Last week, it was overseas central bankers who stole the show. Many of them particularly in EM locations have had a really rough go of late, and a few in particular wanted the world to pay attention to dollars. Not any dollars, of course, as that would be far too easy. Rather, offshore “dollar” markets have found a few voices.

This week, by contrast, we go back to the domestic monetary agenda. Beginning tomorrow, the Federal Reserve’s FOMC will begin its normal deliberations over monetary policy. It is widely expected that the Committee will vote for another “rate hike” on Wednesday.

That may not be the primary matter of discussion, however. In fact, there are hints that other technical issues may take center stage from what should be a routine, incremental policy shape. Disclosed within the published minutes of the March 2018 meeting was a vague reference to possible considerations for altering the corridor.

US dollar monetary policy does not work like it used to (boy is that an understatement). Before the Great Financial Crisis (that was supposed to be impossible), the FOMC voted for a single target for a single money rate; in this case federal funds. Throughout most of the history under this sort of interest rate targeting regime, the effective federal funds rate (EFF), the weighted average of actual transactions taking place in that market and reported by FRBNY, never strayed much from the policy target.

The lack of anything so interesting in federal funds projected the illusion of control; Alan Greenspan’s Fed said X and the market obeyed X through nothing more than the the “maestro’s” word. The US central bank never did have to do anything to get the market to shift, only threaten that if EFF didn’t stay close to target they would then do something (ostensibly with open market operations).

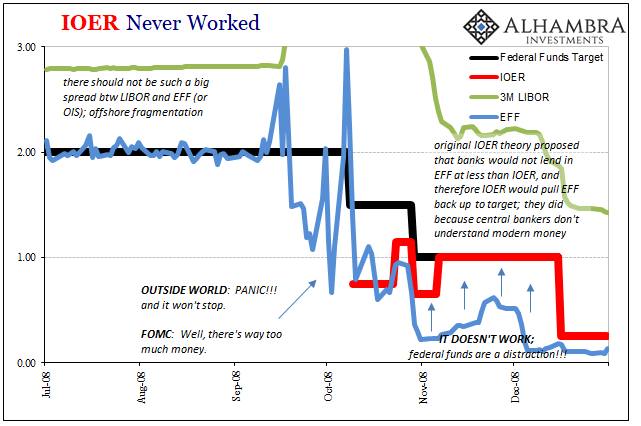

Starting August 9, 2007, EFF suddenly became very interesting. Given that this was a global monetary panic focused in US dollars, you might expect that EFF was too high for the FOMC’s liking throughout the period. That was true on August 9, but starting August 10 the opposite condition developed. Not only that, it stayed that way particularly during the worst parts of it.

In their infinite ignorance, central bankers tried to claim that the conspicuously shallow EFF was a product of their own efforts. The Fed in its increasing panic attempted to arrest the worldwide monetary disaster through various liquidity programs, the byproduct of which was an increase in the level of bank reserves (more assets, little absorption, therefore reserves rise as the leftover). They thought this way simply because the textbook writes a central bank into the monetary center.

Instead, the dramatic divergences between EFF and LIBOR more effectively described the situation as it really was. Offshore (LIBOR) it was total devastating chaos, and nothing the Fed did (including dollar swaps with foreign central banks, the factor most responsible for the increase in bank reserves during the crisis) alleviated let alone arrested the catastrophe.

The FOMC tried various means to pull EFF back up to their target, including reverse repos and an increase in the UST’s discretionary borrowing (which had the further byproduct of creating additional T-bill-like collateral, similarly ineffective in repo). Finally, in early October 2008 they received statutory authority to move up payment on those excess reserves.

This IOER rate was meant, not thought, meant to put a floor under EFF that the FOMC could then control. It never worked. The reason it continuously failed was simple – central bankers don’t understand the modern monetary market. Their biggest blindspots were and remain offshore vs. onshore dollars as well as dollar vs. “dollar.” These are not trivial distinctions.

During the Greenspan era, central bankers (not just those in the US) had grown lazy and disinterested. They stopped investigating modern money long before because of, as Alan Greenspan admitted in June 2000 (and many times before), the “proliferation of products” that were even then in use as monetary equivalents was so far out of control there was no way to define money. And if you can’t define it, you can’t even begin to measure.

Thus, so long as the federal funds rate behaved, it was merely assumed the Fed remained in control of monetary conditions (the several bond market “conundrums” were a related reminder that wasn’t true). The test of that hypothesis began August 9, 2007, which our central bank as well as all the others failed spectacularly in it.

Rather than use the massive worldwide episode to learn what went wrong, it was (again) merely assumed that though they performed poorly (if courageously, at least according to some) the Great Panic of 2008 was just a temporary moment of embarrassment. Through the use of large scale asset purchase (LSAP), or quantitative easing (QE), central banks would regain their authority in practice if no longer in simple threat.

The QE regime rather further established beyond all doubts what was proposed and proved during the crisis. There is no money in monetary policy; global money resides, and behaves, elsewhere.

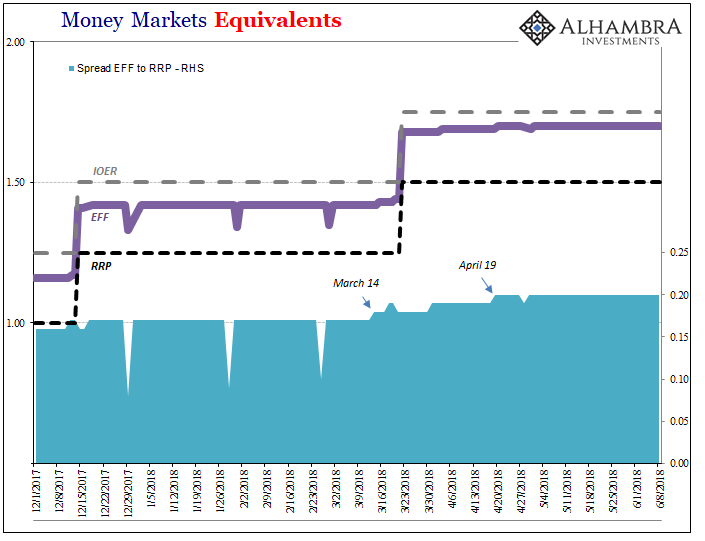

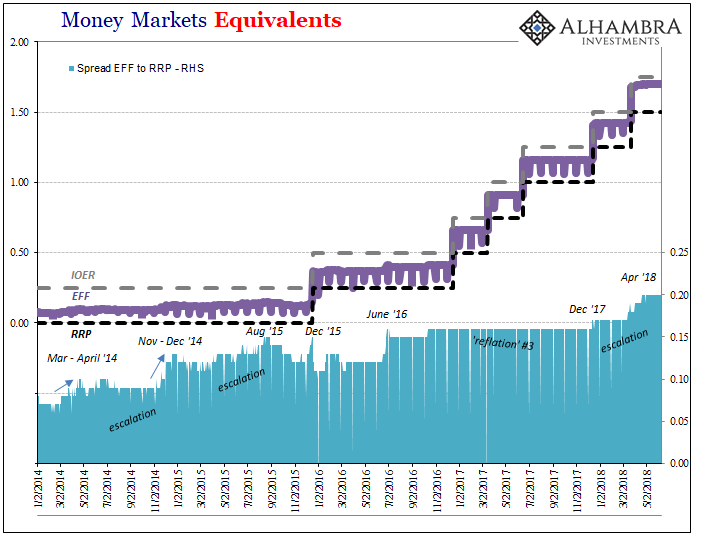

In very partial recognition of this fact, the Federal Reserve no longer uses a simple target to convey its monetary policy intentions. There is the balance sheet dimension, which is a similar distraction, and now a corridor for the federal funds rate. On top of this policy range resides IOER – again, an embarrassing acknowledgement that it never was a floor (though, curiously, no explanation for why). At the bottom is the reverse repo, or RRP, which has itself failed so many times especially last year in relation to T-bills (that would often yield less than RRP).

The issue this week, perhaps, is again EFF only this time the effective rate is pushing a little too high for the FOMC’s comfort. It is still less than IOER, but since mid-March that distance has shrunk to just 5 bps.

The bigger issue is, as always, they really have no idea why EFF is exploring the upper ends of its range.

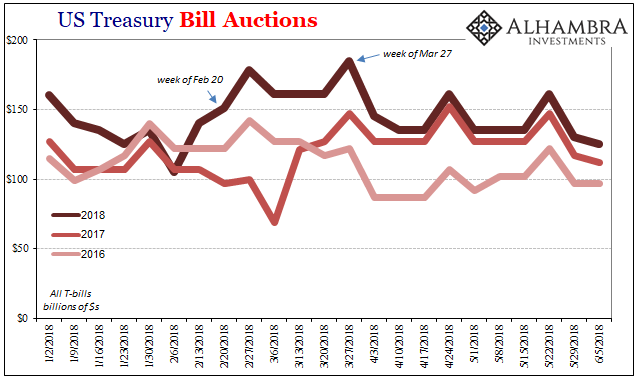

No one is 100 percent sure. But a prevailing theory, one shared by Fed officials, is that a big burst of Treasury bill sales — nearly $350 billion in the first quarter, partly to fund tax cuts and a surge in government spending — flooded an already saturated short-end market, fueling a spike in bill yields. That pushed other key overnight rates higher, especially in the market for repurchase agreements. As these other short-term assets became more attractive alternatives to lending reserves to other banks, the availability of funding lessened, putting upward pressure on the Fed effective rate.

Yeah, no. What’s really going on is again very simple. The mainstream and central bankers at the front of it are trying their absolute hardest to deny what in their world cannot be; even though what “cannot be” is just a repeat of what has already happened several times before to uniformly tragic effect. They have to propose the utter absurd (and easily disproved) in order to avoid realizing and confessing to the fact there is no money in monetary policy, and that central bankers have no idea what they are doing on the most basic level.

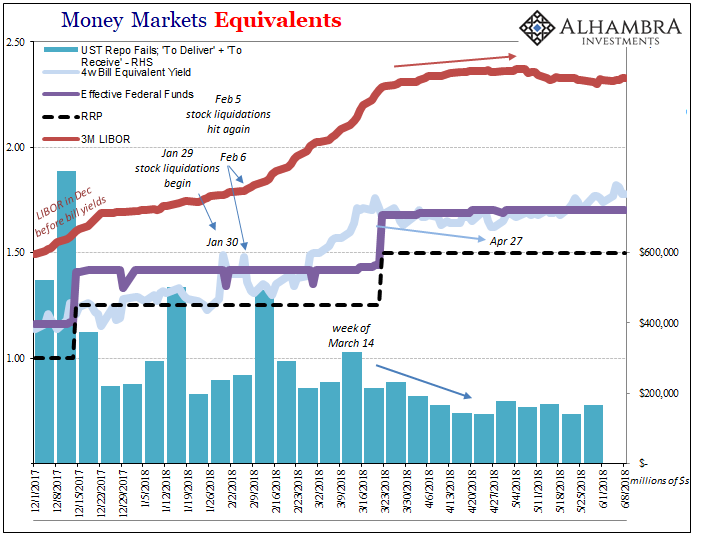

If we isolate just EFF and its relation to either IOER or RRP (I’ve used a positive spread to RRP), it doesn’t look like much but it’s clear anyway:

The T-bill theory, therefore, has some rather large holes in it. Why didn’t EFF start moving higher in mid- or late-February when the “deluge” of bill issuance began? Why didn’t the EFF spread renormalize after it ended in late March?

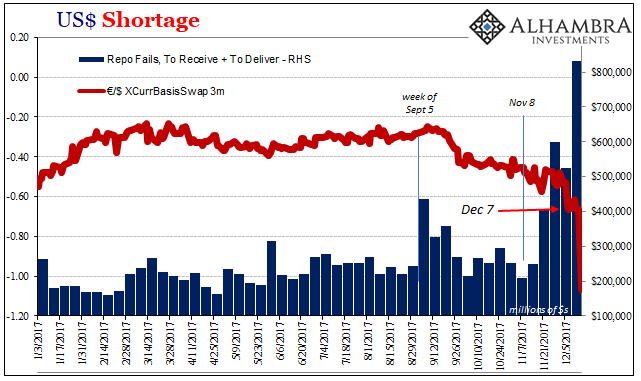

Not only that, April 19 is a prominent day on practically all the EM currency charts that matter. In other words, there was tick up in the federal funds market indicating illiquidity in between the last jump in repo fails (March 14) and the breakout of desperate global currency crisis (April 19). What a huge coincidence.

Except it isn’t. The federal funds market is for practical purposes not very important anymore. Briefly, beginning in August 2007, overnight and short-term funding shifted away from unsecured as in federal funds (and also eurodollars, LIBOR) to repo. That doesn’t mean, however, federal funds is completely dead. We need only go back a few years to see why:

The EFF spread to RRP has acted like this before during a very similar period where FOMC officials were equally baffled by what was going on in the world. Back then, they talked about “overseas turmoil” that was certainly overseas just located in offshore dollar markets.

The EFF spread started to rise in March and April 2014, which if you may recall was a big deal also in a place central bankers don’t consider – at least those authorities not located in China. It was at that time the “rising dollar” began to be noticed in Asia, particularly CNY.

The big jump in spread November and December 2014 followed closely the clear warning of October 15 that year, and coincided with global fireworks that included the main oil price crash, a dramatic decline in UST yields, a ruble crisis, a real crisis, and ultimately the first big broken foreign central bank following in January 2015 (SNB).

The next jump for EFF was up and to August 2015, which if you might recall there was something going on then with CNY, too.

To be clear, I’m not saying that tightness in federal funds was the cause of all or even any of those things. It almost certainly wasn’t. Instead, what is more likely to have happened was how global “dollar” tightness was so severe at times it actually registered very close to home (for the FOMC) in an out-of-the-way money market. If it hit in EFF, what does that say about the scale of the problem outside of there where it might instead really matter?

The same goes for “reflation”, too. Between June 2016 and December 2017, the EFF spread was nearly perfectly stable at 16 bps (not including month-ends). In December 2017, however, this happened:

The global basis (XCurrBasisSwaps in all denominations) crashed on December 7, 2017, falling precipitously to a shocking low on December 15. The day the previously steady 16 bps EFF spread turned to 17 bps? December 12.

Let’s review. The FOMC is thinking about getting involved in 2018 because unlike 2014-15 it is merely assuming that once again like the precrisis era correlation is causation. As I wrote last week, this is the sole reason why the “rising dollar” was largely ignored. Since the Fed wasn’t tightening policy convention believes (despite a decade of evidence to the contrary) there couldn’t be any tightening in dollars.

The result was absurdity to the point of often comedy; the extraordinary lengths the media and central bankers went to try explain away a massive, almost textbook global “dollar” deflation event. In the official record, it never happened.

Now that the Federal Reserve intends to “tighten”, even though it really has no effect, now “we” can admit there might be tightening (including these things that are so similar to the last “rising dollar”). But still the emphasis lingers exclusively on the central bank. The result is once again absurdity and comedy, especially the preposterous notion that despite all its tragic history changing the IOER will accomplish anything of value (unless you consider, as I do, providing more evidence Federal Reserve officials are technically incompetent as valuable).

It’s another unhelpful distraction, too, because they put the focus on federal funds where it doesn’t really belong. Since August 9, 2007, federal funds are at best a secondary notice of what’s going on elsewhere that is of supreme importance – offshore “dollars.”

Stepping away from central bankers and central banks, the only word that comes to mind, the only word that matters, is escalation.

That just can’t be, so T-bills or something. And IOER. It never worked from Day 1, so of course it makes perfect sense for this mess of absurd denial.

Stay In Touch