India was not alone in having its central bank unexpectedly act in attempted defiance of the “dollar.” There was Indonesia (last week) raising rates, too, and Turkey by a lot more. Argentina was handed the largest bailout (dollar funding) in the IMF’s history. And Brazil, well, that country’s monetary officials called you stupid.

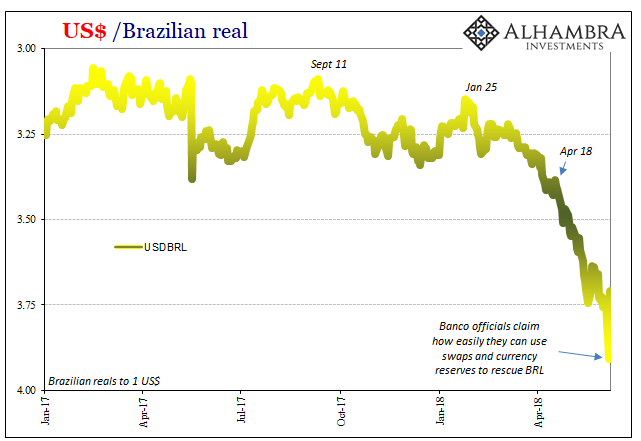

Yesterday afternoon, Ilan Goldfajn, Banco do Brasil’s President, hastily arranged a press conference to defend the country’s collapsing currency. Kind of. He declared quite confidently that Brazil’s central bank had more than enough FX swap capacity and dollar reserves to do whatever he might like with the real.

The ironically named Mr. Goldfajn didn’t address the elephant in the room, of course, nor did he have to as the mainstream just ate it up like always.

“The Brazilian central bank continues to have considerable ammunition to intervene in FX markets,” said Gustavo Rangel, chief economist for Latin America at ING Financial Markets LLC in New York.

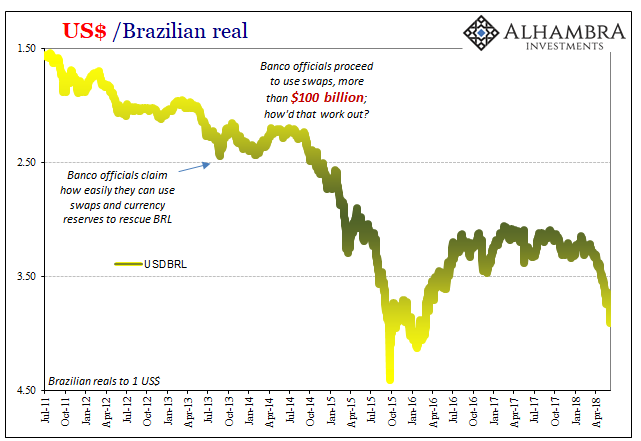

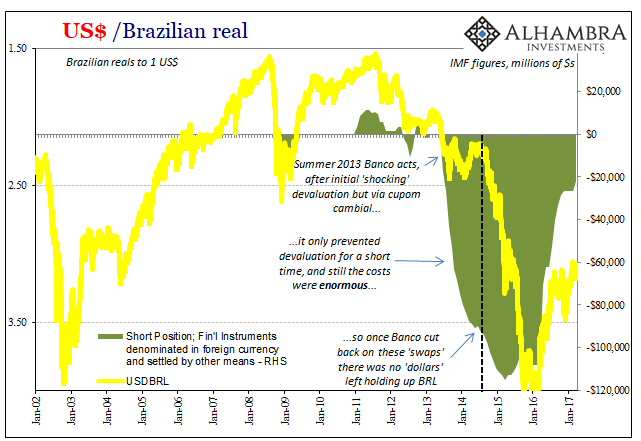

We are just short of five years from when the last Banco chief called a press conference in 2013 to declare pretty much the same exact thing. Only then, Banco acted and had initiated a swap program that by early 2015 had extended to more than $115 billion. It ran so smoothly, the Brazilian economy is today celebrated as the model for how all EM crises should be handled.

Just kidding. Of course not. The real crashed and with it the Brazilian economy. But we are supposed to believe in some alternate history where none of that happened, or that Banco’s swap program meant for the real to take out 4.00 and unleash internal Hell.

Yes, they are calling us all stupid.

Stay In Touch