There is a huge difference between believing in gold and believing in the gold business. The former is about wanting a stable, dependable global monetary system, one very much like what survived thousands of years of history without a whole lot of changes to it. The latter is about convincing you who are likely to believe the same thing to actively buy as much gold as you possibly can.

To the gold business, deflation is a killer. To a true goldbug, either inflation or deflation suggests the monetary world is off its axis. The economics of gold in that situation has very little to do with its price, at least so far as the price in either direction denotes what’s wrong.

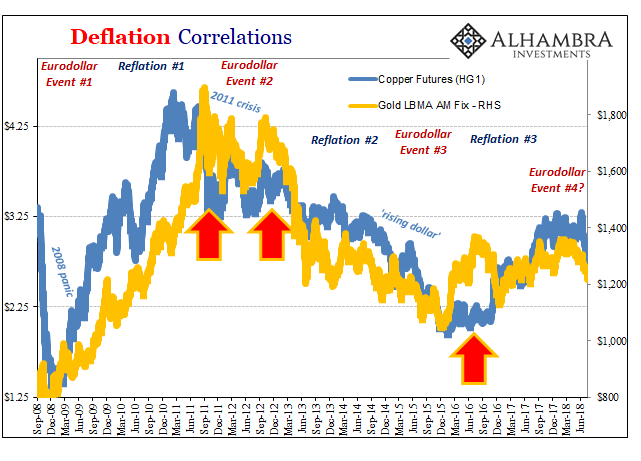

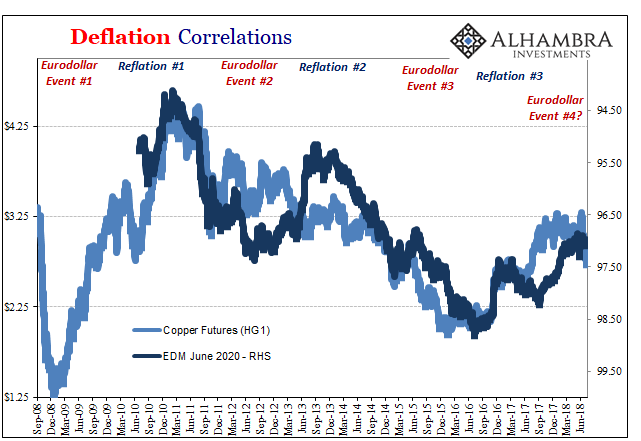

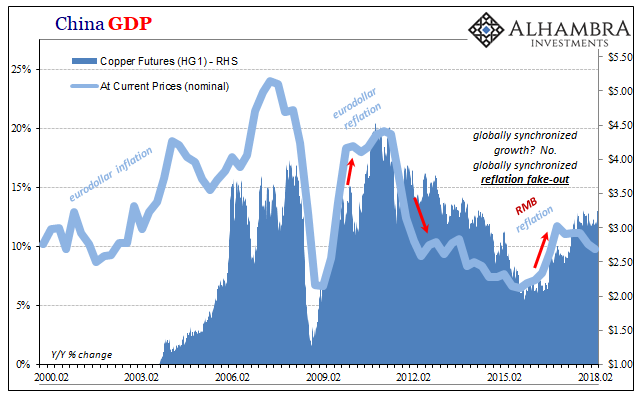

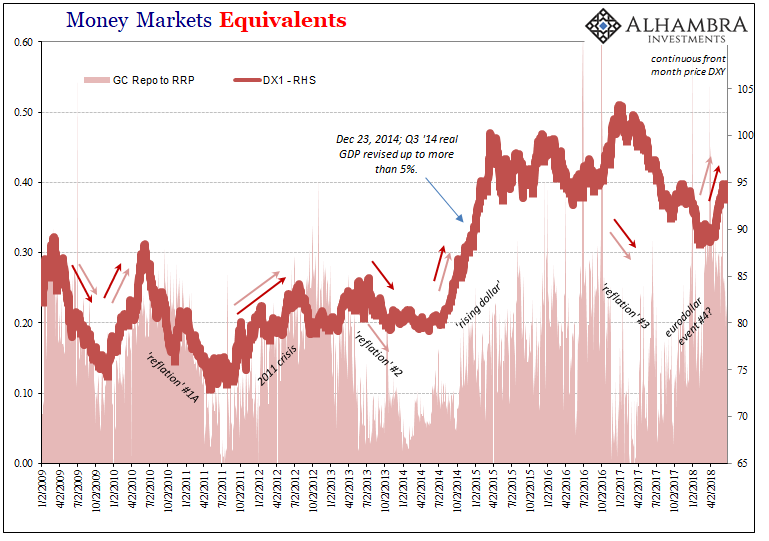

When you put gold and something like copper or even eurodollar futures together on a chart, they show very clearly one thing – that deflation. Since 2011, there is a clear monetary impulse in that direction. Seven years is a very long time for there to have been anything else so substantial. It is textbook stuff, excepting that the actual monetary system which is bringing all this into our lives has never had written its required chapter in that book.

To those in the gold business, this cannot be possible. Central bankers are printing money, you see, furiously, therefore gold should be shooting to the moon. It’s not and hasn’t been for many years, therefore there has to be monkey business pegging the price of gold way, way less than its real price. And who better to perpetrate such insidious nonsense than the very central bankers who are killing the dollar with all their money printing!

If central bankers would stop their clandestine activities carrying out their visceral hatred of the metal, gold would reflect its “true” price, which is at the present time incalculably high. They say. Buy now, supplies are limited.

There is a corollary to this conspiracy stuff. It posits that Asians, the Chinese in particular, are playing some long game. They are buying up gold so as to create a solid alternative to the dollar. Every gyration in its price is due to this undercover future trap, the Chinese doing things to de-dollarize (with the Russians, naturally) with gold at the base of their new pyramid.

Gold’s not down, it’s just reflecting the reality of this curiously convoluted trap and when it finally gets sprung at some unknowable future date the price of gold will, say it with me, shoot to the moon!

Conversely, the dollar becomes worthless. Therefore the “weak dollar” is the currency’s “true” price while the “rising dollar” is just something else entirely. They say.

These unbelievably patient supergeniuses are biding their time while the idiots in the West are squandering every advantage.

The second part can be true, is true, without it necessarily defaulting to the first part. In other words, absolutely, Economists in the West are idiots a fact you don’t need more than the price of gold to establish. They had no idea why it was going up (I still chuckle every time I hear “global savings glut”), and they have even less about why it’s down.

But that doesn’t mean central bank Economists in China are by inverse transitive properties somehow supersmart and technocratically competent. They may look that way in direct comparison to their counterparts, but that’s a meaningless low standard. There is the possibility, and a very good one, that both sets of Economists are equally bad at economy. This shouldn’t be surprising nor controversial, especially since many if not most of Asian central bankers were trained somewhere in the vast network of worthless Western Economic schools.

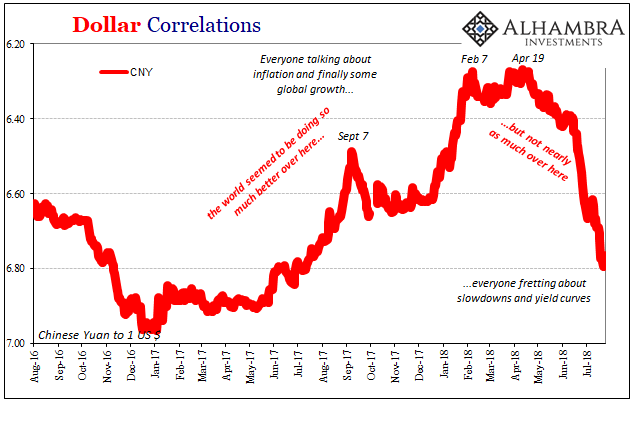

The dollar doesn’t need the Chinese and the Russians to help undermine its authority, as Putin says today; that already happened on August 9, 2007. What has occurred over the nearly eleven years since is an on-again/off-again dance with every individual country around the world trying to deal with the fallout.

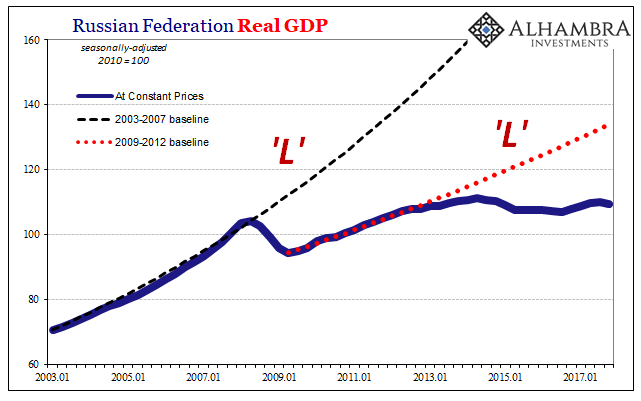

There are two simple facts at play here. The “dollar” system is broken, and there is no alternative to that broken system. If there was, it would have been ready and implemented long before now. This deflationary direction has given the Chinese and Russians every reason and incentive for a decade to have accomplished something else before they, too, suffered the fate of this global deflationary “L”, or double “L” for some.

Longtime PBOC Governor Zhou Xiaochuan wrote all the way back in March 2009:

The desirable goal of reforming the international monetary system, therefore, is to create an international reserve currency that is disconnected from individual nations and is able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies. [emphasis added]

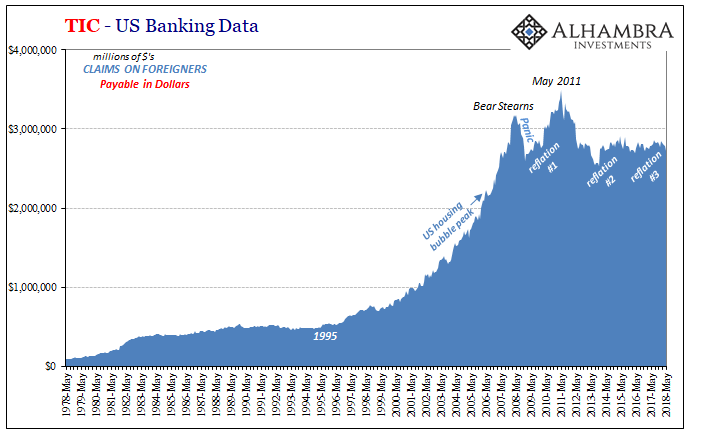

You can understand why he might write about this in March 2009, for the BIS no less. Though the Western media publishing on behalf of incompetent Western central bankers characterized the panic and crash as subprime mortgages wreaking havoc on Wall Street, the truth which Governor Zhou realized is that it was really about eurodollar disruption wreaking havoc via Lombard Street to everywhere else on the planet.

Credit-based national currencies. Exchange the word “national” for “offshore” and he would’ve had it on the nose; eurodollar.

But reform never went anywhere. Why?

First, because in the immediate years following the global dollar crisis it looked like everything was going to go right back to normal, or what everyone in Asia at least thought was normal. There was to be a “new normal” in the West, but EM economies were surely insulated from such a glitch – according to Economists.

Urgency to build toward an international currency in 2009 and 2010 died out with what looked like an actual recovery, especially in China. That country enjoyed more of the privileges of the eurodollar system than any other place on earth, including the supposedly nominal national sponsor of this “dollar.” If it was going to work even reasonably well again, as it appeared, why mess with it?

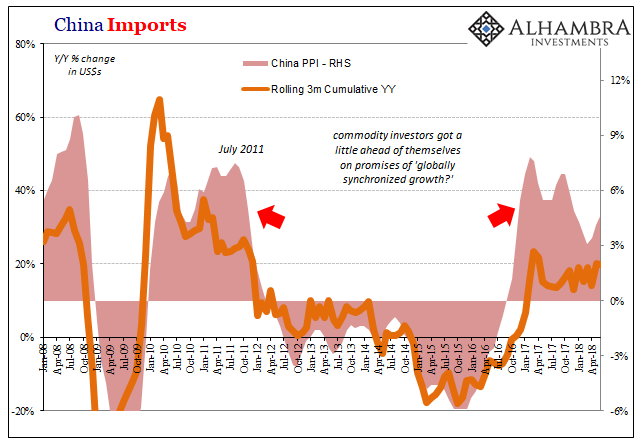

It made perfect sense to complain in March 2009 when Chinese exports were falling by 20%, but not so much in May 2010 when they were up nearly 50%.

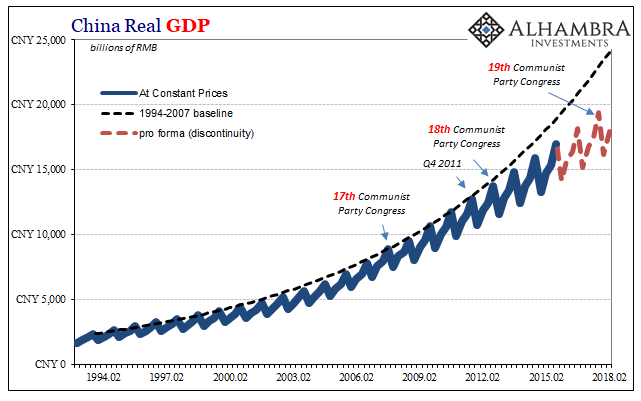

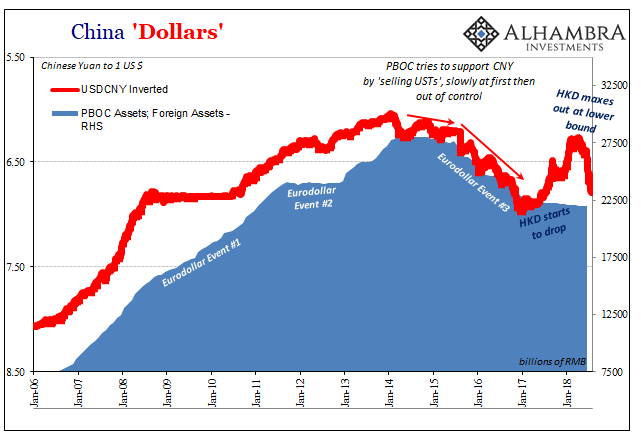

But that only got them through to 2011 when the reality of chronic dollar dysfunction dropped on them like a hammer. The deflationary wave that followed the 2011 break swept up everyone in its way – eventually.

It wasn’t like 2011 happened and then China’s economy suffered tragedy right then and there. It slowed in 2012, seemed to have stabilized in 2013, and then got into real trouble in 2014. That was three years where Governor Zhou could have been pushing a dollar alternative – but he didn’t.

And then 2015 and 2016, still no alternative even though the Chinese economy finally joined everyone else in the global economic “L.” Why wait until now, suffering so much trouble over the last seven years since 2011? Does it take more than seven years to get the de-dollar thing ready?

Where Chinese and other Asian officials differ from Economists in the West is only that they are aware this is an “L” and not an actual business cycle at record length expansion. They don’t appear to be able to do much about it, which is why 2018 has seen too much of this (again):

I seriously doubt any central banker anywhere spends his or her time manipulating the price of gold down to the penny. Why would they? The whole point of QE was to play upon inflation expectations, which means a higher price of gold would actually help them achieve (as they saw them) their economic goals!

Never ascribe to malice, or supergenius Chinese long-range planners, dollars which can be explained, easily, by incompetence on both sides of the Pacific.

True goldbugs know the difference. Instability is the factor that matters, however it comes. Sometimes, ladies and gentlemen, deflation is just deflation.

Stay In Touch