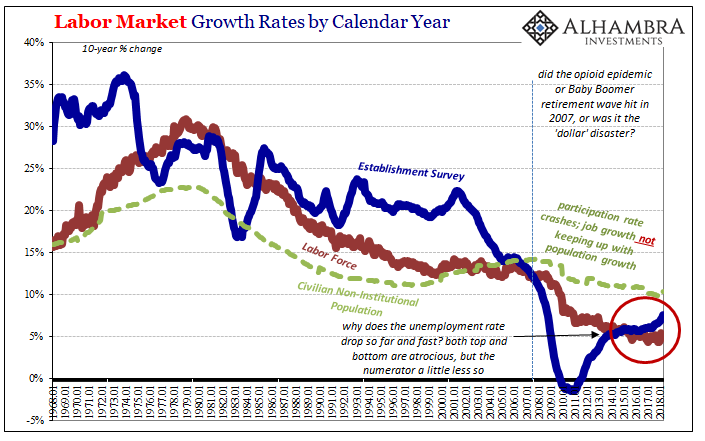

You’ve heard all the ridiculous explanations for the labor market’s big deficiency. When not attempting to characterize payrolls as strong, Economists have tried to explain the participation problem through opioids and Baby Boomers. According to this absurd theory, businesses just can’t find enough willing or able workers to grow in a more normal fashion. That’s the unemployment rate.

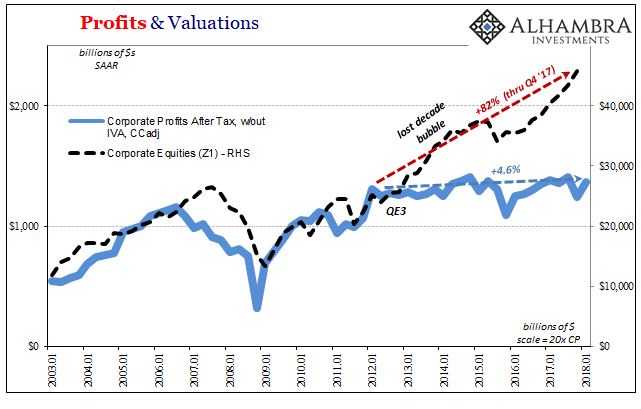

What they never talk about is the simpler, common sense version. No one ever raises the issue of corporate profits except in the context of the stock market. Share prices are through the roof, therefore most people assume that profits are likewise. They aren’t; not even close.

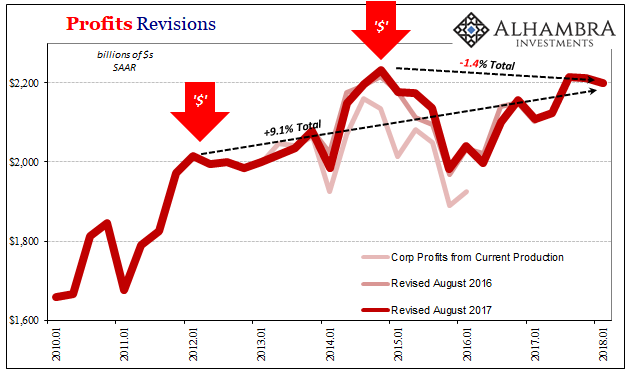

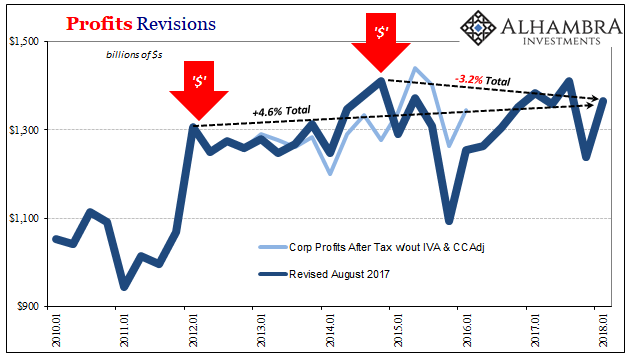

The final revision to Q1 GDP includes the preliminary estimates for corporate profits for 2018 (Q1). Nearly all the profits series in Q4 2017 were affected by the BEA’s imposition of a statistical artifact related to tax reform completed during that quarter. Q1 is the first opportunity to see how profits have really been performing when not distorted by the tax change.

Corporate bottom lines continue to struggle. Over the last two quarters, those coinciding the “re-rising dollar”, profits are down again. That means not only are profits lower across those quarters, they remain lower (after tax without IVA and CCadj) compared to the high in 2014 and barely more than 2012.

Rather than blame heroin’s reappearance on American streets and the slow, demographic shift decades in the making, the labor market’s struggles especially over the past few years coincide with this devastating lack of profit growth. Companies that can’t manage much profit return growth are not going to hire a ton of new workers, nor will they be willing to pay through the roof for new or existing workers no matter how low the unemployment rate falls. It really is just that simple.

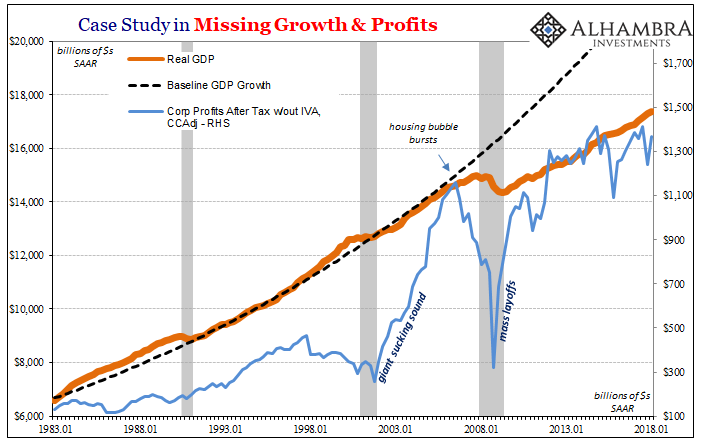

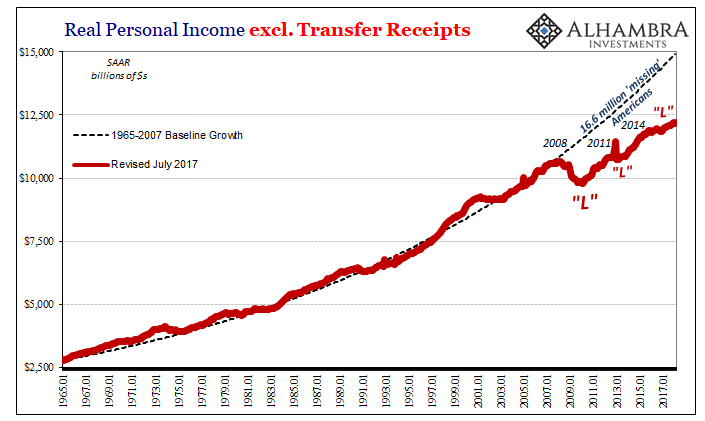

Simpler still, there isn’t any mystery as to why profits have been depressed. The bottom line is collectively hurting because there isn’t any real growth on the top line. Going back to the middle of 2006, the economy began its descent from which it has yet to recover. What happened around Q3 2006? The housing bubble began to collapse.

Thus, the economy stopped growing (2008 as both a financial and economic matter playing a big role) leaving companies with no way to accomplish profit growth except by over-emphasizing cost management, pushing tens of millions out of the labor force. The economy doesn’t work, companies can’t make money, so now Americans don’t work.

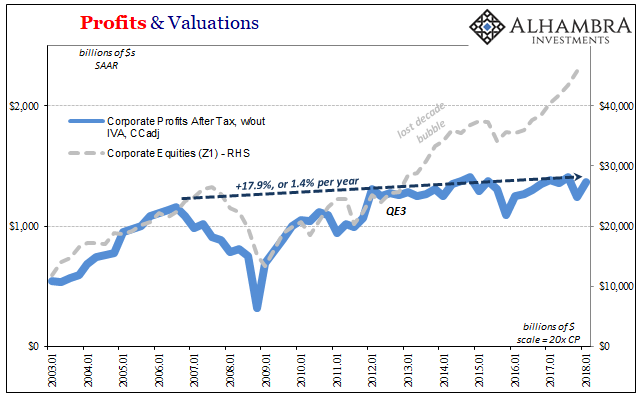

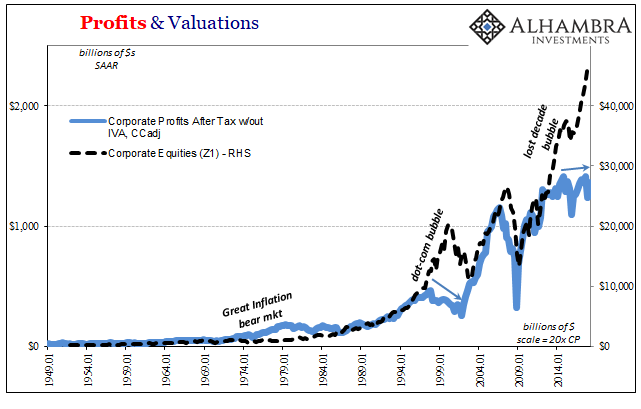

Where it starts to get muddied is by examining profits via share prices as is common practice. The stock market is believed by many to be a discounting mechanism, and therefore it is thought to more accurately describe the future state of the economy and profits. If shares are highly valued, collectively, that must be because the future is going to be so incredibly good.

But that view has already been shown as little more than a modern rationalization of a scenario that has time and again failed to come true.

In just the last six years, share prices have risen by 82% (through Q4 2017, the latest available Z1 figures) while again corporate profits have barely budged. The conventional way of reading this disparity is that the market expects profits will rise, precipitously, at some point.

Despite the “rising dollar” creating both an economic downturn as well as profit recession, following it in 2017 stock investors rationalized that time could only be on their side. Yet, as we find again in the latest data for Q1 2018, net incomes remain tepid without any meaningful acceleration. There isn’t any sign this is about to change, meaning share prices more ominously reflect a dot-com style of over-valuations the more the economy fails to live up to them.

What the profit story tells us is not only why things aren’t good now, but also why this isn’t about to change. Rather than wasting economic analysis on heroin, we can instead realize that if companies can’t make more money, they aren’t going to hire nearly enough new workers to begin the recovery process, leaving the economy in its chronically deficient state, meaning companies can’t make more money, etc.

What companies have learned that stock investors haven’t (yet) is that the only profitable investment for them (or at least management) is to buy back their own shares rather than invest in their productive capacities (which includes labor utilization). High share prices suggest, conventionally, that they should be doing just that meaning that corporate managements are seeing something vastly different than what is currently being traded on the NASDAQ.

These are little more than liquidity preferences combined with a closer examination of their own realized profit potential.

Stay In Touch