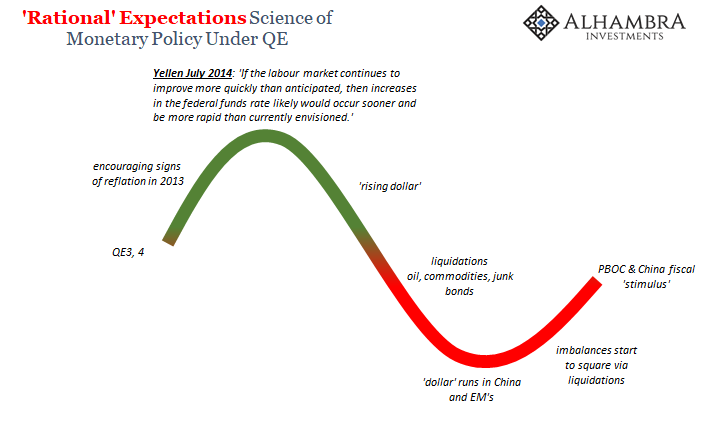

In July 2014, then-Federal Reserve Chairman Janet Yellen testified before Congress. It was the usual Humphrey-Hawkins stuff, except in this instance at that particular time there was every reason to suspect things were finally changing. The unemployment rate, in particular, was sinking like a stone dropped in a pond. Some additional economic indicators signaled perhaps the pathway toward substantial improvement over the economic dud of 2013.

She therefore suggested to Congress:

If the labor market continues to improve more quickly than anticipated, then increases in the federal funds rate likely would occur sooner and be more rapid than currently envisioned.

Central bank officials often make similar kinds of statements, keeping them more toward bland platitudes than anything specific. Alan Greenspan once (in)famously said, “I know you think you understand what you thought I said but I’m not sure you realize that what you heard is not what I meant.” This was different; Yellen had a purpose.

And it was taken that way. This decidedly “hawkish” tone derived from the first part of her declaration, not the second. She clearly felt the labor market was behaving quite favorably so as to more confidently extrapolate where that would lead if it kept going.

She was also predictably cautious about it, too. Referencing too many “false dawns” that had plagued Bernanke’s tenure, the Fed she said was caught between hope and reality. Once hope turned to reality, that would be full recovery.

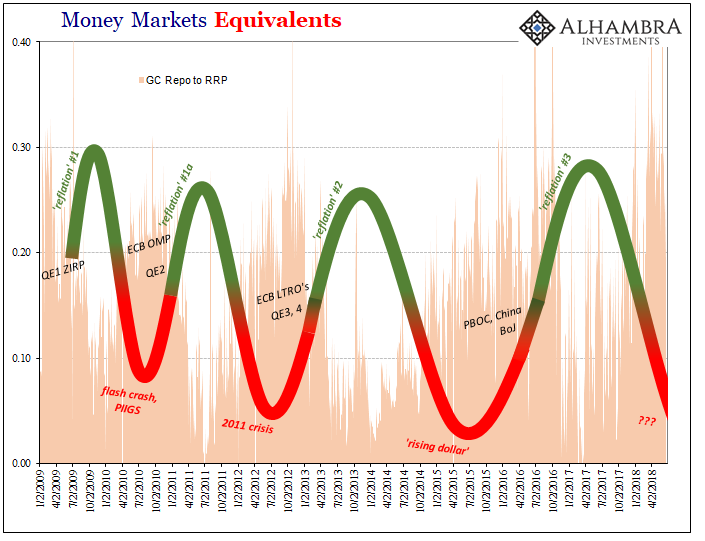

It never happened. Like all the others before, 2014 turned out to be nothing more than the next iteration of the false dawn. Reflation #2 ended for the US in a sharply lower unemployment rate that was uncorroborated by anything else. A manufacturing recession, a near recession in GDP, and what’s more, income growth that has substantially weakened since then leaves the US much worse for the trouble.

And that was nothing compared to what ended up taking place elsewhere around the world.

What we are interested in 2018 are the parallels. For one, there exist right now far too many. They aren’t so much parallels as repetition, the “s” indicating plural on the end of “false dawns” that raises suspicions about the current climate of economic optimism.

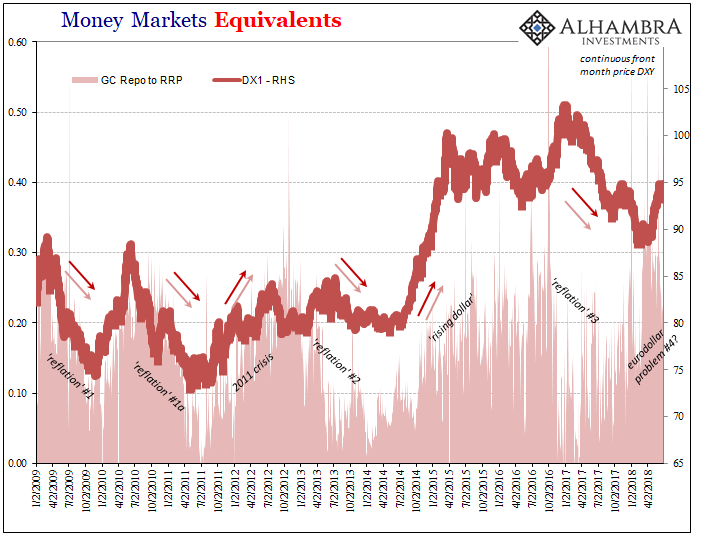

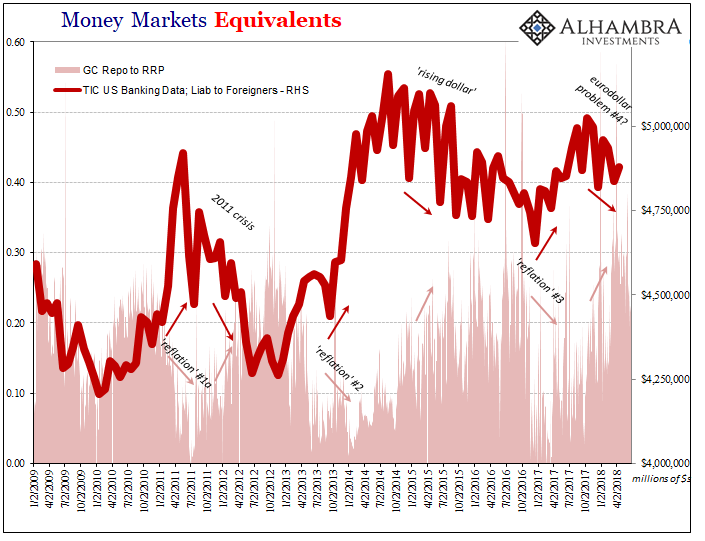

By the time Yellen turned “hawkish” in July 2014, the eurodollar markets had already begun transitioning toward doubt. From that middle or peak, we can reconstruct the cycle.

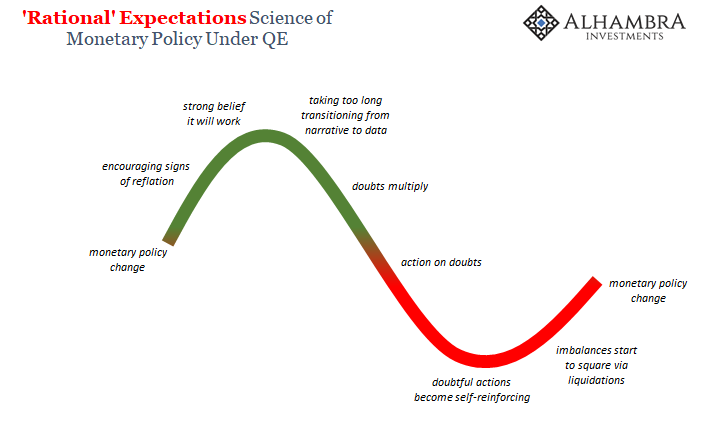

It typically begins inside one of the world’s major central banks, or, as has happened frequently enough, more than one. A monetary policy change is implemented which immediate triggers a flood of obedient drooling. Whether or not that alteration is actually the cause of an inflection doesn’t really matter at the time, especially as more encouraging data comes in suggesting that things aren’t getting worse (reflation).

That eventually passes from cautious optimism to outright hawkishness not just in interpreting central bank statements but among the wider class of economic commentary. If QE3 and 4 were the basis for that particular cycle, by the middle of 2014 there was universal belief in their efficacy – as exemplified by the unemployment rate.

However, these subjective interpretations aren’t nearly enough to sustain the cycle – or the economy, for that matter. Expectations won’t do it alone. What ends up happening each and every time is too much time; by that I mean hope rises on introductory signals but then it takes too long to become more than that, where hope remains unfulfilled by actual data or more so market (not stocks) confirmation.

Not one or two economic accounts, either. A recovery, a real V-shaped monster, is universal to the point of being uniform. When it happens it happens everywhere and across everything (almost, but you get the point).

These false dawns fade toward black (or red, as I’ve colored their transition) when enough people/investors/economic agents begin to suspect one or two good numbers aren’t actually representative of the underlying condition. If this situation persists, as it has in each one so far, those growing doubts turn into action.

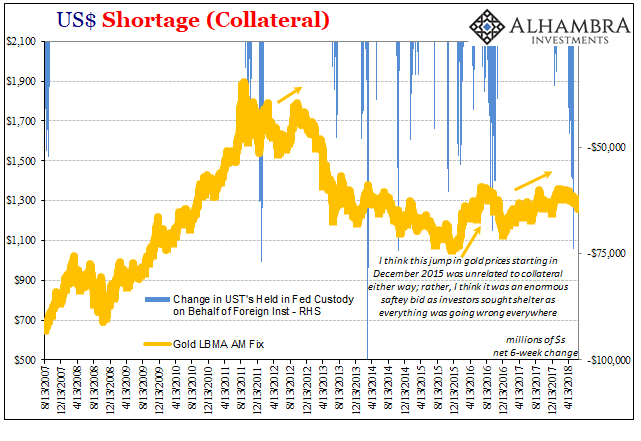

Where it really matters is in balance sheet capacity and global “dollar” liquidity. Ultimately, economic growth is opportunity; recovery would be opportunity far and above lingering risks, primarily liquidity risks. If risk perceptions unbalance again in the wrong direction, first you pull back and then you withdraw as the data never quite matches the rhetoric. Risk overwhelms again.

Past some critical threshold, these negative pressures become self-reinforcing; increased doubt about opportunity and risk, less balance sheet capacity offered, the economy (and markets) suffers for this tightening, leading to more doubts about opportunity and risk, and so on. Eventually liquidations, even shadow runs.

These square some positions such that negative pressures abate around the same time central bankers are awakened from their fairy tales to the blistering difference of another false dawn. They act, the cycle repeats.

At least it has so far.

The 2014-16 downturn was, again, just the latest cycle in the same process. That’s ultimately our goal here, to try and determine if in 2018 we’ve escaped the vicious circle. In order to do that, something meaningful must have already changed. It can’t have been some textbook monetary policy maneuver because they’ve all been tried to no success over a long enough period of time and across so many geographical dimensions the empirical rejection is quite emphatic.

What’s happened so far in 2018, starting around September last year, doesn’t make it look very good for this one, either. Jerome Powell sounds a lot like 2014 Janet Yellen, using the same unemployment rate uncorroborated by a broad economic survey (or even a narrow one, like wage acceleration). The markets have grown tired of waiting for more than talk about globally synchronized growth.

Where is it?

Doubts have multiplied and I think we are back somewhere in the red again. There are way too many indications pointing in that direction – so many that officials have been forced to address this situation, even if their tempered explanation is childishly nonsensical.

But I don’t think we have quite yet reached the point of the self-reinforcing spiral. Obviously, there is no possible way to tell for sure; that’s merely my guess. I think it’s also the position of the UST market and the yield curve; it has been flattening but not inverting. The long end remains relatively stuck; no longer the rising nominal rates of the inflation hysteria, but not quite yet pushing considerably lower as narrowed doubts turn toward outright fear – like December 2014.

There was the bond market event of May 29, but like the similar one from October 15, 2014, it may mark an early stage of the cycle turning red rather than a later stage. Again, that’s my guess.

It’s important also to note that “they” never have an answer for the clear shift toward tightening. Even just this year we’ve been through how many explanations? Korea, inflation, Italy, trade wars, T-bills; the red remains consistent no matter any of them.

We also should make plain none of this will have been “unexpected.” It’s only thought of that way conventionally because the mainstream remains in the top of the green while everything else progresses into the red. It’s only at the very bottom of the red that anyone considers maybe the unemployment rate is confused.

There are, obviously, a lot of unfilled gaps in this picture. There is enough roughly filled in, however, to suspect quite a lot. It started with repo, and that part is confirmed. The real question is what this all means, up to and including whether it marks like fails in June 2014 the start of whatever the next phase of eurodollar decay might be. We obviously won’t know anything like that for some time (and we have to be very careful about bias, meaning that since I suspect it, it’s easy to believe and see what I think is already there), but the biggest clue will be in escalating warnings like this.

Stay In Touch