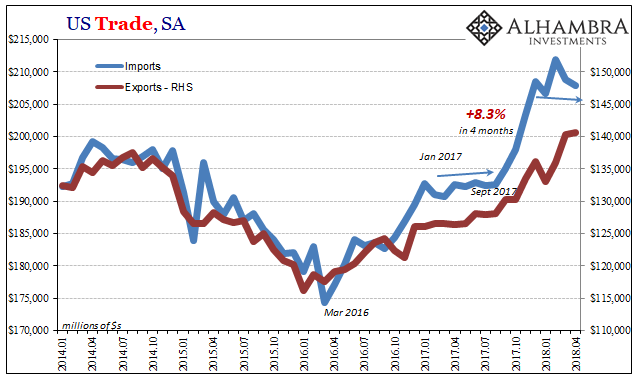

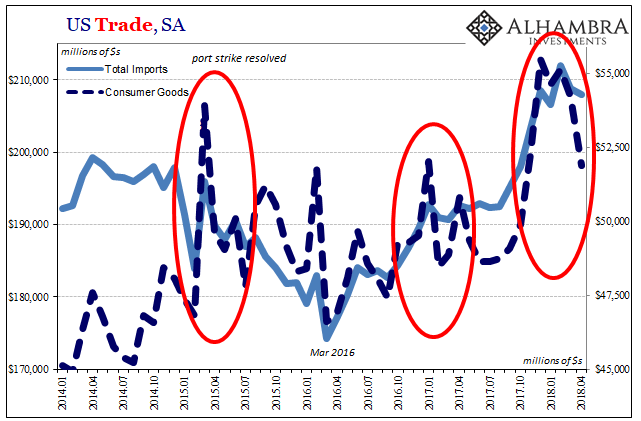

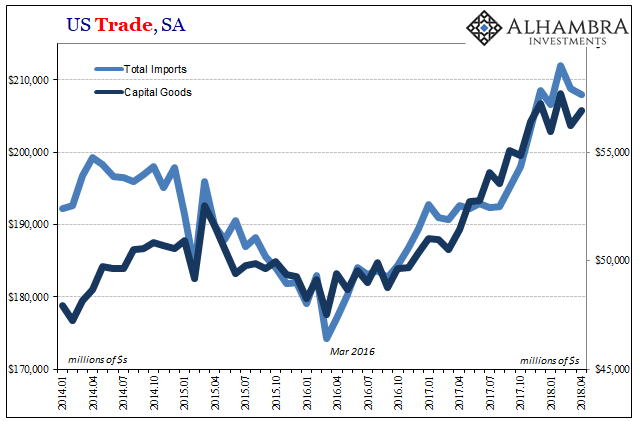

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods.

Since December, imports have leveled off again. The one remaining question following the storm stuff in early 2018 were indications that certain places were almost channel stuffing material. The intention was not to improve sales metrics but to beat or get ahead of any trade and tariff restrictions that might be imposed. The prime candidate in this effort was the Chinese.

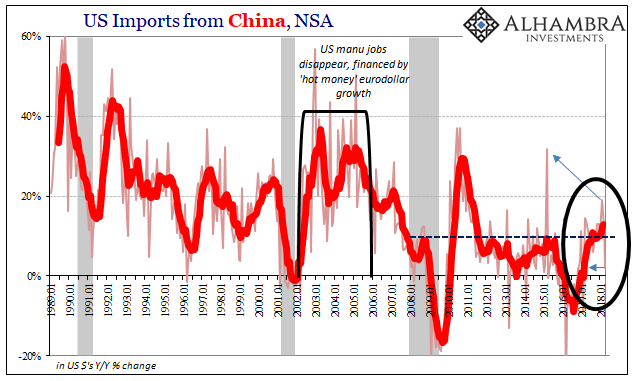

Imports from China had been growing by low double digits, which is already a lower growth mode incomparable with precrisis trade. They did jump to almost 20% year-over-year in February 2018, just as trade war rhetoric was at its most intense. It was still way less than official Chinese figures, which suggested something like +40% growth in that month (hinting at other things happening on the Chinese side, likely in relation to Hong Kong but also the calendar placement of the major holidays).

Census Bureau estimates were more consistent with recent trends in March, growing almost 12%. That’s a rate that didn’t suggest much either way. In April 2018, however, imports from China were up just 2%. It’s the lowest non-Golden Week month going back to November 2016.

I don’t believe that represents a collapse in marginal demand for Chinese goods, rather it would appear to confirm the idea that exporters in China (or importers inside the US) were racing to get ahead of any additional imposed costs. One month isn’t conclusive, but it is for now consistent with that hypothesis.

It would also seem to indicate that there isn’t any acceleration in the underlying trend, either. Following a serious decline in trade (globally, not just with China) in 2015-16, the rebound out of that downturn has been suspiciously low key. In other words, the results are indicative of the same low-grade upswing that we’ve been seeing since later 2016.

This is not what would be expected of globally synchronized growth. That narrative starts with something like symmetry, meaning that there should be a major difference now that all the world’s major economies have plus signs at the same time for the first time in over a decade. This was thought to amplify any positive trend locally so that the global economy would finally be propelled into full recovery.

Instead, it is proving to be the same lackluster upturn here as at any other point over the last decade (in some ways, it’s less than even 2014). Taking hurricanes and tariffs into consideration, we can understand better what’s taking place in EM’s and with their currencies of late.

If China sees no meaningful uptick in demand from the US (or Europe) and decides that there isn’t going to be one, they won’t internally offset their external weakness with purposeful government efforts (“stimulus”). That could only trap EM resource-oriented economies (like Brazil) in a state of something like limbo; it’s growing again but not growth, certainly not after experiencing years of substantial contraction.

In other words, the same “L” still permeates again the whole global landscape. As things start to settle down again, it is becoming clearer what all that was. It was nothing but a (predictably) mistaken reprieve last fall when the inflation/boom narrative used in good part this shift in accounts as a basis for what in hindsight sure looks to have been hysterics.

Stay In Touch