In December 1999, Princeton Professor Ben S. Bernanke wrote a relatively obscure paper largely denouncing the Bank of Japan’s shyness. Japan’s economy had by then been mired in its first Lost Decade, one which at that moment not everyone was sure should have been lost. It was fashionable at the time to pile on the BoJ.

Dr. Bernanke argued for extreme aggressiveness, truly radical experimentation. Big problems require equally big solutions. These were necessary because of the huge scale of the issue facing them. In conclusion, the future Fed Chairman wrote:

Japan is not in a Great Depression by any means, but its economy has operated below potential for nearly a decade. Nor is it by any means clear that recovery is imminent. Policy options exist that could greatly reduce these losses. Why isn’t more happening? To this outsider, at least, Japanese monetary policy seems paralyzed, with a paralysis that is largely self-induced. Most striking is the apparent unwillingness of the monetary authorities to experiment, to try anything that isn’t absolutely guaranteed to work. [emphasis added]

His larger point was valid, and poignant. In Japan’s case, as anyone’s might be in the same situation, there should be no stone left unturned when confronted by such a substantial break in economic function. A dislocation of that magnitude, meaning length of time if not depths to some 1930’s trough, demands emergency thinking rather than stolid patience almost to the point of indifference.

To be so relatively passive would be a crime, especially if the results were to be losing a decade of actual economic sufficiency. Dr. Bernanke argued for thinking way outside the box, for what else would be demanded by this sort of situation?

Federal Reserve Chairman Bernanke, by contrast, was apparently unimpressed by his earlier urgency. I wrote just a few short weeks ago that though the Bank of Japan was run by clowns, I’d prefer the clowns every time to the corruption that has so thoroughly inundated “our” central bank.

You see, the Japanese at least acknowledge their problem, meaning that they still have one. Western Economists have taken a far darker path, one begun under the self-induced paralysis of one Ben Bernanke. They haven’t made recovery so much as erase the problem from the official canon. The media simply parrots, uncritically, this absurd judgment.

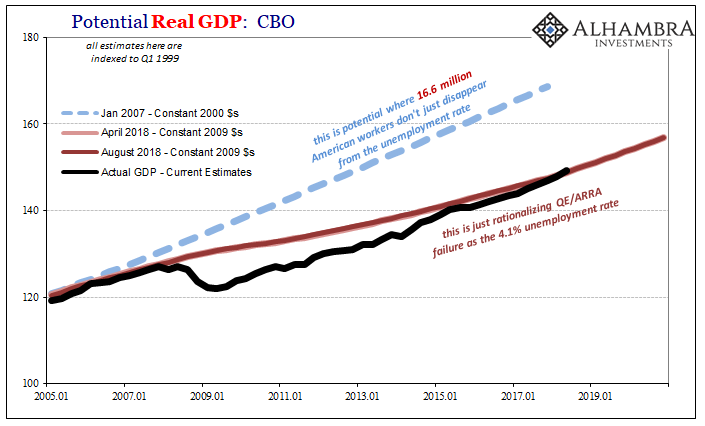

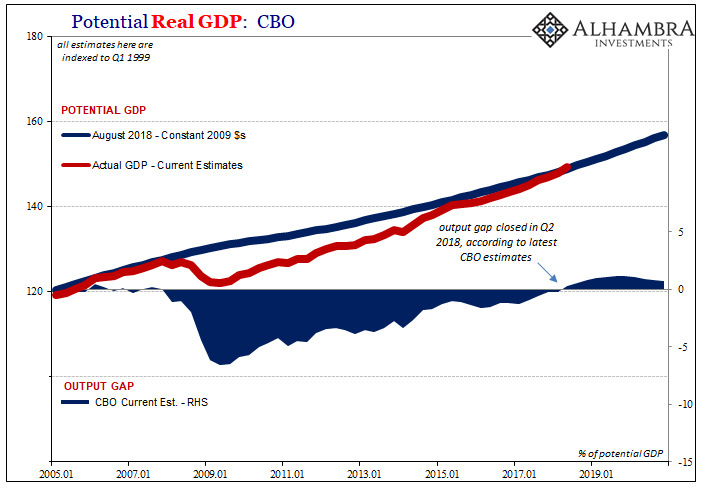

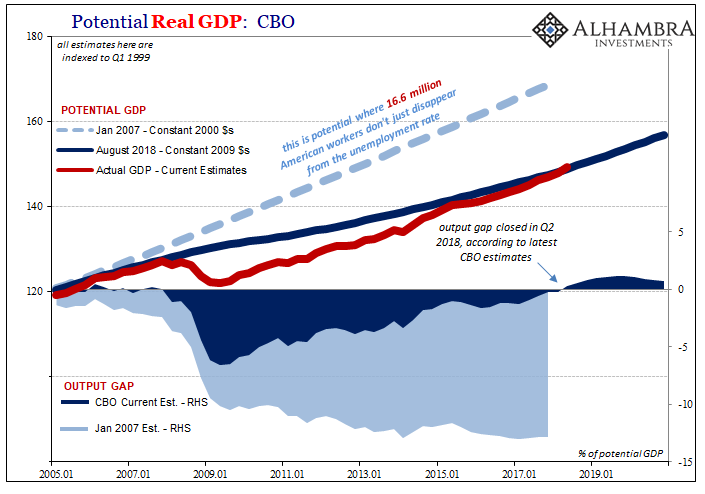

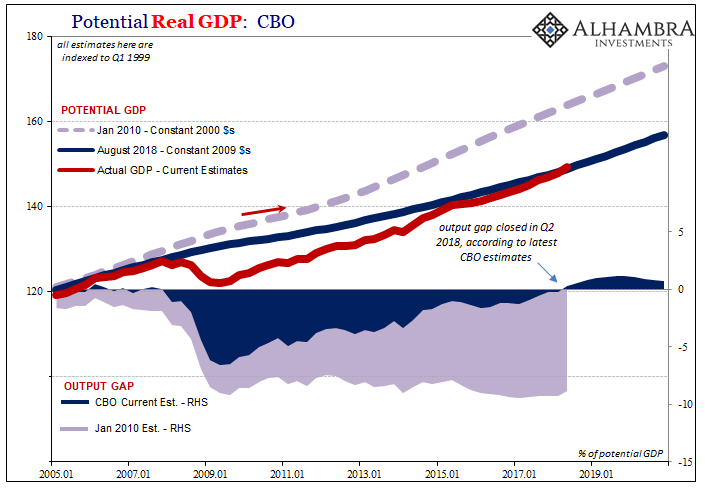

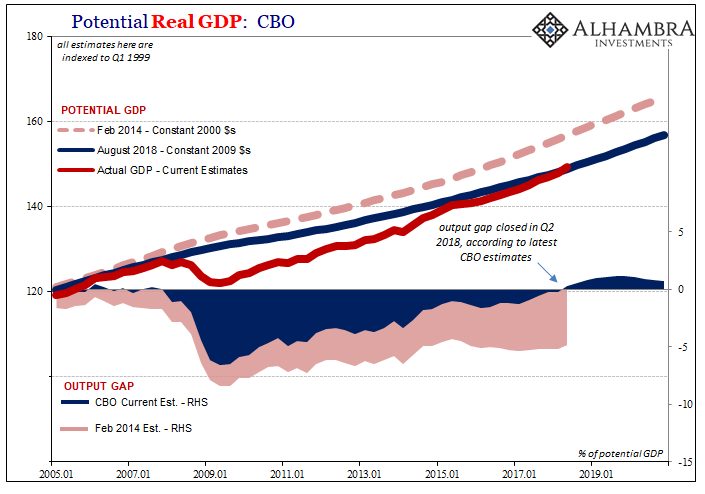

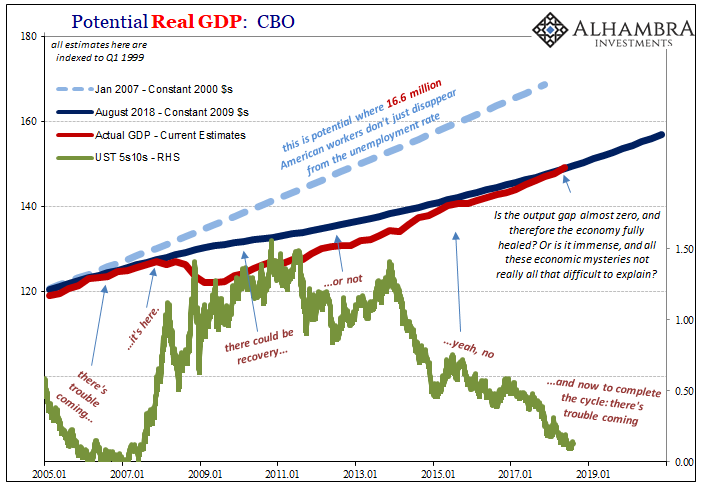

The CBO has released its latest estimates for economic potential, and therefore what might remain of what economists call the “output gap.” This concept governs a lot of what central banks do, when or how they do it.

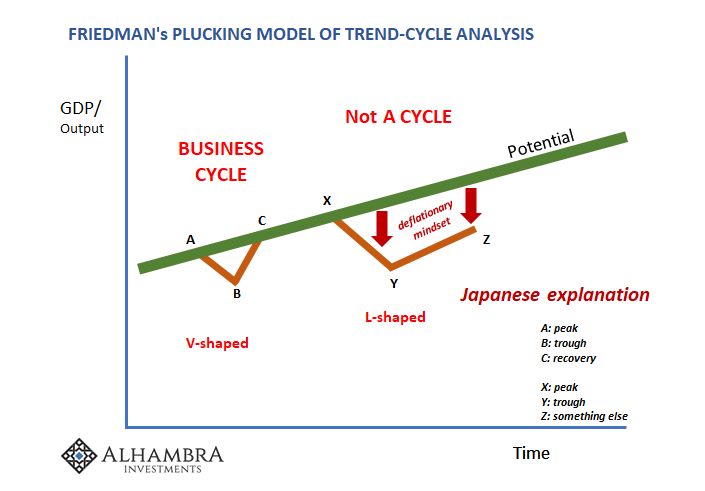

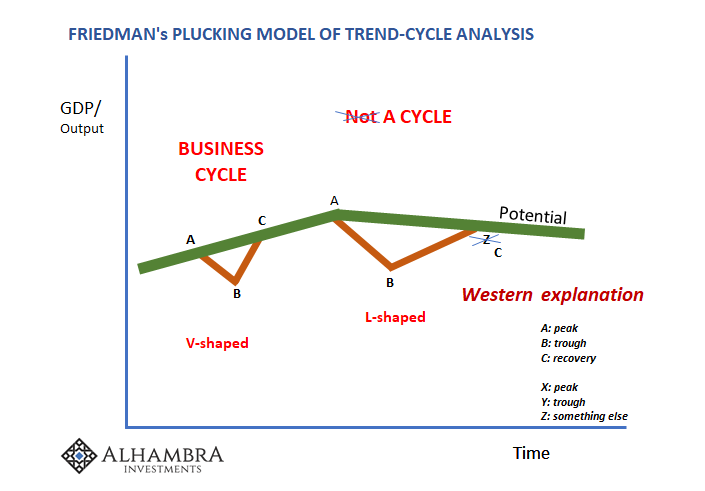

A recession is supposed to be nothing more than a temporary break from trend, otherwise known as potential. Modern monetary policy is meant as a tool for ensuring the gap remains both small and short-lived. The end result is recovery, or the point at which actual output is equal again to potential; the output gap falls to zero.

What Bernanke was writing about in 1999 was Japan’s experience where the output gap simply refused to disappear no matter what anyone did, fiscal or monetary. To the former Bernanke, this should have led the Bank of Japan toward more radical solutions. The most radical of all would have been to completely rethink the modern money system and the central bank’s actual role in it (not much of one), which might have been on the table had central bankers any real incentive to think freely.

According to the updated CBO numbers, the US is not Japan. The output gap by these calculations has been fully digested in Q2 2018. From here on, over the next several years, the CBO figures Jay Powell is right to be “raising rates” since the output gap will have reversed; meaning that the economy should operate above potential for the first time in a very long time, raising the risks, as Economics sees them, for inflation.

Again, this is a thoroughly corrupt view. Recovery hasn’t happened because output remains on the same lower basis that has plagued the global system since 2007. Rather, recovery is being calculated on a very different basis that adds up instead to where it can’t actually happen – the very thing ’99 Bernanke declared as dangerous and unworthy self-paralysis.

For one thing, this recovery is quite unexpected. At every prior juncture, those older calculations expected the output gap would have remained substantial if GDP today were as low as it has been. In other words, using older estimates of potential we can see that by those standards there isn’t a recovery right now nor is there likely to be one anytime soon.

Only by reducing and then reducing some more estimates on potential has the CBO been able to even suggest Jay Powell, as Janet Yellen, as Ben Bernanke, has been something other than paralyzed. This should never be acceptable. But now that the shoe is on the other foot, suddenly it is.

Using January 2007’s figures on potential, the output gap today wouldn’t be anything other than enormous. In fact, according to this track the gap in 2018 is substantially larger than it was at the worst point of the Great “Recession” in 2009. The economy got worse over the last decade, not at all better.

A few years later, after having then been confronted by the size and duration of the contraction, driven by a monetary panic, no less, the CBO began to adjust its trend numbers but still in 2010 was expecting something like the prior pre-crisis potential to eventually materialize. Under these estimates, the current measure of output is still a little further behind than in 2009.

Even by 2014, after suffering one false dawn and then a major “unexpected” worldwide slowdown, the CBO continued to expect a considerably greater trend for the US economy. By these estimates, the output gap in Q2 2018 would still be an unusually unhealthy 5% not 0%. That was a mere four years ago. If you have so much trouble coming up with consistent trend and potential estimates, maybe you’re doing them wrong?

In short, the CBO cannot say why economic potential has been so drastically demoted over the years. All they do know is that the economy has never lived up to even those lesser numbers, exactly the same problem Professor Bernanke urged monetary officials to become aggressive about. The economy never performs, so it must be healed? No way.

In other words, central bankers have a sacred duty to the public to do something about it until it does actually live up to some reasonable standard. If their experiments fail, then they shouldn’t just give up and rewrite economic history. Rather, they might instead begin to look for the problem in the one place they might otherwise refuse. The mirror.

That’s ultimately where Bernanke’s prior thinking would have taken him, if for one second he had ever considered Economists especially those at central banks really don’t know what they are doing. The rest of us are under no such religious-like oath or constraint. We don’t have to accept an output gap that nobody, especially markets (curves), believes has disappeared.

Let’s rewrite Bernanke’s 1999 central bank creed:

Why isn’t more happening? To this outsider, at least, US monetary policy seems paralyzed, with a paralysis that is largely self-induced. Most striking is the apparent unwillingness of the monetary authorities to accept reality, to believe there remains as big a problem today as when first confronted with it a decade ago. That starts with examining down to the very fundamental level what central bankers know, and don’t know, about economy, finance, and especially monetary operation.

Yeah, it’s much easier and less prone to spark uncomfortable questions to just rewrite potential so as to mechanically erase the output gap rather than honestly search for the way back toward a real recovery. Pure, unforgivable corruption.

Stay In Touch