Chinese officials are getting nervous. Everyone knows that whenever your favorite sports team struggles and fans are calling for the head coach’s head, any owner or general manager who then issues the dreaded (from the coach’s perspective) vote of confidence is essentially sealing his fate. PBOC Governor Yi Gang issued a similar sort of statement today.

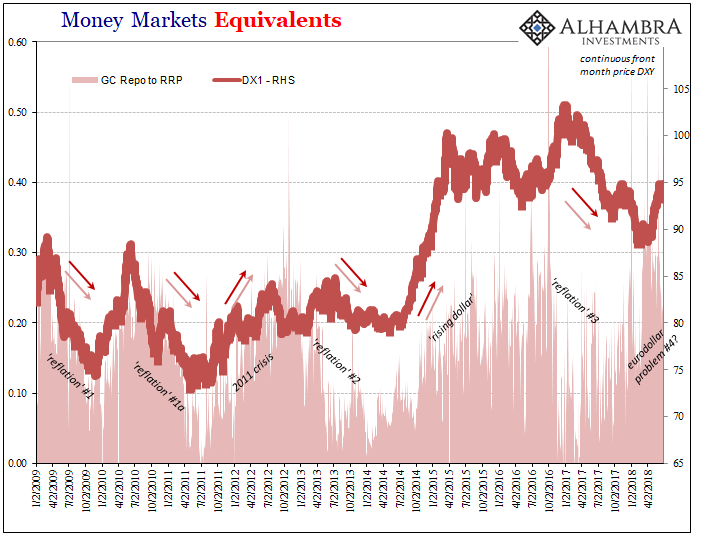

CNY is in freefall, which is dangerous in and of itself but more so given the (mistaken) political ramifications. Not only do the Chinese bear the brunt of “dollar” misfortune, they will also be blamed, just as they have been already, for engineering the stunt in the name of trade “stimulus.”

There was nothing really of note within Yi’s message. The significance is that there was anything provided to the public at all. A vote of confidence rarely works; not in sports and certainly not in central banking. There is as much danger that any central bank putting out a message will only end up confirming the worst fears (if they feel they have to say something, what does that really mean?)

The issue is further complicated by the unsettled nature of the current PBOC political framework. When Zhou Xiaochuan was leading Big Mama, he was also its political official. The latter is actually a separate office than the Governor, and in Chinese practice outranks the former.

Zhou held both posts meaning that there was never any issue between strategy and tactics. The political office defines the long-range policies of the central bank while the Governor runs the day-to-day operations. He only needs to seek approval for any measure or policy that might fall out of the norm.

That’s the question about Yi Gang’s statement. Are the operations people the only group sweating CNY’s drop? Or does this go all the way up?

The top political post at the PBOC is now occupied by Liu He. Liu, or Uncle He, is one of China’s Vice Premiers and also a Politburo member. He has been an economic skeptic, meaning what would count against the mainstream view of the global economy as more of a realist. In my view, it’s very doubtful Liu and Yi aren’t on the same page. CNY for both is a big problem, but one they aren’t exactly surprised by.

Bloomberg is reporting today on comments from another PBOC official. According to the report, Guofeng Sun, head of the financial research institute at the bank, was quick to dispel any ideas about the yuan being used as a lever in the current “trade war.” Instead, he points out another far more likely, and troubling, development:

Recently the yuan’s exchange rate has shown some weakness. This is entirely due to changes in market expectations as external uncertainties rise rather than intended guidance of the central bank.

What might those rising “external uncertainties” be? Rising “dollars?”

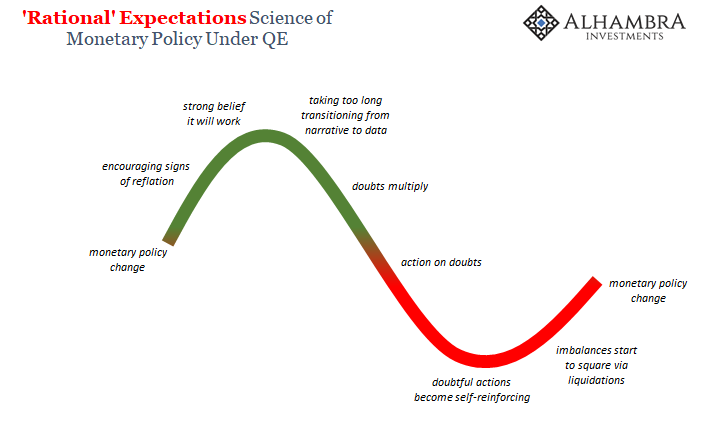

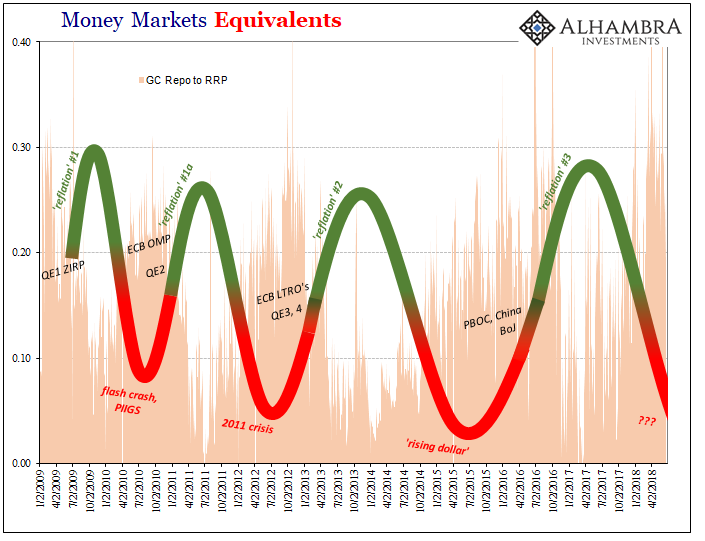

The eurodollar cycle is playing havoc with everything (again). We can even witness the effects in Chinese data.

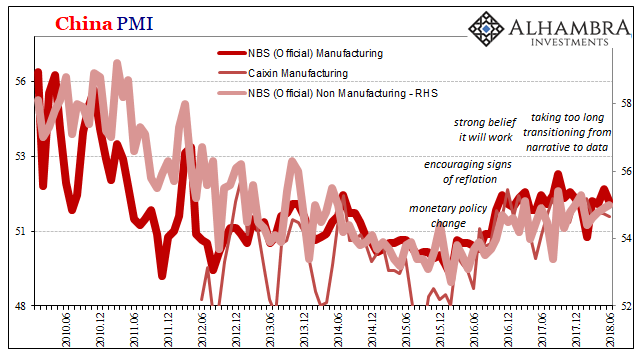

China’s National Bureau of Statistics released recently PMI levels for the month of June 2018. The manufacturing version fell slightly while the non-manufacturing index was up a bit. Neither of those moves made any significant difference. What both suggest instead is that according to the PMI’s China’s economic acceleration seems to have stalled.

And not recently, either. This plateau, more or less, dates back to early 2017. In 2018, it remains but with more downside indications (especially in things like manufacturing export orders).

This is not the globally synchronized growth eurodollar money dealers were promised and were to a limited extent betting on when they embraced reflation in the second half of 2016. It is better than 2015 and early 2016, but that was a nasty global downturn, hardly any rational basis for comparison. Following such an event, even just according to basic symmetry there should have been far more “V” long before now.

Instead, China’s economy like so many others suffered the downside and then the more troubling development of an “L” following it. There isn’t any additional growth indicated over the last two years than there was in 2013 and 2014 when the last eurodollar event took root.

The Western media hasn’t noticed, but more than a few market participants in some of the most important markets have. Economists don’t get it, either, especially since most are happily slapping each other on the back for this “boom.”

This is pretty abhorrent stuff in several ways. Economic illiteracy, gross top-level incompetence, and even the often blatant dishonesty that goes with it all.

The day before Independence Day, we are forced yet again to recognize that China’s Communists know more about the dollar than any American official (or American, for that matter). This is so dastardly upside down, yet it explains a lot about how the world economy could lose the last ten years then begin this second decade starting out even more lost.

It’s been so long since one happened, everyone seems to have forgotten what a boom actually looks like. Severe currency disruptions especially for the world’s second largest economy isn’t it.

Stay In Touch