Why so much wholesale emphasis on collateral? Easy. The monetary history of recent times hasn’t been very kind in that regard. On the one hand, the repo market has become so much more important than it was, as scared interbank participants fled unsecured eurodollar markets eleven years ago next month for the presumed shelter of security(ies).

But in turning toward collateralized interbank funding, participants have run into almost constant problems here, too. That they continue no matter what suggests there just isn’t any alternative, an observation about both repo and repo’s suggestion of the eurodollar system as a whole. If you ditch unsecured for secured, where do you turn when secured isn’t so secure?

First it was any highly rated MBS (tranche) taken as pristine collateral, subprime or not; then only prime; then few if any MBS at all.

After that, primarily European banks sold their MBS pieces largely to the Federal Reserve in QE’s one and two – only to use the proceeds to buy sovereign debt like bonds issued by Greece, Spain, or Italy for repo purposes. These formerly risk-free were reclassified, and haircuts readjusted, in a hurry.

After some more central bank interventions in 2011 and 2012, including two more US QE’s, policymakers were shocked to find that market agents were forced to be creative with respect to this systemic shortfall. The system couldn’t just massively shrink the list of what goes for pristine collateral and everyone expect that it would be fine. Policymakers did expect that it would be fine. They always expect that.

If MBS were first to be reconciled from risk-free to risky, and PIIGS next on the journey, in 2012 and 2013 under the auspices of “stimulus” leading to the assured recovery it wasn’t really so shocking that junk corporates would form the basis of a third risk-free to risky transition. Why not use (and build monetary infrastructure around) what was plentiful in light of complete economic recovery and truly robust growth? That was the theory, anyway.

I wrote in August 2016:

Not only were dealers transforming US corporate junk collateral on behalf of much more than insurance companies, there is every reason to suspect that they, especially foreign banks in the eurodollar system, were also doing so for emerging market debt securities, too.

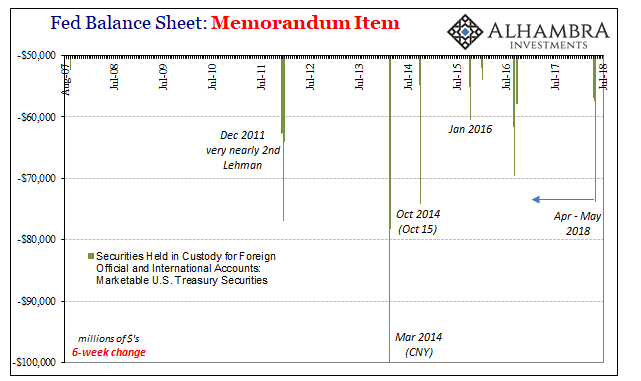

Collateral transformation never became a mainstream buzzword, but it should have. What really happened on October 15, 2014? The buying panic, really collateral call, in the UST market tells us everything about junk bonds and the mad scramble to find pristine securities with which to replace them in the repo (and FX) chain.

The junk bond market, as well as EM debt markets, was suddenly facing a serious reversal for the first time. Because of collateral transformation, we know that to some degree repo financing was being obtained through artificial means, an internal risk transformation that placed more risk upon dealers rather than directly of funding counterparties.

As junk bonds were being repriced, especially in the first two weeks of October 2014, so, too, was this repo collateral chain in exactly the same manner as subprime MBS once was.

With that long and tortuous history in mind, forgive money dealers if they are a little itchy and prone to flight for any presumed changes in the underlying collateral. It’s really not supposed to be this way, but it is and has been for a very, very long time (and some somehow dare to call this capitalism).

Secured lending is supposed to make things less risky, but like many eurodollar facets it has proven procyclical especially at the worst times like September 15, 2008, October 15, 2014, or May 29, 2018.

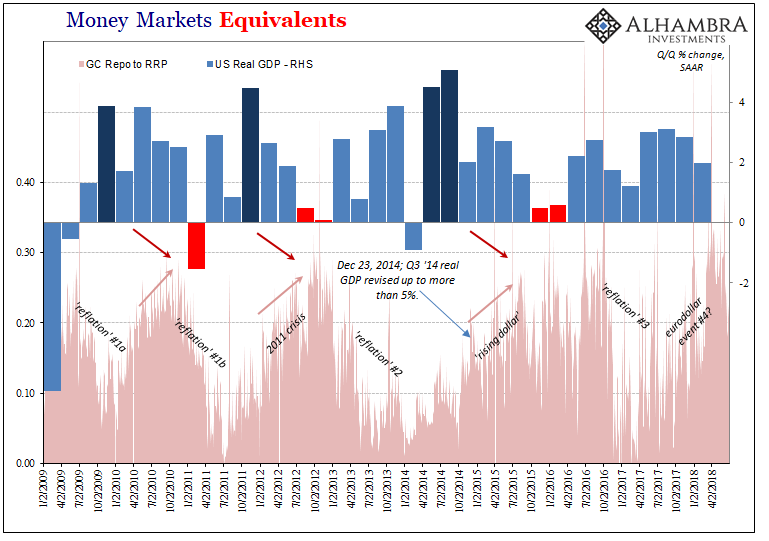

But while collateral calls can be dangerous leading up into them, and for what may eventually follow behind, there are times (also October 2014) when they end up being something like the eye of a hurricane. There is fierce storm ahead of the main episode and even worse conditions following, but for a nontrivial period of time there is falsely reassuring calm in between.

The reason is simple enough; a collateral call, like a margin call, forces market agents to do many things they don’t want to but in making these market participants do those things it also squares off imbalanced positions at the margins. In the often-inappropriate terms of Economics, a collateral call can create a new temporary equilibrium. Enough leverage is expunged so as to create a transitory settled state.

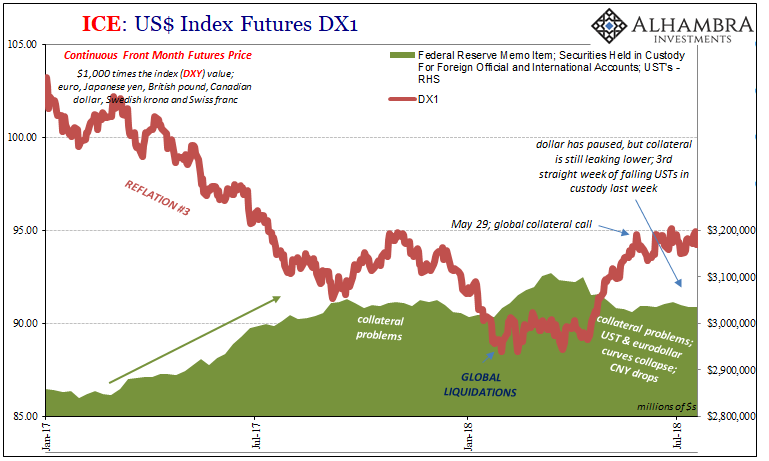

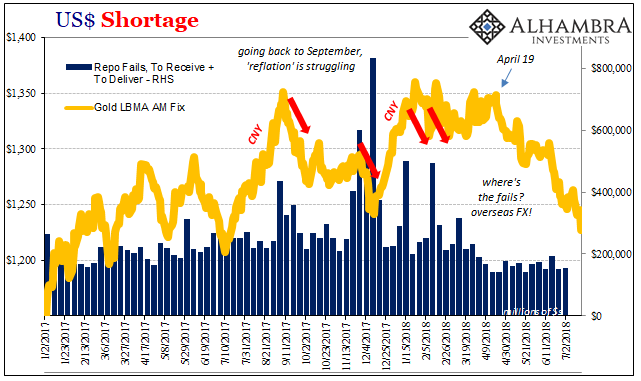

There is every reason to believe that’s what has happened following May 29. First of all, while the dollar was “rising”, precipitously, between April 18 and then overseas collateral indications were about as bad as they have been at some of the worst financial moments of the last eleven years.

Since May 29, things are not so disturbed as they were; the eye of 2018’s version of eurodollar storm. Some of that is surely due to widespread (and often ridiculously heavy) central bank counteraction, but a lot is almost certainly related to the calmer aftermath of this major collateral call.

It doesn’t mean, however, that everything is good to go now. In fact, there are several key indications and prices that suggest things may be picking up again on the other side of the eyewall. Gold keeps falling (deflation via collateral substitution) as do UST’s in Federal Reserve custody. It isn’t nearly to the same degree as from mid-April forward, but the decline over the last three weeks (through last week) is still substantial.

With no pickup in domestic repo fails (almost certainly thanks, ironically, to higher T-bill supply) the focus remains offshore.

The dollar has gone sideways since May 29, but that might only mean, as always, nothing goes in a straight line. What I wrote in 2016 about collateral in 2014 is useful again in 2018.

Third quarter [2014] GDP, the last quarter before the “rising dollar” fully bloomed, had been initially reported as 5% and the headline labor figures suggested, in isolation other than GDP, the arrival of the “best jobs market in decades.” Yet, right there in front of them was everything they would need to understand why GDP and the unemployment rate would never live up to their drowning hype: the growing discord, disarray, and, yes, global “dollar” illiquidity. For policymakers, however, it was all too easy to set aside because they still somehow believe they know better about the dollar than anyone trading “dollars.”

Or trading the last eleven years of insecure secured interbank.

Stay In Touch