There are two components to economic demand: willingness and ability. The two factors work only in tandem. We all want to buy our own private islands stocked with the most obscene amenities yet invented, but none of us are able to put together the down payment for such an insane venture. The demand for ultra-wealthy living is high in fantasy, low in actuality.

It works, or doesn’t, the other way around, too. The potential market for Microsoft’s Zune was huge, nearly anyone could have realistically afford one. The problem for the tech giant was how practically no one was willing to buy them.

As straightforward as that might be in easy economic settings, it’s more complicated in other realms. For money, as one example, there doesn’t need to be both parts to its demand.

Picking up where I left off on Friday:

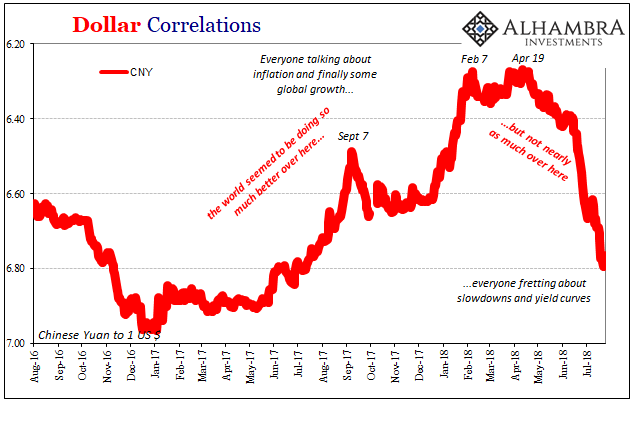

The dollar doesn’t need the Chinese and the Russians to help undermine its authority, as Putin says today; that already happened on August 9, 2007. What has occurred over the nearly eleven years since is an on-again/off-again dance with every individual country around the world trying to deal with the fallout.

The Russians and Chinese, the latter in particular, are supposedly working on a currency system alternative. It’s been a constant feature of global economic commentary for a decade, with little to show for it.

The new competing arrangement may or may not be based around gold (realistically it couldn’t be), and it “will” be depending upon who you ask and what they are trying to sell you. And it doesn’t have to be a global reserve, either. The way things are headed, it may be more realistic if it would be instead a regional alternative, with several competing blocs of different means and abilities spread out around the globe (as it had been before the mid-20th century).

There is little doubt that in many foreign places the willingness to transact via the dollar system is low to the point of visceral disdain. Yet, the dollar, really eurodollar, remains. Ten years after both parts of the eurodollar money system broke, the stuff out of Russia or China is little more than sideshow conspiracy.

China used to rail against the outsize role of the U.S. dollar. But in a major turnaround, the world’s second-biggest economy has started embracing the currency of its larger rival.

Chinese companies and banks—and even the government—sold bonds denominated in dollars at a record pace last year, and underwriters expect that growth to continue for years.

I would have serious doubts that China’s appeal to the Eurobond market is “growth to continue for years”, rather I think we are already seeing the downside of it already just a year after the binge. That’s just Bloomberg’s (who else?) way of trying to make sense of what to many might seem a contradiction. It isn’t a contradiction, it is the lack of currency regime alternative.

In other words, the Chinese followed the same bypass route (figuratively; literally, does anyone doubt the geographic location of this gateway was situated in and around Hong Kong?) as practically everyone else on the planet whose “dollar” needs were severely, and devastatingly, curtailed by the “rising dollar” squeeze of 2014-16. They all hired Wall Street’s vaunted salesforce and went on sizable, sustained road shows. Borrowing heavily in Eurobonds in lieu of credit-based eurodollar dollars.

But Eurobonds are not a perfect substitute for eurodollars. Just ask Argentina, by proportion the country attempting the largest workaround. In many ways, the bond market’s fickleness can be worse than credit-based money. It was last ditch effort which though it may have gotten this “reflation” (number three) started it may also have sealed its unsatisfying fate.

They may not like the dollar in China, despise it, even, but they are stuck with it. That’s why they went nuts in dollar-denominated bonds. We are all stuck with it. There is no ability to do something else, and if there was it would have been done long before the damage had been done.

Why?

Because as chronically dysfunctional as it is, the eurodollar at least keeps the lights on. The global economy can still function, even grow a little bit. It may not be true growth as is commonly understood and associated with the word “boom”, but it’s enough to fool Economists into predicting true growth is right around the corner or declaring it today; and just enough for enough people to believe the fairy tale. The current dollar system doesn’t work, but it isn’t total collapse, either. It’s the worst sweet spot ever conceived.

A truly fragmented system like the one the dollar-is-worthless crowd (those in the gold business) keeps hyping is a monumental risk first to those who attempt it. It is cold risk/reward analysis. Chinese officials would likely have long ago contemplated the trade-off. Better the devil you know, especially under strain.

Thus, the participants in the system are only able; meaning they have no ability to do whatever else despite heightened willingness to get out. Even tolerate these intermittent squeezes, though we might not know for sure just how one originating in Eurobonds might differ from the other three so far.

It seems reasonable, therefore, that the cycle can only continue; squeeze, reflation, squeeze, reflation, until social and political conditions deteriorate far enough first. That might explain the political changes in China, and, ironically, those of its biggest rival the United States. Trump ran, and won, on the economic defects to the eurodollar’s ups and downs, only to now wholeheartedly embrace the ups as his own.

In other words, the eurodollar ain’t goin’ nowhere. Not yet.

Stay In Touch