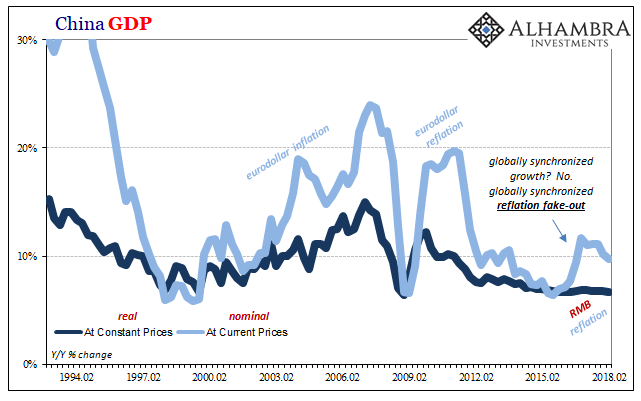

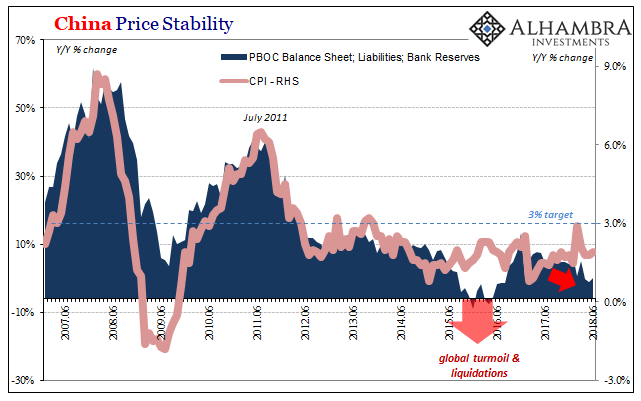

For the second half of 2015, how dicey did it really get in China? It’s difficult to assess going by something like real GDP given how notorious the Chinese have become for hitting their growth targets no matter what. But for those two quarters we can infer a whole bunch of nasty problems by the difference between real GPD growth and nominal expansion. In both Q3 and Q4 2015, real GDP was gaining faster than nominal (deflation).

That answers for the official freakout in Q1 2016, monetary as well as fiscal. It was begrudgingly admitted in the Western media how the Chinese might find themselves staring into a “hard landing” when in fact that may have been the most charitable interpretation of how things could have unfolded.

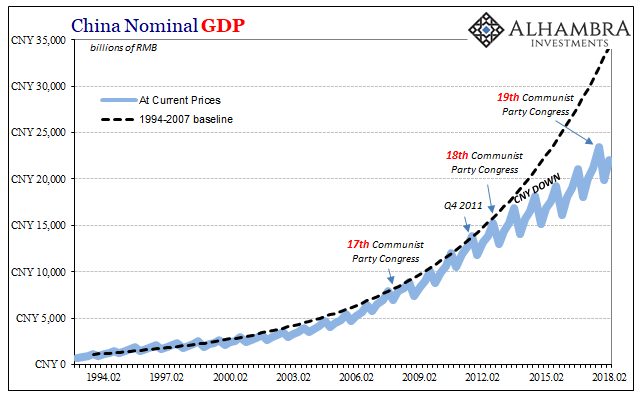

Nominal Chinese GDP follows Reflation #3 very closely; or, more precisely, Reflation #3 takes on these proportions more properly rearranging global cause and effect. GDP growth in current prices peaked at 11.7% year-over-year, but in Q1 2017 now five quarters in the past. The latest estimates for Q2 2018 released over the weekend have China’s nominal growth back under 10% again for the first time in a year and a half.

The current direction is as important as the level.

So, while local Chinese government officials hit their real GDP targets, in nominal terms we can better appreciate the growing turmoil of 2018. Globally synchronized growth was supposed to mean acceleration not deceleration as has become more apparent in China and beyond. A grand global slowing fits with what’s actually happening in markets (rising risk).

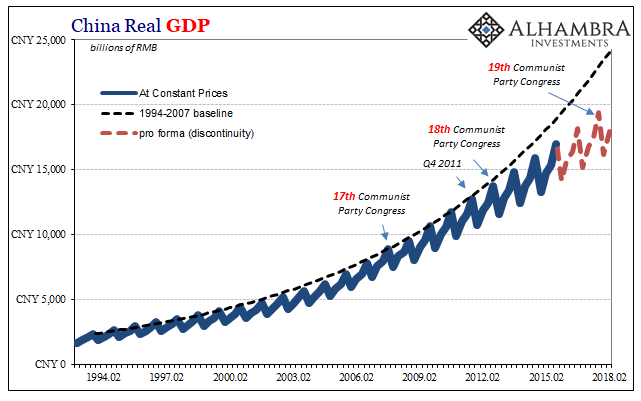

Chinese GDP therefore projects both the big problem with the single global economy, even as in real terms the economy hit its mark yet again in Q2 2018 (6.7% year-over-year). It falls further and further behind as time passes largely because of these “L’s”; in other words, after each slowdown there is an obvious and frustrating ceiling “somehow” imposed during the disappointing upturns that follow them. The net result is trouble in two dimensions; the baseline “L” with time on the wrong side and the falling into the next potential downturn in 2018 rather than the other way toward recovery.

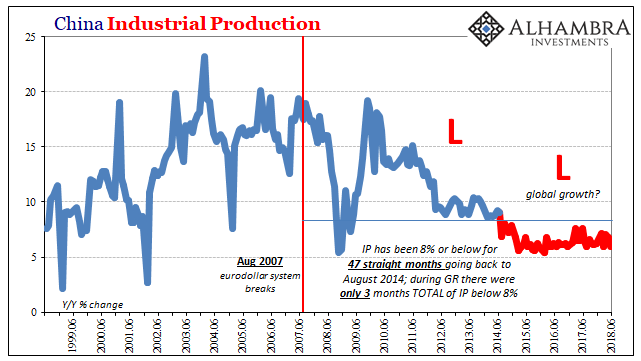

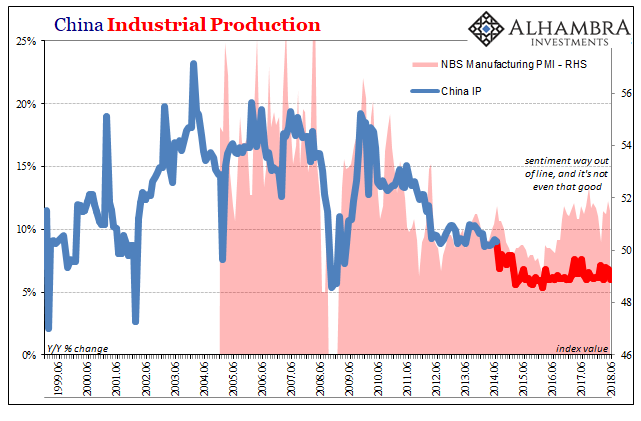

From this perspective the rest of China’s economic accounts make much more sense. The Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment (FAI), all exhibit the same troubling tendencies. Industrial Production fell back to just 6% year-over-year again in June 2018, with Chinese industry now just one month shy of four years at this same low level. China was once the world’s industrial engine, the means for global growth in actual rather than rhetorical terms. It still is, only now it does nothing other than sputter in direct contradiction of the Western boom narrative.

It’s an interesting as well as telling phenomenon about how in China as elsewhere sentiment is now better than during 2012-14, yet actual production is appreciably and perhaps permanently worse. It further shows just how different these circumstances are from anything ever printed in the Economics textbook. Economists aren’t really equipped to handle this kind of situation, though central bankers should be given where all this starts.

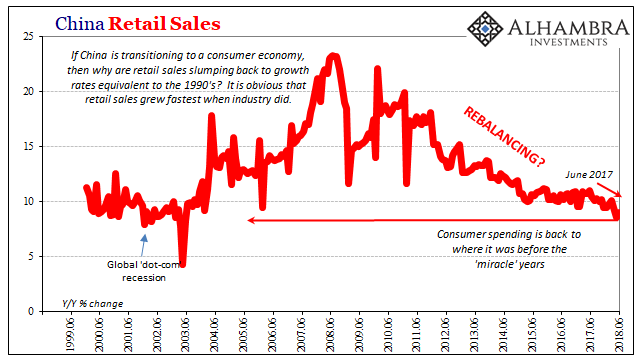

While it may be expected for manufacturing to struggle, Chinese retail sales weren’t any better. If there was hope in the world for globally synchronized growth it was that early 2016 Chinese freakout.

To the Western media, it proposed a swing of the pendulum back in favor of the precrisis condition; the government in China after surviving the 2015 downturn and brush with real deflation would go back to prioritize growth over every other consideration. The global economy was supposed to be much better off for it, bridging any lingering gap between weakness in the developed world and the resource economies situated below China in the global supply chain.

Retail sales data especially since the middle of last year indicate something else. For the month of June 2018, retail sales rose 9.0%, up from a low of 8.5% in May, but really not suggesting a change in trend that now spans a full year.

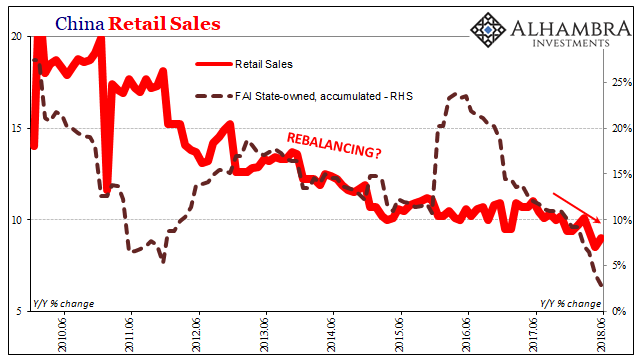

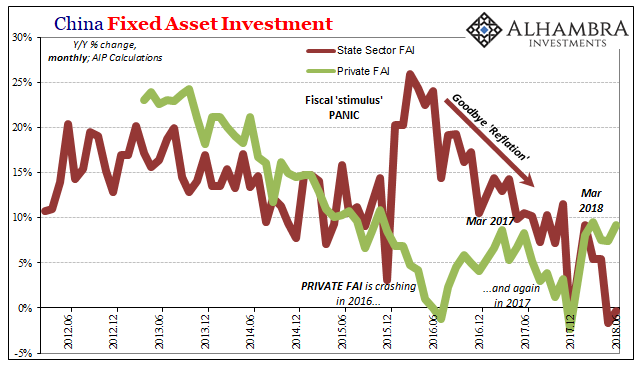

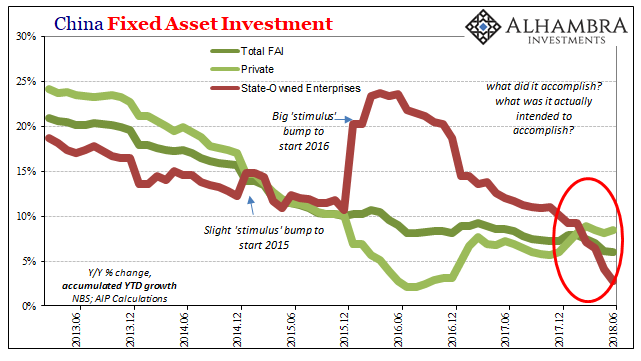

The slowdown inside China seems to have returned and it is timed to official action. FAI through state-owned entities (SOE) was the primary fiscal “stimulus” which was simply and vastly overestimated in the collective Western opinion. Misunderstanding what it was for, as well as assigning it almost magical properties, conventional commentary looked upon the actions of early 2016 again in a way that wasn’t appropriate to the setting or the intent.

Chinese authorities are now actively pulling back FAI without any meaningful acceleration having been obtained. For the second month in a row, and the third of the last seven, official FAI is contracting making plain this official intention.

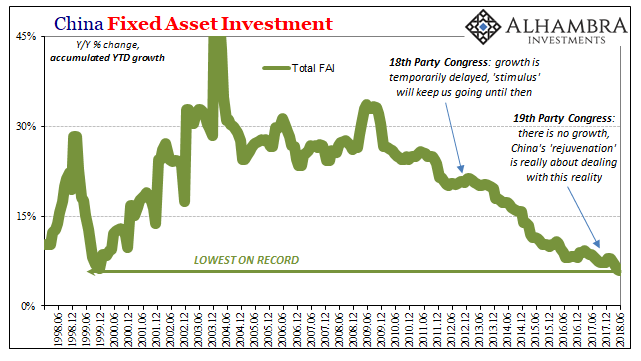

So far, private FAI has held up but that may be nothing more than a matter of time especially as the rest of China’s economy decelerates underneath. As it is, the current levels of private FAI aren’t that much different than last year or the year before, nowhere near prior peak levels. As a result, total FAI, the backbone of China’s “economic miracle” is disappearing into the bottom handle of the big “L.”

For the six months so far of this year, accumulated total FAI was just 6.0%, the lowest recorded in data stretching back to 1997.

This is not the way it was supposed to go. And though it may seem like the US unemployment rate is unrelated to China’s gathering slowdown, or rather re-slowdown, it actually isn’t though it should be. If the US was really gripped by a legitimate boom of true 4.0% unemployment, China’s economy just doesn’t behave this way. This is a world without growth, not just a specific economy here or there.

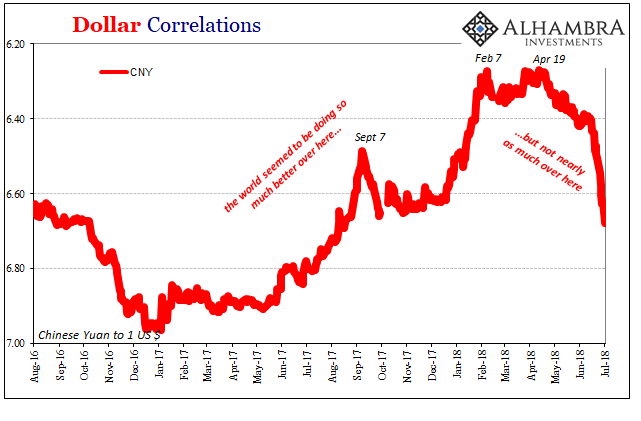

Money problems in China do reverberate from Wal-Mart to Wall Street but that’s as a second step (reverberating reverberations). The first is what happens out there in the world in between all these conventionally laid distinctions, conventions that in practice don’t actually matter. Offshore currency is still the ghost in the shadows.

It was almost all the way back in the shadows to begin 2017, but the ghost is really starting peak out of them once again in 2018.

Stay In Touch