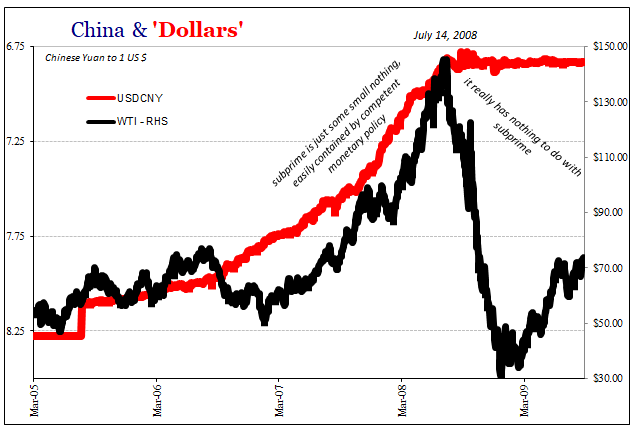

The term “decoupling” was invented in early 2008 really because of oil prices. It was widely believed that though the US economy might stumble that year (because of nothing other than subprime mortgages, naturally) the rest of the world would be insulated from any fallout. EM economies like China’s were immune from such folly, they said.

Like every other economic tall tale that has been told the last eleven years, the idea was born out of some evidence, misinterpreted though as always. Like oil prices, the first half of 2008 went along with the decoupling thesis. The second half, cleaved right at July 15, 2008, didn’t. It so didn’t.

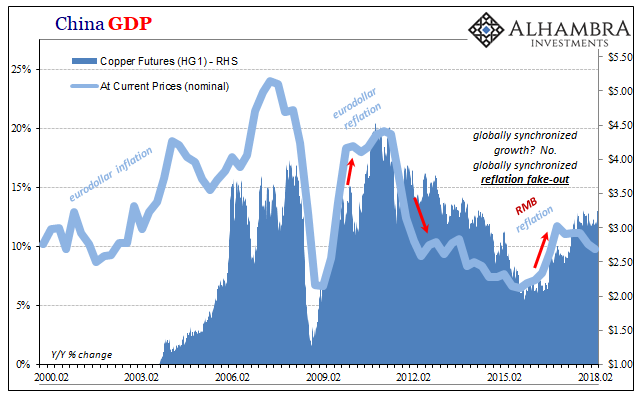

These are not separate systems that in times of trouble can merely go their separate ways. The eurodollar binds them all together. Before August 9, 2007, everyone thought that was a very good thing (globalization). Since, not so much.

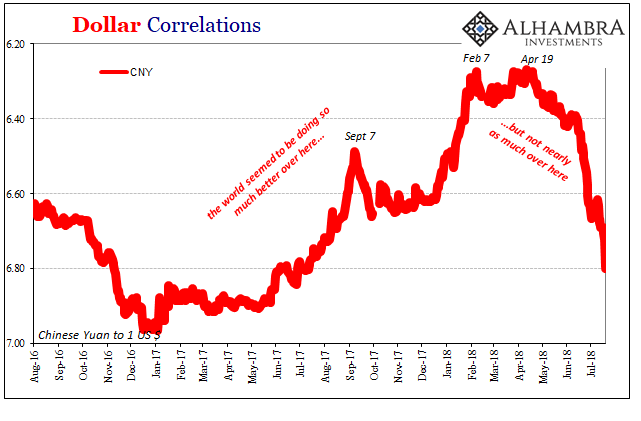

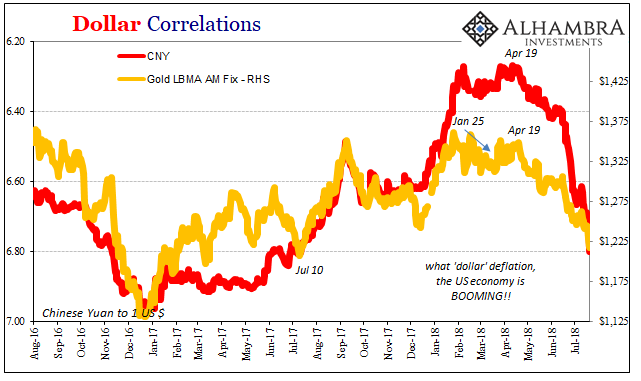

Ten years later, yesterday’s Wall Street Journal Economy Section according to M. Simmons. It seems to present now US decoupling:

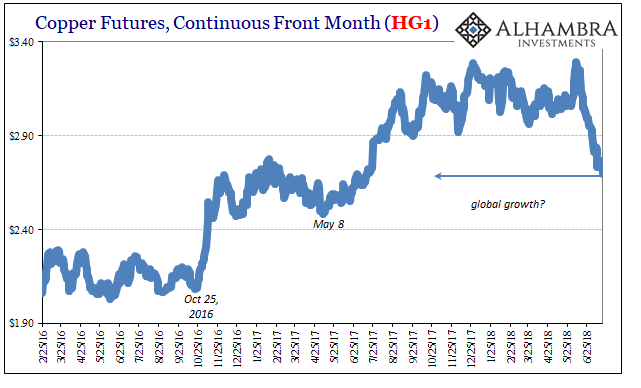

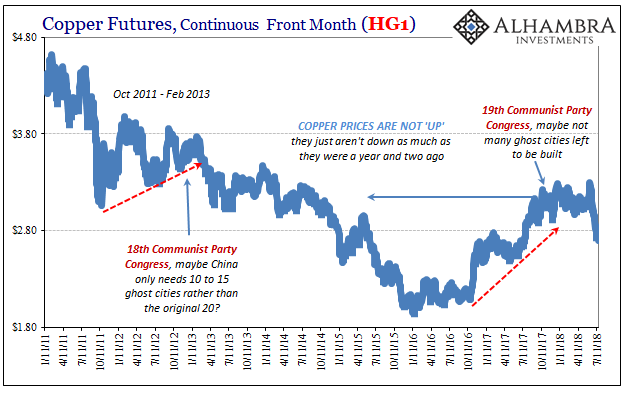

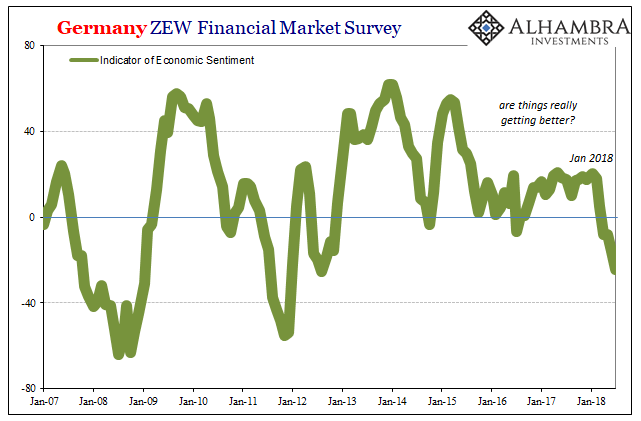

CNY is nearly at 6.80 as I write, copper is falling sharply again, and the eurodollar curve inverts just a little more. So, sure, the US economy is fine. Why wouldn’t it be? Jerome Powell testified in front of Congress that he sees nothing to make him think otherwise. Especially global growth.

Make that globally synchronized growth.

Stay In Touch